- Solana’s price spiked to $141.29 but may dip back to $130.

- Analyst suggests watching the $146 risk line; surpassing it could propel prices to $150-$166.

As a seasoned analyst with years of experience navigating the volatile waters of the cryptocurrency market, I have learned to read between the lines and anticipate the ebbs and flows that define this dynamic landscape. After careful analysis of Solana’s recent performance and considering the insights shared by respected analyst Ali, here is my take.

In just one day, the value of Solana (SOL) has significantly increased by around 15%, currently trading at $141.29. This significant rise stands out against its recent downward trend, where it had dropped to as low as $110 earlier in the day.

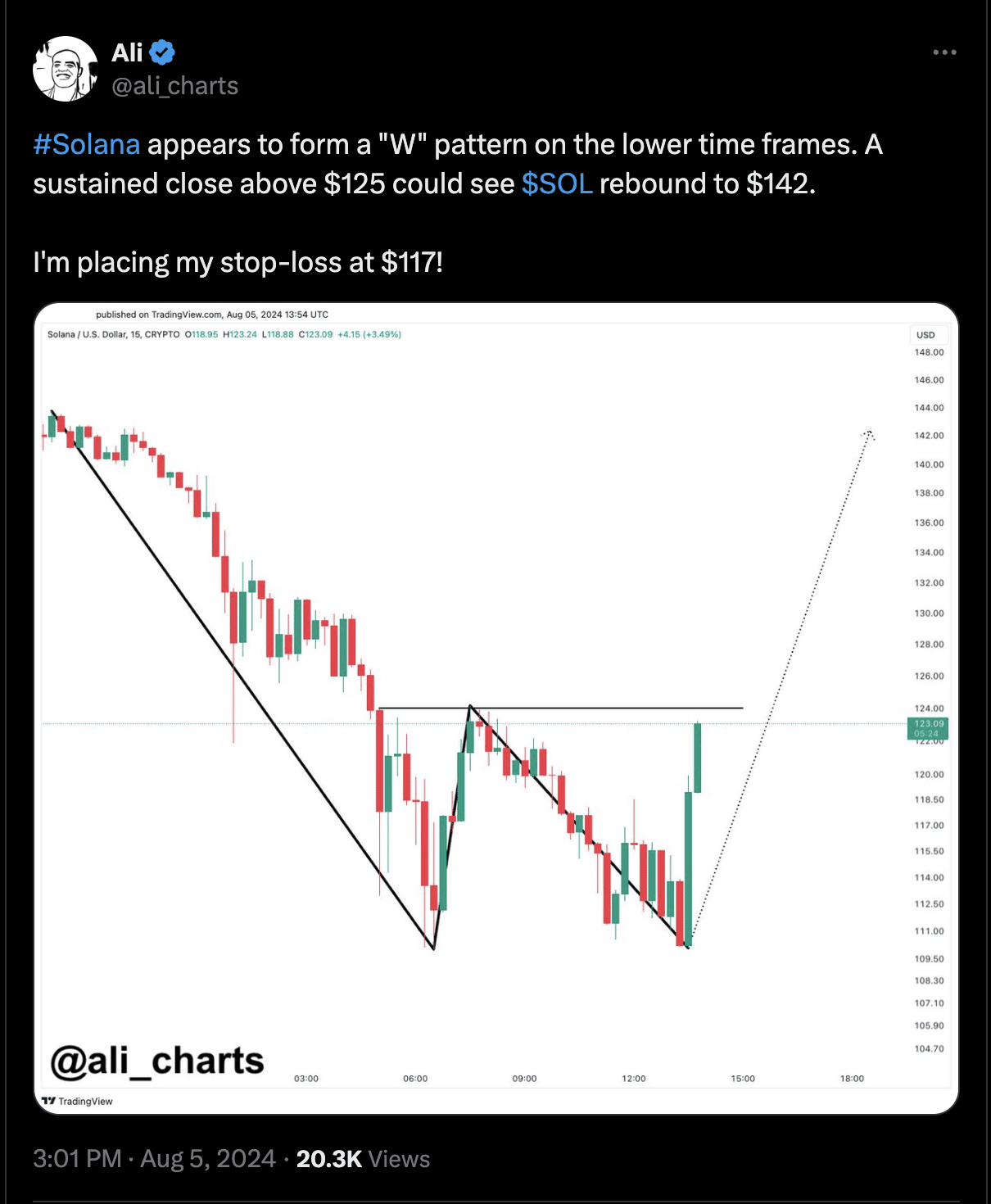

As a crypto investor, I’m excited about the recent upward trend, but I remain cautious, given the insights from industry experts like Ali. He’s known for his astute analysis in the cryptocurrency world, and he’s hinted that the bearish phase for Solana might not have fully run its course yet.

The technical outlook on SOL

By examining the TD Sequential indicator, a commonly used trading tool for detecting market trends, the analyst noticed a sell signal appearing on Solana’s one-hour price chart. This technical signal hints at a possible price drop towards the ranges of $135 to $130.

Instead, Ali highlighted a significant resistance point at $146. If Solana manages to surpass this barrier, it might counteract the bearish prediction, possibly pushing its value up to the $150-$166 price range.

As of now, Solana has touched a high of $143 but has not yet surpassed the notable $146 mark.

The reliability of these predictions is strengthened because the analyst has a strong history of making accurate predictions, as demonstrated by correctly predicting that Solana’s price would rise from its previous low to reach $142.

As a researcher studying investment strategies, I propose setting a stop-loss at $117 for my portfolio. This measure aims to protect my investments while still allowing me to benefit from potential profit opportunities.

Solana fundamental outlook

To determine if these predictions might actually happen, it’s wise to examine Solana’s key market fundamentals instead.

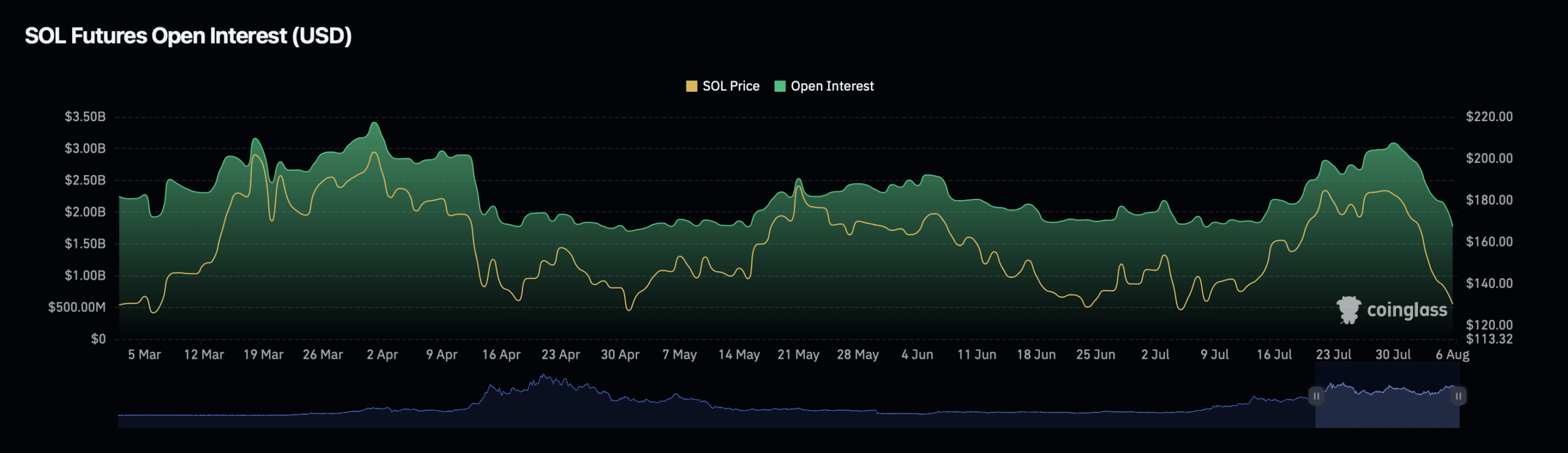

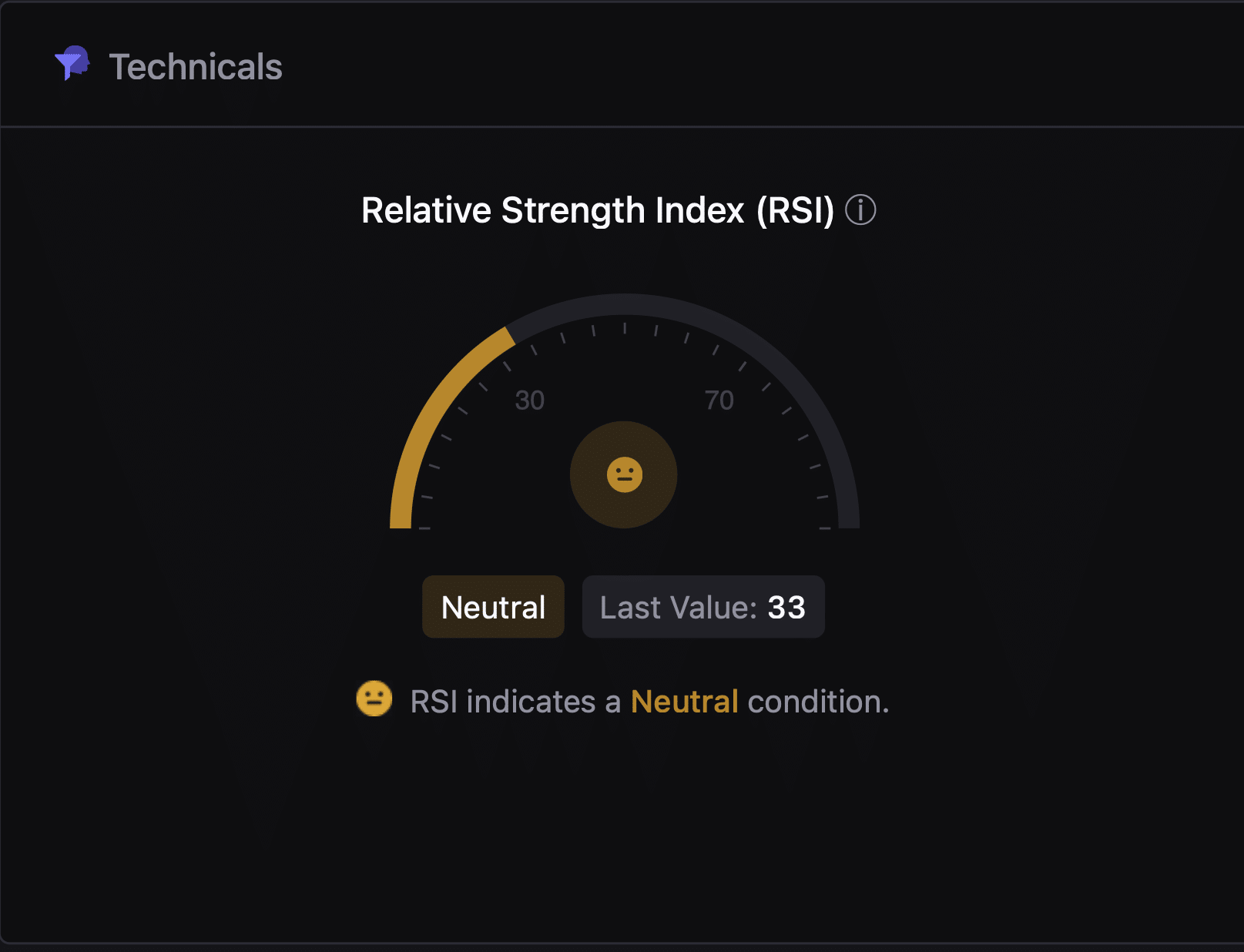

Using these metrics like open interest and the Relative Strength Index (RSI) can sometimes provide clues about the potential direction of the market.

Based on statistics from Coinglass, the amount of unsettled derivative agreements (like futures and options) for Solana has increased by approximately 18.43% over the past day, now standing at around $2 billion.

Instead, the open interest volume of the asset dropped by 14.338%, finishing at approximately $21.48 billion.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Additionally, the Relative Strength Index (RSI), which gauges the rate and direction of price fluctuations, currently indicates a neutral state of 33 for Solana.

Based on my extensive experience in the financial markets, I can say that when a value indicates neither overbought nor oversold conditions, it suggests a potential period of stability for the price. However, keep in mind that external market factors can always influence the market, so it’s essential to stay vigilant and adaptable. In my career, I’ve witnessed countless instances where seemingly stable markets have been swayed by unexpected events, reminding us all that the financial world is dynamic and unpredictable.

Read More

2024-08-06 21:11