-

WIF had a short-term bullish outlook at press time.

The rally is likely to struggle to push beyond the $2 resistance.

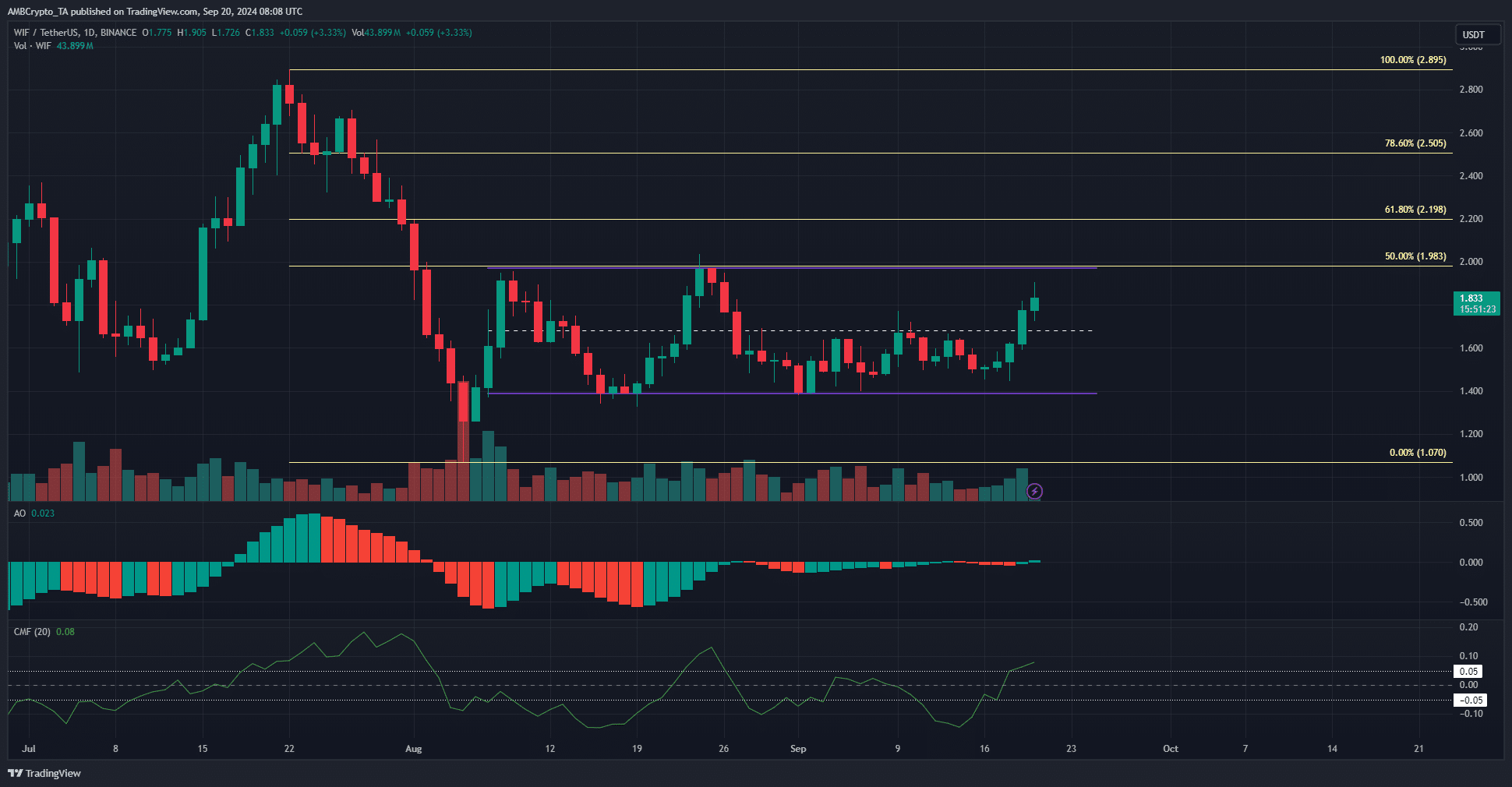

As a seasoned crypto investor with battle-tested nerves and an eye for spotting trends, I find myself intrigued by the current state of WIF. Having witnessed its dance within the range since late August, I can’t help but feel a sense of déjà vu. The recent break above the mid-range level at $1.685 is encouraging, but the looming $2 resistance has me on high alert.

5 days ago, a series of green candles were observed by onlookers, indicating that the price was increasing as the bulls took control. This upward trend in Bitcoin (BTC), which surpassed the $60k resistance, significantly boosted the overall market mood.

In simpler terms, the price of this meme-based cryptocurrency has been rising temporarily, but it may encounter a strong barrier near the $2 mark. The question is whether investors should buy more (go long) or sell some now (fade the move) in anticipation of a drop (going short).

Answers from the range formation

Since the second week of August, the price of this asset has been fluctuating within a specific band. The lower limit of this range is $1.39, while the upper limit is $1.98. Over the last three weeks, the midpoint of this range at $1.685 has acted as a barrier, preventing any significant price increase.

After breaking through this level, the bulls have pushed the Cryptocurrency Memecoin upwards significantly, with its Moving Average Convergence Divergence (MACD) crossing above 0.05, signaling strong purchasing interest within the market. This surge may take the coin to its peak range, though a breakout remains uncertain for now.

On the daily chart, the Awesome Oscillator experienced a bullish crossover, indicating a potential change in momentum towards bullish. However, it’s important to note that this is just one positive signal, and traders should prepare themselves for the possibility of a ‘WIF‘ rejection at $2.

As an analyst, I often find it more advantageous to trade within a price range rather than attempting to predict a breakout. Should the market close above $2 in a single daily session, it would significantly influence my short-term trading perspective.

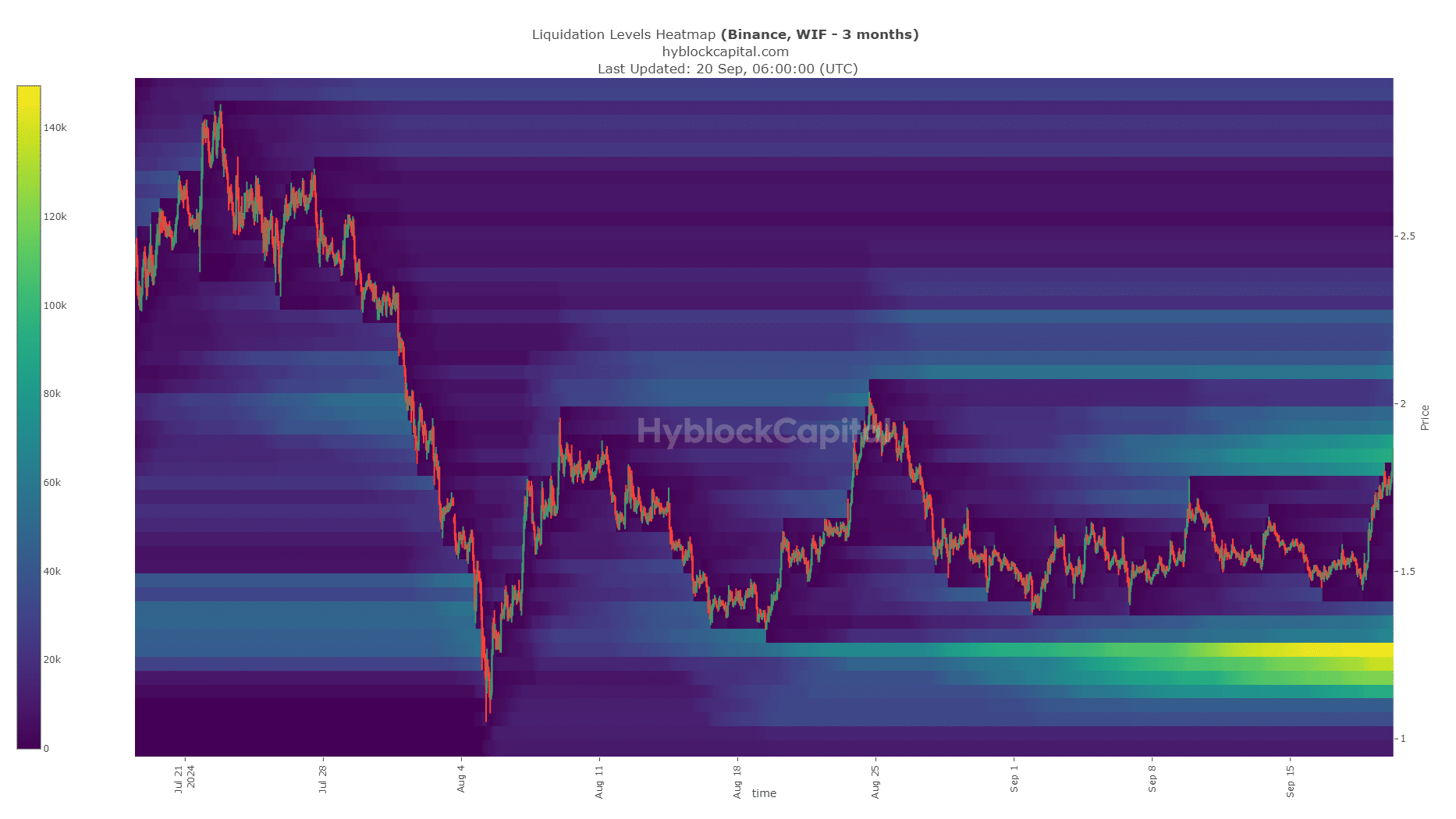

The liquidation heatmap highlighted the range formation

In simpler terms, the liquidation chart shows slight discrepancies compared to the trends observed in the market prices. There appears to be a substantial accumulation of long positions in the price range between $1.22 and $1.26, which is significantly lower than the price ranges that have formed over the past few weeks.

In simpler terms, the area around $1.88 is marked as a potential spot for a change in trend, possibly a turnaround point. For traders looking for short-term opportunities, this could be where they might find their chance. Moving forward, two additional levels, specifically $2.09 and $2.06, are identified as potential profit-taking points for aggressive traders aiming for bullish movements in the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-21 00:07