-

XRP has reported a price rise in the last 24 hours.

The bearish trend persisted even with the current price rise.

As a crypto investor with some experience in the market, I’ve seen my fair share of price fluctuations and trends. While XRP reported a 3.24% surge in the last 24 hours, it’s important not to get too excited about short-term price movements. The bearish trend has persisted even with this current price rise.

Over the past 24 hours, XRP, the cryptocurrency by Ripple, has witnessed a 3.24% price increase and was priced at approximately $0.49 at the time of writing this. In the last week, its value has ascended by a modest 0.04%.

Coinmarketcap reports a 3.08% rise in XRP‘s market cap over the past hour, pushing it up to $27.4 billion. Nevertheless, its trading volume has dropped by nearly 19% within the last 24 hours, amounting to $813 million.

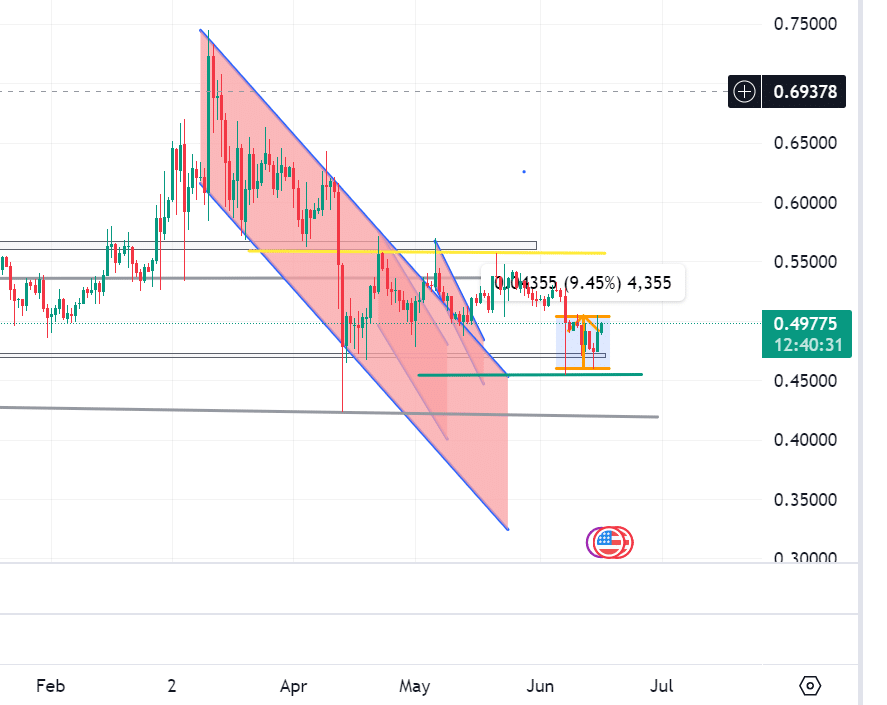

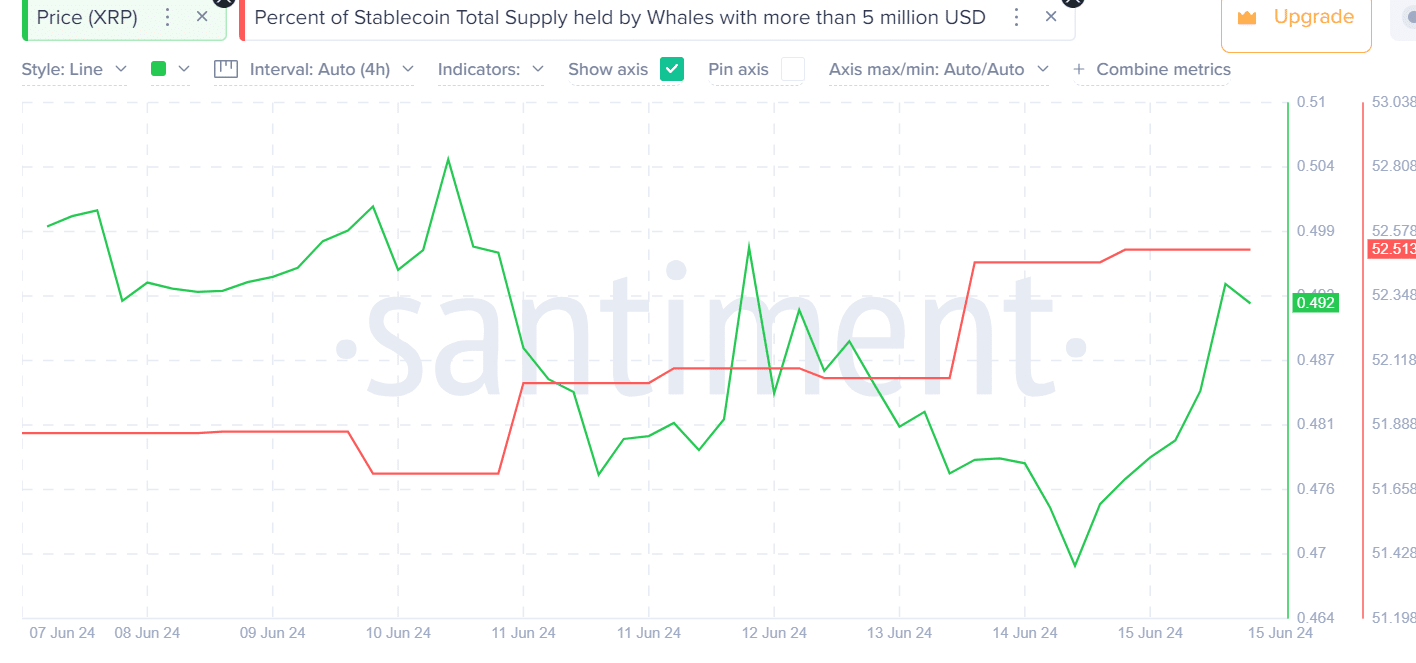

According to AMBcrypto’s assessment, XRP experienced a notable jump in value, rising from $0.46 to reach a peak of $0.51 on the 15th of June. This represented a substantial price growth of approximately 9.45%.

As a researcher studying market trends, I’ve observed that the price experienced a decline following its peak at $0.45. However, this correction was short-lived as the support level successfully halted the downward trend. Consequently, the price has rebounded and risen within the last 24 hours.

If XRP manages to surpass its current resistance point roughly at $0.53, its price could potentially soar higher due to this recent upward trend.

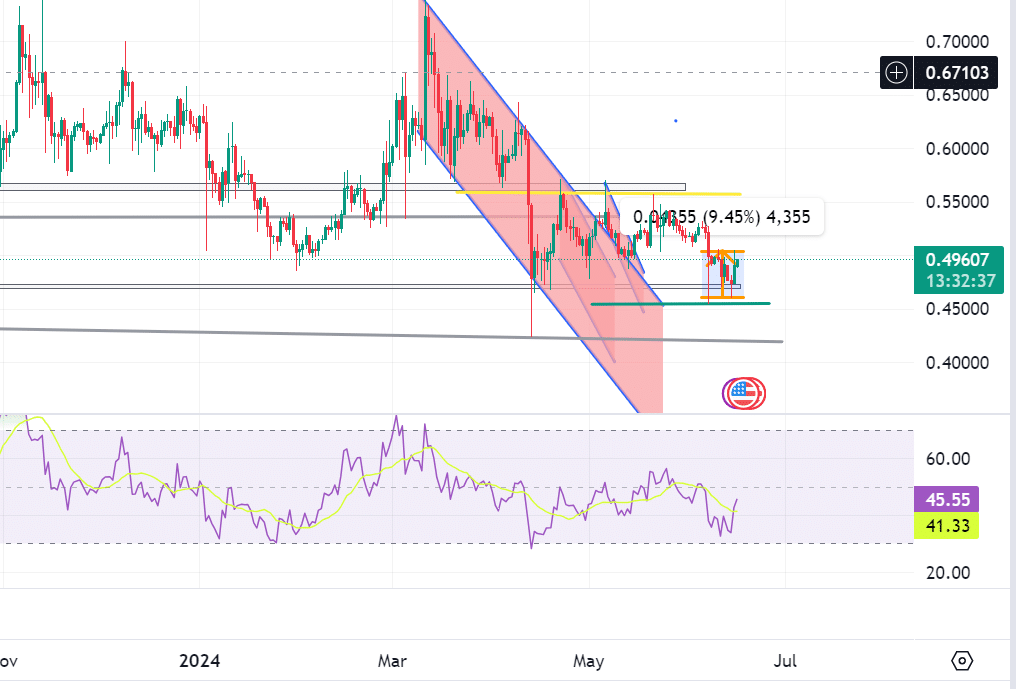

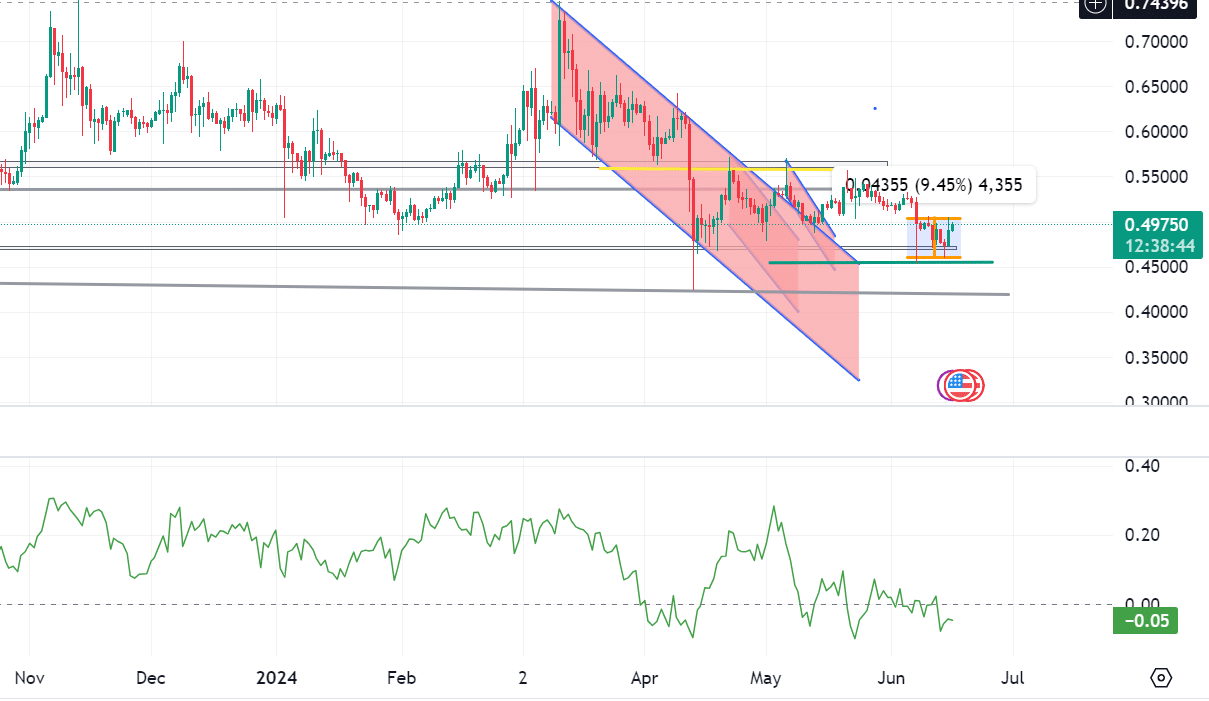

The RSI reading of 45 indicated that sales outpaced purchases. This signified that sellers were putting more pressure on the market, which could potentially lead to a price decrease. In essence, increased selling pressure tends to cause prices to fall.

Similarly, a CMF of -0.05 indicating a negative value suggests that the downtrend has persisted. In other words, when the Complementary Moving Average (CMF) falls below 0, it tends to signal a bearish market trend. Consequently, even with the present price increase, there is a strong likelihood of a continued market decline.

What do metrics indicate?

Looking further, various indicators support a continued bearish trend.

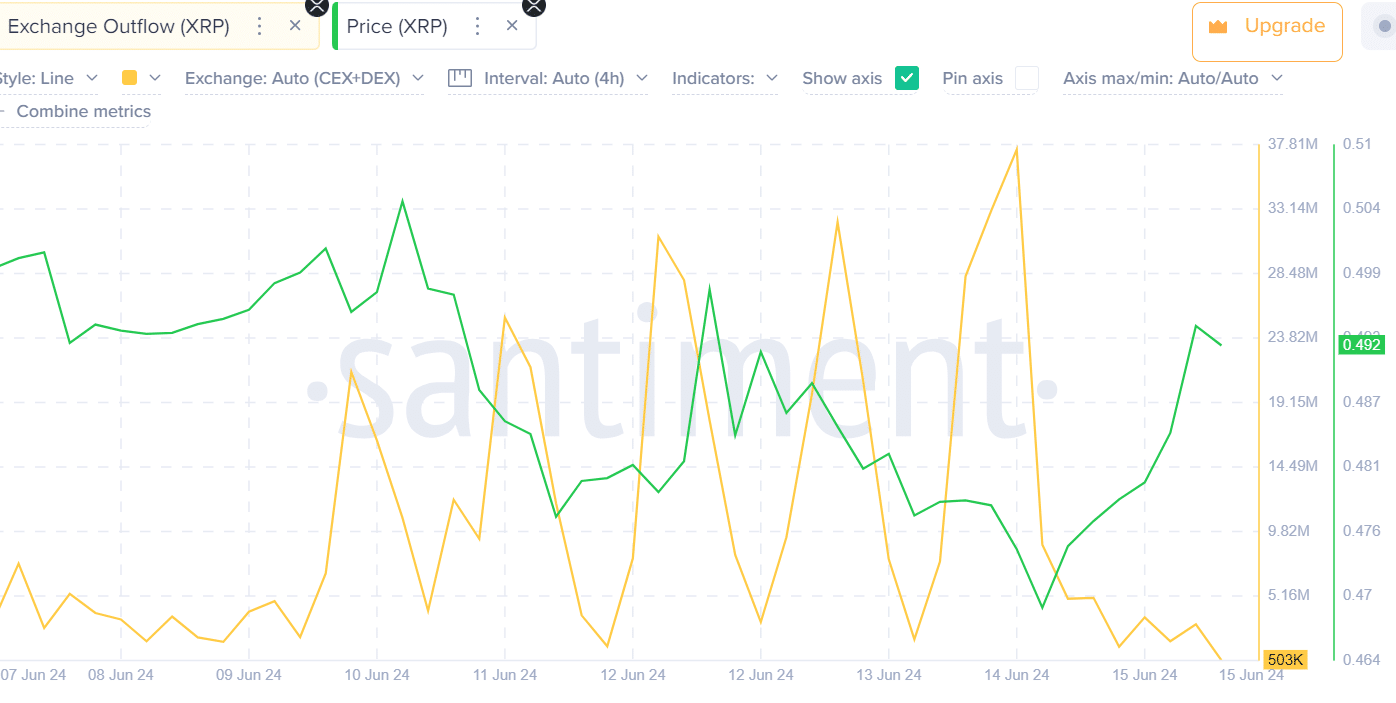

Based on Santiment’s findings, there has been a persistent decrease in the amount of XRP being moved from exchanges to wallets as indicated by their data.

As a researcher studying the cryptocurrency market, I’ve observed an intriguing pattern. When there is a substantial increase in the rate at which new coins are entering circulation (high outflow), it leads to a rise in crypto prices. This occurs due to scarcity – with fewer available coins relative to the demand, each coin becomes more valuable. Conversely, when the outflow decreases, meaning fewer new coins are entering circulation (reduced outflow), it results in lower crypto prices. The reason being that an oversupply of coins can dilute the value of each individual coin.

As a researcher examining the data from Santiment, I’ve found that a larger amount of stablecoins are being held by XRP whales compared to previous periods. Specifically, these wealthy holders currently possess around $27 million worth of XRP, representing approximately 52% of the total stablecoin supply in circulation.

In the hands of a few traders, an amassing of transactions heightens price instability, as evident in the downward market trend despite the latest uptick in prices.

Realistic or not, here’s XRP’s market cap in BTC terms

What’s next for XRP?

At present, I observe an approximately 3% rise in XRP‘s value within the past 24 hours. Yet, this uptrend appears to align with a larger bearish market pattern. Multiple analytical indicators suggest that this downturn may persist further.

In simpler terms, the large amount of assets leaving the market suggested a prolonged downturn, and the negative Chance Movement Indicator added evidence of a continuing decline. Furthermore, the Relative Strength Index reading of 45 signaled intense selling activity that might lead to additional drops in the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-17 07:03