-

WIF has witnessed a price decline amid the rally in the general market.

Key indicators suggest that its price might witness a further drop.

As a researcher with extensive experience in cryptocurrency markets, I’ve closely monitored the performance of WIF (dogwifhat), a popular meme coin. Despite the general market rally over the past week, WIF has not only failed to keep pace but also witnessed a 2% price decline during this period.

Despite the recent market surge, the price of the meme coin Dogewhats (WIF) with a dog theme hasn’t experienced a notable increase over the past week.

As an analyst, I’d rephrase it as follows: Based on CoinMarketCap’s current data, the value of WIF coin is at $2.84 at this moment in time. This represents a 2% decrease over the past seven days. Notably, among the leading meme assets, WIF is the only one that has not experienced any price growth during this period.

More losses ahead

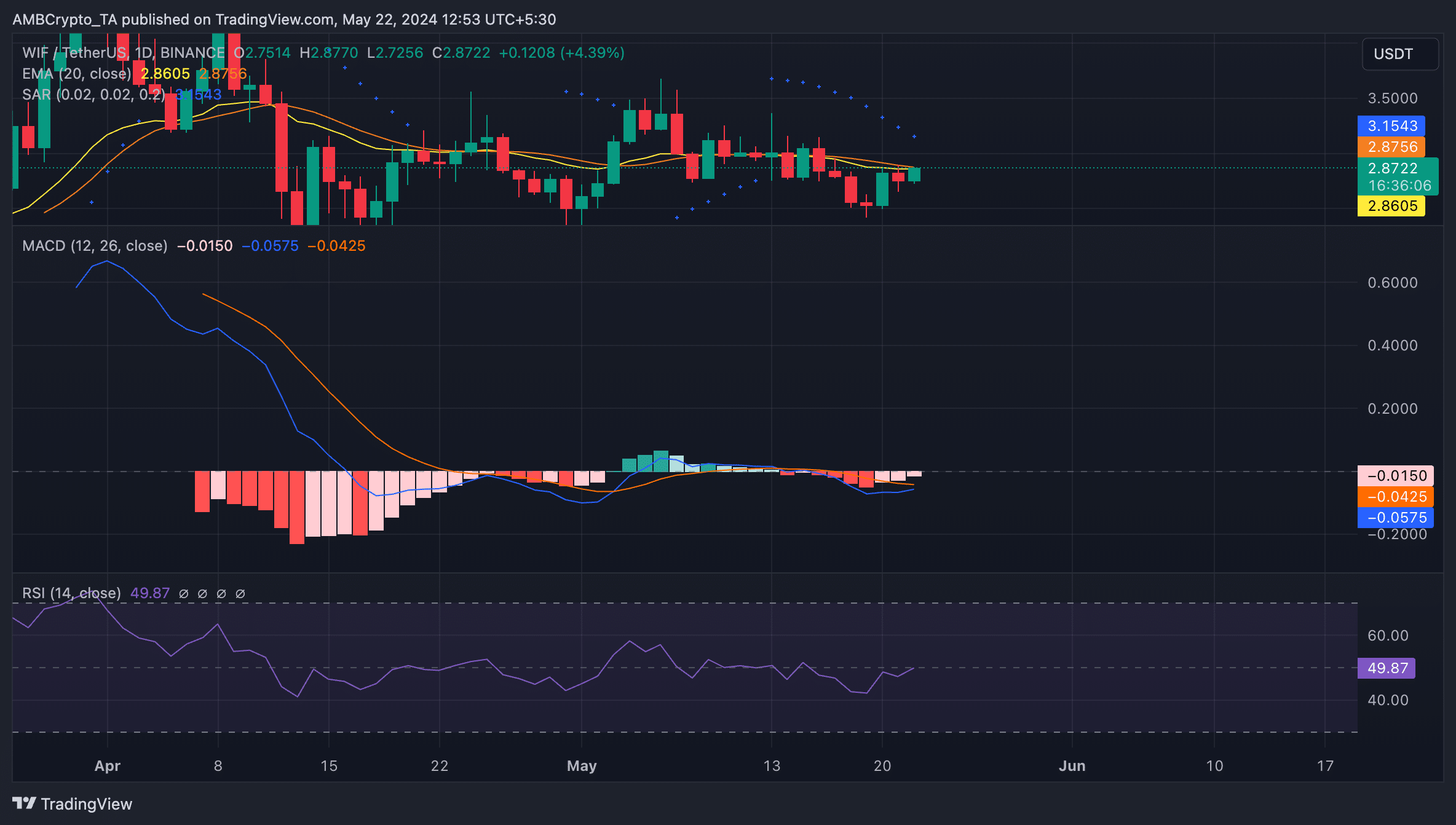

From my perspective as a crypto investor, the daily chart analysis of WIF suggests potential for further price drops. First and foremost, this meme asset is currently trading below its 20-day Exponential Moving Average (EMA) at present.

If an asset’s price is lower than its 20-day Exponential Moving Average (EMA), this is considered a bearish sign. This indicates that the current price has dropped below the average price of the last 20 days, as seen by market participants. They may view this as a sign of impending coin sales.

As a crypto investor, I’ve noticed a shift in market sentiment towards WIF tokens. The Relative Strength Index (RSI), which measures the magnitude of recent price changes to evaluate overbought or oversold conditions, has dipped below the neutral threshold at 49.47. This indicates that more traders have favored selling WIF tokens rather than buying and holding them for accumulation.

Further, WIF’s MACD line (blue) rested below its signal (orange) and zero lines.

As a researcher studying financial markets, I’ve observed that when the short-term moving average of an asset falls below its long-term moving average, it’s a bearish indication. This signal underscores an existing downtrend in the asset’s price movement.

As a market analyst, I’ve observed the bearish trend in WIF‘s price action. Specifically, the Parabolic SAR indicators have been placed above the price since the 13th of May.

this metric helps determine possible market trends and turning points. When its lines lie above an asset’s value, the market is considered to be experiencing a downturn.

It indicates that the asset’s price has been falling, and the drop may continue.

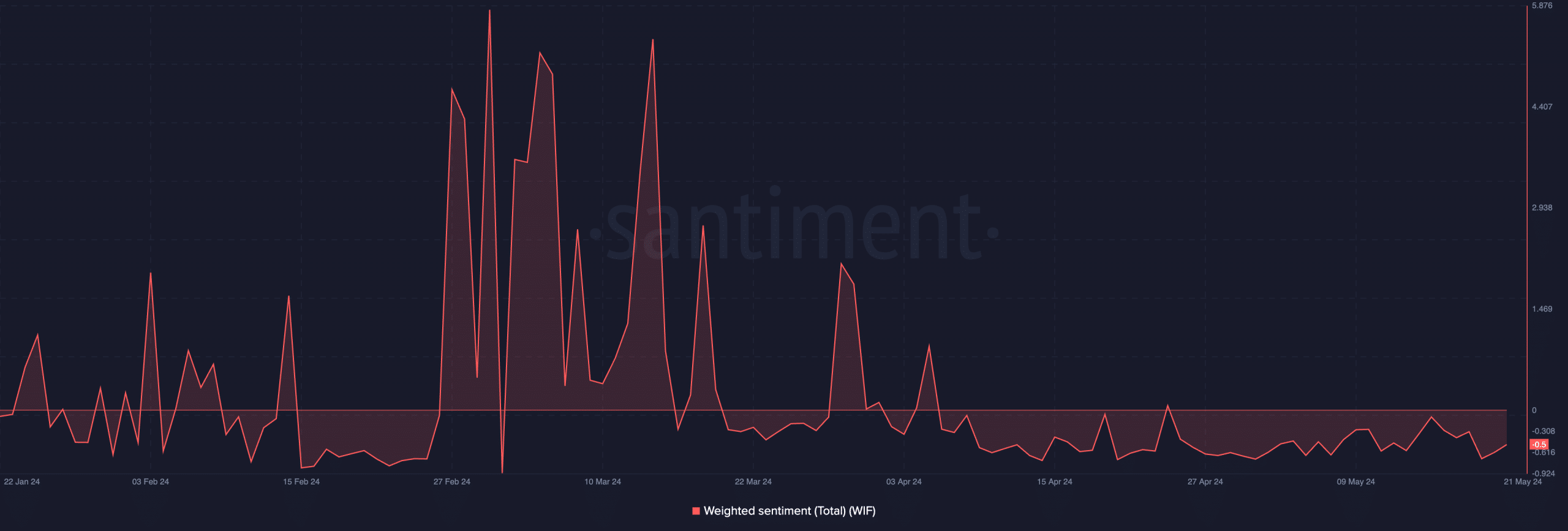

The sentiment analysis of the token’s weight supported the earlier argument. According to Santiment’s information, it had a score of -0.5 at that moment in time.

Read dogwifhat’s [WIF] Price Prediction 2024-25

When an asset has a negative weighted sentiment, it typically indicates that investors are losing confidence in it.

Inevitably, negative feelings toward an investment can prompt some individuals to offload their shares, as they may no longer trust the asset’s ability to deliver strong returns in the near term.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- The Battle Royale That Started It All Has Never Been More Profitable

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- ANKR PREDICTION. ANKR cryptocurrency

- Maid Cafe on Electric Street major update now available, adds new side story and more

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- 10 Must-Read Romance Manhwa on Tapas for Valentine’s Day

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

2024-05-23 07:03