-

SOL price has increased by 6% over the last 7 days but is down 17% since the start of the month.

Indicators flashing mixed signals have resulted in indecisiveness among SOL market speculators.

As a seasoned crypto investor with battle-tested nerves and a knack for reading market trends, I find myself intrigued by Solana’s [SOL] recent price action. The 6% surge over the last seven days is certainly encouraging, but the 17% drop since the start of the month leaves me somewhat concerned.

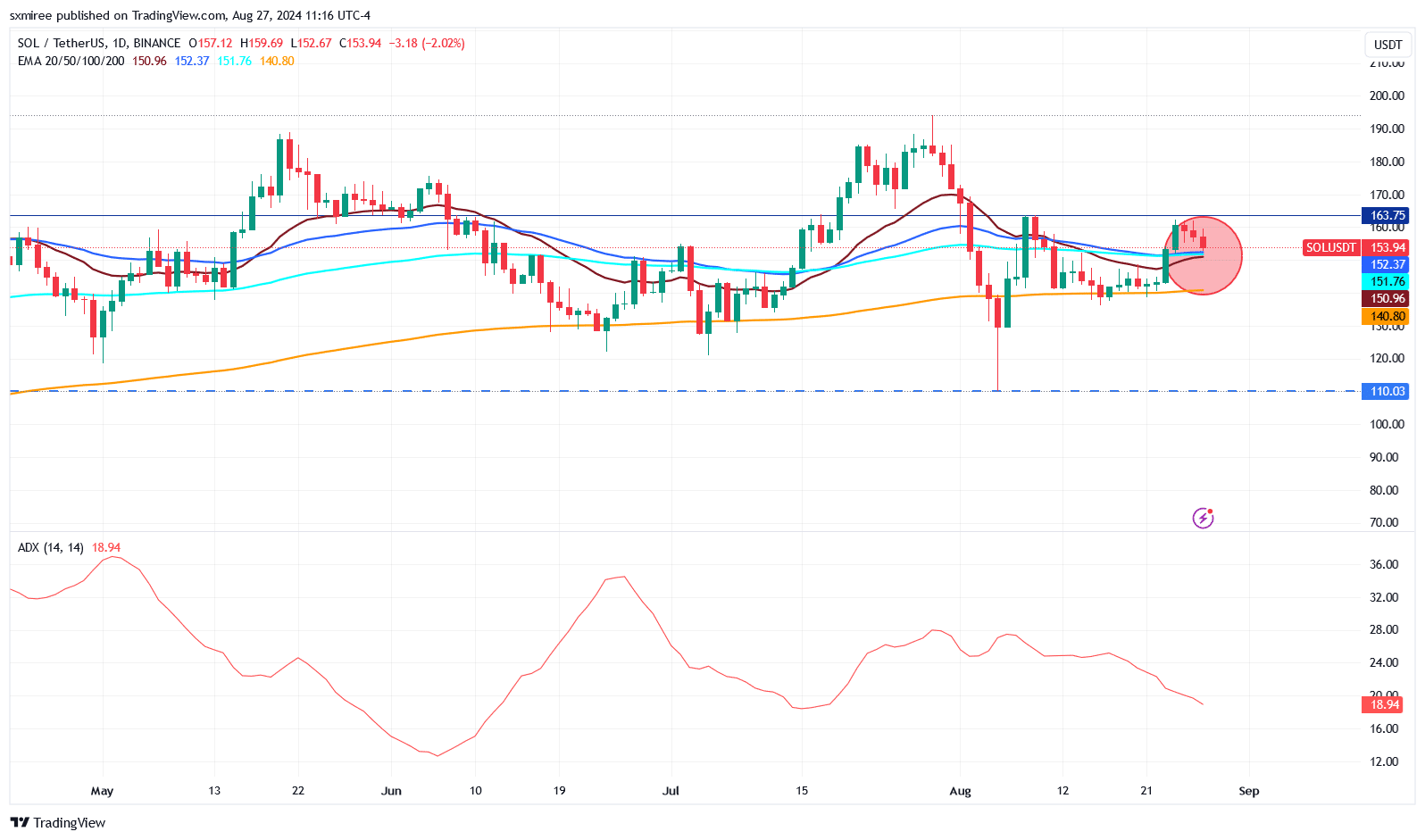

Over the weekend and this current week, the price movement of Solana [SOL] has shown a failed upward trend. Data from TradingView indicates that the 20-, 50-, and 100-day exponential moving averages (EMAs) for SOL/USDT have closed in quite closely together.

This indicated that the difference in momentum across various timeframes has diminished.

Lack a clear trend direction as momentum rebuilds

On the daily SOL chart, the Average Directional Index (ADX) – a tool for measuring trend strength in a market – has fallen to relatively low values. This decrease suggests that the current market trend may not be as decisive or dominant as it once was.

In simpler terms, when the Average Directional Index (ADX) is low, it often signals lower market volatility. For Solana specifically, this could mean that the upward trend might be weakening and the market is shifting from a trending state to a more stable period of consolidation or range-bound trading.

According to the data from TradingView, the ADX (Average Directional Movement Index) for the SOL/USDT pair has been gradually decreasing over time. On August 6th, it stood at 26, but as of now, it’s down to 19.

This reading falls significantly short of the 20-point minimum. It implies that Solana might not experience significant price fluctuations in the immediate future.

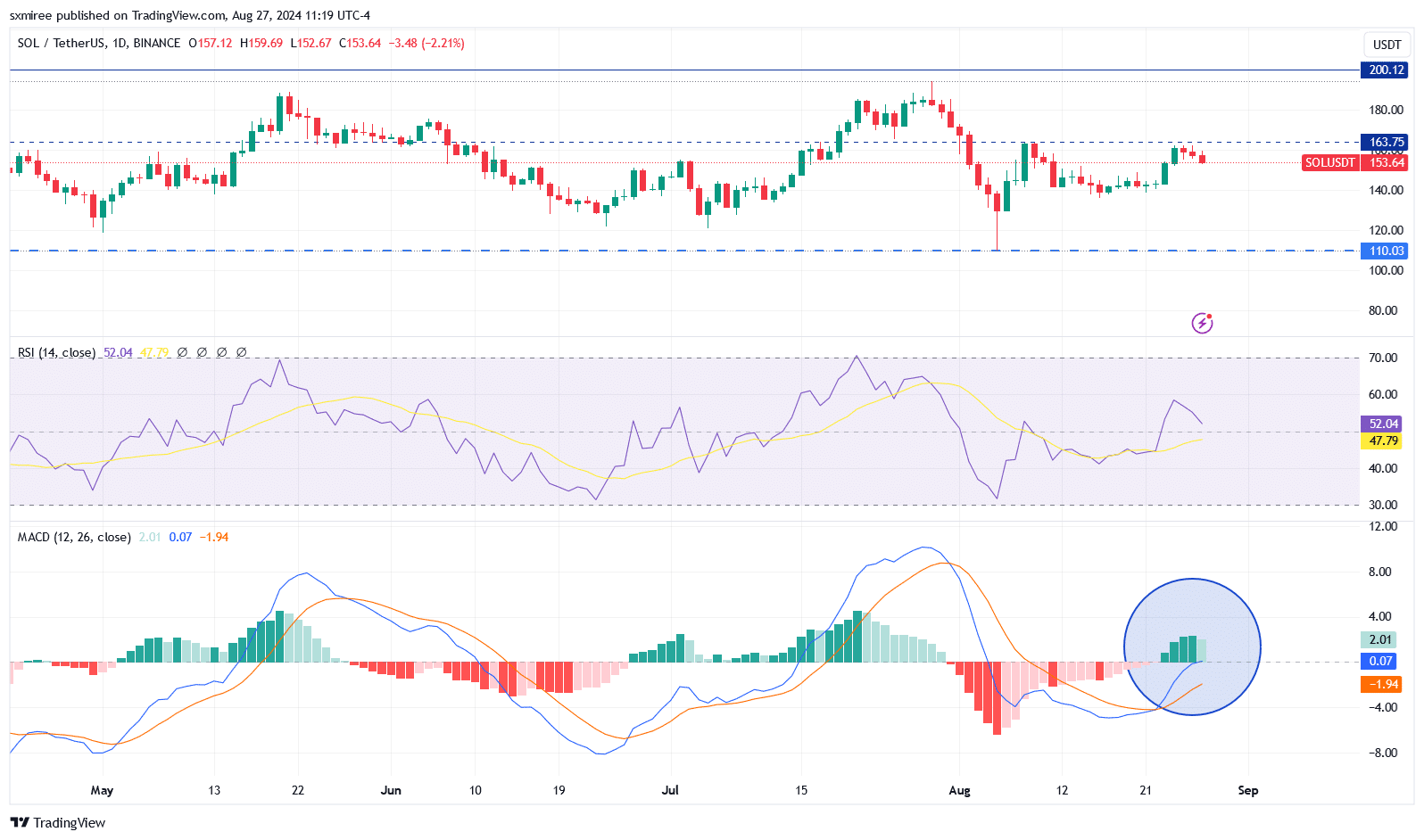

Momentum indicators point to uptrend continuation in the near term

When the Average Directional Index (ADX) is low, it’s advantageous to focus on strategies that are based on range-bound or mean-reversion patterns. Over the last five days, the Solana/USDT pair has shown a series of positive Moving Average Convergence Divergence (MACD) bars on its daily chart. This indicates a potential trend for price consolidation or reversal in this period.

Apart from the favorable bar graphs, the Moving Average Convergence Divergence (MACD) line has lately moved above zero, while the signal line continues below it.

The MACD overall picture suggests that bullish momentum has been reasserting itself steadily. But the longer-term trend is still catching up.

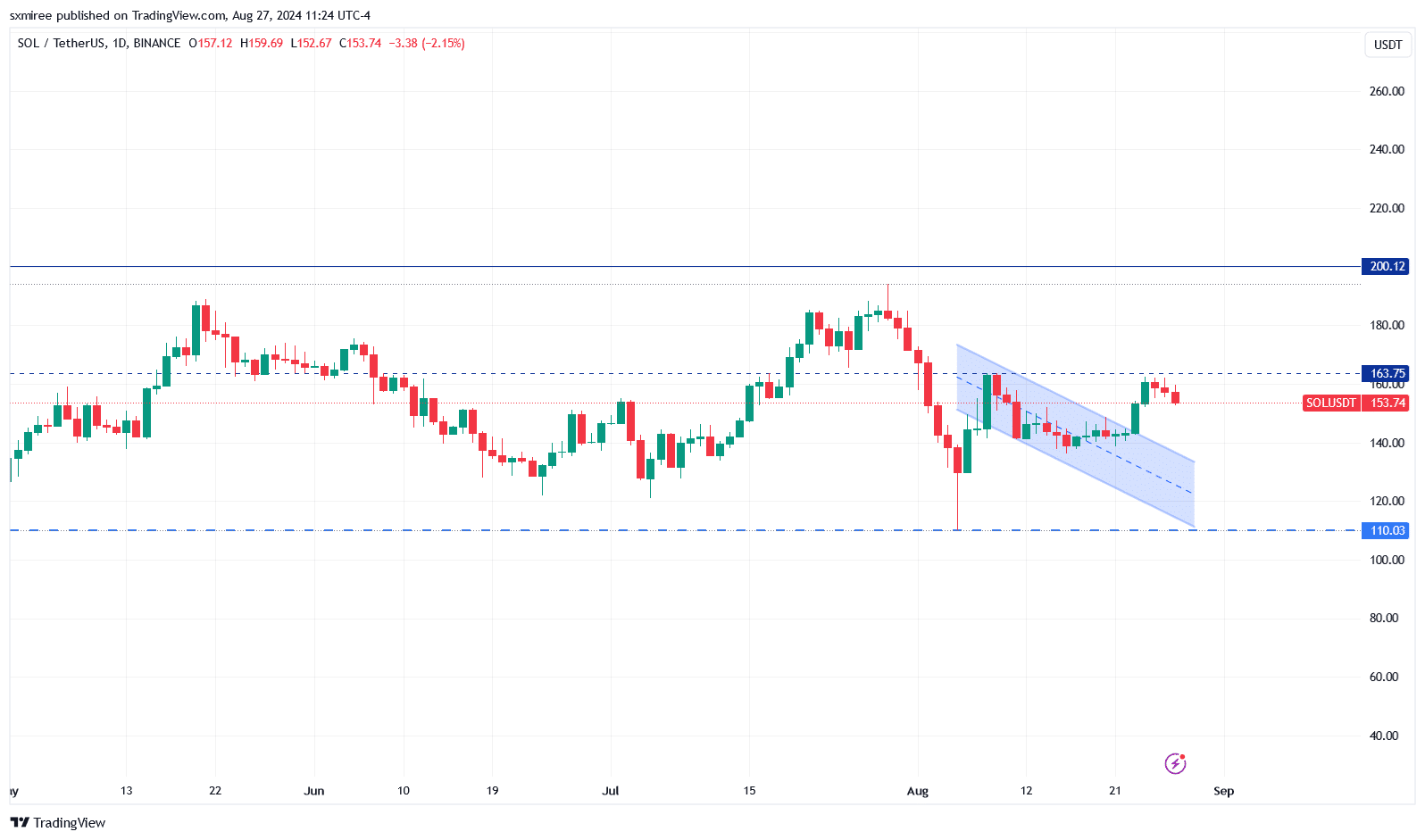

Looking more closely at the graph, it appears that SOL/USDT has breached an ongoing downward pattern (descending channel). This break suggests that the corrective phase, which had been ongoing for several weeks, has concluded, and we might now be witnessing the start of an uptrend.

The breakout is verified as buyers exert growing influence, evident through candles that exceed the upper boundary limits.

Read Solana’s [SOL] Price Prediction 2024–2025

On-chain metrics indicate a slowdown in network usage

Currently, Solana’s transaction fees are close to their minimum levels, similar to what was observed in early May at the network level.

The decrease in daily transaction fees indicates less network activity due to waning interest in Solana-associated meme tokens such as Dogwifhat, Popcat, and Bonk. These coins have significantly influenced Solana’s recent popularity in the cryptocurrency market. In simpler terms, fewer people are using Solana because there’s less excitement around the meme coins built on its platform, which have contributed to SOL‘s recent rise in value.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-08-28 11:04