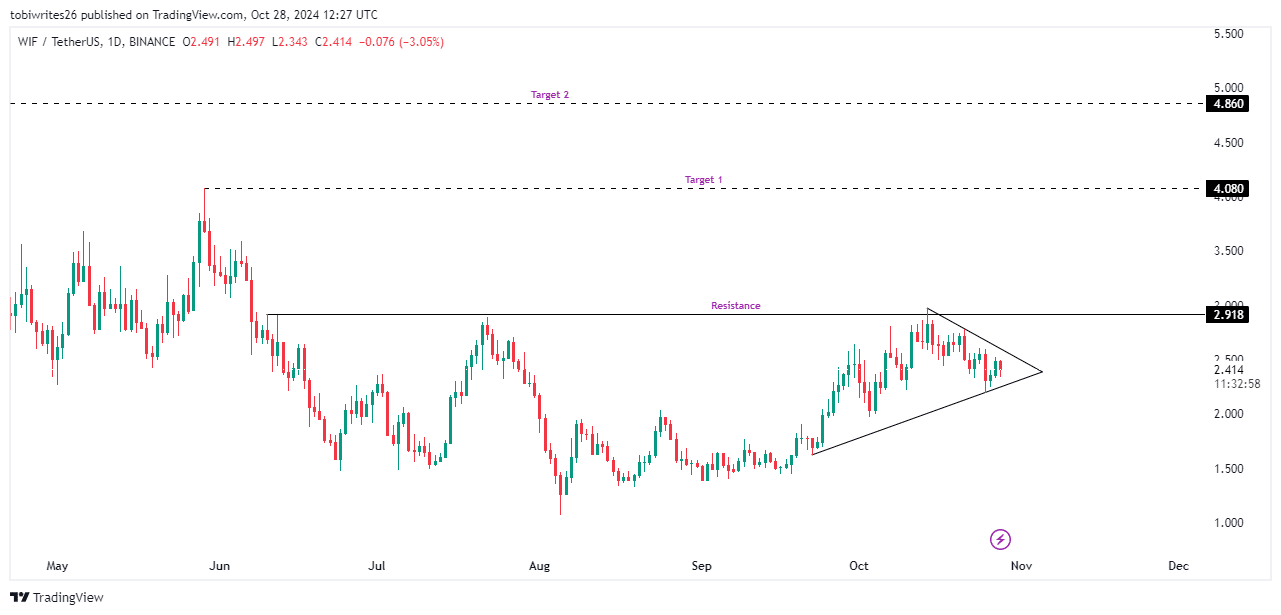

- WIF has been trading within a symmetrical triangle pattern – A technical setup that suggests a growing push from market participants

- Analysis of key metrics indicated that market participants are actively positioning for WIF to shift into bullish territory

As a seasoned researcher with a knack for deciphering market movements and a soft spot for cryptocurrencies, I find myself intrigued by WIF’s current position within a symmetrical triangle pattern. This technical setup has been the harbinger of many bullish rallies in my experience, and if history repeats itself, we might be on the brink of another one here.

Over the last seven days, the value of dogwifhat (WIF) has experienced fluctuations, dropping by 6.65%. At the current moment, its price stands at $2.44. Previously, this level was surpassed during an October rally, but subsequent strong resistance led to a reversal and a decline.

Currently, WIF is trying again to surpass current levels and potentially push past the barrier that previously limited its growth. If successful, WIF may be poised for a significant advance toward the $4.80 price point.

Key pattern signals potential rally

It appears that WIF’s stock movement has been confined within a symmetrical triangle, which is typically seen as a significant precursor for bullish surges. This pattern emerges when two lines of support and resistance gradually come closer together, limiting the fluctuations in price.

If this trend continues with significant force, World Innovation Fund (WIF) might breach the resistance point at $2.918 – a level that has consistently limited its price advancement during past endeavors.

If the rally takes off, it’s possible that the price of WIF might double, eventually reaching a long-term goal of $4.860. Along the way, it may also hit an intermediary target of $4.080.

By examining various on-chain indicators, AMBCrypto discovered further signs pointing towards a bullish trend, which aligns well with the current market sentiment.

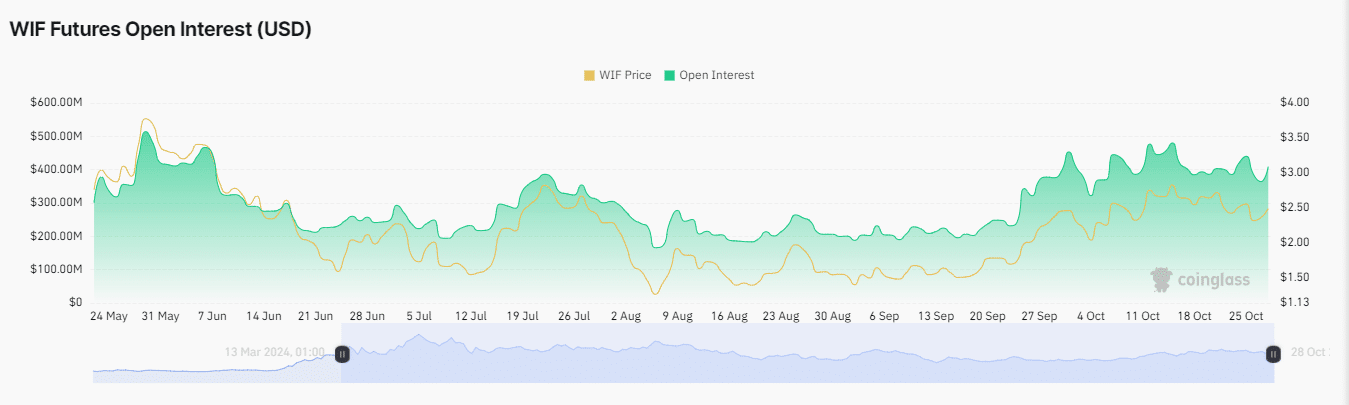

Bullish pattern supported by rising trader activity

Based on data from Coinglass, it appears that an increase in open interest (OI) – a measure counting outstanding derivative contracts yet to be settled, predominantly within the Futures market – signifies heightened buying activity.

Currently, at this moment, the Open Interest (OI) has increased by approximately 3.95% to reach a level of $396.52 million. Moreover, its graph indicates an upward trend. This surge in OI coincides with a 40.8% rise in WIF’s trading volume, causing the overall trading volume to soar to $857.60 million.

Apart from the OI hike, there was also an increase in the funding rate, currently standing at 0.0065%. This implies that long traders are aggressively funding their positions to maintain price equilibrium, which suggests a positive outlook or optimism among traders regarding WIF.

If both indicators continue trending positively, a WIF rally will be increasingly probable.

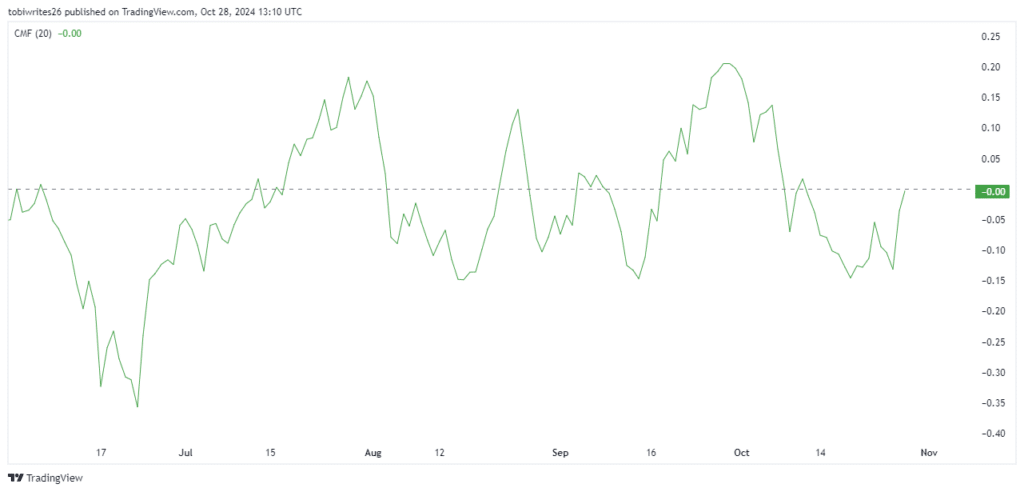

Hike in liquidity flow

In the end, transactions on the blockchain hinted at an increasing pattern of purchasing, as traders persisted in opening long positions and substantial amounts of liquidity were invested in the acquisition of WIF tokens.

As a researcher, I observed an intriguing surge in the Chaikin Money Flow (CMF) indicator, transitioning from negative values to a balanced 0.00, suggesting a shift from bearish to a more neutral stance.

Based on my years of experience in the financial markets, I have observed that a sudden change from a bearish to a neutral stance often signifies a strong acceptance of liquidity in the market. This shift can be seen as a positive development and could indicate sustained bullish momentum. In my career, I have witnessed many instances where such a change has led to significant growth, making it an important factor for investors to keep an eye on.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-10-29 11:35