-

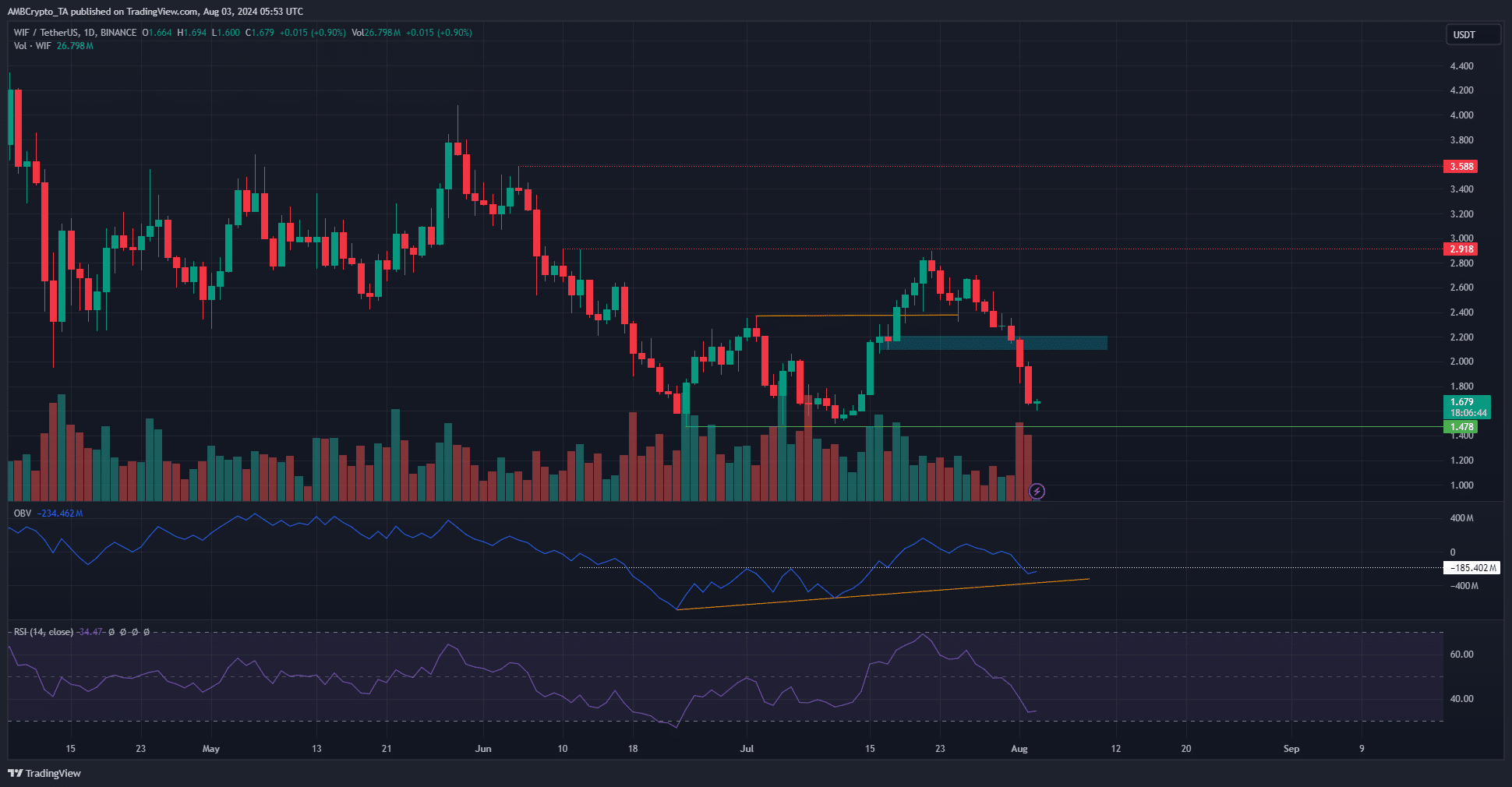

WIF formed a bearish structure break after its fall below $2.32

Momentum remained bearish, but the OBV gave buyers some hope

As a seasoned analyst with over two decades of experience under my belt, I’ve seen my fair share of market highs and lows, bull runs, and bear markets. Looking at WIF (or as I like to call it, “What If Coin”), I can’t help but feel a sense of deja vu.

Last week, DogeWhatever (WIF) suffered a 38.4% loss. Two weeks ago, there was optimism about this memecoin as its bulls managed to break through a bullish structure. However, since July 29th, Bitcoin‘s significant price declines have negatively impacted the overall altcoin market.

As a researcher, I must admit that the current string of losses might not tell the whole story. However, there seems to be a glimmer of optimism hidden within the volume indicators, suggesting a potential swift recovery. Yet, at this moment, it appears the overall sentiment is not favoring the bulls in the immediate future.

More volatility, but WIF recovery is still possible

1. The drop beneath the $2.32 and $2.15 points intensified the negative trend in WIF‘s price movement. As the $2.32 level was breached, the daily Relative Strength Index (RSI) dipped below the neutral 50, signaling a change in momentum. With an RSI reading of 34, it appears that bears continue to hold the upper hand.

It appeared probable that the previous lows in June and July, priced at $1.47, could be revisited as potential support again. After these levels are hit, a swift recovery may follow.

Over the past six weeks, the OBV has been on an upward trend. As we speak, it’s hovering slightly below the peak levels reached in early July. Interestingly, despite a recent surge in selling activity over the last ten days, buying volume has remained strong when prices surpassed $2, not being outweighed by the subsequent sell-off.

If bulls cling to this modest optimism, they might grow more confident in the near future, though it may lead to further declines.

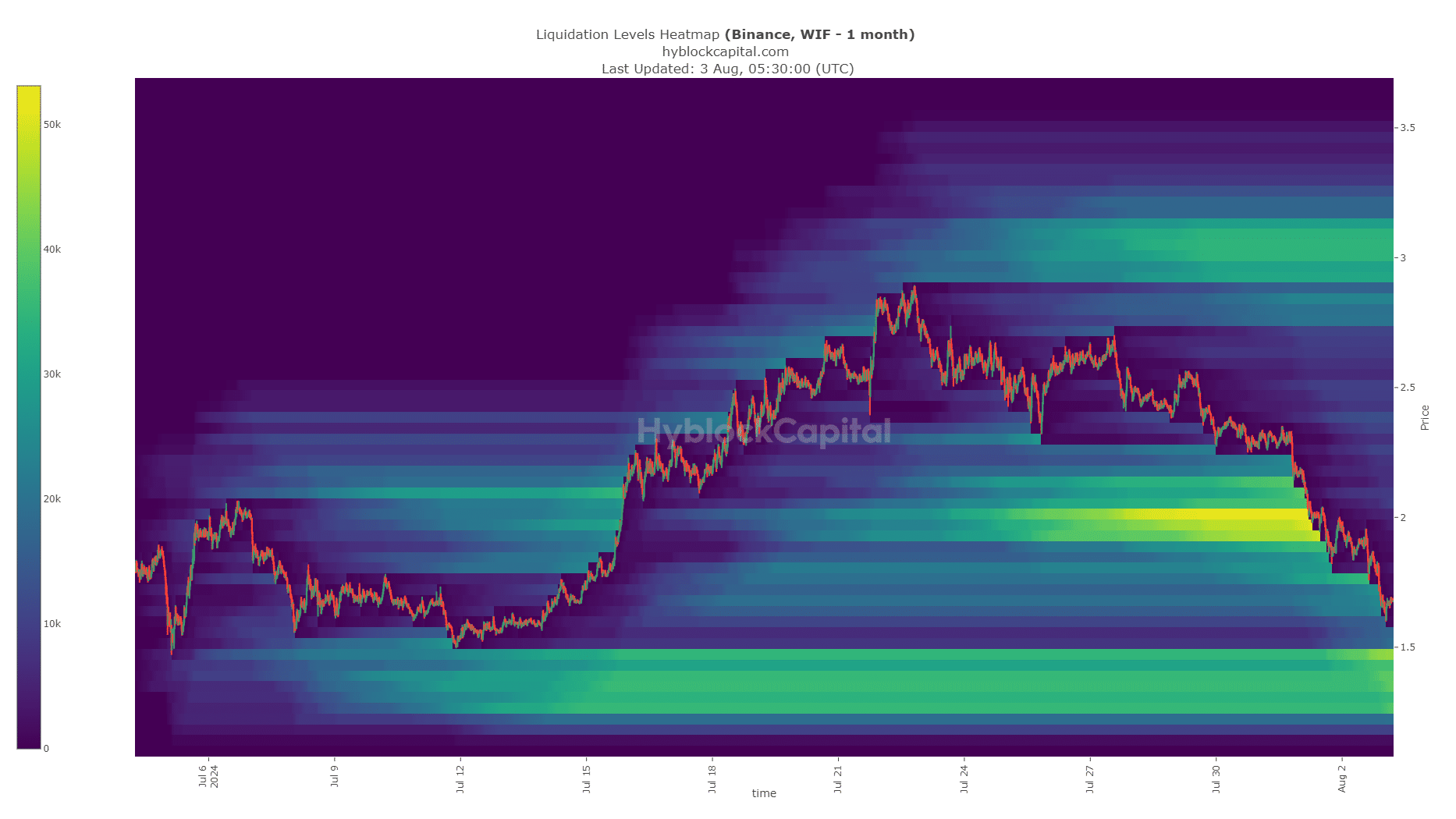

Liquidation heatmap supported price move below $1.5

In simpler terms, when the prices stayed at $2, it couldn’t prevent the sellers (bears) from pushing down the price. As a result, due to the prevailing pessimistic market sentiment, WIF gradually moved closer to the next group of buyers (liquidity pool) priced around $1.4 – $1.5.

Realistic or not, here’s WIF’s market cap in BTC’s terms

In this area, we find an intersection with the resistance level marked earlier. There’s a chance that a bullish turnaround might start right here, as long as Bitcoin maintains its position within the $60k support zone.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-03 16:07