-

WIF may be mirroring DOGE’s early 2021 cycle, reigniting hopes for a breakout.

An AMBCrypto strategy could help make that breakout a reality.

As a seasoned crypto investor with a knack for spotting trends and a keen eye for market dynamics, I find the recent surge of WIF intriguing. It seems to be mirroring DOGE’s early 2021 cycle, which, if history repeats itself, could indeed reignite hopes for a breakout.

dogwifhat [WIF], dubbed Solana’s mascot, has seen a 14% surge over the past week, trading at $1.74 – double the gains of DOGE in the same period.

As I observe the current market landscape, it’s evident that WHIF, which peaked at $4.60 in March, is experiencing a retreat. However, its growing popularity has sparked intrigue among analysts who are pondering the potential for a bullish trend reminiscent of DOGE‘s extraordinary surge in the early months of 2021.

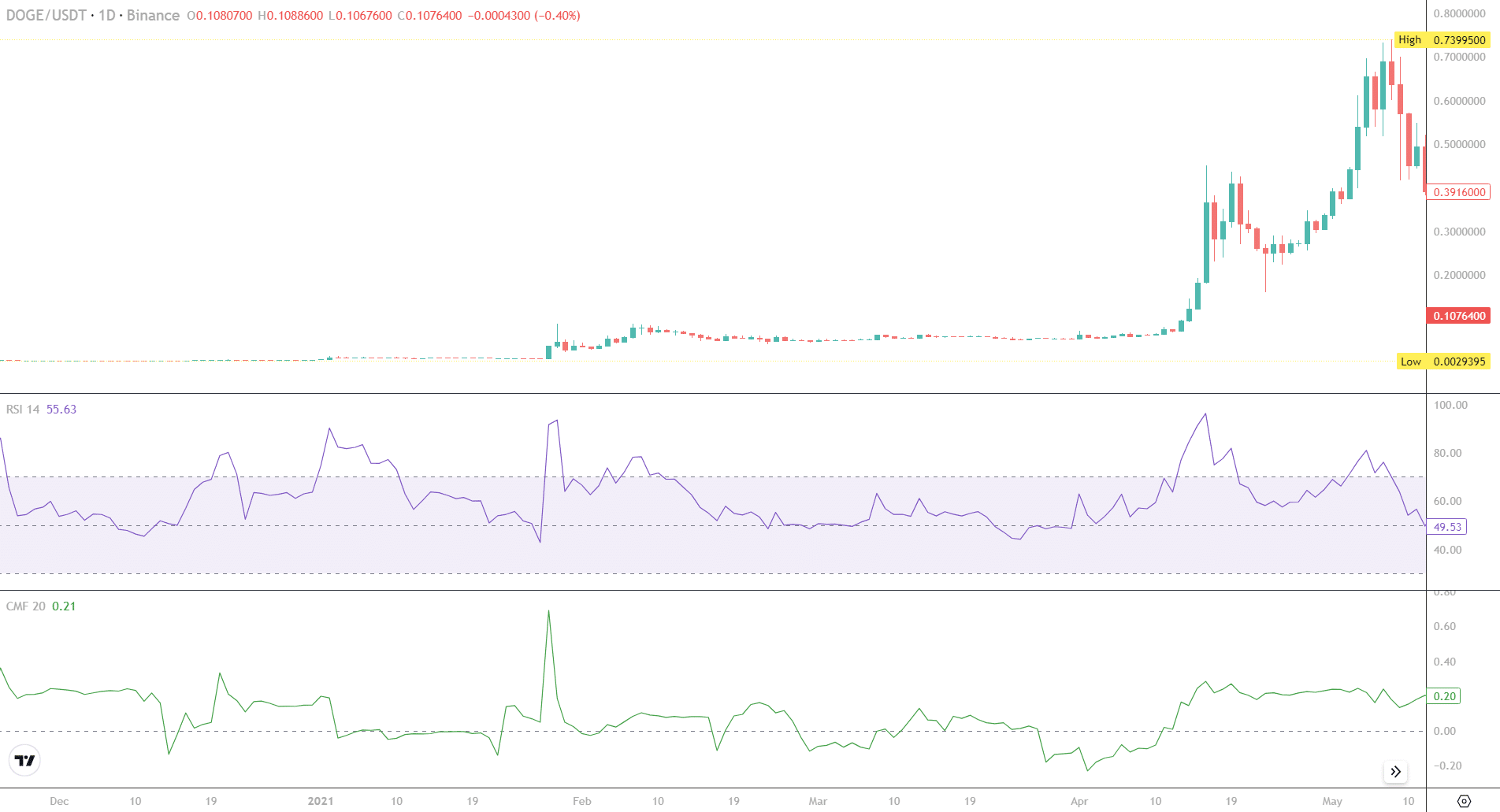

Uncovering the historic 2021 cycle

Source : Coinalyze

In the daily price chart for 2021, Dogecoin experienced a dramatic surge to notability with its parabolic increase, gaining an astounding 1,333% within merely two days, finishing at $0.0459054.

After a while, there was a strong upward trend (bullish move) for DOGE, which soared an astonishing 10,351% over a period of 100 days, peaking at an all-time high (ATH) of $0.70. In simpler terms, this surge brought unprecedented profits to investors; unfortunately, subsequent events led to losses, with DOGE now being traded at $0.1075.

Contrarily to what we’ve witnessed so far, WIF hasn’t experienced a parabolic surge yet, but it seems primed for one. If a similar pattern unfolds, WIF might reach a new all-time high by revisiting its mid-July cycle, as long as it maintains support at $1.70.

Boosting the positive outlook is the historical trend of Bitcoin, with October typically being a bullish period. This trend might act as an extra motivation for the meme coin to escape its month-long phase of stability and potentially surge.

If the current pattern continues, it’s possible that WIF might experience a substantial decrease in value during the opening quarter of the following year.

If specific conditions align

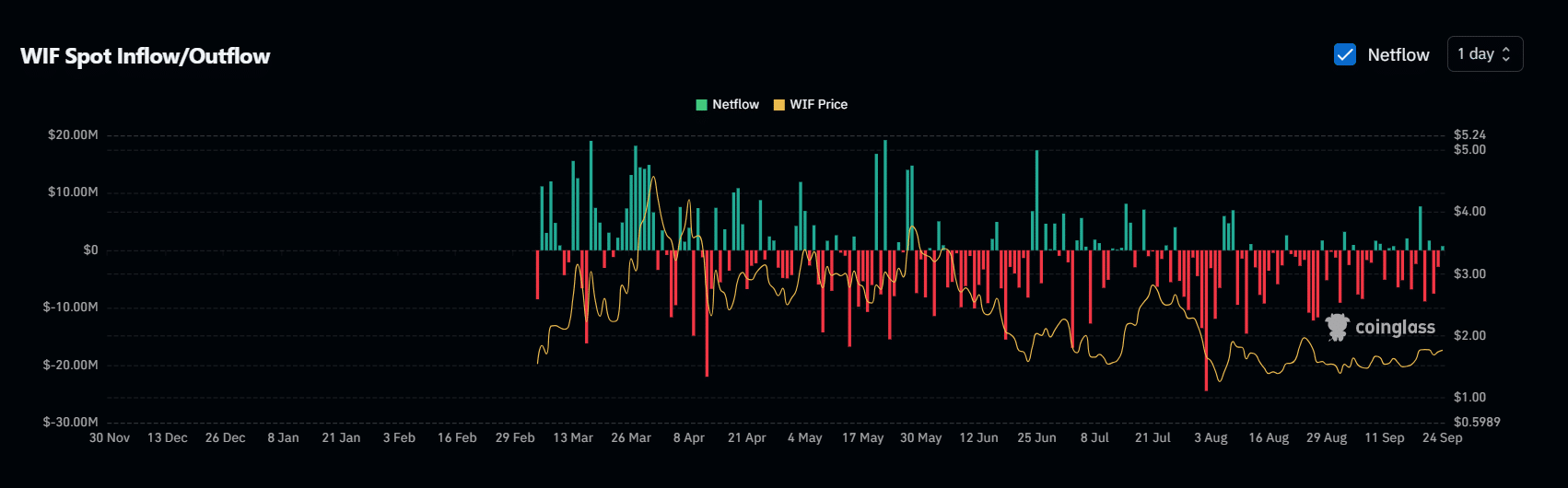

Generally, holders try to pinpoint the lowest price level for buying, followed by an upward price movement, which is what we see happening with WIF according to AMBCrypto’s observations.

From my analysis, revisiting the resistance levels towards mid-July holds significant importance as it could potentially shift the current trend. This assertion is bolstered by an uptick in holders initiating withdrawals via WIF, a pattern evident in a sharp increase in net outflows amounting to $26 million on the day WIF touched its lowest point at $1.664.

Source : Coinglass

Simply put, a price adjustment typically occurs when stakeholders abstain from participating in the distribution process. Vigilance regarding this factor is essential.

Over the past few weeks, there’s been a significant drop in speculative trading activities, closely following the trends of WIF‘s price. As reported by AMBCrypto, this decrease in Open Interest (OI) might be a positive signal, suggesting that the price may become more resilient against sudden fluctuations.

As more futures traders step away, power could increasingly pass to the immediate market (spot market). If investor interest continues to be robust, the likelihood of a turnaround becomes stronger. Thus, it’s essential to take advantage of this pattern to foresee a potential bullish surge ahead.

Spot traders must capitalize on this for a WIF reversal

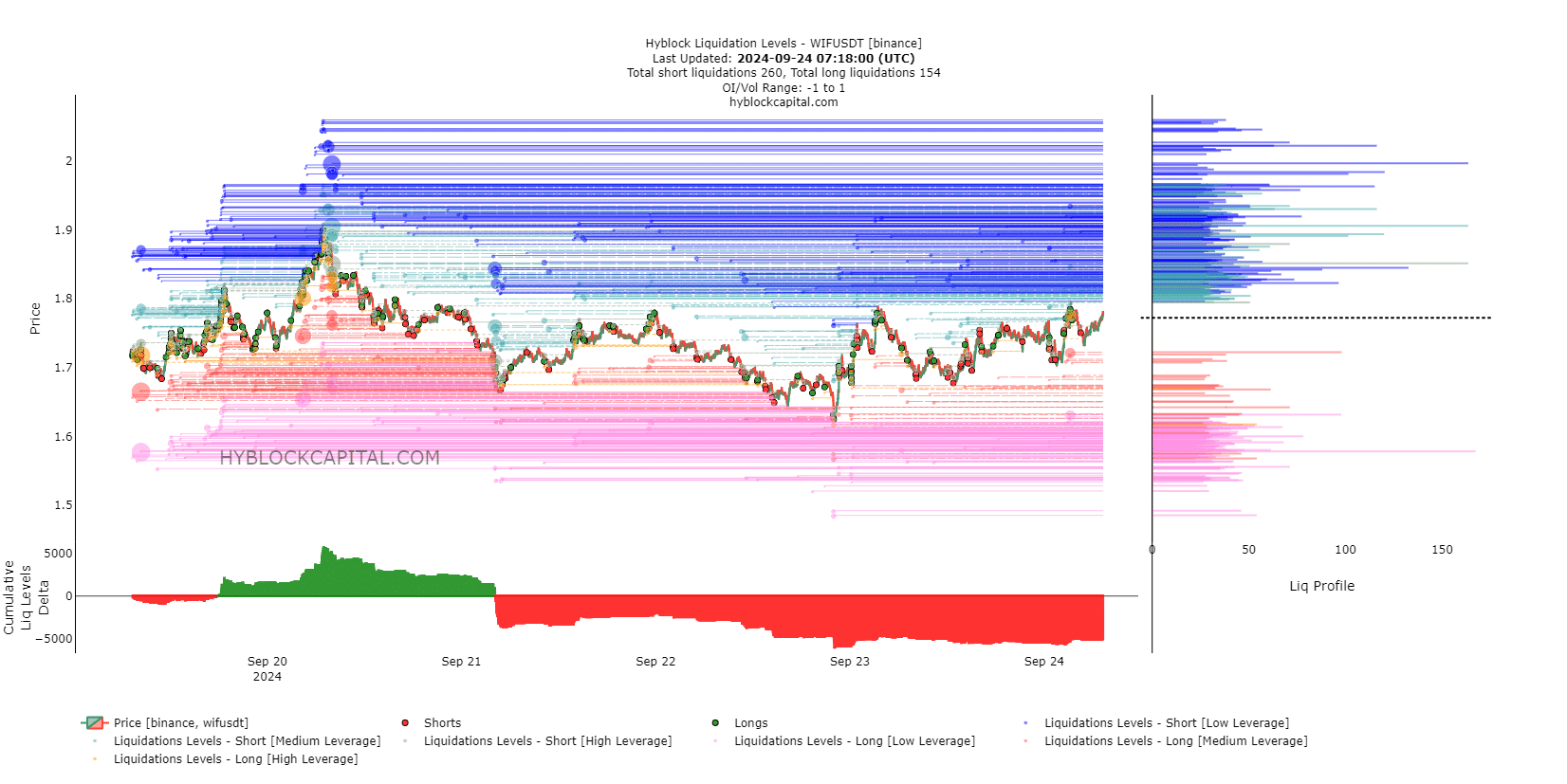

3 days past, when bears blocked an effort to bring WIF close to its earlier rejection at $1.90, long investors pulled back, leading to a substantial increase in short positions.

Source : HyblockCapital

Despite appearing non-optimistic, strategic moves by spot traders might lead to a reversal in WIF‘s pattern for a breakout. Normally, a minor uptrend compels short sellers to wrap up their positions. Given the prevalence of short sellers at present, if spot traders persist in buying, it could instigate extensive liquidations.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

To put it simply, should more traders start buying (long position) in the crypto market and bears (those selling) back off, there’s a possibility that WIF may move toward the $1.90 price range. If this pattern continues, the next potential obstacle for WIF could be around $2.

In summary, considering the current market trends, there’s a strong possibility for a significant surge or “breakout”. This could happen if traders effectively utilize this particular trading approach.

Read More

2024-09-24 17:12