- iCryptoai reported that MKR was in the SDT accumulation zone. Sounds fancy, right? 🤓

- Traders were over-leveraged at $1,062 on the lower side and $1,144 on the upper side. Someone call a financial therapist! 💸

At the time of writing, Maker [MKR] was defying the bearish trend with a 14% price hike. Yes, you read that right! It’s like the little engine that could, but with more zeros. 🚂💥

The key reasons behind this rally are the consistent increase in investor and trader interest, along with its bullish price action forming on the daily timeframe. Basically, everyone wants a piece of this pie! 🥧

Maker’s price action and upcoming level

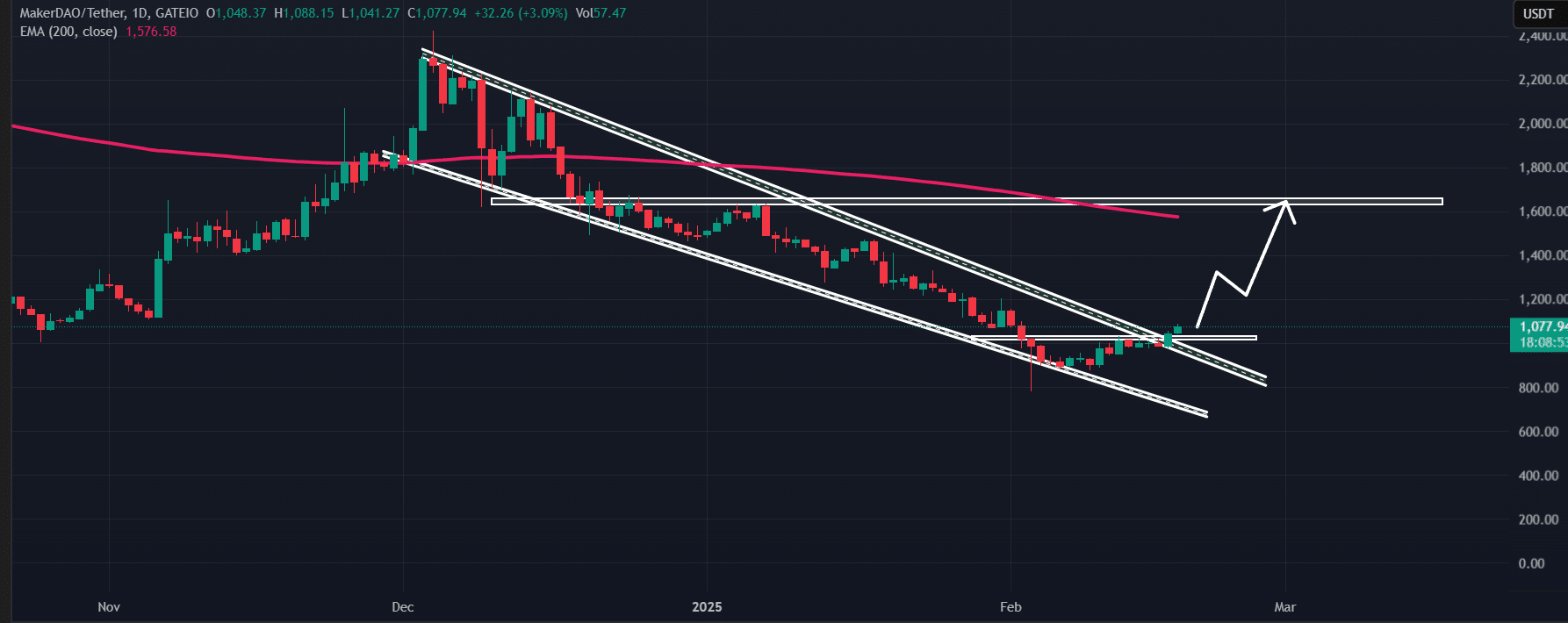

According to AMBCrypto’s technical analysis, MKR has broken out of a descending channel pattern on the daily timeframe. It’s like MKR decided to break up with its bearish ex and is now dating a bullish trend. 💔➡️❤️

Based on the recent price pattern, it is possible that MKR could soar by 50% to reach the $1,600 level in the future. Fingers crossed, right? 🤞

Investors’ rising interest

Recently, the blockchain-based crypto intelligence firm iCryptoai made a post on X (formerly Twitter). Because where else would you get your financial advice? 🙄

They stated that smart DEX traders and whales have consistently accumulated MKR tokens over the past few days. The post noted that on DEX trades, the buy volume from whales and traders continues to dominate the selling volume, making it more bullish. It’s like a whale party, and everyone’s invited! 🎉🐳

However, the intelligence firm also noted that MKR is currently in the SDT accumulation zone. This might be the reason behind the consistent accumulation, ultimately leading to a price surge. Or maybe it’s just a really good marketing strategy? 🤔

$2.81 million worth of MKR inflow

Despite this bullish outlook from investors and traders, some long-term holders have been cashing out their holdings, as reported by the on-chain analytics firm Coinglass. Because who doesn’t love a good cash-out? 💵

Data from spot inflow/outflow revealed that exchanges across the crypto landscape have witnessed an inflow of $2.81 million worth of MKR tokens in the past 24 hours, potentially signaling a sell-off. Or maybe they just really need to buy a yacht? ⛵️

Rising Open interest and bulls’ bet

The intraday traders appear more confident, increasing their open positions in the past 24 hours. Data shows Maker’s Open Interest (OI) jumped by 20.5%. It’s like they all took a confidence pill! 💊

At press time, traders betting on the long side dominate, encouraging holders to maintain their bullish stance on the token. This might be the reason for the jump in Maker’s OI. Or maybe they just really like the color green? 💚

Currently, $1,062 is where traders holding long positions are over-leveraged, with $2.20 million in long positions. Meanwhile, $1,144 is another level where short sellers are over-leveraged, currently holding $970K in short positions. It’s like a financial tug-of-war! 🤼♂️

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- BLUR PREDICTION. BLUR cryptocurrency

2025-02-18 19:40