- Kiyosaki thinks Bitcoin‘s recent dip is like finding a tenner in your old coat pocket.

- Trump’s tariffs might just be the plot twist we didn’t ask for in the Bitcoin saga. 🎭

So, Robert Kiyosaki, the guy behind “Rich Dad, Poor Dad” (which, let’s be honest, sounds like a family therapy session gone wrong), is calling the latest Bitcoin [BTC] dip a “buying opportunity.” Because who doesn’t love a good sale, right? 🛍️

In a plot twist worthy of a soap opera, President Trump has decided to slap tariffs on imported goods from Canada, China, and Mexico, effective February. Market experts are clutching their pearls, worried that these tariff wars might trigger inflation and ruin the Fed’s rate cut plans. Spoiler alert: This is bad news for risk assets like Bitcoin. 😱

But wait! Kiyosaki thinks the real villain here is the U.S. fiscal debt situation, which is like that annoying relative who just won’t leave the party. He said,

“Trump tariffs begin: Gold, silver, Bitcoin may crash. Good. Will buy more after prices crash. Real problem is DEBT…which will only get worse. Crashes mean assets are on sale. Time to get richer.”

In January, our friend Kiyosaki stuck to his wild $175K-$350K price target for BTC by the end of 2025. So, the burning question is: Can Bitcoin really reach those heights? 🚀

Will February be the month of gains or just another sad rom-com? 🎬

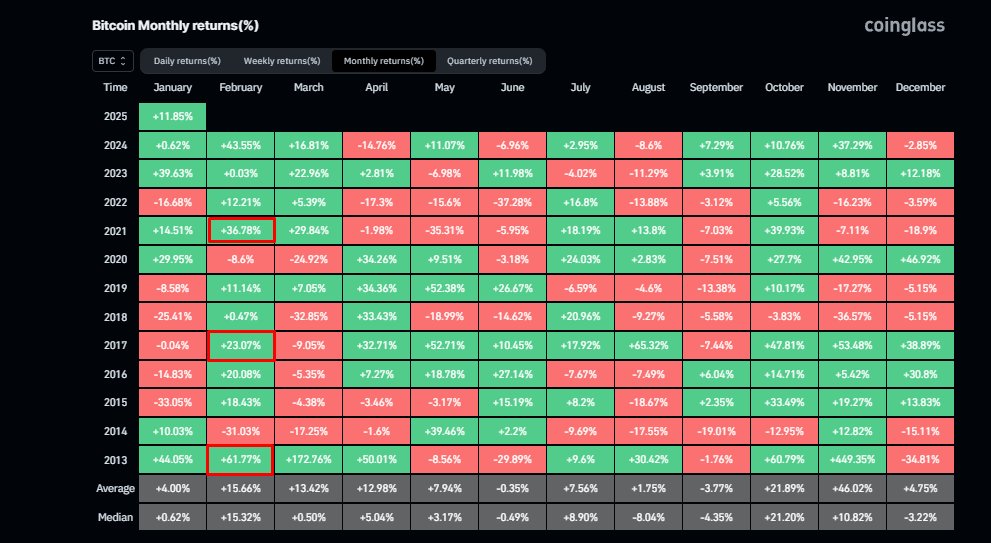

Bitcoin wrapped up January with a 9.29% gain, which is like winning a small lottery. February has historically been a goldmine for BTC, especially in post-halving years. Since 2013, BTC has never closed February in the red. That’s right, folks—an average of 15% gains! If history repeats itself, we might just see Bitcoin strutting its stuff again. 💃

But let’s not get too carried away; the tariff-induced inflation risk is still lurking like a bad smell. 😷

Another shiny beacon of hope for Bitcoin is the U.S. money supply (M2). More USD liquidity usually means Bitcoin parties like it’s 1999. According to market analyst Joe Burnett, this indicator could break 2021 highs and send crypto prices soaring. 🎈

“M2 is set to break all-time highs for the first time since 2021. Infinite liquidity chasing 21,000,000 bitcoin. You know what happens next.”

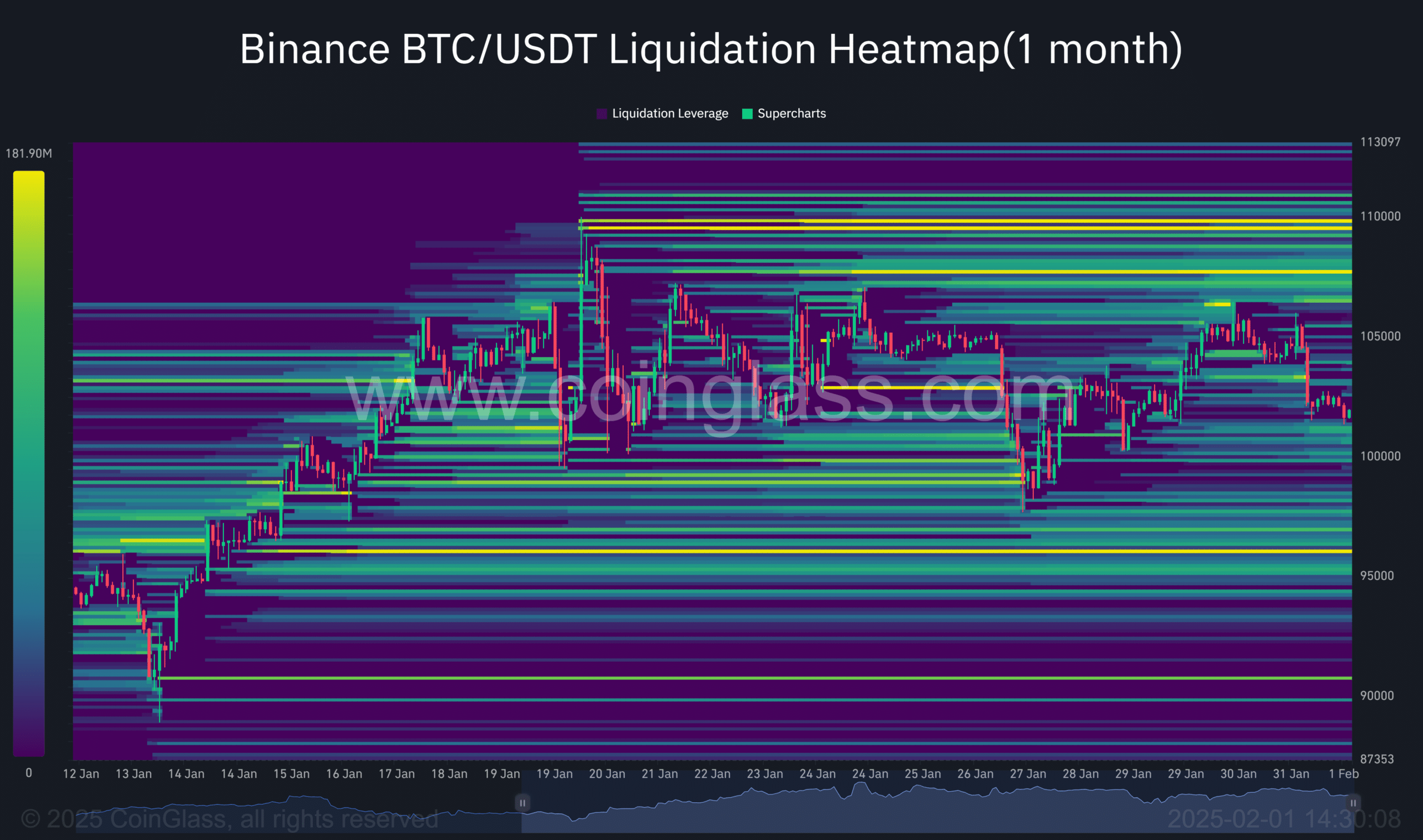

Meanwhile, the monthly liquidation heatmap is showing some bright yellow key levels at $96k, $107k, and below $110k. It’s like a treasure map, but instead of gold, we’re hunting for Bitcoin. 🗺️

As of now, the price action is hanging out halfway to those key liquidity levels. It’s anyone’s guess which way it’ll go. Maybe the U.S. jobs report (coming on February 7) will give us a hint about BTC’s next move. Or maybe it’ll just leave us more confused than ever. 🤷♀️

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-02-02 07:06