-

WIF’s value has dropped by over 10% in the last 24 hours

Derivatives market performance highlighted the presence of significant bearish sentiments

As a researcher, I find the recent market performance of WIF, or Solana-based memecoin dogwifhat, quite concerning. In just 24 hours, its value has dropped by over 10%, making it one of the top losers in the cryptocurrency market, according to CoinMarketCap’s data.

In the past 24 hours, the value of dogwifhat (WIF), the memecoin built on the Solana blockchain, has dropped by more than 10%. As a result, it currently ranks among the greatest decliners in the cryptocurrency market based on CoinMarketCap’s statistics.

In my current composition, the cryptocurrency alternative was worth around $2.69 when I penned this down. Its value dropped by approximately 12% within the last 24 hours. Concurrently, the daily trading activity saw a decrease of roughly 38%.

WIF traders begin to lose bullish conviction

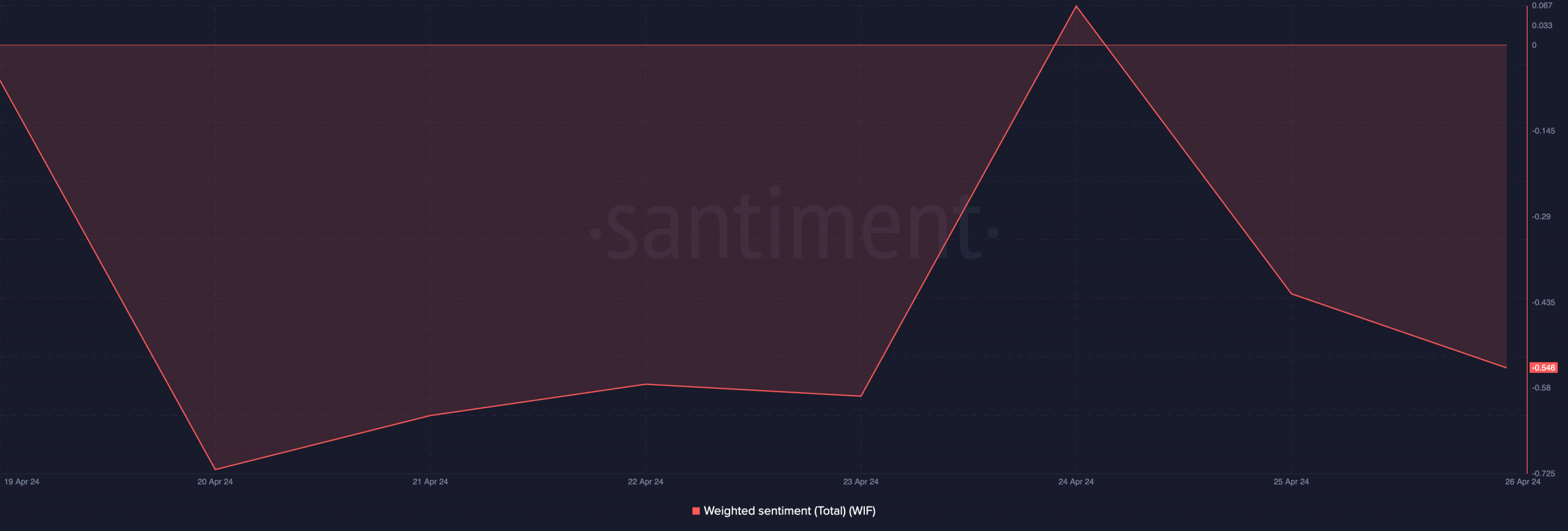

Based on recent market analysis, there has been a significant increase in pessimistic views towards WIF. At the current moment, the coin’s sentiment score, as calculated by Santiment, stands at -0.546. This negative value signifies that the bearish sentiments have overpowered the bullish feelings among traders and investors in the WIF market.

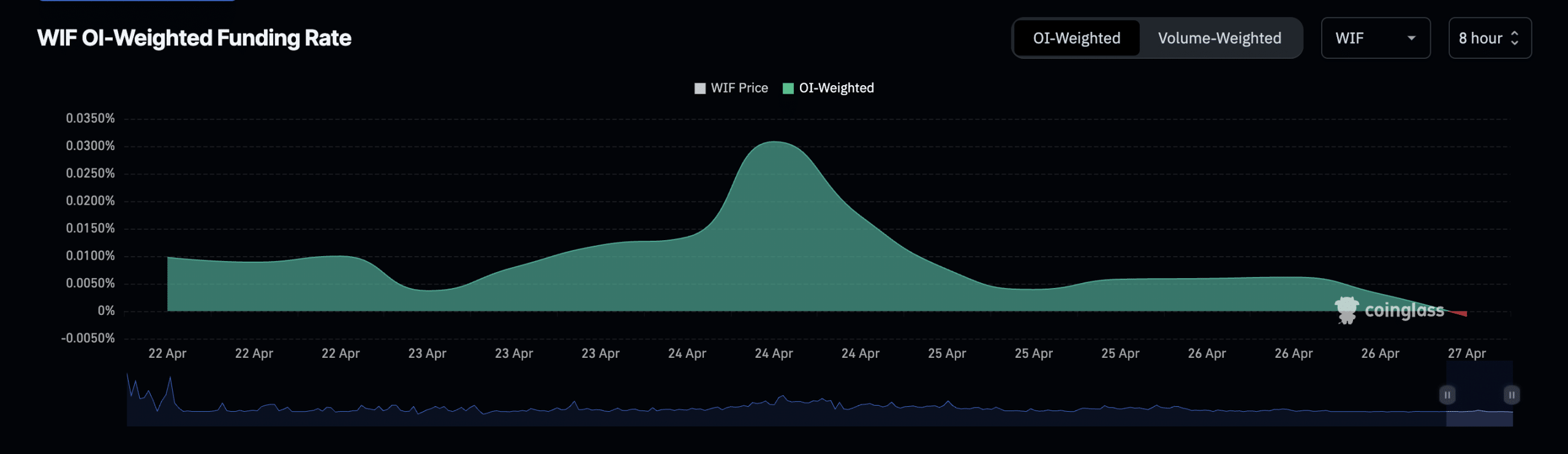

As a researcher examining the current trends in the WIF token market, I’ve noticed that its bearish trend is further confirmed by its negative funding rate. Based on Coinglass’ data, this funding rate across cryptocurrency exchanges stood at -0.0009%. This is an important observation because the WIF token’s funding rate has turned negative for the second time since 8 February.

As an analyst, I would explain it this way: In perpetual futures contracts, funding rates serve as a self-regulating mechanism to maintain the contract’s price in alignment with the current spot price.

When an asset’s funding rate holds a positive value, it signifies that the contract price surpasses the current spot price. Consequently, traders holding long positions are required to make a payment, in the form of a fee, to those who have taken short positions on the asset.

In contrast, if the contract price is less than the current market price, or the “spot” price, then short traders are required to pay a fee to traders with long positions.

As a researcher studying financial markets, I would explain it this way: When an asset’s funding rate is in the red, it signifies that a larger number of traders have taken up short positions on that asset. In simpler terms, they are betting that the asset’s price will decline. This situation implies that there are more traders anticipating a price drop than those who believe the asset will rise and buy it with the intention of selling at a higher price point.

The negative funding rate for WIF‘s Futures contracts isn’t the only issue. Open interest in this market has been decreasing significantly since April 9th. Currently valued at $302.45 million, it has dropped by approximately 41% from its previous amount.

Due to the consistent decrease in WIF‘s price, long position holders have experienced a greater number of forced liquidations compared to those with short positions during the previous week. Specifically, as of April 26th, the total value of long positions that were closed against their will amounted to $1.7 million, whereas only $1 million worth of short positions underwent such liquidation events.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-04-27 15:03