-

BTC’s recent rally could stall amidst rising sell pressure, as per Coinbase analysts

QCP Capital and Coinbase analysts projected a range-breakout in Q4 2024

As a seasoned financial analyst with extensive experience in the cryptocurrency market, I’ve witnessed numerous price movements and trends throughout the years. The recent Bitcoin (BTC) rally to a monthly high of $67.3k has been an intriguing development, especially amidst the broader selloff in U.S equities.

On Friday, the price of Bitcoin [BTC] surged and reached a peak of $67,300 on the charts, bucking the downward trend in the US equity markets.

Coinbase analysts issue a warning: The latest price increases may entice sellers looking to make profits, thereby limiting any further upward price movement.

In fact, part of the exchange’s weekly market commentary read,

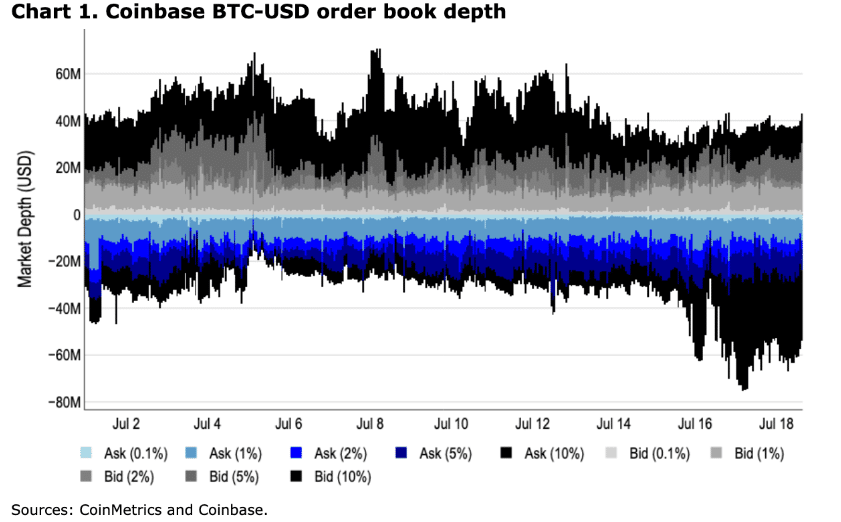

As an analyst, I’ve observed a noteworthy uptick in the number of sell orders being submitted within a 5-10% range of the mid price. This trend implies that some investors could be taking profits at current levels or that market participants are growing more inclined to sell even as prices continue to rise.

From a different viewpoint, market depth represents the number of pending buy and sell orders. Orders indicated with positive values in US Dollars signify buyers waiting in the wings, while negative values reflect sellers ready to transact.

The Coinbase graph indicates a noticeable decrease in market liquidity around the 16th to 18th of July, accompanied by a rising number of sell orders. In the near term, this situation could intensify the downward trend for the cryptocurrency’s value.

More Bitcoin sell volumes

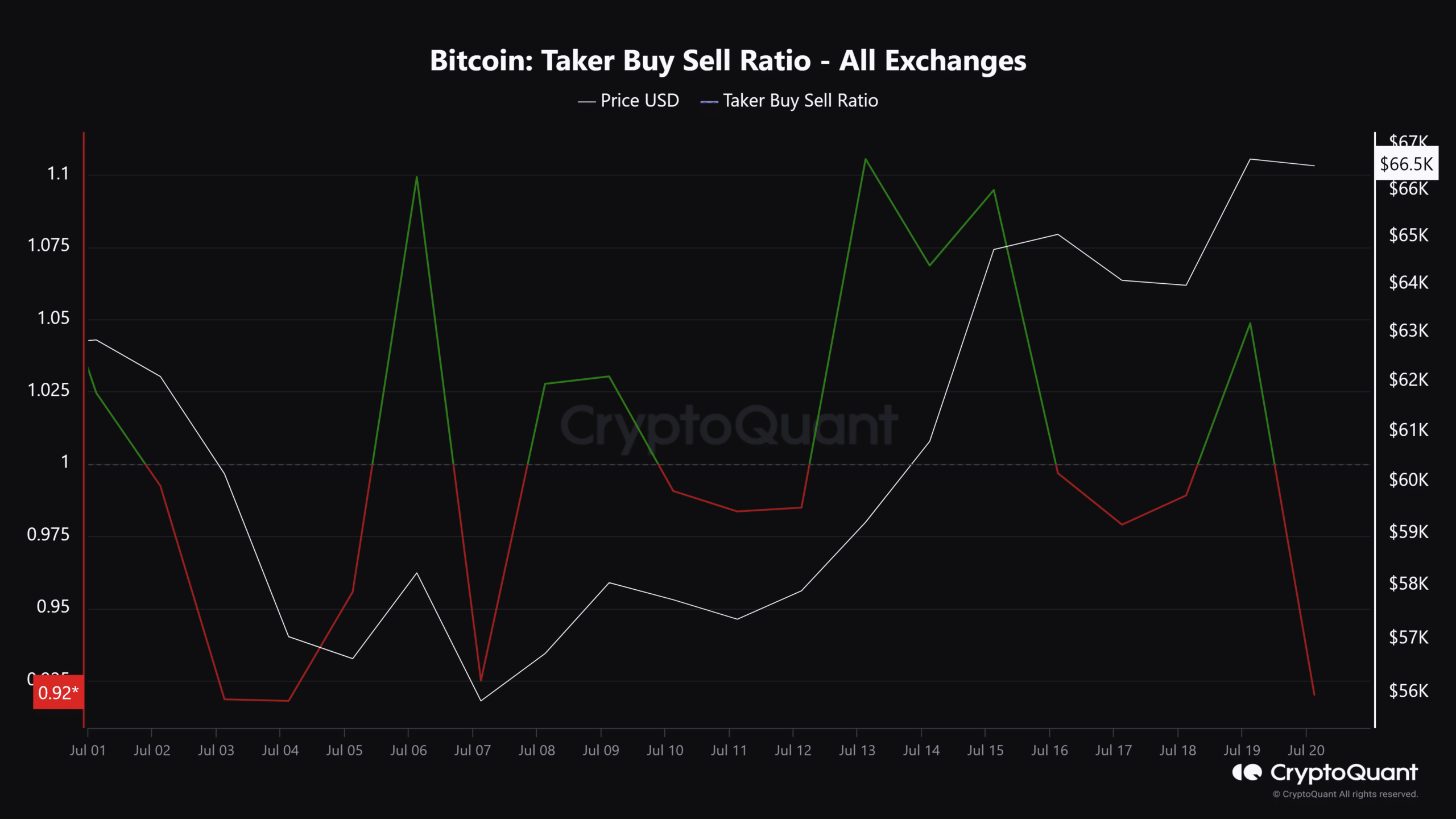

The trend I mentioned earlier was apparent in the majority of cryptocurrency exchanges, with significant activity observed in the derivatives market. According to CryptoQuant’s data, for instance, sell orders surpassed buy orders on the weekend, as evidenced by a decreasing Taker Buy Sell Ratio.

At present on the charts, a ratio indicator, calculated by dividing buying volume by selling volume, indicated a bearish outlook when it fell below the threshold of 1.

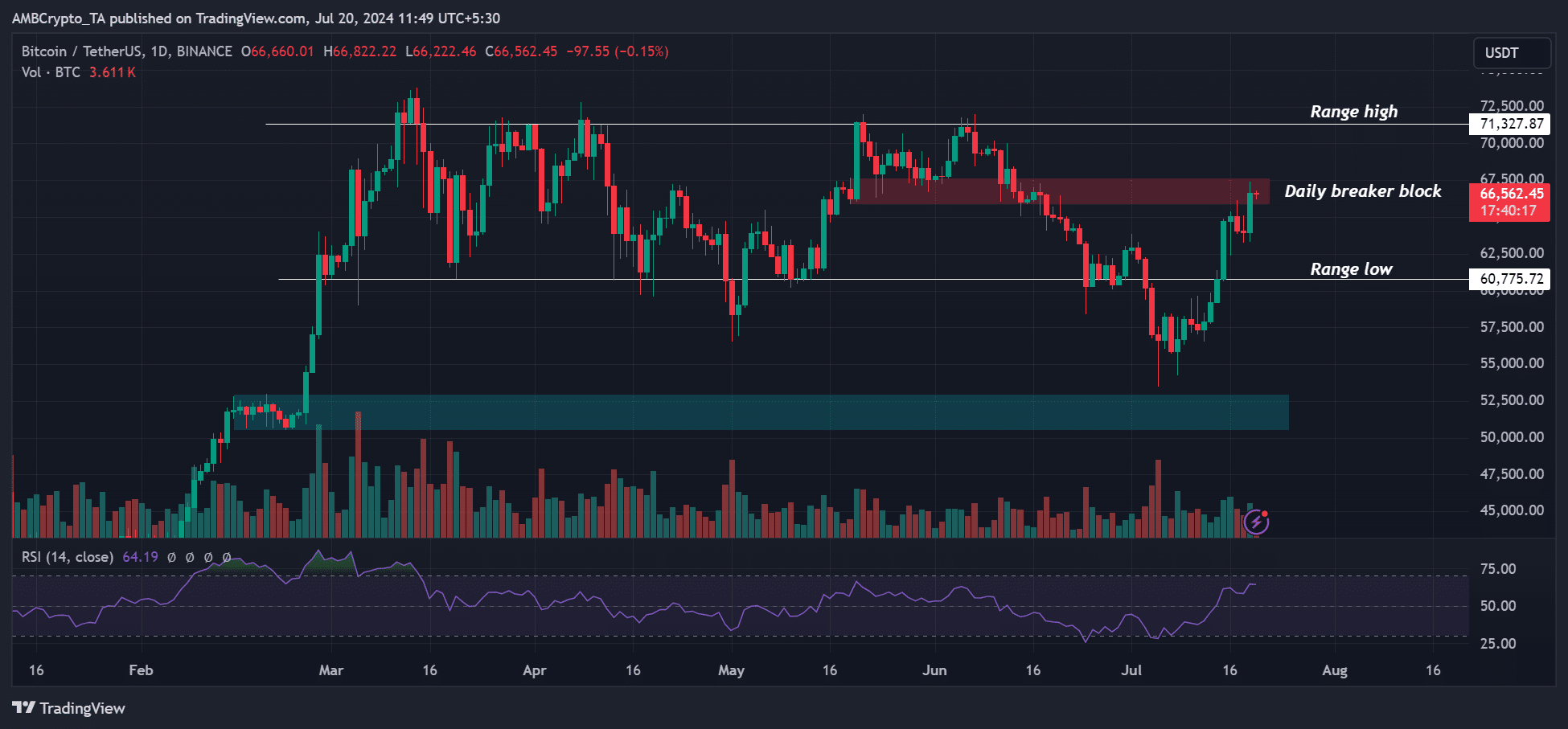

During the latest price surge, Coinbase’s analysts have hypothesized that investors may have taken profits, aligning with their prediction of erratic and band trading for the third quarter of 2024. Nevertheless, these analysts remain optimistic, suggesting a potential rally could still transpire in the final quarter of 2024.

The forecast I’m presenting aligns with the views expressed by QCP Capital’s analysts in their recent communication to their Telegram group on Friday.

As a crypto investor, I’m observing that the current spot price may fluctuate in the short term, particularly since dealers hold large positions for the 26-Jul $67k strike. However, it’s clear from market indicators that there’s a strong belief among investors that a significant breakout is imminent, leading up to the US elections.

At the current moment, the cryptocurrency had not surpassed the resistance and daily high mark, which was located around $67,500, as indicated by the red line on the price chart.

If bulls clear this hurdle, a swift retest of the range-highs at $71k would be likely.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-07-20 16:08