- Solana’s founder proposed a mechanism to lower entry barriers to node operations.

- The executive mulled ways of dealing with voting fees to address the issue.

As a researcher with extensive experience in the blockchain industry, I’ve followed the developments between Solana and Ethereum closely. The recent focus on validator costs and entry barriers to node operations has been a topic of much debate.

Solana [SOL] and Ethereum [ETH] leaders have debated various issues in the space for a while.

Lately, the Solana Foundation’s crackdown on validators employing MEV (Maximum Extractable Value) double-dip attacks has garnered significant notice.

The Foundation withdrew financial support to some validators to reduce the attacks.

As a Solana investor, I’ve come to realize that operating a validator node on the network comes with significant costs, approximately amounting to $65,000 annually. Given this substantial investment required, it would be beneficial for the Solana Foundation to consider providing financial assistance in certain situations to help offset these expenses.

As an analyst, I would rephrase that statement as follows: Contrary to popular belief, becoming an Ethereum validator involves a one-time payment of 32 Ether, although the cost does not include hardware expenses or other resources.

Why Solana nodes are 10x costlier

Anatoly Yakovenko, the founder of Solana, explained the price disparity between Ethereum’s superior consensus mechanism and its own.

“The economic threshold for genuine nodes to take part in Solana’s consensus process is approximately ten times greater than that of Ethereum presently. This disparity is mainly attributed to Ethereum’s substantial investment in BLS aggregation for transmitting consensus messages.”

The BLS scheme, named after its creators Boneh, Lynn, and Shacham, is a signature method favored by Ethereum due to its efficiency. This technique allows multiple messages to be independently authenticated by validators within the same signature.

This allows several messages to be aggregated effectively, lowering overall costs.

According to Yakovenko’s observation, Solana’s present approach differs from Ethereum’s method. Yet, the creator mentioned that Solana will adopt this system in due time.

“Perhaps Solana may introduce voting subcommittees or other solutions in the future. With advancing hardware, the base fee for transmitting a message network-wide is expected to decrease, resulting in lower costs per vote and reduced economic thresholds.”

One user pointed out that a significant portion of Solana’s expenses appeared to be due to transaction fees during voting processes. How does Solana plan to address this issue? According to Yakovenko, he addressed this concern.

As aanalyst, I propose that implementing voting subcommittees could benefit us in several ways. Firstly, it would enable us to lower the voting fee. Secondly, by rotating the ballot boxes in and out of these subcommittees, we would effectively reduce the overall vote load. Ultimately, this would lead to a significant decrease in voting costs.

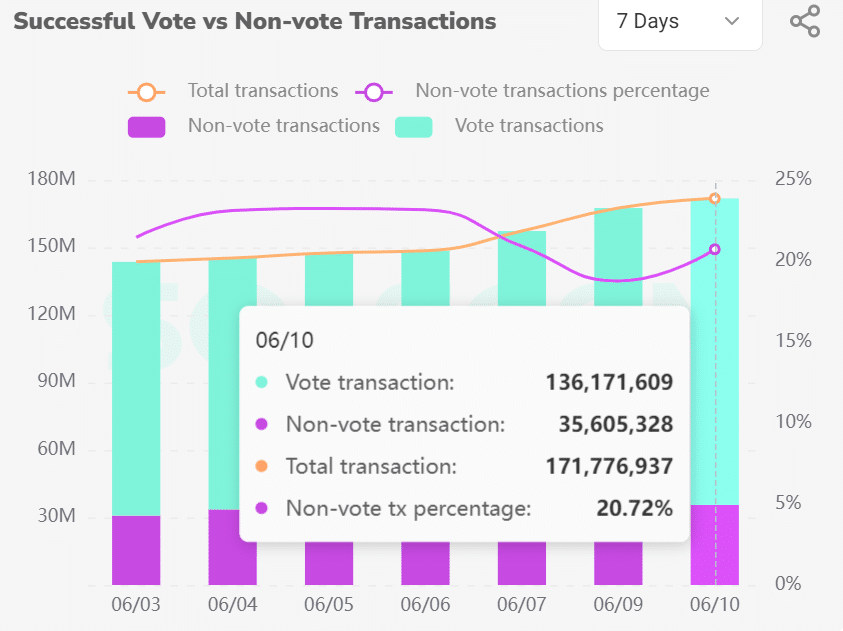

As a researcher studying transaction data on the Solana blockchain over the past week, I’ve discovered that a staggering 80% of all transactions can be categorized as vote-related. This finding emphasizes the significant role votes play in shaping the landscape of transactions on this dynamic network.

As a crypto investor, I’ve noticed that validators incur fees for processing vote transactions just like any other transaction in the network. The fact that some validators hold a larger share of the network’s power indicates that voting fees may be a significant expense and even act as an obstacle for newcomers entering the crypto space.

It remains to be seen whether Solana will implement the solution as floated by the founder.

While waiting for the FOMC meeting, I observed a 6% decline in SOL‘s value due to crypto investors reducing their risk exposure.

On June 11th, the price of SOL dipped down to $145 – a figure not seen since mid-May – as the market turmoil forced sell-offs throughout various markets.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-12 09:11