-

WIF, one of the best-performing memecoins this cycle, lost a chunk of its value and left the top 50.

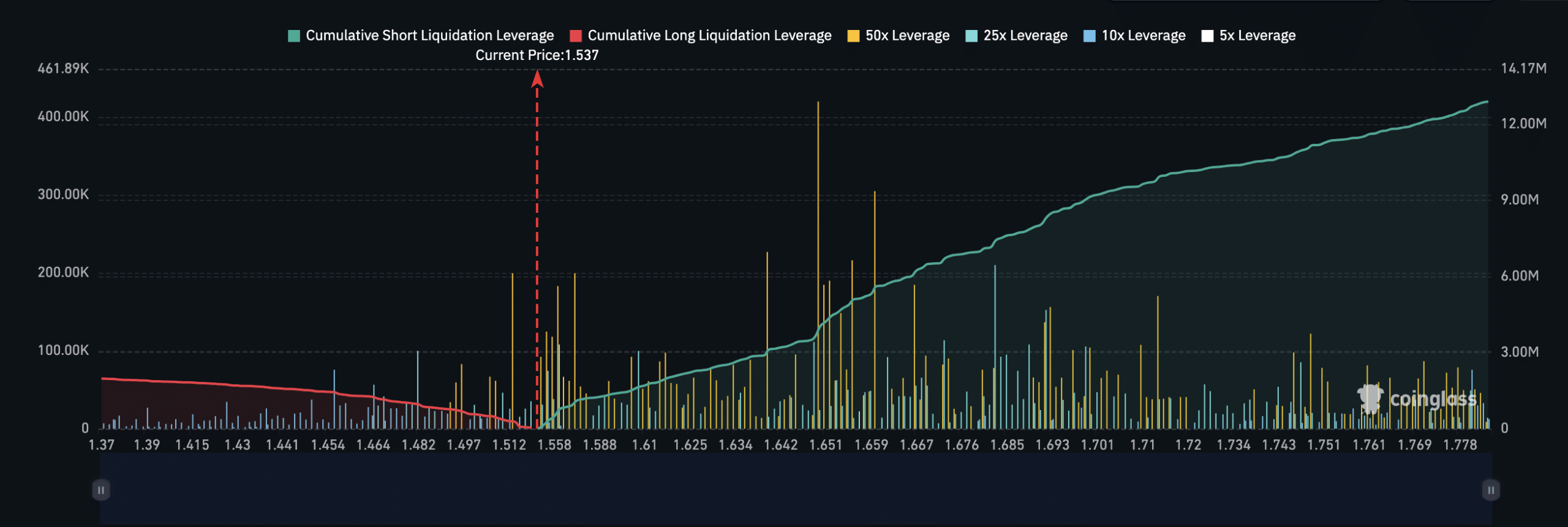

Data from showed that million of short position would face liquidation if WIF bounces.

As a crypto investor who experienced the meteoric rise of WIF (Dogwifhat) in Q1 2024 and saw its subsequent steep correction, I’m left feeling disheartened by the token’s recent performance. The 45.83% decrease in price within the last 30 days and its exit from the top 50 market cap list is a stark reminder of the volatile nature of this asset class.

WIF, the popular meme token on the Solana blockchain (SOL), has surprisingley seen a significant price drop of 45.83% over the past month.

Additionally, WIF‘s cryptocurrency no longer holds a spot among the top 50 most valued by market capitalization. At present, its price is at $1.53 and its market cap is $1.56 billion, while Fantom (FTM) has taken over this position.

Despite Dogwifhat being introduced in the middle of December 2023, it gained significant popularity and saw a substantial price increase of over 1500% during the first quarter of 2024.

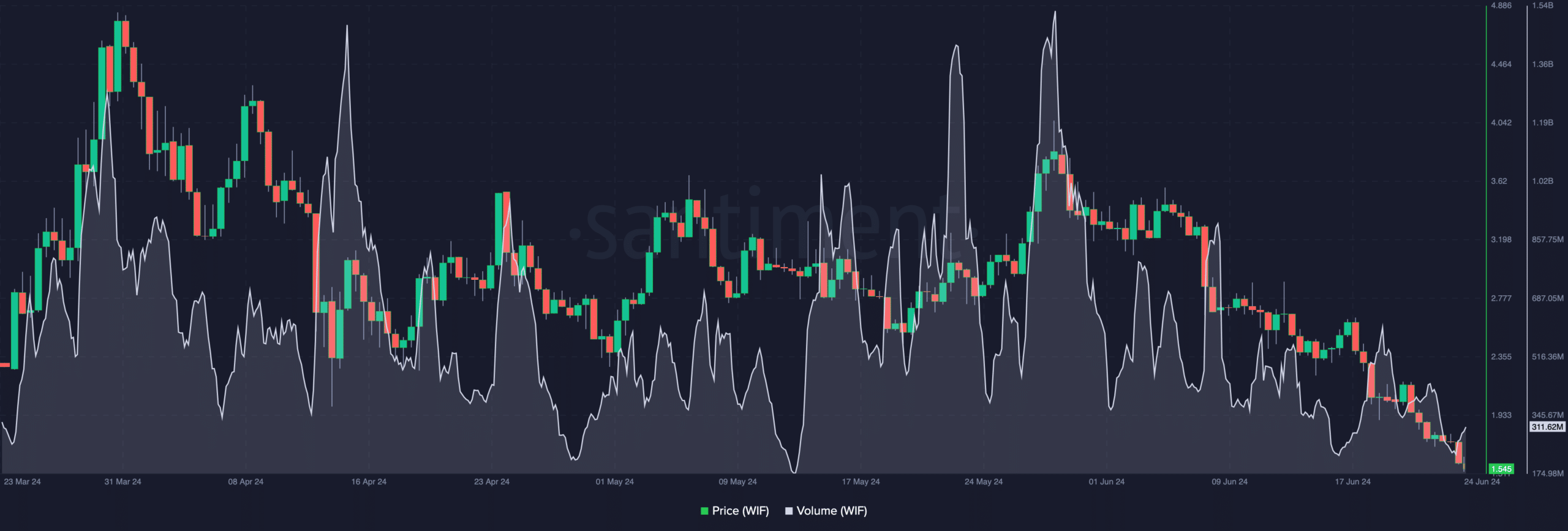

WIF’s volume is no more at the top

The surge in factors supporting WIF cryptocurrency propelled its price to a record peak of $4.84. Despite forecasts suggesting a potential rise to $10, no such development has occurred since the significant downturn began.

Analysts once predicted that the memecoin would surpass the popularity of Pepe (PEPE) and Shiba Inu (SHIB). However, this hasn’t come to fruition yet.

In this analysis by AMBCrypto, we explored Dogwifhat’s current on-chain situation and prospects. Our initial focus was on the crypto volume associated with its WIF (Wasabi Wallet Integration Factor).

As a researcher analyzing market data from Santiment, I’ve discovered that the token’s trading volume amounted to approximately $211.62 million during the observation period. This figure was nearly as low as the minimum recorded since the 13th of May.

During the past quarter, WIF saw a significant increase in trading activity, approaching the $2 billion mark on multiple occasions.

Bears risk liquidation

At the current value, the token’s popularity appeared to be waning close to its lowest point. Consequently, regaining some of the lost price seemed difficult.

As a researcher studying the financial markets, I’ve observed that if a significant number of market participants choose to buy WIF at the current discounted price, there’s a possibility that its price could bounce back. However, my analysis shows that not many traders are optimistic about WIF making a strong comeback.

As an analyst, I’ve come across a post from an anonymous trader going by the name of Blockgraze. Based on his perspective, he is skeptical about the memcoin offering any new buying chances. In his own words, he expressed this viewpoint on X (previously known as Twitter).

“It’s being widely discussed that WIF is within the accumulation range for many investors. However, upon examining the chart, it appears no one is actually amassing holdings at this time.”

As a crypto investor, I’ve noticed that there’s a significant risk for traders if the WIF price were to rebound unexpectedly. Based on the data from Coinglass, it appears that millions could potentially be lost in such a scenario. Upon examining the liquidation map provided by AMBCrypto, this became clear.

As a crypto investor, I understand that sometimes market conditions can lead to significant losses on my open positions. To protect against potential excessive losses, exchanges have the power to liquidate my trades. This means they forcibly close my position, thereby ending the trade and minimizing any further potential losses.

As a researcher studying financial markets, I have observed that an imbalance in margin accounts or heightened market volatility can often pose challenges for traders when market conditions move against their positions.

As an analyst, I’ve examined the liquidation map and discovered that there are approximately 12.89 million short positions at risk of being liquidated should WIF rebound to a price of $1.78.

If the cost of WIF cryptocurrency drops to $1.37, approximately 2 million long positions will be liquidated. On a larger scale, sentiment towards WIF has been rather pessimistic recently.

Is it over for WIF?

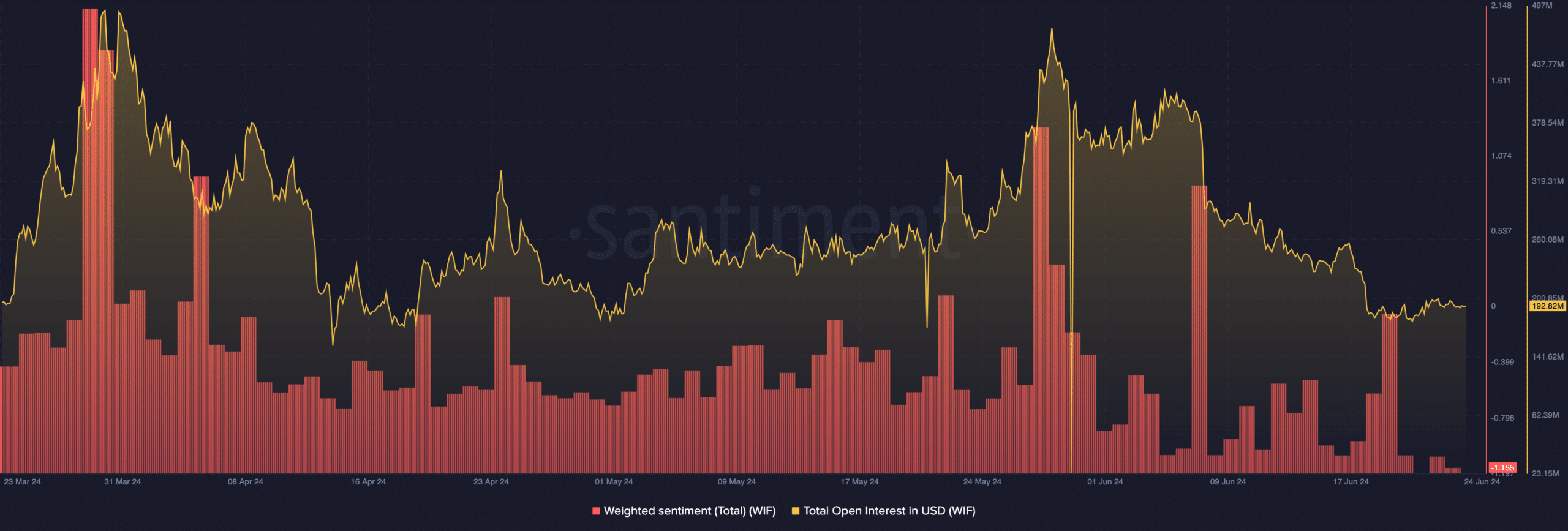

As a researcher analyzing WIF‘s Weighted Sentiment at present, I found the score to be -1.15, which is the minimum value this metric has taken over the past six months based on the latest on-chain data.

The weighted sentiment analysis reveals that for every favorable comment regarding the memecoin found online, there are approximately 1.15 negative or bearish comments.

Should this trend persist, the WIF price might further decrease. In the event that it does, the price could reach as low as $1.35.

If extreme pessimism were to coexist with WIF‘s current situation, it could potentially serve as a catalyst for its recovery. Consequently, the price of the token might surge towards the $2 mark.

Currently, the Open Interest for WIF futures contracts has dipped under the $200 million threshold. Open Interest refers to the total number of unfilled orders in the market for these contracts.

Realistic or not, here’s WIF’s market cap in PEPE terms

When it rises, this indicates an upward shift in net positioning. Conversely, a decrease, as in the case of WIF, suggests that traders are liquidating their current positions.

If this position continues, there is a possibility that WIF‘s price could drop, causing its market capitalization to fall beneath the ranking of the 51st largest cryptocurrencies.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-06-24 21:12