- At press time, ONDO‘s price is having a bit of a dramatic moment, down 6.26%—rolling the suspense dice! 🎲

- Large transactions are taking a leisurely stroll downhill, and liquidation risks are lurking like that one friend who always says, “Trust me!”

So, here’s the tea: Ondo [ONDO] Finance is practically throwing a party in the decentralized finance (DeFi) space, surpassing $1 billion in total value locked (TVL) faster than your last relationship fell apart. 🎉 In just 30 days, it skyrocketed by 57%, cementing its fabulous status in the tokenized U.S. Treasuries market, now boasting a cool total market value of over $4 billion. Fancy, right?

As a result, this project is strutting its stuff like it just walked into the club—seems like a major player in this fast-paced fiendish game called finance.

What does ONDO’s price action indicate?

When we dissect ONDO’s recent price behavior, it’s almost like an art exhibit showcasing intriguing “meh” patterns. The token is cozily trading within a symmetrical triangle formation, particularly cheeky considering its sharp hike, and is now flirting with the lower boundary of this triangle. 🙈

Currently, ONDO is chilling at $0.96, having a mini existential crisis with a 6.26% slump in the last 24 hours. It’s a little unsure of itself—like that person on a first date, testing the waters. 🌊 Although the trend has been on the up-and-up, the current downward spiral is raising eyebrows about its short-term vibes.

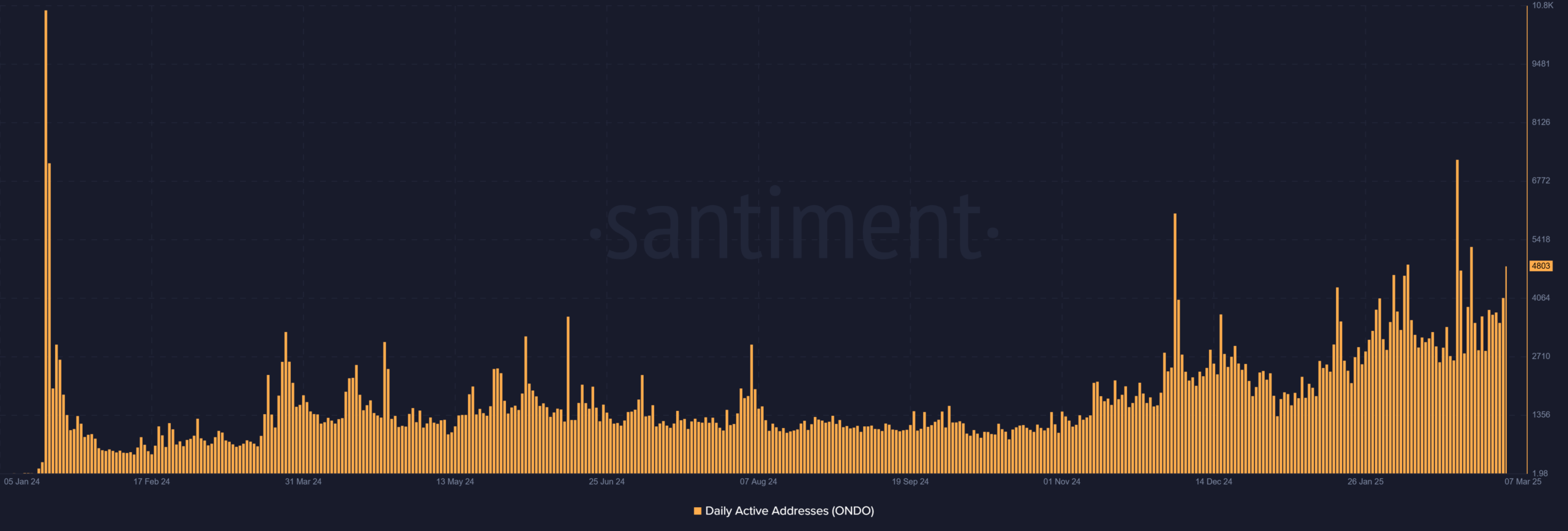

How have daily active addresses evolved?

Drumroll, please! ONDO has clocked in 4,803 daily active addresses—cue mild applause. 👏 This uptick indicates that some folks are actually awake and engaging, particularly with the surging popularity of tokenized treasuries. Lovely, isn’t it?

But hold your horses, because while this uptick seems promising, it remains to be seen if our friends stick around or make a hasty exit like they forgot their wallet at the bar. 🏃♀️

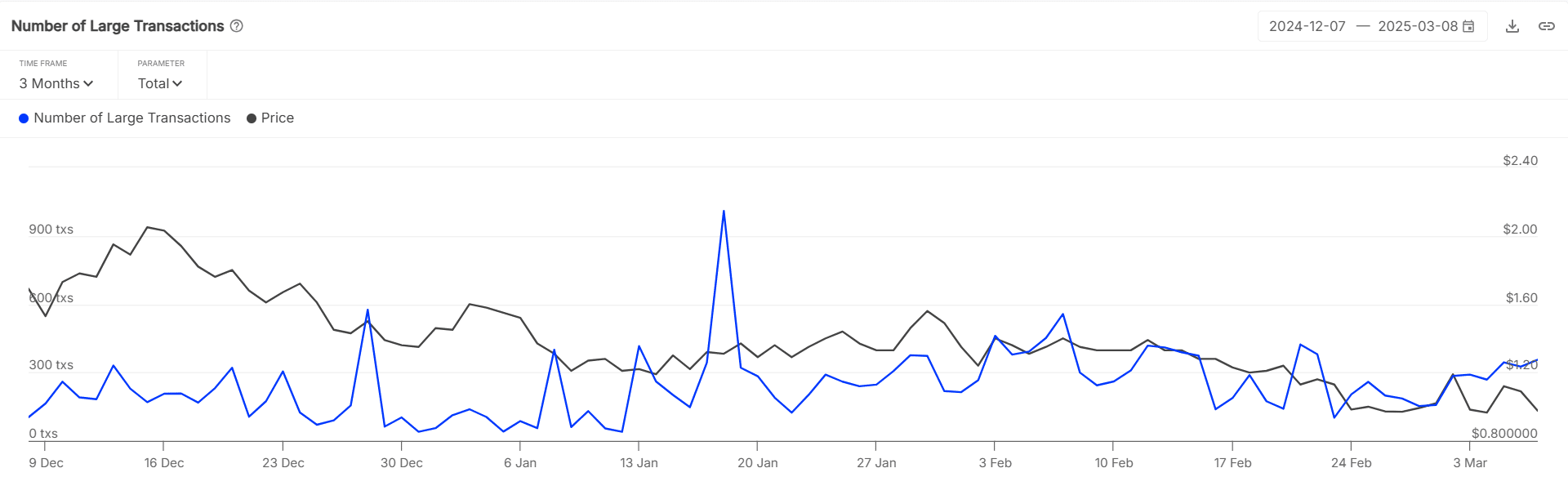

What do large transactions tell us?

Let’s talk large transactions—or rather, the dramatic decline of them. We’ve seen a 1.09% dip in big spending. Ouch! 😬 This could mean some of our investment giants are playing hard to get, possibly sitting back and sipping their lattes instead of diving into Ondo as it corrects itself.

This little dip hints that institutional investors might be playing the “let’s wait and see” game, carefully measuring before pouring more money into the pool—classic casino behavior.

Keep your eyes peeled on the broader market sentiment! It’s all about those juicy vibes, darling.

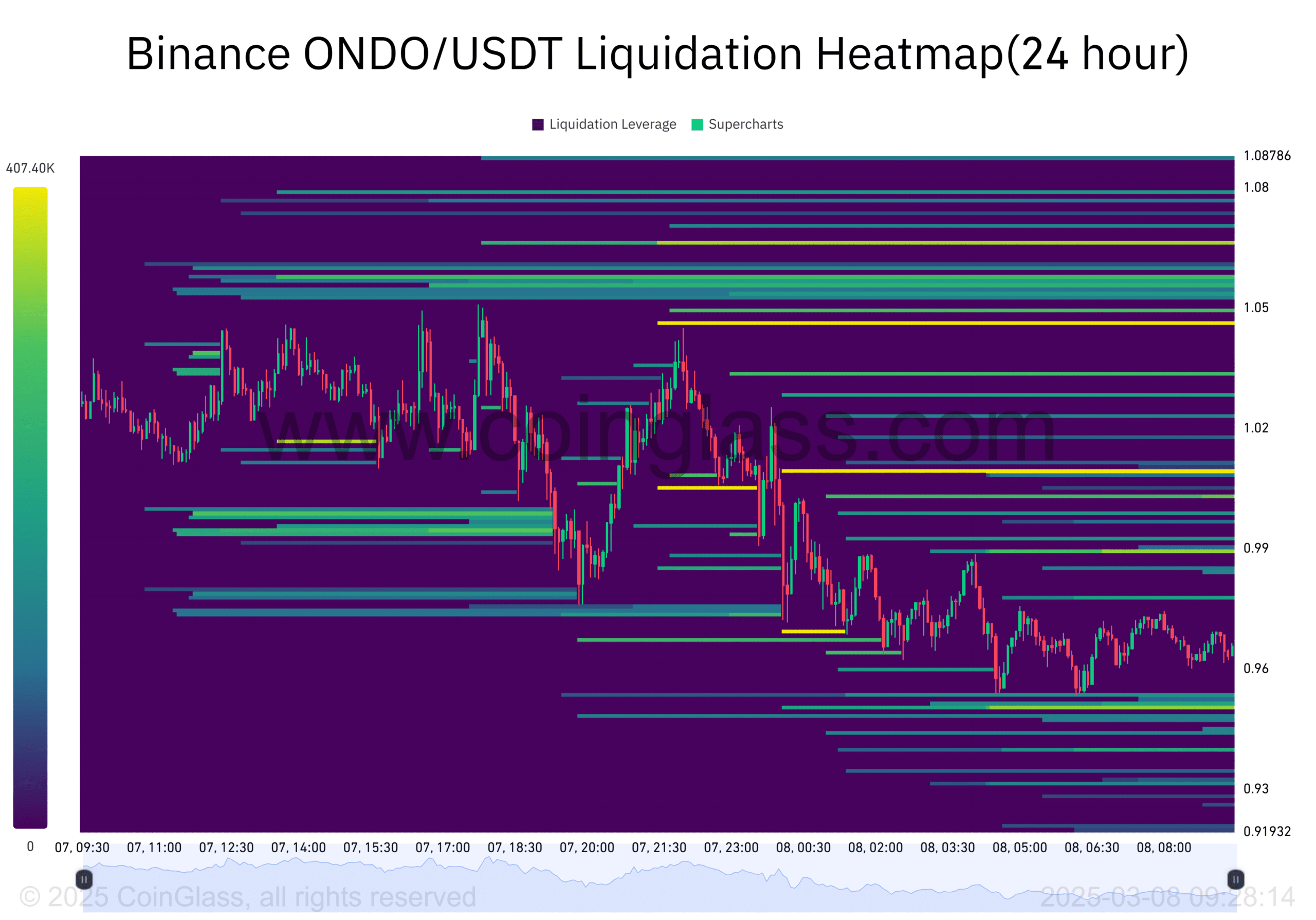

What does the liquidation heatmap reveal about market sentiment?

Now, take a look at the liquidation heatmap for Ondo—what a gem! 😱 We’re seeing significant liquidations stacking up like an unwanted pile of laundry in the 0.96–1.00 price range. Warning signs, people! Many traders are out in the wild risking it all, and we don’t mean at the blackjack table.

With prices inching closer to that range, we might witness a liquidation extravaganza that could lead to even more volatility—plot twist! 🎢 Keeping an eye on those liquidation levels is essential, especially as they could unleash a world of sharp price fluctuations. Hold on tight!

In the grand finale of this financial soap opera, despite Ondo’s rave-worthy growth in TVL and a burst of user activity, several ominous clouds are looming on the horizon, whispering potential volatility in the short term. ⛈️

While it struts confidently in the tokenized treasuries market, the recent downward trend, dwindling large transactions, and pesky liquidation risks are plotting a theatrical curveball. 🎭 So while Ondo has made a splash in the DeFi world, whether it can maintain this growth amidst swirling risks is anyone’s guess.

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Quick Guide: Finding Garlic in Oblivion Remastered

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

2025-03-08 16:29