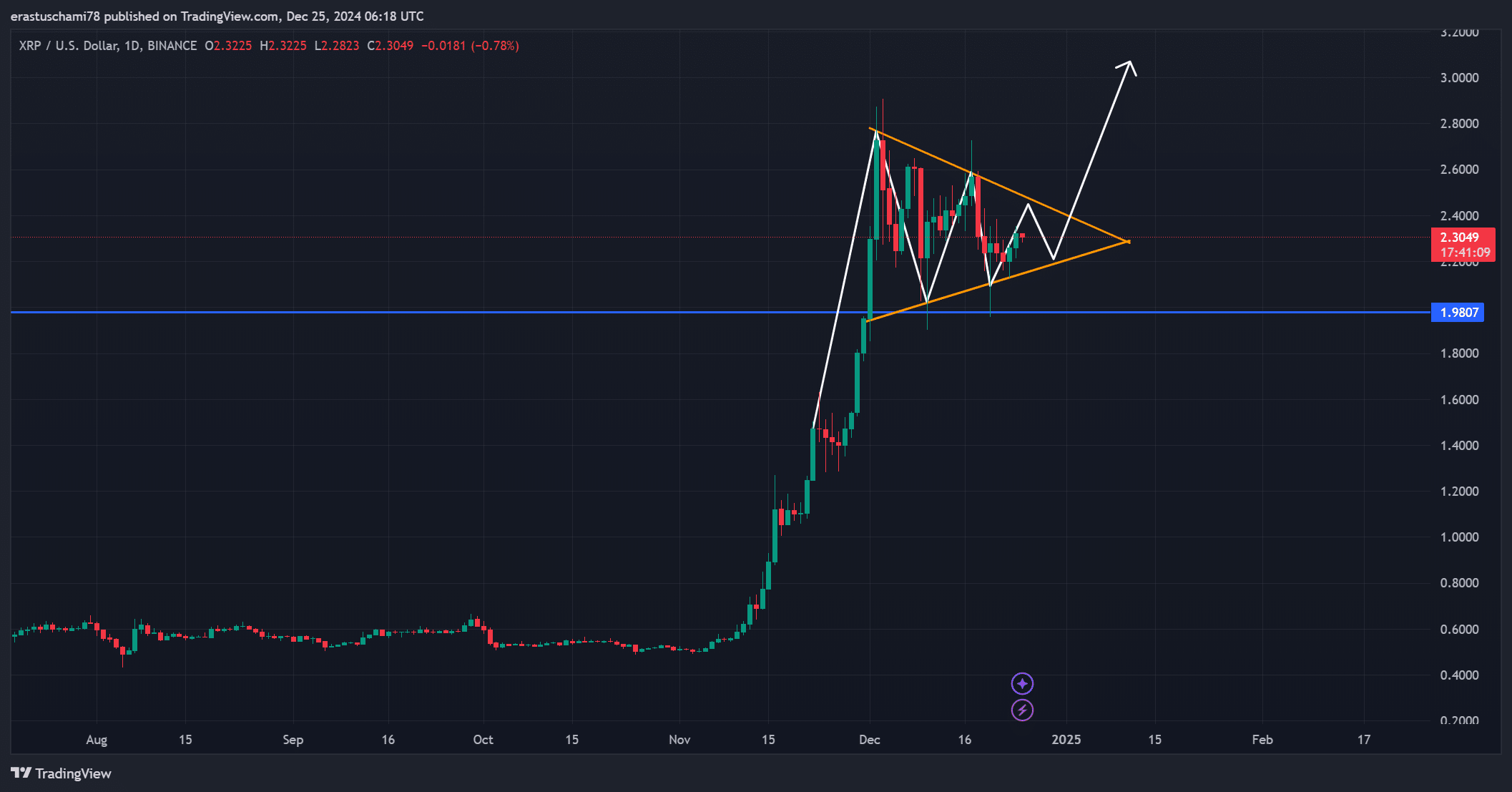

- XRP’s bullish pennant pattern suggests a potential breakout, with $3.00 as the next target.

- Market sentiment has surged, with Open Interest up 47.57% and active addresses increasing 1.37%.

As a seasoned researcher with over two decades of market analysis under my belt, I can confidently say that the current bullish trend for XRP is as promising as a freshly baked croissant at a Parisian bakery in the morning. The bullish pennant pattern, coupled with the surge in open interest and active addresses, paints a picture of an imminent breakout that could push XRP past the $3.00 mark.

XRP is garnering substantial market interest, as optimistic opinions prevail among both the general public (Crowd) and sophisticated investors (Smart Money), according to recent trends.

Based on Market Prophit’s assessment, there seems to be a high level of optimism, which aligns with robust technical indicators. This could potentially mean that the value of cryptocurrency may rise substantially in the near future.

Currently, Ripple (XRP) is being exchanged for approximately $2.30, marking an increase of 2.22% over the past day. Notably, it’s hovering slightly beneath a significant barrier for potential growth.

What’s driving XRP’s momentum?

At the current moment, the pattern of XRP’s price fluctuations suggests the emergence of a bullish pennant formation. This pattern often indicates a pause or consolidation phase that precedes a possible surge or breakout.

This pattern, combined with the recent steady price action, is drawing attention from traders.

Significantly, $2.30 is now a crucial level of resistance. If there’s a strong push past this point, it might open up a path for XRP to aim at $3.00, an important psychological barrier.

Clearing this level is important because not doing so could result in more tightening of the pennant formation, pushing back any substantial increase in price.

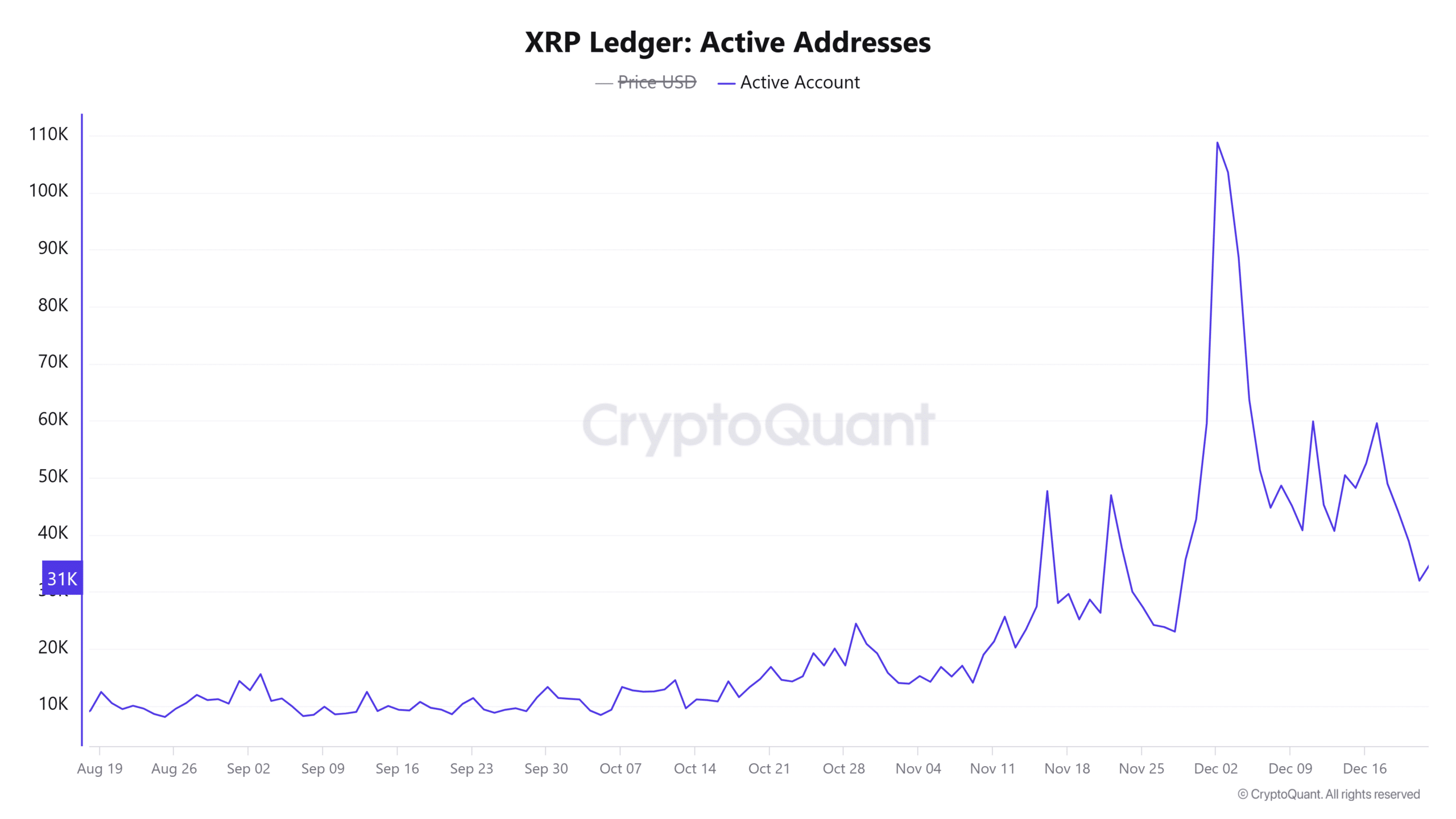

Active addresses: a bullish on-chain signal?

Furthermore, the data recorded on the blockchain showed positive indications of increasing network engagement. The count of active XRP accounts increased by approximately 1.37%, totaling around 31,000.

This rise suggests a higher level of user interaction and trading actions, which frequently signal upcoming price surges.

Consequently, the increase in active wallets might indicate increasing trust from market participants, which could support the idea of an upcoming bullish surge.

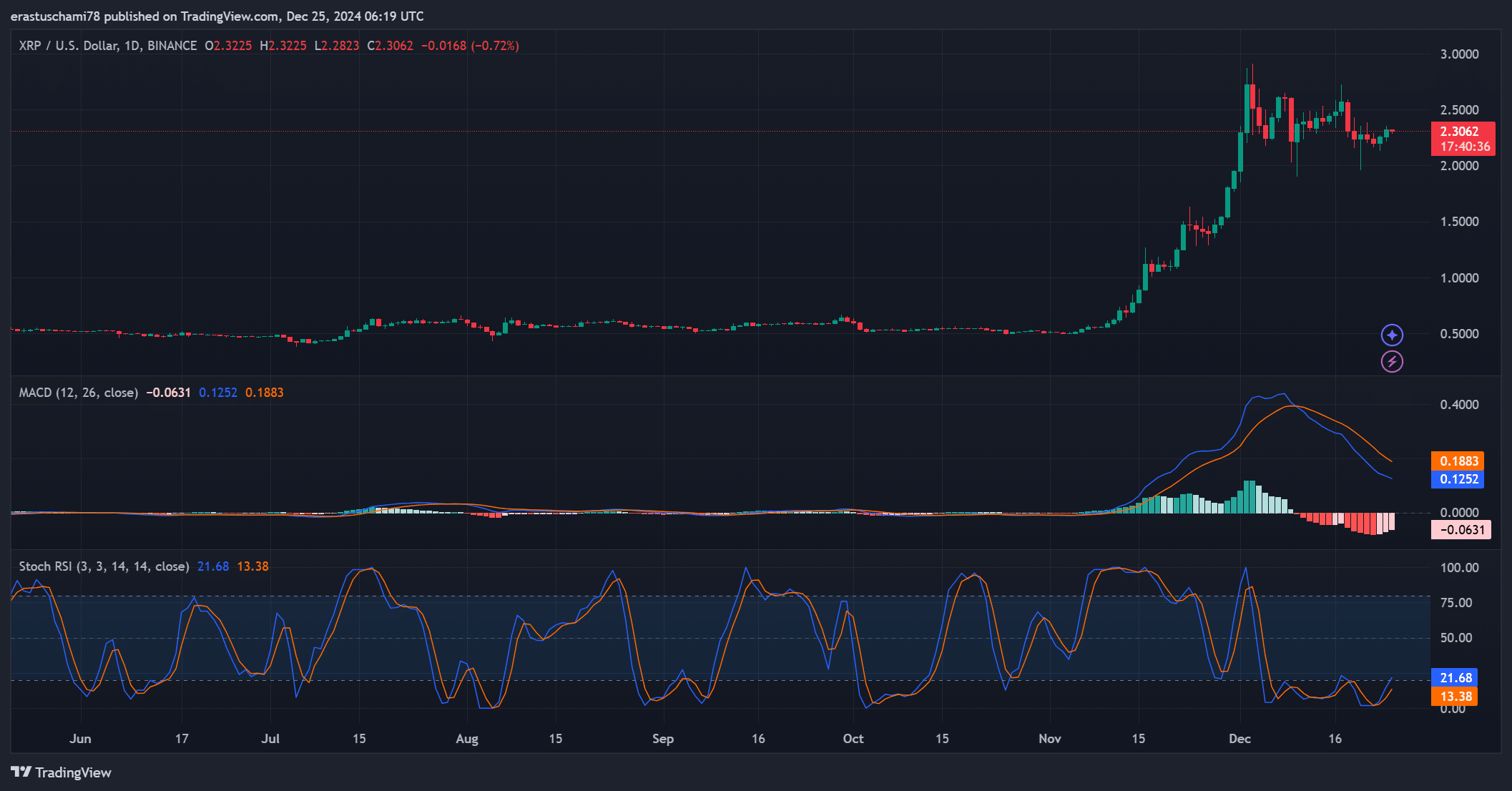

Technical indicators show mixed signals

Technically speaking, the Stochastic RSI (Stochastic Relative Strength Index) registered at 21.68, indicating it was deeply within the oversold territory. This implies that XRP could potentially experience a price reversal soon, with increased buying activity on the horizon.

Additionally, the Moving Average Convergence Divergence (MACD) stood at -0.0631, suggesting a bearish trend in momentum. However, the shrinking distance between the MACD line (0.1883) and the signal line (0.1252) hinted towards a potential convergence or convergence of these two lines.

This could hint at weakening selling pressure.

Collectively, these signs portray a somewhat ambiguous future, yet they hint at a possible increase in prices should the positive trend gain traction.

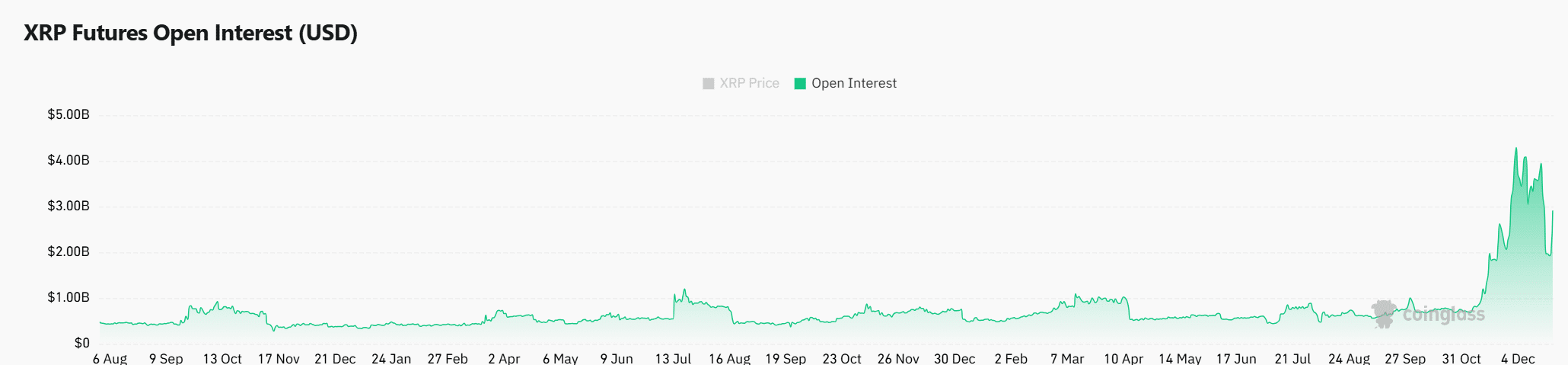

Market sentiment and Open Interest surge

Market sentiment is further reinforced by a massive surge in Open Interest, which has increased by 47.57% to $2.90 billion.

This sharp increase indicates increased trader involvement, signaling increasing anticipation for substantial price fluctuations. Combined with the upward-sloping pennant formation and the rise in active user numbers, this growth tends to bolster the optimistic outlook.

Read XRP’s Price Prediction 2024–2025

Is a rally imminent?

The positive outlook for XRP is growing, as increased on-chain interactions and favorable technical indicators hint at a potential surge past $2.30, which might drive its price up further.

If the right pace is maintained, XRP could potentially reach around $3 soon. This makes it an important time for traders to keep a close eye on its progress.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-25 13:52