-

Scam alerts rattled ShibArmy as technical indicators flashed mixed signals for SHIB

Whale addresses now control over 60% of SHIB’s supply

As a seasoned researcher with years of experience navigating the crypto market, I find myself constantly intrigued by the dynamics of Shiba Inu (SHIB). The recent events surrounding this meme coin have been nothing short of fascinating – and a tad worrying for those invested.

On August 15th, the price of Shiba Inu (SHIB) experienced a dip due to market-wide cryptocurrency price drops, as reflected in its chart.

Currently, Shiba Inu is being traded at approximately 0.0000137 USD, marking a 1.74% decrease in the past day. However, it’s worth mentioning that over the course of the last week, Shiba Inu experienced a small increase of more than 3%, suggesting its ability to remain strong even amidst market declines.

That’s not all though as the Shiba Inu community is now on high alert due to growing concerns about potential scams. In fact, according to Shibarmy Scam Alerts, an X account dedicated to Shiba Inu, scammers are impersonating Shiba Inu’s lead developer, Shytoshi Kusama, on social media.

🚨SHIBARMY WARNING:🚨

Be cautious when encountering individuals posing as ShytoshiKusama on social media who ask you to click links. Shytoshi will never solicit such actions from you directly.

Stay SAFE #Shibarium #SHIBARMYSTRONG

— Shibarmy Scam Alerts (@susbarium) August 14, 2024

These unscrupulous individuals are trying to trick people into clicking harmful web links, which could result in phishing scams or other deceitful actions.

The increased vigilance and worry shown by Shiba Inu community members might have played a role in the recent drop in SHIB‘s value.

A mixed bag on the charts?

As an analyst, I’ve recently delved into an analysis of SHIB at this specific moment. The findings are somewhat ambiguous, hinting at both potential perils and prospects. For instance, the Bollinger Bands suggest a stretch of reduced volatility for SHIB. At present, the altcoin’s price appears near the middle band, with the bands tightening – a sign that consolidation could be imminent.

From my years of observing market trends and analyzing various economic indicators, I have come to understand that sudden breaks or shifts can happen unexpectedly in financial markets. If I were to interpret this setup based on my personal experience, I would say there’s a possibility of either an upward surge (breakout) or a downward plunge (breakdown) in the short term. A significant rise above the upper band could indicate a strong bullish momentum, while dipping below the lower band might signal increased risks for further declines. It is crucial to stay vigilant and keep a close eye on market movements to make informed decisions.

As an analyst, I’ve observed that the Chaikin Money Flow (CMF) indicator stands at 0.26, suggesting robust buying pressure in the market. This indicates more money is flowing into the market than out of it, potentially setting the stage for further upward movement if this trend persists.

On the other hand, the Relative Strength Index (RSI) was at 38.36, suggesting that SHIB was positioned within the bearish-neutral area.

The Relative Strength Index (RSI) had not dipped low enough, below 30, to be considered oversold, but it was also significantly away from the 50 level, which usually signals a transition toward more optimistic market trends, or bullish momentum.

Whales tighten grip on SHIB

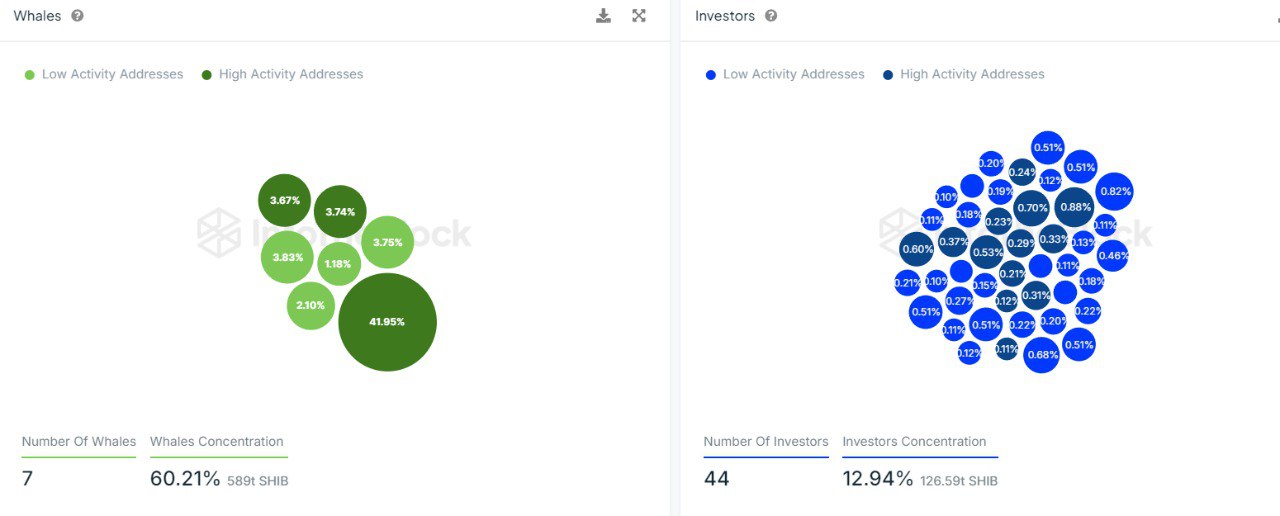

As reported by IntoTheBlock, a small group of whale accounts has significantly influenced the Shiba Inu (SHIB) market. Specifically, there are just 7 such whale addresses that collectively control about 60.21% of all available SHIB tokens, which amounts to roughly 589 trillion coins. This high concentration of tokens in the hands of a few large holders means they wield substantial power over the market’s direction.

Compared to others, about 44 investor locations control approximately 12.94% of the total Shiba Inu (SHIB) supply, which is roughly equal to 126.59 trillion SHIB. Although the broader investor group is more spread out, they still significantly influence Shiba Inu’s market movements, with both less and highly active addresses exhibiting different levels of participation.

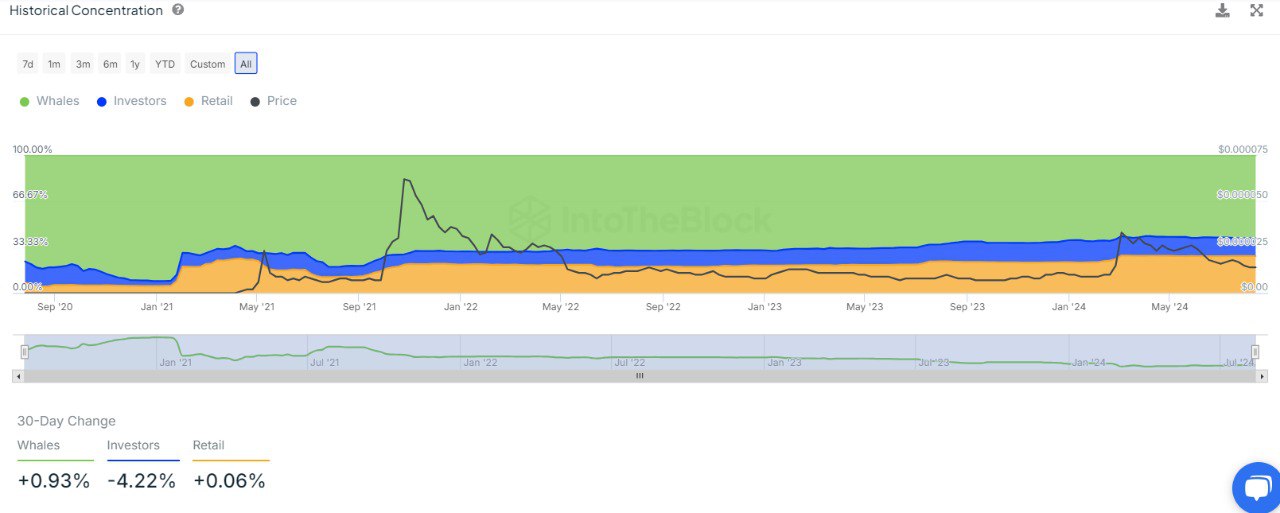

Over the last month, historical data reveals an increase of approximately 0.93% in whale activity, suggesting that major investors are strengthening their positions.

Instead, the ownership share held by investors decreased by 4.22% over the same timeframe, implying a drop in smaller investor involvement. However, retail investor engagement has stayed consistent, showing a modest increase of 0.06%, indicating ongoing interest within this demographic.

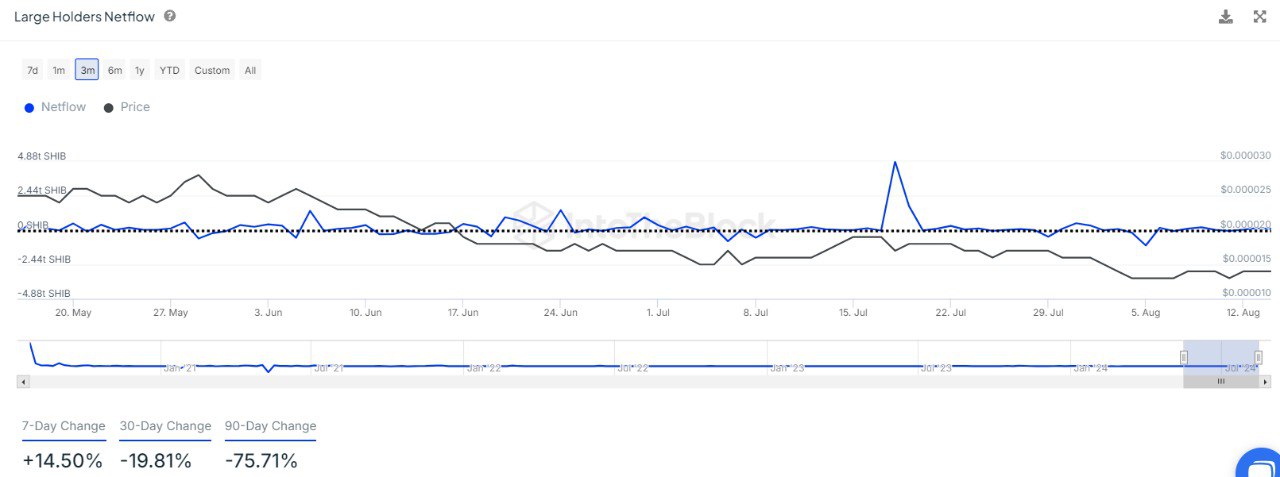

In summary, the flow of significant Shiba Inu coin holdings, which indicates the total amount moving into or out of major wallets, has displayed both positive and negative patterns recently. Over the last week, there’s been a 14.50% surge in this flow, suggesting that large investors have been accumulating more Shiba Inu coins.

Over the past few days, I’ve noticed a surge in gains for SHIB. Yet, when looking at the trends over 30 and 90-day periods, it appears netflow has dipped by 19.81% and 75.71%, respectively. Intriguingly, despite these shifts, SHIB’s price remains relatively steady, implying that the market has managed to accommodate these fluctuations without experiencing substantial price volatility.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-08-15 21:51