Key Insights:

- Three major US economic indicators are about to play a game of tug-of-war with Bitcoin’s price this week. 🎢

- A deeper-than-expected decline in retail sales could be the unexpected hero for Bitcoin. 🦸♂️

- Rising jobless claims are waving a red flag, hinting at a labor market that’s losing its grip, which might just nudge the Federal Reserve to loosen the purse strings. 💸

The crypto world is bracing itself for another rollercoaster week, as three economic indicators prepare to take the stage like a bad reality show. 📺

Will Bitcoin’s price be the star of the week, or will it be relegated to the background? With inflation data already stirring the pot, the Federal Reserve might just be ready to change the script. 🍲

All eyes are now glued to retail sales figures, jobless claims, and the much-anticipated interest rate decision from the Federal Open Market Committee (FOMC). Spoiler alert: it’s going to be dramatic! 🎭

Here’s how these economic levers could affect the crypto market in the days ahead. Buckle up! 🚀

Retail Sales, Consumer Spending Take Center Stage

For those blissfully unaware, consumer spending drives nearly 70% of the US economy. Yes, that’s right—70%! It’s like the economy’s version of a high school prom queen. 👑

The US Census Bureau’s monthly retail sales report is the gossip column of economic health, revealing juicy tidbits about consumer confidence, purchasing power, and overall economic momentum. 📈

In April 2025, the data showed a modest 0.1% increase in sales. Not exactly a blockbuster, but hey, it’s something! 🎉

Key Events This Week:

1. Markets React to Israel/Iran Escalation – Monday

2. OPEC Monthly Report – Monday

3. May Retail Sales data – Tuesday

4. Fed Interest Rate Decision – Wednesday

5. US Markets Closed, Juneteenth – Thursday

6. Philadelphia Fed Manufacturing Index -…

— The Kobeissi Letter (@KobeissiLetter)

Fast forward to May, and economists are predicting another 0.6% drop. If this happens, it might just mean that American consumers are tightening their belts—probably because they can’t afford to loosen them! 😅

For the crypto market, a deeper-than-expected decline in retail sales could be like finding a $20 bill in an old coat pocket. A weaker consumer economy raises hopes for monetary easing, and could even trigger interest rate cuts from the Fed. 🤑

In turn, this would make Bitcoin shine like a diamond in a coal mine, especially since traditional savings instruments like bonds and gold are looking more like last season’s fashion. 💎

But if retail sales surprise us with a positive twist, the US dollar could flex its muscles and weigh down Bitcoin and other risk assets. Talk about a plot twist! 📉

Initial Jobless Claims

The labor market is like the backbone of the economy—if it starts to crumble, we’re all in trouble. 🦴

Each week, the US Department of Labor releases data on initial jobless claims, which is basically a report card on how many Americans are applying for unemployment benefits for the first time. Spoiler: it’s not looking great. 📊

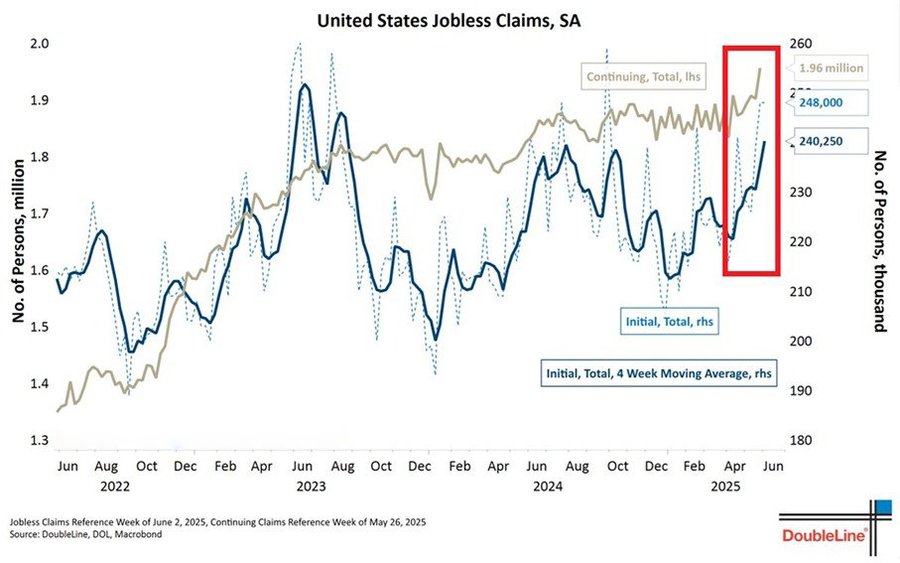

Last week, jobless claims jumped to 248,000, slightly higher than economists’ expectations of 242,000. Oops! 😬

US initial jobless claims, Source: X (Twitter)

For this week, that number is expected to rise again to 250,000. If that forecast holds, it could signal that the labor market is starting to crack like an old sidewalk. 🧱

A weakening job market increases the likelihood of the Federal Reserve loosening monetary policy to support employment. Because who doesn’t love a good bailout story? 📉

The FOMC Interest Rate Decision

The week’s biggest event will be the FOMC’s decision on interest rates, scheduled for Wednesday. This is like the Super Bowl for economists, and it comes just days after a surprise uptick in May’s Consumer Price Index (CPI). 🏆

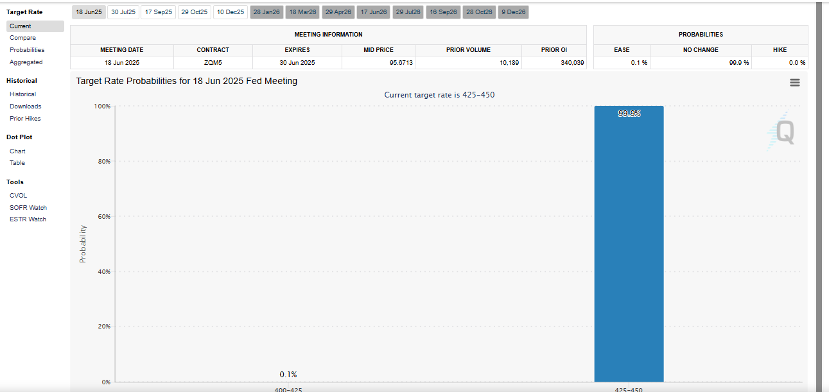

Currently, markets expect the Fed to hold its benchmark rate steady at 4.25–4.5%. The CME’s FedWatch Tool even assigns a 96.7% probability to no change. Talk about a safe bet! 🎰

Still, there’s a small 3.3% chance of a 25-basis-point cut, which would lower the rate to 4.0–4.25%. Fingers crossed! 🤞

FED interest rate forecast, Source: CME

If the Fed decides to throw caution to the wind and cuts rates, the crypto market could take a hit harder than a piñata at a birthday party. 🎉

Lower interest rates would reduce the opportunity cost of holding non-yielding assets like Bitcoin, making them slightly less attractive to the average investor. At least compared to other assets, such as government bonds. Because who doesn’t want to invest in something that’s as exciting as watching paint dry? 🎨

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-06-17 20:18