- WIF’s price has been strategically capped at $3.80, a level where both big and small players are quick to exit.

- The key to breaking through this barrier lies in one of two conditions.

As a seasoned analyst with over a decade of experience in the crypto market, I’ve seen my fair share of wild rides – from the meteoric rise and fall of Bitcoin to the unexpected twists and turns of memecoins like dogwifhat (WIF).

Approximately a month ago, the price of dogwifhat soared dramatically by 30%, reaching an unprecedented high of $4.83 within a 24-hour period – marking its longest stretch of continuous price increase on record.

Initially appearing poised to surpass its record high, the memecoin surprisingly experienced a significant reversal, dropping to $2.90, demonstrating their inherent volatility and unpredictability.

Even though investors have suffered losses, the tale isn’t concluded just yet. A more substantial dip to $2.00 might appear enticing as an entry point. However, AMBCrypto’s analysis indicates that WIF could make a resurgence, but only if the bulls play their hand skillfully.

How a long squeeze has cost WIF a new ATH?

According to an old adage, timing is crucial in cryptocurrency, and the WIF bulls have demonstrated this. In just one day, there was a significant 30% increase that brought WIF close to a fresh record high. However, the Relative Strength Index (RSI) reached levels suggesting it had become overbought.

It’s worth noting that this event happened around the time when Bitcoin’s [BTC] price closed above $90K for the first time, which ignited genuine concern among investors during the “Trump pump.

The next day saw Bitcoin drop by 3%, whereas WIF experienced a steep fourfold decrease instead. Despite several subsequent efforts by bulls to recover, the price of WIF has been consistently held back by the $3.80 barrier.

What’s happening is that two key reasons are influencing the situation: Initially, the unpredictability in the market is causing trouble for memecoins such as WIF, pushing their values down. This is because the appeal of swift, substantial profits is becoming increasingly attractive amidst this volatility.

2. As fear of missing out (FOMO) subsides, major investors are selling off their holdings, sensing a potential shift in the market. This, along with other factors, is preventing the value of What-Is-Forgotten (WIF) from rising significantly.

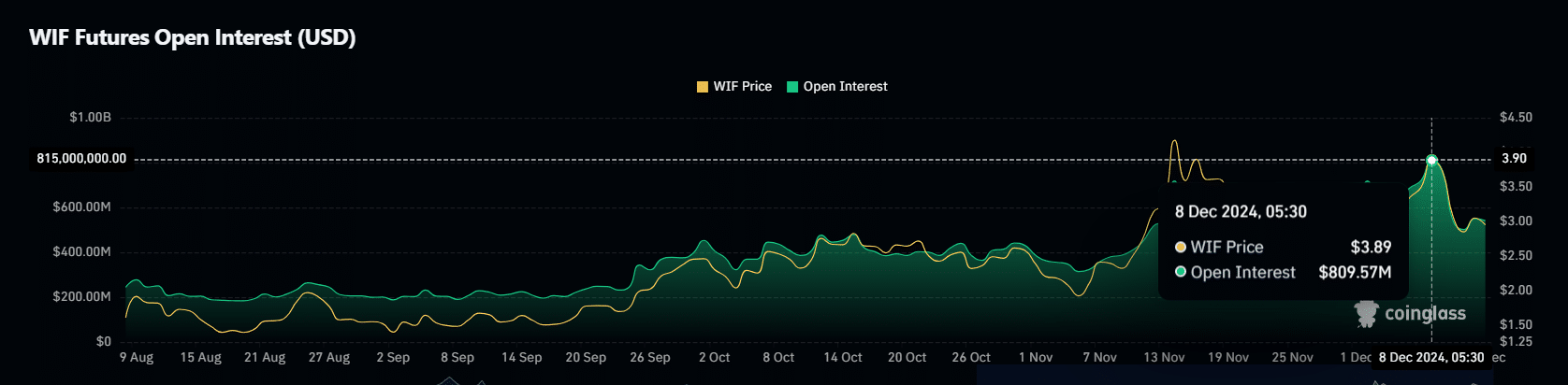

Whenever WIF approaches its crucial price level, a huge grouping of open long positions gets liquidated, causing those with long positions to close them quickly. This phenomenon can be observed in the significant decrease in Open Interest (OI), which indicates a large number of trades being closed at once.

Initially, the OI was valued at approximately $1 billion, but it has since decreased to $541 million as of the latest report. This significant drop had a dramatic effect on WIF, resulting in a large, red candlestick on the daily chart, which symbolizes a steep fall of more than 17%. Now, the value of WIF is below the $3 mark.

Since the price level of $3.80 has demonstrated its strength as a resistance point for WIF, it’s essential that if you hold a long position in this asset, forming a solid base (right bottom) will play a vital role in witnessing a potential recovery.

If things go well, the following move might involve holding onto the asset, which can help its value stabilize and possibly surge beyond current levels. Stay alert – this moment could mark a significant shift that optimistic investors have long anticipated. However, keep in mind that there are specific circumstances to be aware of.

Should you HODL or let go?

Two days ago, whales disposed of approximately 1.2 million WIF tokens valued at around $3.47 million, as the token’s price exceeded $3. It appears that we might be premature in declaring a market bottom, given that investors with weaker hands are yet to fully exit the market.

However, there’s a faint sign of optimism. The Relative Strength Index (RSI) has dropped below overbought territory, suggesting that some traders are taking advantage of the dip, and short positions are becoming excessively high, potentially leading to instability.

As an analyst, I find myself in a position where I’m observing the current market landscape. It seems that this situation presents opportunities for fresh players to enter and make their strategic moves. For those who possess WIF (a cryptocurrency) and HODL (hold onto it), making this decision could prove to be a shrewd investment choice, given the potential developments ahead.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

In order for significant recovery, it’s crucial that major contributors become more active. Here’s the reasoning behind this: When large whale investors dominate the buying sector, it attracts both spot and futures traders who seek to capitalize on the discount.

If there’s an increase in demand for purchases and active traders drive up the price, it could force those with large short positions to exit, which might initiate a chain reaction leading to another significant price rise.

If one or both of the stated conditions come true, it’s possible that WIF could overcome its persistent resistance at $3.80. It’s crucial to keep a close watch on the significant aspects I’ve highlighted; monitoring them carefully in the upcoming days will be vital.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-12-13 14:16