-

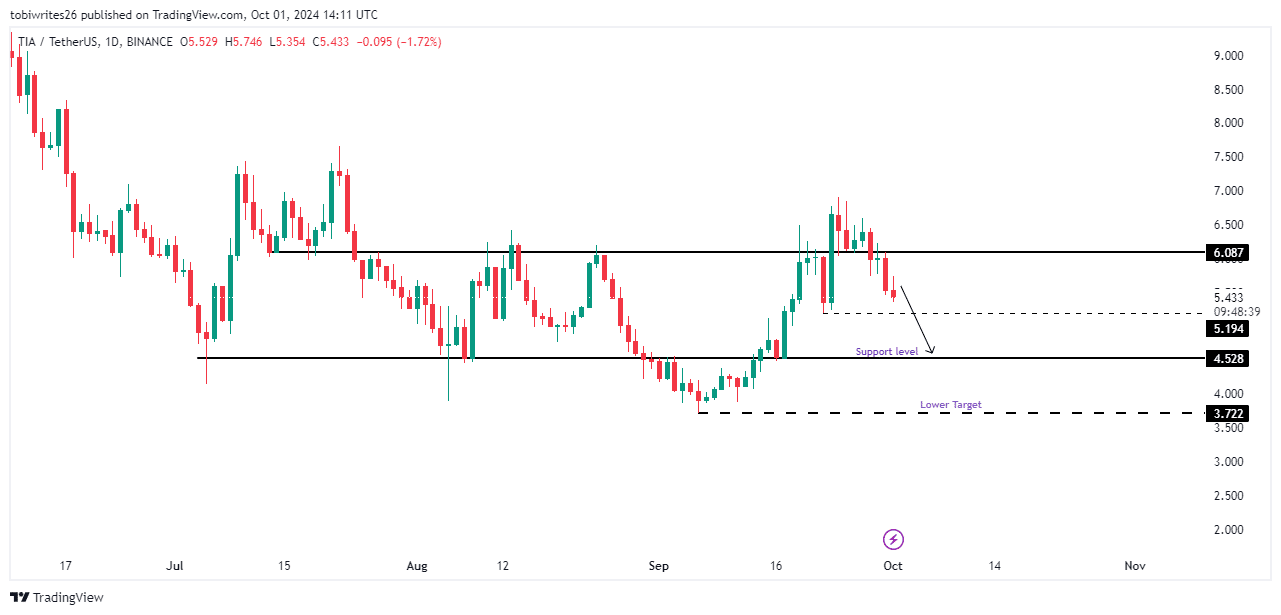

TIA is projected to continue its downward trajectory in the coming days, potentially reaching $4.55.

This bearish trend is underscored by a death cross formation on the MACD, indicating a strong possibility of further declines.

As a seasoned crypto investor with battle scars from the 2017 bull run and the infamous bear market of 2018, I can’t help but feel a sense of déjà vu when analyzing Celestia [TIA]’s current trajectory. The death cross formation on the MACD and the significant sell pressure driving TIA’s price downward have me bracing for impact.

Based on CoinMarketCap’s data, there was a decrease of approximately 2.63% in the total value of the cryptocurrency market. This decline is primarily attributed to losses in the altcoin sector.

As a crypto investor, I’ve noticed that Celestia [TIA] has been one of the hardest hit, experiencing a substantial decline of 6.53%. With the market sentiment turning increasingly bearish, further analysis by AMBCrypto indicates that TIA’s price might plummet even more drastically.

Significant sell pressure is likely to drive TIA’s price downward

Ever since I hopped on board with TIA back in early July, it’s been riding a consolidation channel – basically moving between a defined range. Notably, it reacts to this range, and as of now, it’s reacted from the resistance line where the selling pressure is quite intense.

Market participants who want to push prices down are finding this resistance as a key target, evidenced by TIA‘s continuous daily drop of 6.53%.

If the current selling force continues, TIA may find a temporary rest at the support point of around $4.528. But if the downward trend persists, TIA might dip to its September low of $3.722, and potentially drop lower still.

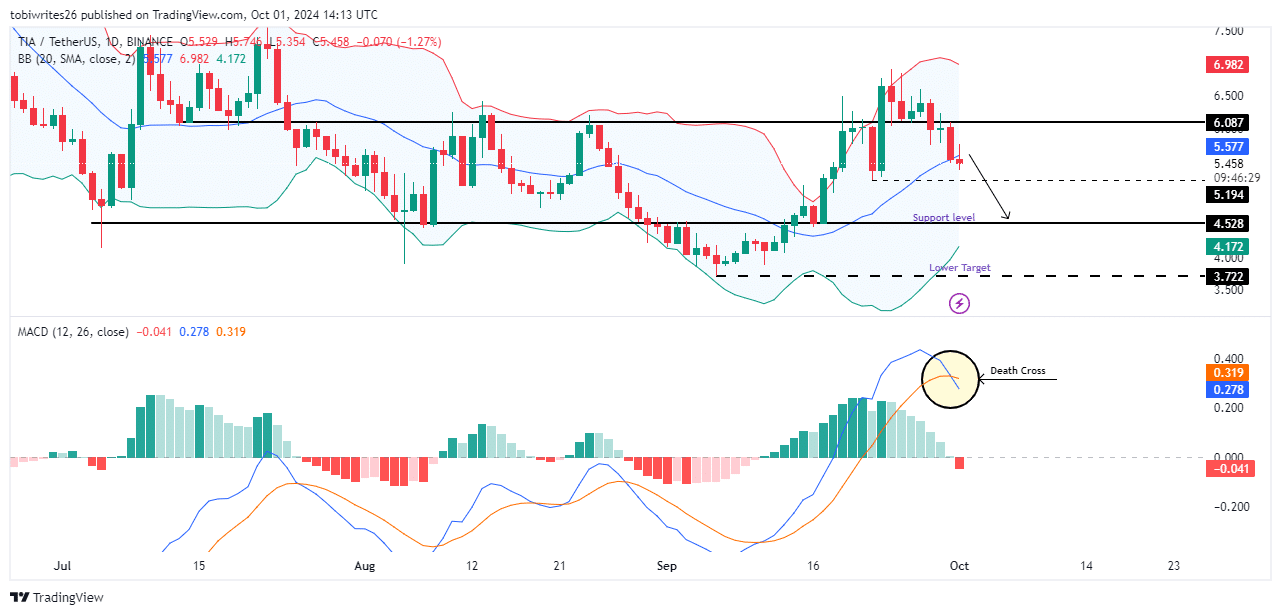

Death cross indicates further decline for TIA

The Technical Indicator Analysis (TIA) is showing signs of a downward trend in the market. This shift is indicated by the blue MACD line moving beneath the orange signal line, which suggests that negative factors are starting to dominate.

Normally, this kind of trend tends to result in a persistent drop, affecting both speed and value. It seems reasonable to expect that the upcoming resistance will be around the $4.55 support level.

Furthermore, the Bollinger Bands indicate that the current downtrend may continue. TIA‘s movement outside the upper band suggests it might be overbought, and its trajectory is now heading towards the lower band. This movement could potentially cause a decrease in its price.

Market trends oppose bullish traders on TIA

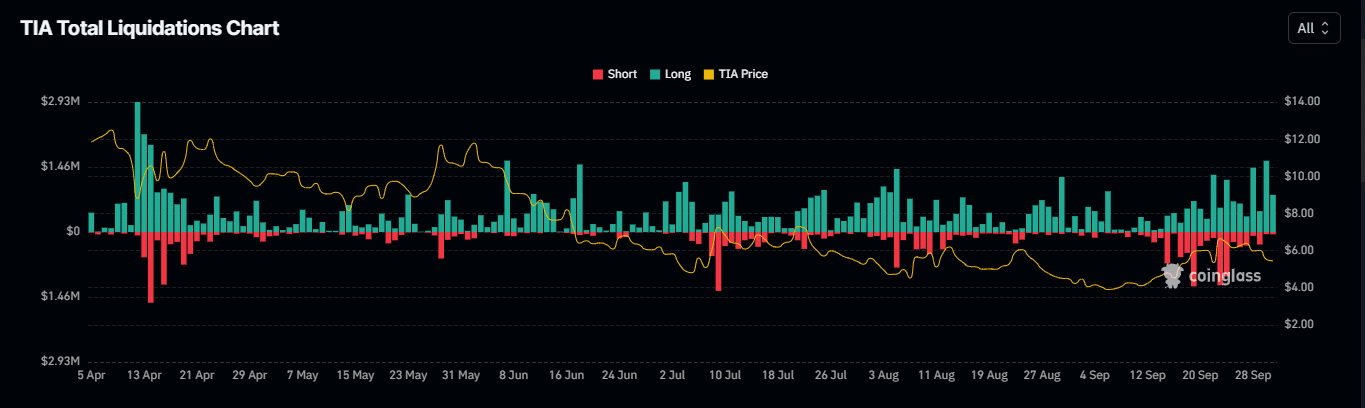

Over the past 24 hours, I’ve observed a significant imbalance between long and short liquidations on TIA, as per the data from Coinglass.

Currently, approximately $1.24 million worth of TIA positions have been compulsorily sold off. Of this amount, about $1.17 million is associated with long positions, while short traders account for around $75,840 in the remaining balance.

The noticeable gap between liquidations among long and short traders suggests a strong pessimistic outlook on the market, as many traders are expecting prices to continue falling.

If a negative market outlook remains dominant, it’s possible that TIA‘s decline could persist until there is significant demand from buyers that pushes the price back up and brings stability.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-10-02 10:15