-

MKR’s price decoupled from ETH as MakerDAO sold some tokens.

On-chain and technical analysis suggested a bounce to $3,545 when the selling pressure halts.

Over the last two weeks, a specific multisign wallet associated with MakerDAO has transferred approximately $14.4 million in MKR tokens to various cryptocurrency exchanges.

Based on Spot On Chain’s report, some exchanges where the tokens found a place were Binance using its BNB token, Coinbase, and Kraken.

An organization’s multi-signature wallet is a term for a wallet where multiple keys are required to access the stored assets. In simpler terms, this means that at least two private keys are necessary to release the assets kept in this type of wallet.

Regarding MakerDAO’s recent transactions, an observation made by AMBCrypto is that each time the project conducted a sale, the value of MKR decreased.

MKR can’t match ETH

At press time, MKR changed hands at $2,952, representing a 3.84% decline in the last 24 hours.

it was intriguing to notice that the token’s price movements didn’t exactly align with Ethereum‘s [ETH], despite a seemingly strong connection between the two.

As of this writing, ETH’s price was $3,216— a 1.48% increase within the same period MKR dropped.

Our analysis revealed that the multisign wallet continues to hold a total of 21,928 MKR tokens as of now, suggesting that there could be further deposits made through exchanges in the future.

If this event transpires, the price of Ethereum (ETH) may diverge even more from Maker (MKR), potentially causing MKR’s value to fall below $2,800. A deeper decline might actually benefit MKR’s worth.

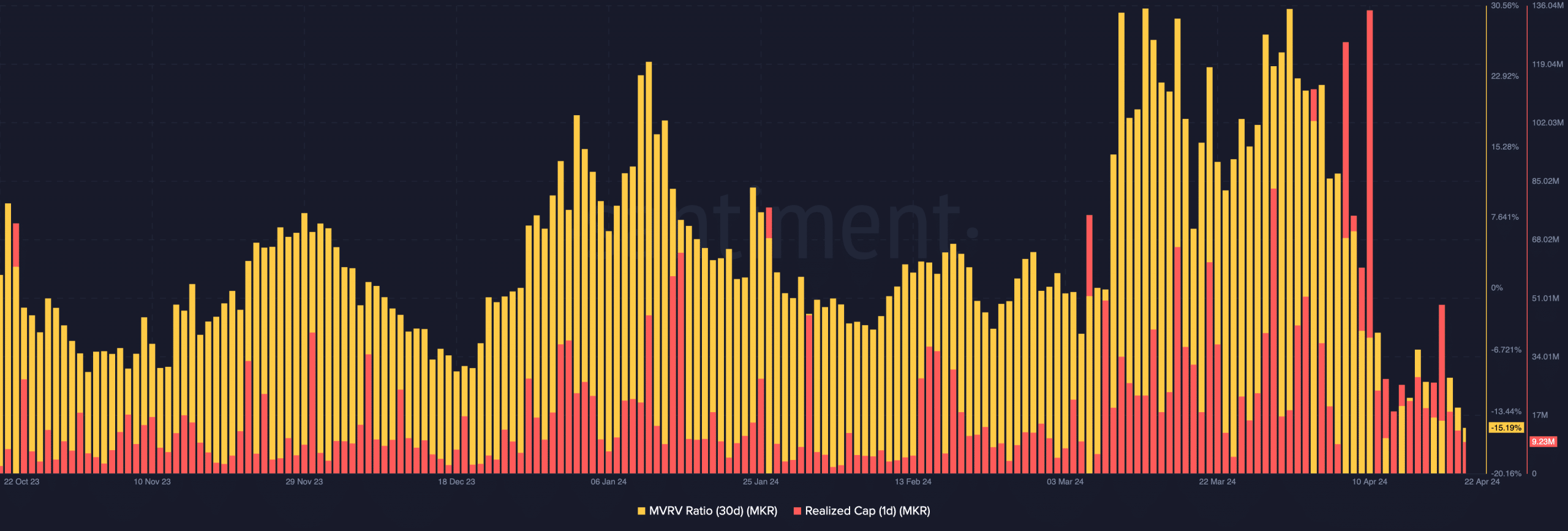

The Market Value to Realized Value Ratio (MVRV) signaled this outcome by indicating the tokens’ profitability and perceived worth.

According to Santiment’s data, the 30-day MVRV ratio stood at a level of negative 15.19%. In the past, such readings have been followed by price increases.

If this occurs once more, the value of MKR might reach $3,545 in just a few weeks according to recent predictions, as expressed by the One-Day Realized Cap as well.

If selling stops, the price will rebound

As of the deadline for publication, the Realized Cap had dropped to 9.23 million, indicating that earlier held tokens were being sold to secure gains.

On the downside, the decrease suggests that MKR may have been underpriced compared to its past trading worth.

Furthermore, this could indicate that MKR’s price has reached a possible minimum. Consequently, MKR may be able to determine its own course in the near future without relying heavily on Ethereum.

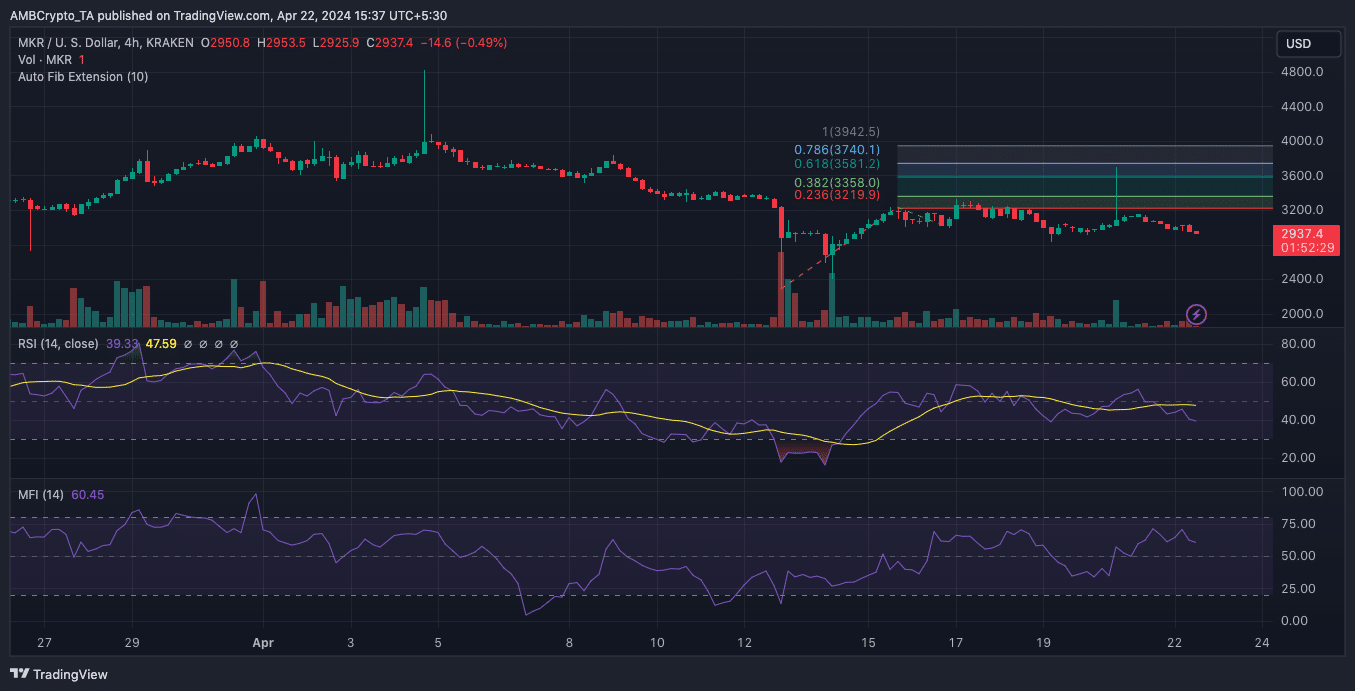

In simpler terms, when looking at the RSI chart technically, the Relative Strength Index for the token fell below the centerline. This is often seen as a bearish sign, indicating potential for the token’s price to decrease even more.

Realistic or not, here’s MKR’s market cap in ETH terms

If the RSI reaches 30.00 for MKR, it would signal oversold conditions, potentially leading to a rebound. According to the 0.786 Fibonacci level, the price could then rise to approximately $3,740 in the near to medium-term future.

Before the anticipated increase in MKR’s price, the Money Flow Index (MFI) indicated that investors were withdrawing their funds from the cryptocurrency, potentially causing a decrease in its value.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-04-22 20:08