-

WIF had a strong bearish market structure at press time.

The buying pressure of last week suggested the sentiment might be changing, but the price action did not signal an uptrend.

As a seasoned crypto investor with a few scars from past bear markets, I’m keeping a close eye on WIF (Dogecoin). The market structure at press time was bearish, with the long/short ratio flipping between bullish and bearish frequently. Last week’s buying pressure suggested a potential shift in sentiment, but the price action didn’t quite signal an uptrend yet.

dogwifhat [WIF] did not show a clear direction in the market at press time.

As a crypto investor, I’ve been keeping an eye on AMBCrypto’s latest report, and it seems that the long/short ratio has been fluctuating quite a bit lately. This shifting back and forth indicates a certain level of uncertainty or indecision in the market, suggesting that there’s not yet a clear consensus among investors regarding the direction of cryptocurrency prices.

Last week saw a whale making a purchase, augmenting its WIF holdings. The surge in demand on the 24th of June has added to this trend. There’s a possibility that WIF may surpass the $2.5 mark as a result.

A buyer comeback might be brewing

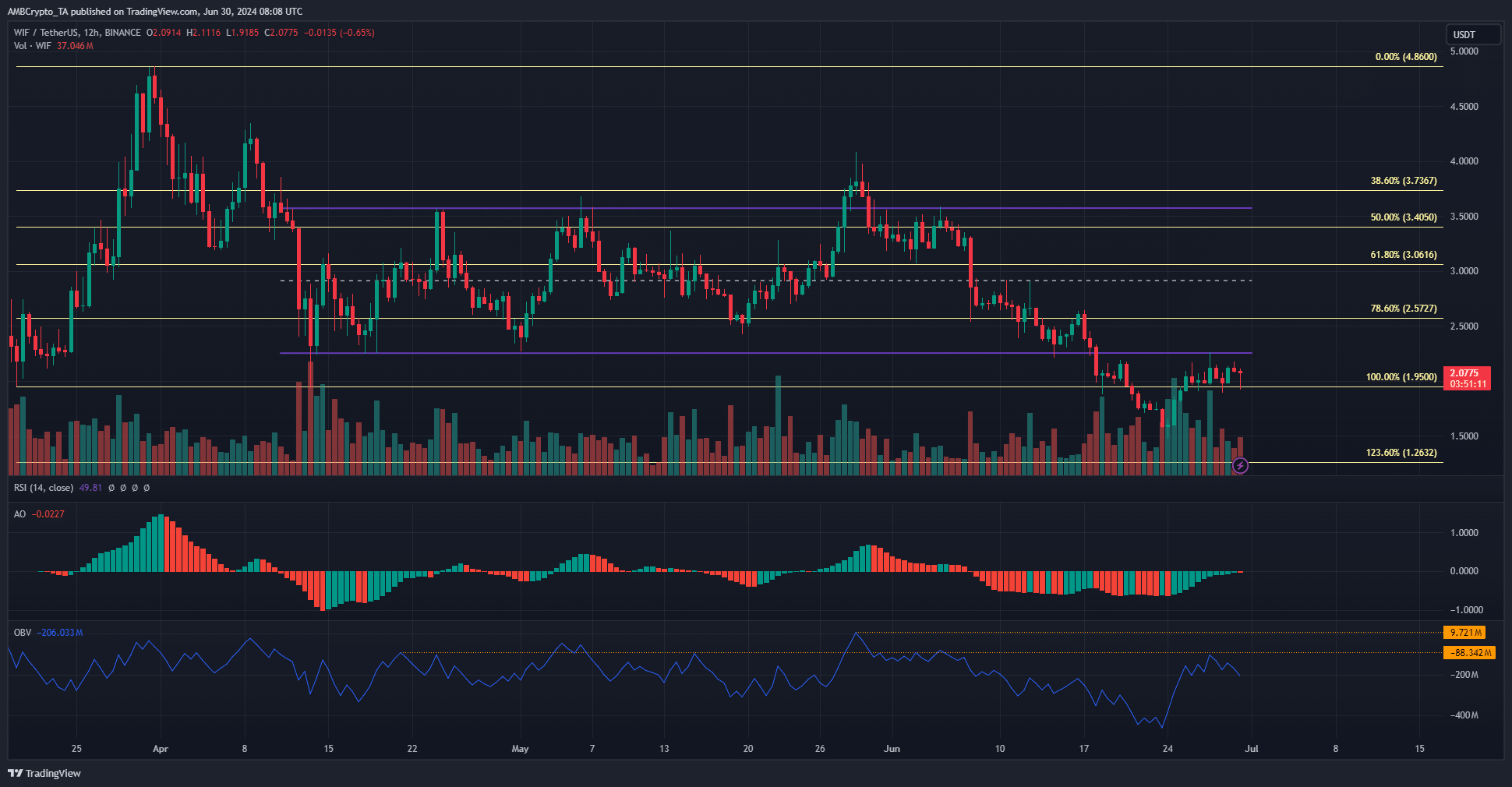

As a researcher studying the price trend of WIF, I’ve noticed that it has been making successive lower lows and lower highs on the 1-day chart since early June. After being rejected from the $3.8-$4 resistance zone, the meme coin plunged to its range lows and continued to slide downward.

As a researcher studying market trends, I’ve noticed an intriguing shift in the Awesome Oscillator’s behavior over the past week. Previously, for the past three weeks, this technical indicator had persistently remained below the zero line, suggesting a bearish momentum. However, this trend has now reversed. The Awesome Oscillator has started climbing higher, and so has the trading volume, indicating a potential shift in market sentiment.

On the 24th and 25th of June, there was a significant increase in demand for purchasing, causing the On-Balance Volume (OBV) to climb towards a nearby resistance point.

At present, the $1.95-$2 price range functions as a base of support for WIF‘s stock. A persistent increase in On-Balance Volume (OBV) within this range suggests a bullish outlook for the stock.

Which way does short-term bias lean?

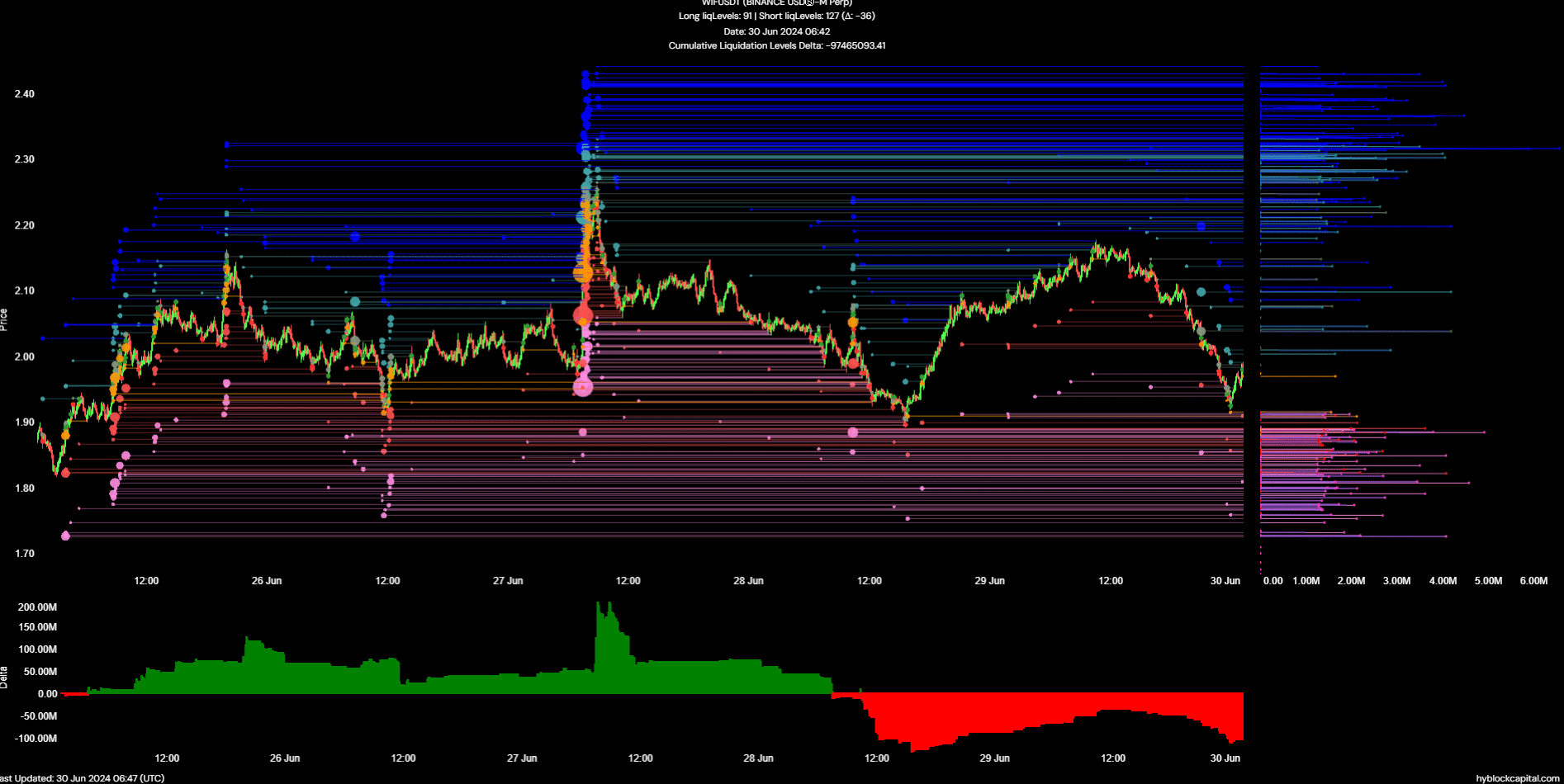

As a financial analyst, I’ve noticed that the cumulative liquidations levels delta showed a significantly negative reading on June 28th. This event led WIF prices to rebound from $1.9 to $2.15. However, since then, the delta has dipped once more, causing WIF prices to retreat from their recent gains.

Is your portfolio green? Check the WIF Profit Calculator

Recent setbacks have provoked an increase in short selling among investors, yet this trend has disproportionately influenced market equilibrium. As a result, these short positions may become attractive targets for those seeking liquidity prior to the next market shift.

As a researcher studying the market trends based on AMBCrypto’s analysis, I’ve identified $2.2 and $2.3 as potential short-term bullish targets due to marked liquidation levels. However, if these levels are retested without significant buying pressure, it’s likely that WIF will continue its previous downtrend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-07-01 00:07