-

Increased Invested Age and other metrics suggested that most MATIC holders were opting to HODL.

High areas of liquidity existed between $0.75 and $0.78, indicating that the price could move towards these zones.

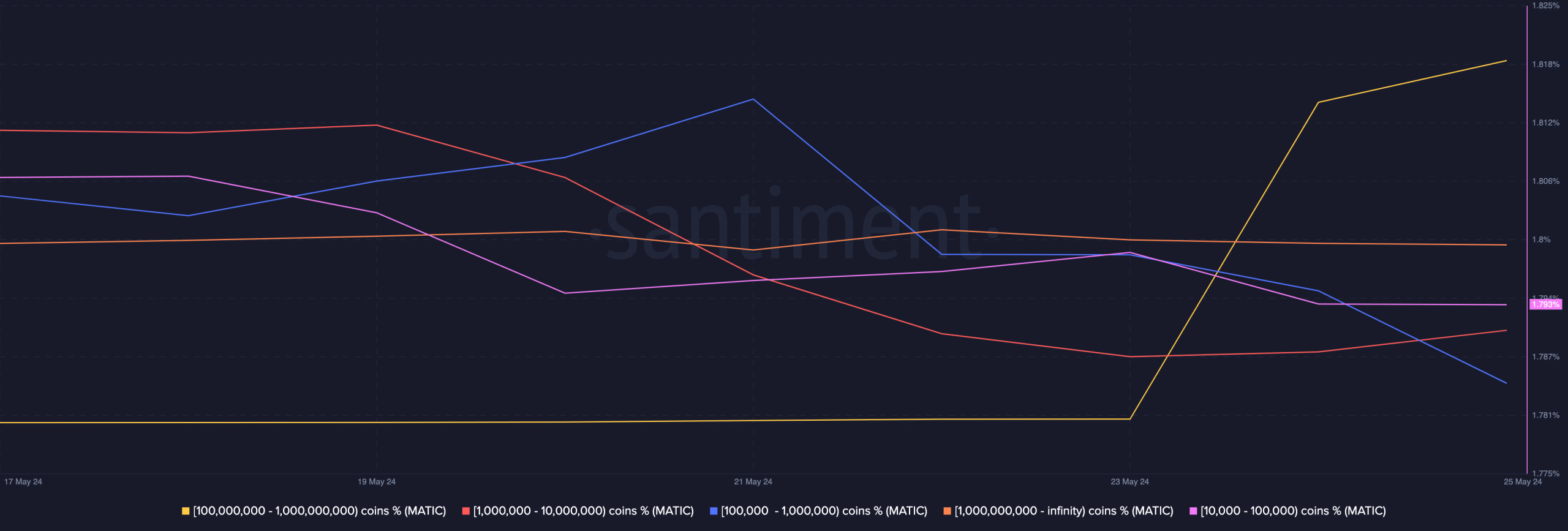

As a researcher with experience in analyzing cryptocurrency market trends, I find the recent developments in Polygon (MATIC) intriguing. According to data from Santiment, there has been an increase in the percentage of MATIC addresses holding between 100 million and 1 billion tokens. This cohort now represents 17.30% of the total supply, up from 16.17% only a few days ago.

In contrast to other groups experiencing a decrease in token holdings, those holding between 100 million and 1 billion MATIC tokens with Polygon saw an increase in their balances.

Based on data from Santiment’s on-chain analytics, the group in question held 16.17% of the supply on May 23rd.

But as of this writing, the percentage had increased to 17.30%.

Skeptics are no longer in town

As a crypto investor, I’ve noticed an uptick in the number of people showing faith in MATIC‘s future prospects. This surge in confidence can have both long-term and short-term implications for the token’s price. In the long run, it could indicate a growing belief in the token’s ability to deliver on its promises. But, in the here and now, this trend might also influence MATIC’s price volatility.

If whales were to sell a significant amount of their tokens, the price of that particular token might drop as a result.

Due to this rise in balance, Polygon’s price could experience an uplift. Currently, the token is priced at $0.72 on the market. However, this represents a decrease of 25.48% compared to the past 90 days.

Matic has made several efforts over the past month to rise above its current price level. Yet, each time it has approached the $0.80 resistance, the market has shown reluctance and rejected the advance.

With the recent buildup, there’s a possibility that the Polygon native token might increase in value. To confirm this suspicion, AMBCrypto examined various other metrics and signals.

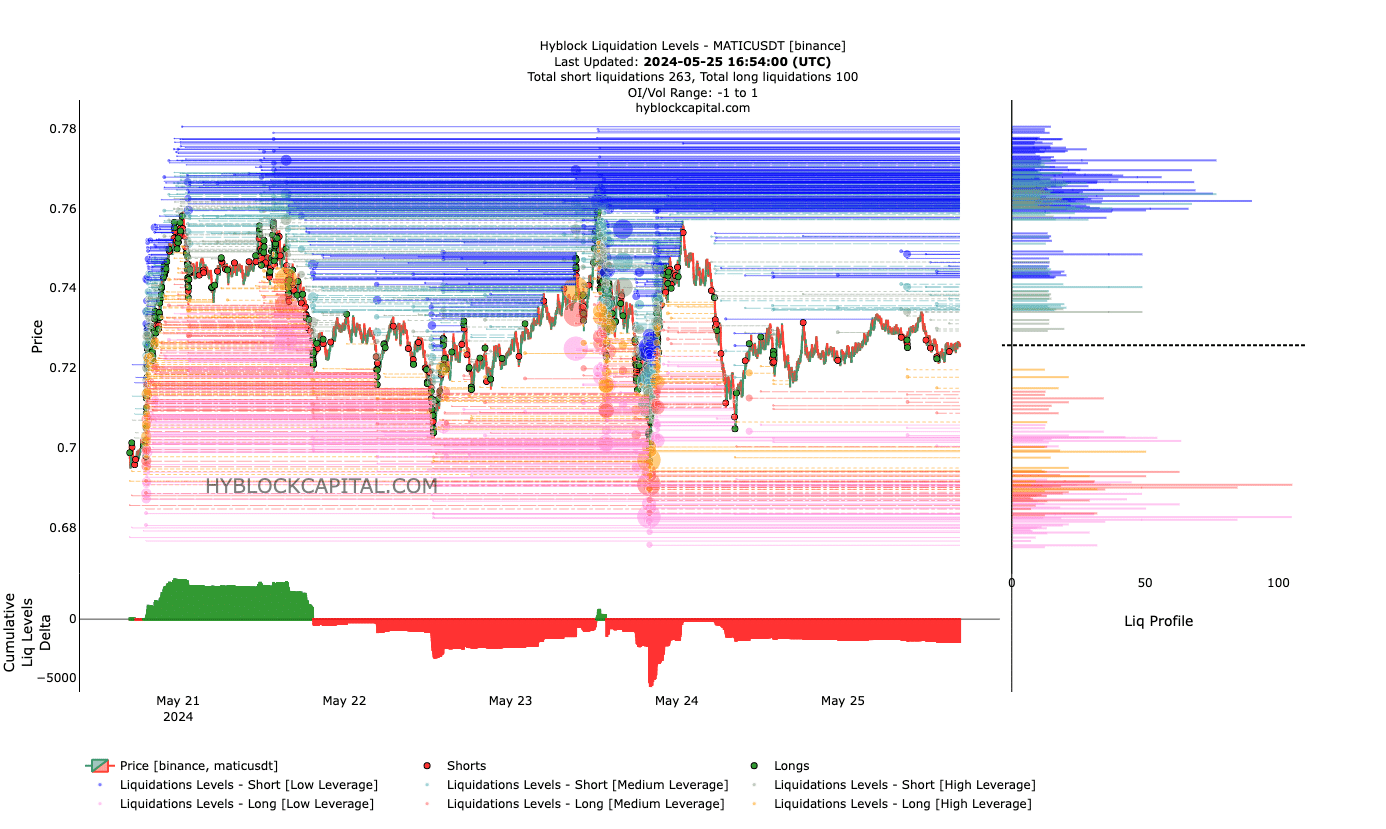

As a researcher investigating the behavior of cryptocurrencies, I examined the liquidation levels as one of the key indicators. These levels reveal significant points where liquidity is abundant in the market, indicating potential price thresholds for a given digital currency.

From my perspective as a market analyst, at the current moment, I’ve observed a significant liquidity pool on the Polygon chart around the price range of $0.75 to $0.78. This area, which I refer to as a magnetic zone, suggests that the token could potentially begin moving in that direction soon.

The season of respite is coming

In the very same plot, the Cumulative Liquidation Levels Delta (CLLD) supported the forecast. To clarify, the CLLD signifies the variation between long and short liquidation amounts.

As a researcher investigating market trends, I would interpret positive readings of the Composite Liquidation-Leverage Ratio (CLLD) as indicative of a larger number of long positions being closed out compared to short positions in the market. Conversely, negative CLLD readings suggest that there are more short positions being liquidated than long positions.

Additionally, the indicator has an impact on the price trend. At the current moment, it is showing a negative sign. For Polygon’s price, this implies that a significant rebound may be imminent, and investors attempting to short at the dip could face losses.

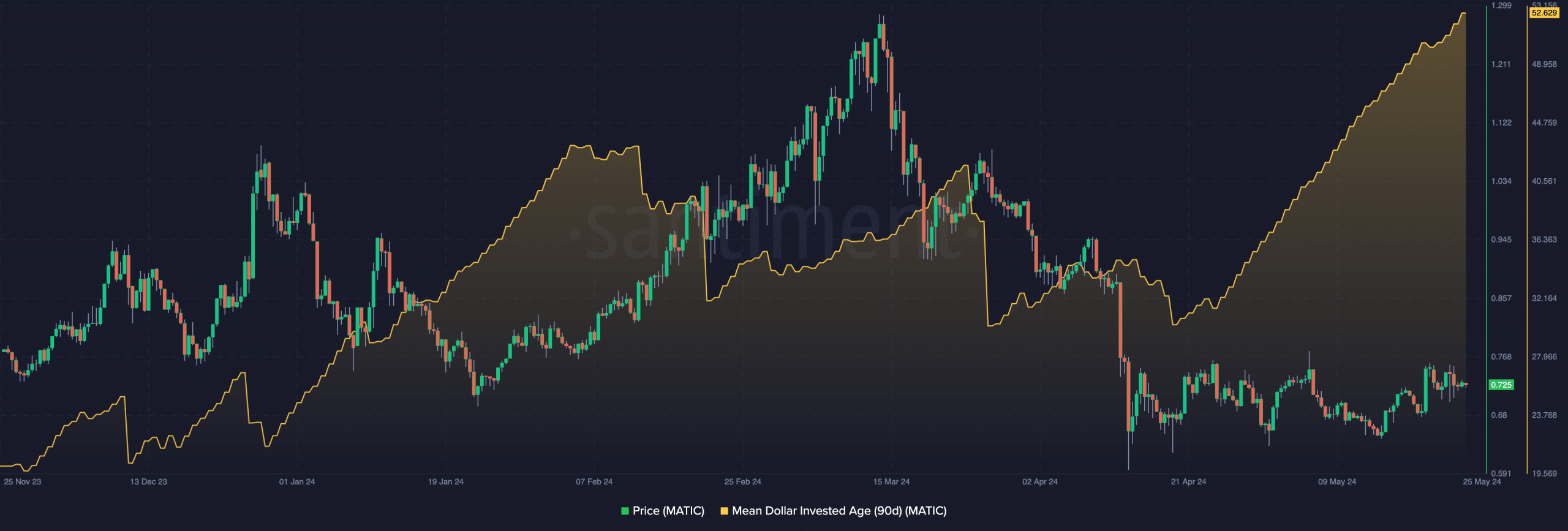

The Mean Dollar Invested Age (MDIA) revealed that the majority of Polygon token holders had tended towards holding onto their MATIC for longer periods. This metric signifies the typical length of time all existing Polygon wallets have possessed their tokens.

Read Polygon’s [MATIC] Price Prediction 2024-2025

A decrease in the reading of the Moving Average Divergence Indicator (MDIA) signifies an uptick in trading transactions. This surge in activity might lead to heightened selling intensity. However, at this moment, the 90-day MDIA has registered a rise instead.

Previously, when the metric displayed a similar pattern, MATIC‘s value rose significantly from $0.71 to reach $1.27. Although it may not follow the same trajectory this time, there’s a possibility that the token price could approach or even exceed $1 within the intermediate term.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-05-26 11:03