- A crypto VC projected a positive outlook for ETH in the long run.

- Large players expected $2.7K-$4K price swings before the end of 2024.

As a seasoned analyst with over two decades of experience in the financial industry, I find myself intrigued by the ongoing discourse surrounding Ethereum [ETH]. Chris Burniske, a respected voice in the crypto space, reiterates his optimism for ETH, emphasizing its leadership role in disrupting TradFi. However, the current market sentiment against BTC paints a different picture, with ETH reaching a yearly low against the dominant cryptocurrency.

Chris Burniske, a partner at Placeholder, continues to express optimism towards Ethereum [ETH], even amidst its present hurdles and unwarranted negativity (FUD).

As per the VC’s perspective, while Ethereum may be trailing behind Solana and Bitcoin, it maintains a significant edge when it comes to challenging conventional finance (TradFi), as he put it.

Solana and other platforms will also join the Inter-Financial System (IFS), and they already have. However, Ethereum has a strong base due to its over-a-decade presence, second only to Bitcoin in terms of brand recognition, substantial liquidity, and attracting corporate attention with implementations like Base.

Burniske encouraged the Ethereum community to educate themselves and establish the network as the core of the upcoming Internet Financial System within the next five years.

New ETH/BTC yearly low

Burniske’s remark came in response to varied opinions about the network’s 2029 blueprint, which suggested major updates to the consensus mechanism to boost its edge over competitors like Solana and other Layer 1 networks.

However, opponents viewed the 2029 target as too long to effect fundamental changes on Ethereum.

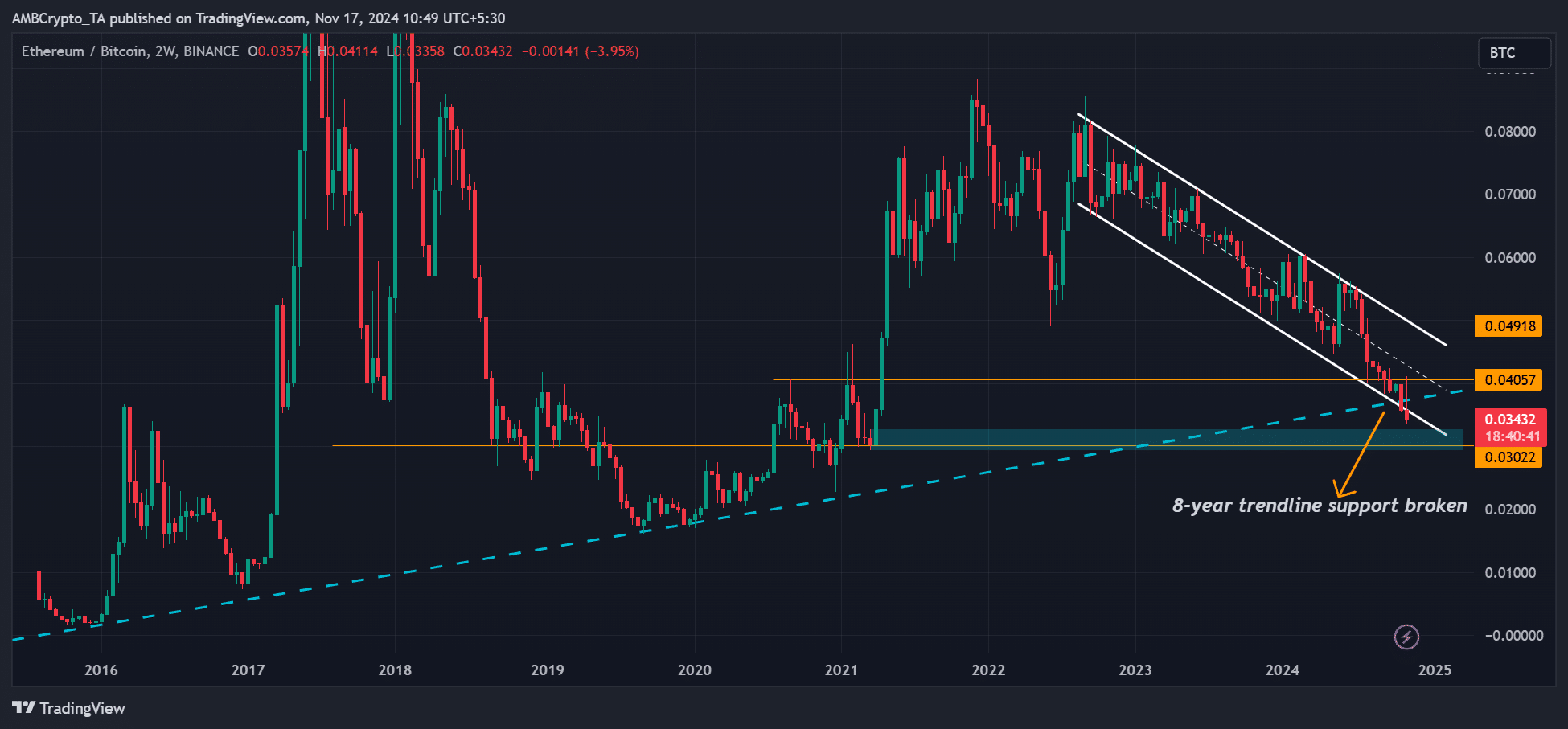

The absence of agreement in the crypto community seems to have significantly influenced the perception towards Ethereum (ETH) this year, causing its market sentiment to reach a one-year low compared to Bitcoin (BTC). In fact, the ratio measuring ETH’s performance against BTC has fallen below a significant eight-year trendline support.

Commenting on the same, Lyn Alden, a renowned macro analyst, showed her reservations about ETH.

1) “The victory of a government favorable towards cryptocurrency securities triggers a spike in ETHBTC, but it subsequently plummets and reaches new lows even following positive news. Uh-oh!” (Paraphrased for clarity and readability)

For those traders and short-term investors focusing on Ethereum (ETH) gains post the US elections, here’s what it could imply: The election outcome may impact the market dynamics surrounding ETH, potentially influencing its price movements in the immediate future. Keep a close watch on related news and developments to make informed trading decisions.

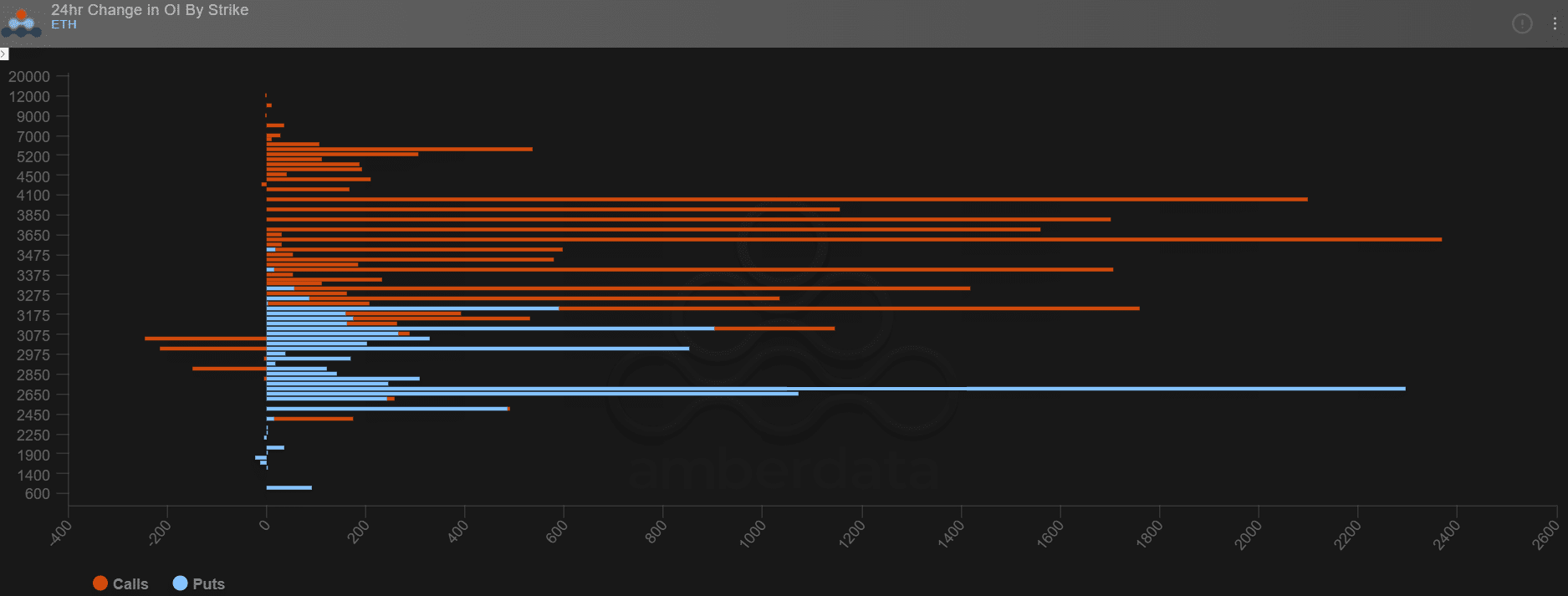

A look at the options market showed that large ETH players were cautiously optimistic.

As reported by Amberdata, the largest shift in Open Interest rates over the last 24 hours has been centered around call options (bets with a bullish outlook, represented by orange lines) for price levels of $3,600 and $4,000.

On the negative side, there were significant bearish positions (represented by the blue lines) predicting potential price drops towards $2.7K and $3K levels. In essence, these large funds anticipated a significant price fluctuation ranging from $2.7K to $4K, with a predominant bullish outlook.

Read Ethereum [ETH] Price Prediction 2024-2025

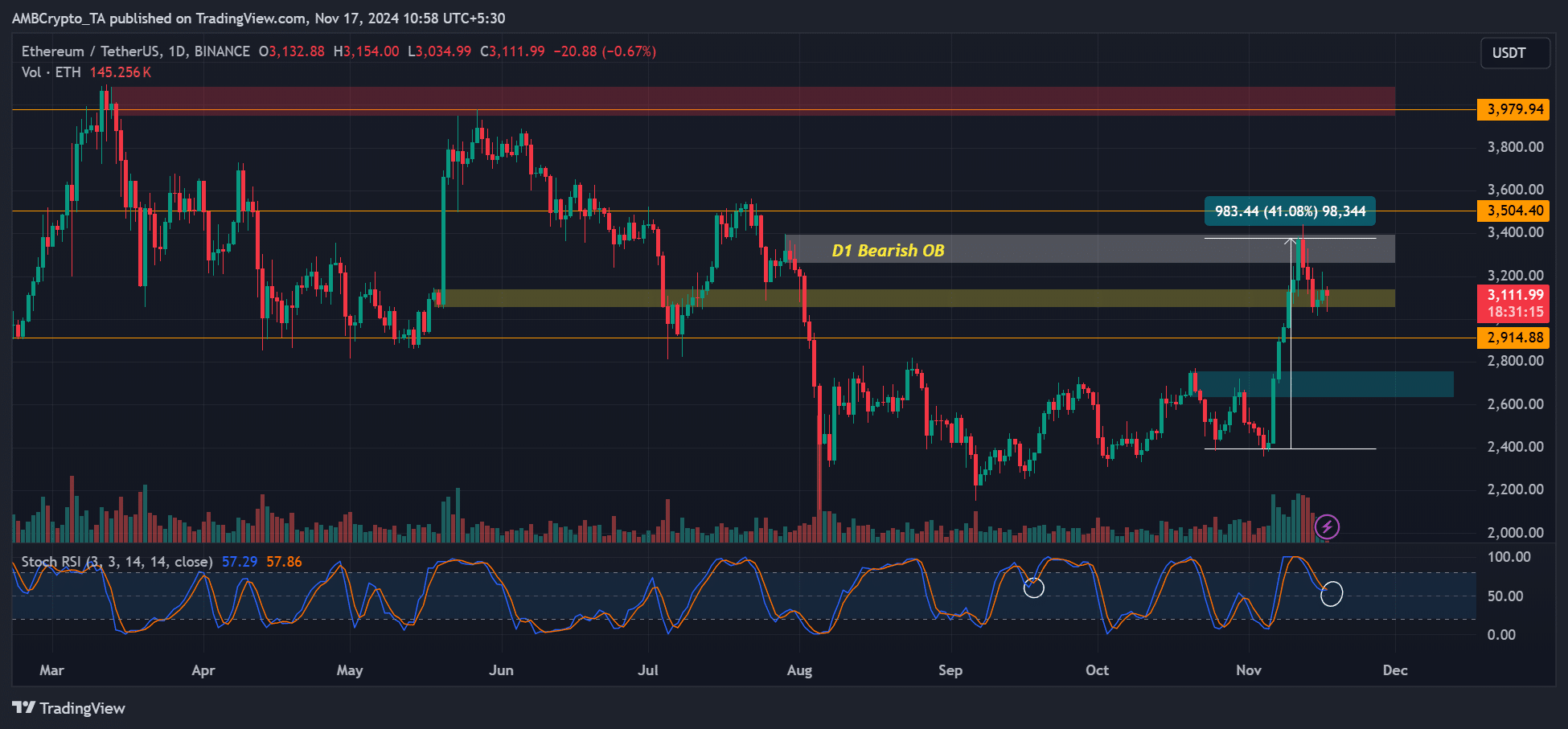

Today’s data showed a consistent pattern and objectives. Following an increase of more than 40% since October, Ethereum encountered resistance and a dip at approximately $3,300. As we speak, the price is battling to remain above the significant $3,000 mark.

If the value of the altcoin decreases further, potential support levels could be found at $2.9K and $2.7K. On the contrary, $3.5K and $4K are significant levels to watch for potential bullish trends.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-17 15:03