- MakerDAO showed signs of budding activity and resilience despite growing competition.

- However, MKR struggled to gain bullish traction as rival coins cruised to new tops.

As a seasoned crypto investor with a keen eye for DeFi projects, I must admit that MakerDAO [MKR] has been a rollercoaster ride. Back in 2021, it was a star performer, but the subsequent years have seen intense competition and market saturation.

During the 2021 crypto bull market, MakerDAO [MKR] stood out as one of the leading DeFi (Decentralized Finance) projects. As we move forward to the present day, however, the DeFi landscape has become increasingly crowded with new projects, leading to a significant increase in competition.

But how has MakerDAO been fairing with these changing conditions?

As a researcher delving into the dynamic world of decentralized applications (dApps), I’ve recently uncovered an interesting fact: MakerDAO has made its way into the elite group of top 10 dApps, as ranked by weekly fees generated.

This finding carried significant weight as it showed that the system was still offering useful functionality at acceptable levels.

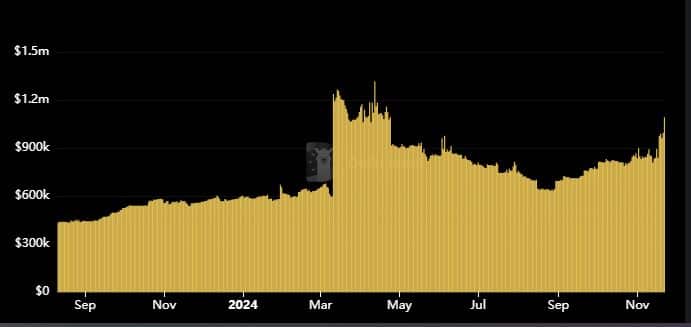

In the past two years, the fees associated with the Decentralized Finance (DeFi) protocol have experienced significant expansion. To give you an idea, MakerDAO’s average daily fees were below $30,000 in October 2022.

As an analyst, I observed a steady climb in the daily fees, reaching its peak at a staggering $1.19 million on the 8th of April 2024.

On November 22, 2024, MakerDAO fees achieved a notable landmark as it was the initial day where daily dApp fees exceeded $1 million during the latter half of that year.

Additionally, various indicators pointed towards an increase in decentralized application (dApp) engagement. To illustrate, the token transaction volume soared from approximately $40 million to a staggering $356 million within the past four weeks. This figure even averaged more than $200 million over the last three days.

Over the past few weeks, MakerDAO’s Total Value Locked (TVL) has shown signs of rebounding. Currently, it has increased by approximately $1.5 billion compared to its lowest point in October this year.

Will MKR benefit?

It’s evident that MakerDAO’s usefulness is expanding due to the current market fervor, as shown by the increase in volume, TVL (Total Value Locked), and fees. Yet, this growth seems to have little impact on the price of its MKR token.

2024 has seen MKR predominantly in a downtrend thus far. On October 25th, it dipped to a 12-month low of $1,006. However, since then, it has recovered significantly, rising by approximately 61% from that point, currently trading at $1,630.

In simpler terms, many of its main competitors have increased their minimum prices in 2024 by more than twice the original amount. This implies that MakerDAO’s performance might not be as strong compared to its peers.

To put it simply, these tokens might be considered underrated and have a strong possibility of significant growth.

The significant rise in MKR’s value this year indicates that it has been accumulated within its current price floor. Yet, the demand has been modest so far, but it might pick up as the flow of liquidity shifts continue.

Read Maker’s [MKR] Price Prediction 2024–2025

However, this does not necessarily mean that such an outcome could occur.

From my analysis perspective, the relatively high cost associated with MKR could potentially discourage potential investors. This could possibly be the reason why it appears to have taken a backseat in some investment portfolios.

Read More

2024-11-23 15:03