- Memecoins could outperform DeFi in the short-term.

- Fed interest rate cut would boost memecoins and DeFi sectors.

As a seasoned crypto investor with a knack for spotting trends, I find myself intrigued by Toe Bautista’s prediction of memecoins outperforming DeFi in Q4. Having navigated through the crypto wilderness since its inception, I’ve learned that the market often takes unexpected turns, and memecoins are no exception.

According to Toe Bautista, a research analyst at crypto trading and liquidity provider GSR, as the Federal Reserve’s easing cycle starts, memecoins might regain their prominence and potentially outshine the DeFi sector during the last quarter of the year.

Bautista told Blockworks that renewed speculative interest could boost memecoins’ upside potential.

“Memecoin strength may continue due to the recent surge in speculative appetite.”

Memecoins vs DeFi

He added that the sector could outperform DeFi as the segment was still riddled with regulatory uncertainty ahead of the US elections.

Conversely, DeFi finds itself in a delicate position. If Donald Trump wins the election, we might see a relaxing of regulations which could potentially lead to increased performance for DeFi. On the other hand, if Kamala Harris wins, we may continue to face regulatory hostility.

Simply put, meme coins might experience a significant surge in the immediate future; however, their success compared to DeFi (Decentralized Finance) largely hinges on the results of the U.S. elections.

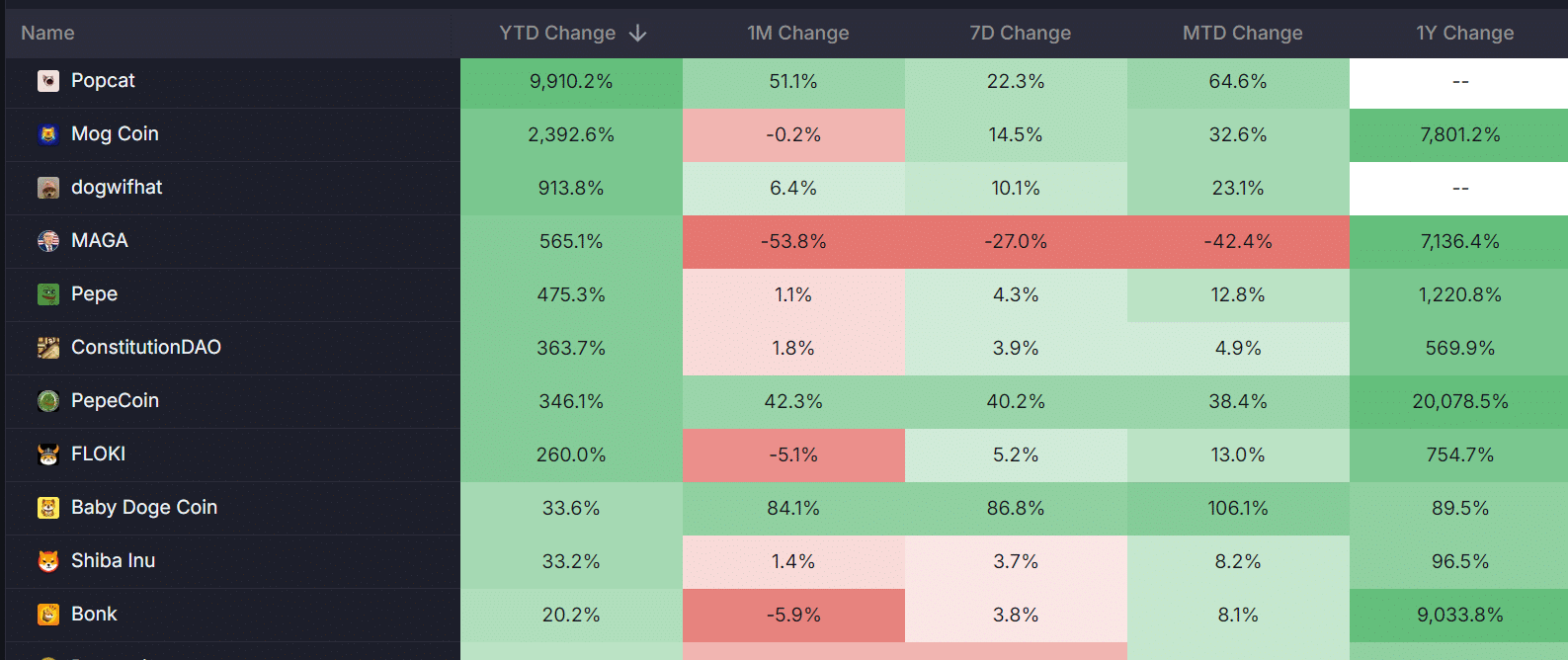

As of now, Popcat (POPCAT) has led the pack this year, boasting almost 10,000% growth. Similarly, dogwifhat (WIF) and Pepe (PEPE) have shown remarkable performance with significant triple-digit increases throughout the same period.

On the other hand, a recent Bernstein analysis indicates that the Decentralized Finance (DeFi) market could see positive growth as traditional finance (TradFi) interest rates decline.

According to Bernstein’s analysis, the return on investment in Decentralized Finance (DeFi) could climb beyond 5%, surpassing yields from US money market funds. This surge could potentially elevate frontrunners such as Aave, Uniswap, and Aerodrome Finance.

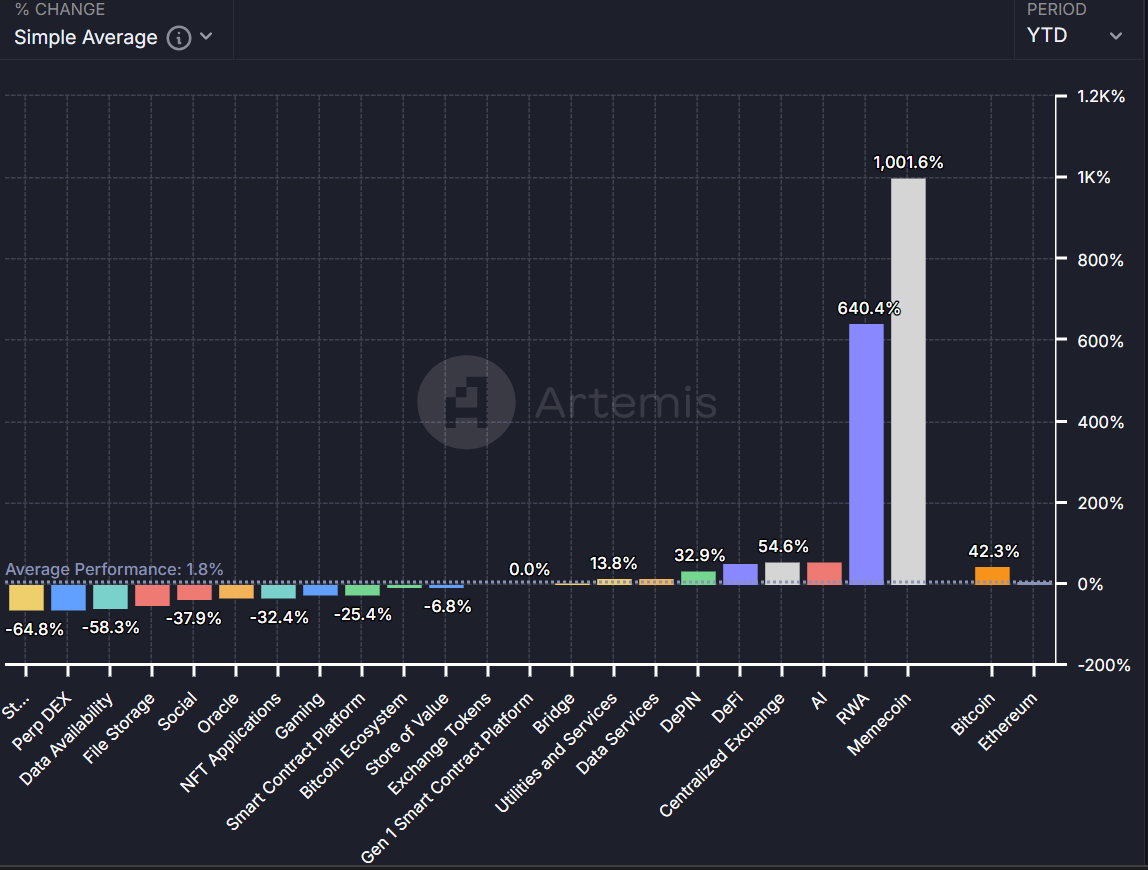

Despite other developments, the barrier to entry for memecoins remained robust in the market. After dominating the rankings during Q1 and Q2, this sector continued to lead on a year-to-date basis. On the flip side, DeFi took fifth place with an average return of approximately 51%, according to Artemis data.

Shifting Fed policy might fuel enthusiasm for meme coins and attract more investors to DeFi profits, potentially enhancing their earnings. Yet, the impact on these sectors during the upcoming U.S. elections is uncertain and needs careful monitoring.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-21 16:07