-

A whale bought 420 billion PEPE tokens at the market bottom.

The whale made a $30K profit in less than one week.

As an experienced crypto investor who has witnessed numerous market fluctuations, I can say that this PEPE whale’s move was nothing short of impressive. The timing and strategic accumulation at the market bottom, followed by a quick exit for a substantial profit within just a week, is a lesson in smart trading.

A significant investor (Pepe [PEPE] whale) stirred the crypto market with swift and lucrative trades, demonstrating the volatile nature of meme-based tokens. Leveraging recent price fluctuations, they underscored the unpredictability that characterizes such digital assets.

Whale’s smart market timing

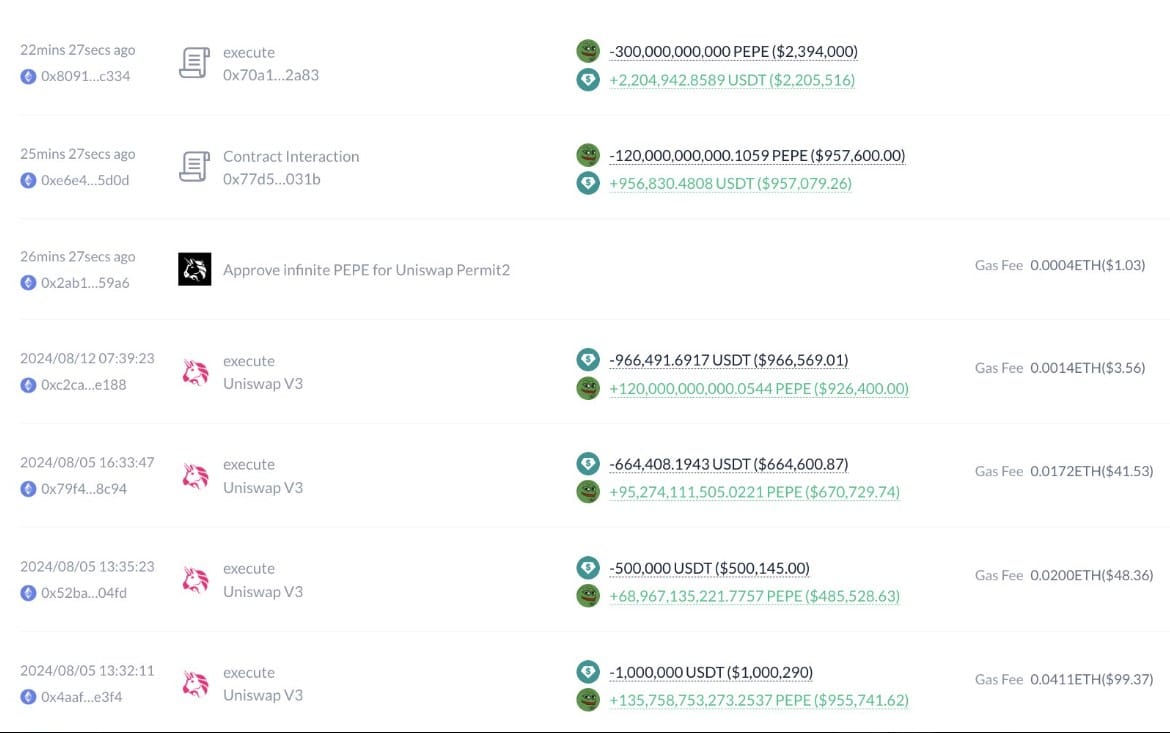

Data from Lookonchain indicates that a large investor, or “whale,” bought approximately 420 billion PEPE tokens for roughly $3.13 million on both the 5th and 12th of August. This significant purchase occurred near PEPE’s recent market low point, suggesting a strategic move.

Remarkably, just half an hour before the deadline, the whale decided to liquidate all its investments. Surprisingly, this swift move generated a profit of $30k in a very brief span.

PEPE sentiment turns bearish

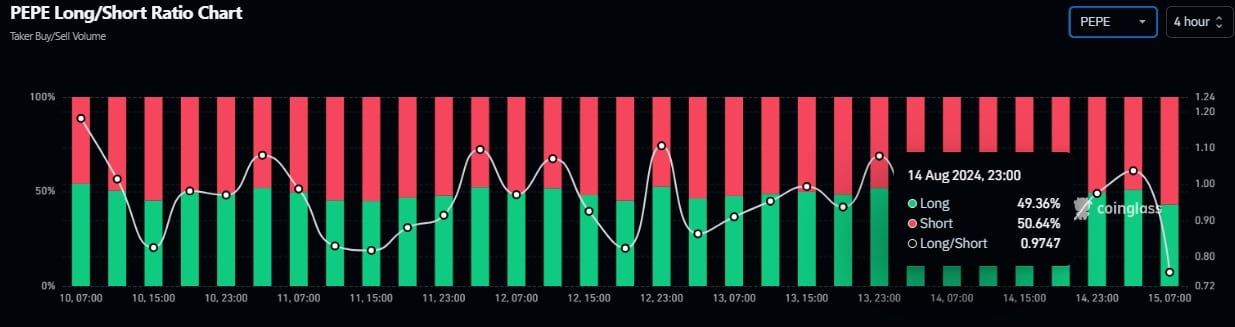

Based on the Long/Short Ratio from Coinglass, there has been growing pessimism towards the memecoin PEPE. On August 14th, the coin showed a low value of 0.9747, suggesting that more traders were holding short positions rather than long ones at that moment, as indicated by the current data.

Based on my extensive experience as a trader and my observations of market trends, I believe that the rapid exit of this whale from their substantial position lends credence to the bearish outlook for PEPE in the short term. This is because large-scale investors often have access to information before it becomes public knowledge, and their actions can serve as a bellwether for market movements. Given my own past experiences with similar situations, I would advise caution when considering investments in PEPE at this time, as the potential for further dips seems quite high.

Large transactions surge

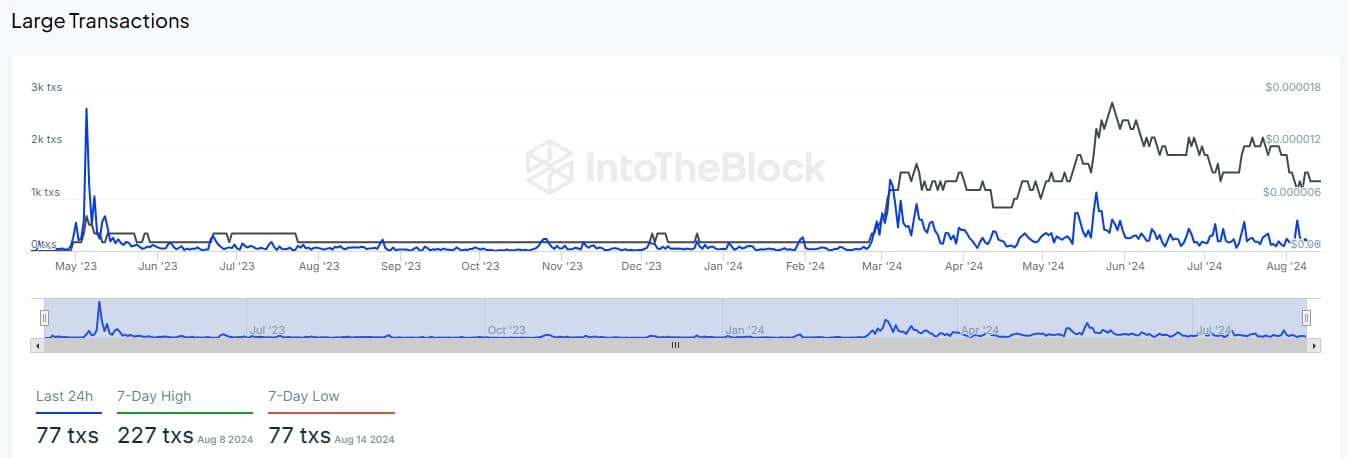

According to an analysis by AMBCrypto using data from IntoTheBlock, there’s been a significant increase in large PEPE transactions over the past day, with a total of 77 recorded. This figure peaked at 227 on the 8th of August, marking a 7-day high.

This enhanced activity from top holders likely signaled more volatility along the way.

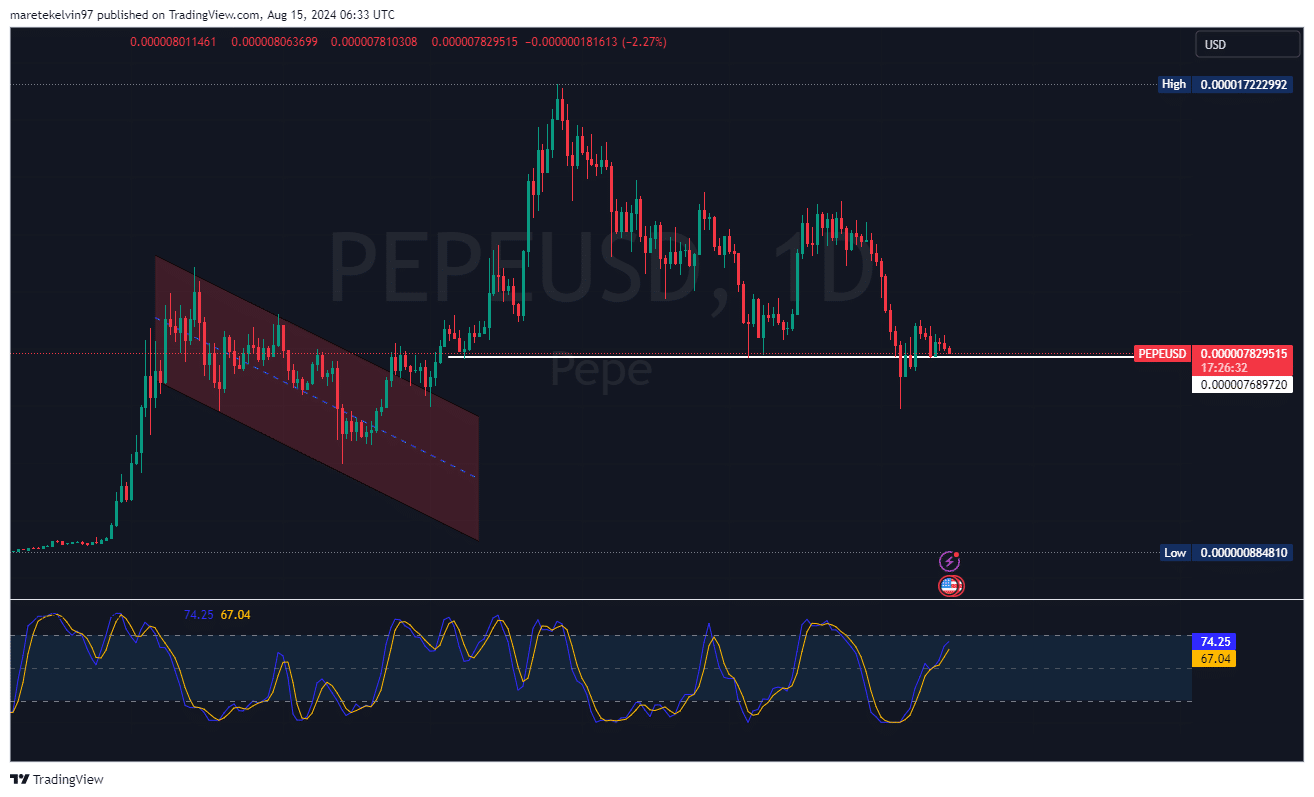

Following a substantial increase in early August, PEPE‘s price graph displayed a noticeable decline since then. At present, it is being traded at approximately $0.00000078295, representing a decrease of 2.27% within the past 24 hours.

Read PEPE’s Price Prediction 2024 – 2025

If the selling pressure from the massive outflow continues, it prices may plummet further.

As an analyst, I noticed that the Stochastic RSI was nearing an overbought region, suggesting that a possible bearish rally might not be dismissed outright.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-08-15 20:15