- Toncoin’s price rose 3.6% to $6.39, but network activity, including swaps and active addresses, declined.

- Analysts linked price trends to decentralized exchange engagement.

As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I find myself intrigued by Toncoin’s [TON] latest price movements and network activity trends.

Toncoin (TON) has shown signs of a significant bounce back following its dip to $5.53 on December 10th.

The cryptocurrency, which had faced a downward trend in recent weeks, has surged by 3.6% in the past day, trading at $6.39 at the time of writing.

Over the past week, TON dipped by 3.3%, and for the previous two weeks, it has decreased by almost 3.9%. However, there was an increase recently.

The varying results of TON have sparked interest among experts, who have uncovered key influences behind its price changes.

A CryptoQuant analyst recently shared insights into TON’s network activity, highlighting a decline in decentralized exchange (DEX) engagement.

The analyst observed a reduction in the quantity of swap transactions and accessible liquidity pools on the decentralized exchange (DEX) systems linked to TON, such as Stone.FI and DeDust.

Historically, an uptick in transactions on these Decentralized Exchanges (DEXs) tends to coincide with a rise in TON’s price, whereas reduced user activity typically follows price declines.

The pattern implies a decrease in enthusiasm for decentralized trading and liquidity supply on TON, likely due to the high level of price fluctuations, notably between approximately $7.20 and $5.20.

Mixed signals emerge

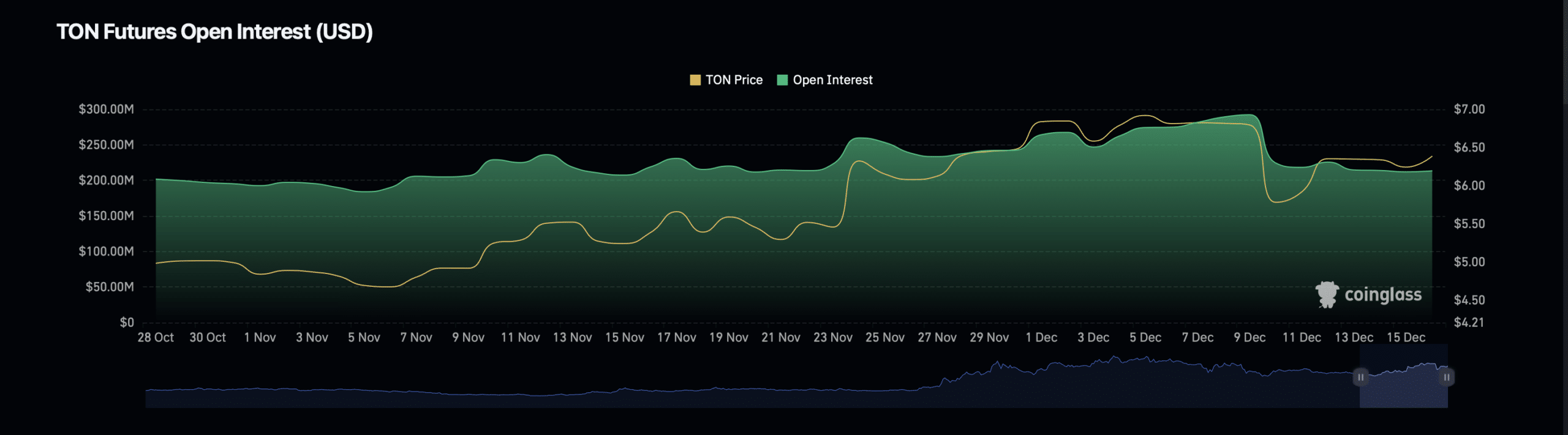

Although there’s been a drop in daily exchange (DEX) activity, Total Open Interest on the TON platform – which represents the collective worth of all open derivative contracts – has displayed an upward trend instead.

As an analyst, I’ve noticed a significant growth in the Open Interest for TON. Specifically, it has expanded by approximately 2.77%, currently standing at around $214.07 million. Furthermore, the volume of Open Interest has also experienced an uptick, rising by roughly 7.10% to reach a value of about $169.73 million.

The data indicates a resurgence of enthusiasm among traders and investors regarding TON’s derivative market, possibly implying a more positive perspective on the cryptocurrency.

As a crypto investor, I’ve been closely monitoring my TON investment, but recent data from Glassnode has given me some concerns. Specifically, the active addresses associated with the TON network have been steadily decreasing. This suggests that the number of unique users actively participating in the network is dwindling, which could potentially impact the overall health and growth of the network.

The number of active addresses has decreased significantly, falling from approximately 3.8 million in late October to only around 1 million on the 15th of December.

Read Toncoin’s [TON] Price Prediction 2024–2025

This substantial decrease indicates a decline in user interaction, which might present difficulties in maintaining price growth over the long haul.

A decline in the number of active addresses might signal a reduction in retail involvement or general enthusiasm for the TON network, which could slow down both network expansion and user adoption.

Read More

2024-12-17 02:15