Ah, the sweet scent of success—perfumed, no doubt, with the aroma of freshly minted stablecoins. On July 31, Tether International announced a net profit of approximately $4.9 billion for Q2 2025, setting not just a company record but also raising the bar for mediocrity among its peers. The attestation, courtesy of BDO (because apparently, even accountants need jobs), assures us that Tether’s finances are as transparent as a glass of water… or at least as transparent as they need to be. 🕶️

Let us not forget that Tether is the proud issuer of USDT, the belle of the stablecoin ball, reigning supreme with a market cap of $163.71 billion. Once beleaguered by regulatory scandals (oh, the drama!), Tether has risen like a phoenix from the ashes—or perhaps more aptly, like a well-timed meme coin rally. Its influence? Growing. Its ambition? Unstoppable. Its critics? Probably writing think pieces somewhere. ✍️🔥

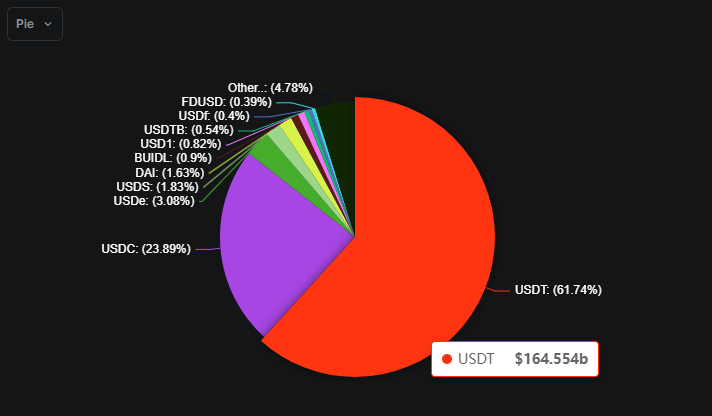

Stablecoin Market Share Distribution | Source: DefiLlama

USDT Supply Swells as Trust Deepens (Or Is It Just FOMO?)

In Q2 2025, Tether issued over $13.4 billion in new USDT tokens, bringing the circulating supply to a staggering $157 billion—a $20 billion leap since January. Clearly, the world cannot get enough of this digital dollar darling. Whether it’s trust, necessity, or sheer curiosity driving adoption, one thing is certain: Tether is now as ubiquitous as bad Wi-Fi at a coffee shop. ☕🌐

“Q2 2025 affirms what markets have been telling us all year: trust in Tether is accelerating,” declared CEO Paolo Ardoino, who seems to have mastered the art of understatement. With over $127 billion parked in U.S. Treasuries, robust Bitcoin and gold reserves, and $20 billion in fresh USDT issuance, Tether isn’t merely riding the wave—it’s building the ocean. 🌊🚢

Speaking of oceans, let’s dive into Tether’s asset reserves. As of June 30, 2025, the company boasts a jaw-dropping $127 billion in U.S. Treasuries alone. Yes, you read that correctly. To put it mildly, Tether could probably fund a small country—or at least an extravagant yacht party for crypto enthusiasts. 🎉🚤

Profits Galore: Thanks to Core Business, Bitcoin, and Gold

The pièce de résistance? A net profit of $4.9 billion for the quarter, contributing to a year-to-date total of $5.7 billion. Of this sum, $3.1 billion came from core operations (boring but profitable), while $2.6 billion stemmed from mark-to-market gains on Tether’s Bitcoin and gold holdings. Because why stop at stablecoins when you can dabble in shiny things too? 💰💎

But wait, there’s more! Tether isn’t content to rest on its laurels—or its billions. Instead, it’s funneling profits into futuristic ventures like artificial intelligence, renewable energy, and communications infrastructure. Presumably, these investments will ensure that future generations can trade USDT while sipping sustainably sourced smoothies. 🥤🌍

Friendly Regulations: Because Even Crypto Needs a Hug 🤗

This financial triumph coincides with the U.S.’s latest attempt to embrace digital dollars through the GENIUS Act. Designed to encourage transparency and robust reserve management, the act has prompted Tether to extend an olive branch to American regulators. “We’re ready to play nice!” said Ardoino, presumably while wearing a suit made entirely of spreadsheets. 👔📊

Of course, Tether isn’t the only beneficiary of this regulatory renaissance. Competitors like Circle (and their stablecoin USDC) are also basking in the glow of newfound legitimacy. But let’s be honest: Tether remains the star of the show, dazzling audiences with its audacity, ambition, and ability to make everyone else look slightly less impressive. 🌟

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- How to Build a Waterfall in Enshrouded

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- These Are the 10 Best Stephen King Movies of All Time

- Meet the cast of Mighty Nein: Every Critical Role character explained

- USD JPY PREDICTION

- Best Controller Settings for ARC Raiders

- Best Werewolf Movies (October 2025)

2025-08-01 03:14