-

WIF’s price rose by double digits in the last week.

However, bulls do not yet have a clear path to victory.

As an experienced financial analyst, I have seen my fair share of market fluctuations and price movements in various assets. The recent surge in WIF‘s price by 20% in just a week is an interesting development that warrants closer scrutiny.

On May 3rd, the cost of Dogecoin (WIF) surpassed its 20-day simple moving average, triggering a 20% increase in its value since then.

If an asset’s price surpasses its 20-day Simple Moving Average (SMA), it’s a sign that the short-term trend for that asset is likely moving upwards.

In simpler terms, this indication implies that the asset’s present value is more than the average value it had over the last twenty days. Such a scenario could imply buyer dominance and potential further price increases.

WIF’s next direction?

According to CoinMarketCap, at press time, WIF exchanged hands at $3.26.

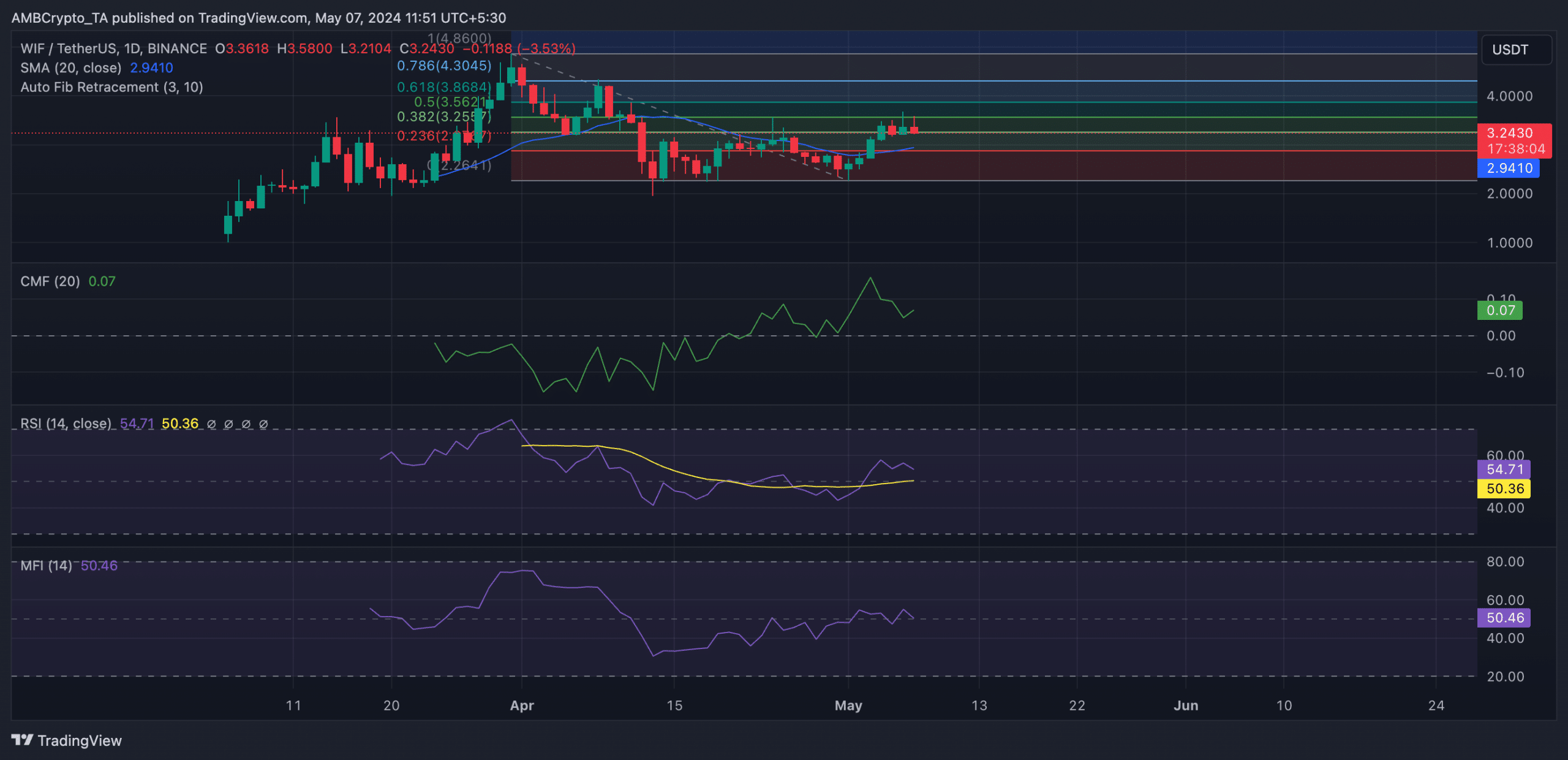

Based on the analysis of the one-day chart for the meme coin using Fibonacci retracement levels, a potential bullish price target of $3.86 could emerge if the positive trend continues.

To bring about this occurrence, a consistent desire for WIF must exist in the market. Nevertheless, based on the data from the token’s crucial momentum markers, it appears that the market is predominantly neutral, with roughly equal numbers of buyers and sellers.

From my perspective as a crypto investor, the current RSI and MFI readings for WIF are at 55.06 and 50.51 respectively, as of now.

At the time of publication, neither WIF buyers nor sellers held a definitive control over the market based on these values.

Additionally, the Chaikin Money Flow (CMF) of WIF was trending downwards during the reporting period. This technical analysis tool signifies the net buying or selling pressure of an asset by calculating the difference between the sum of money flowing into the security and the sum of money flowing out of it over a given timeframe.

As a researcher examining market trends, I observed an intriguing phenomenon: While Commodity Money Fund (CMF) values were declining during a specific timeframe, the price of Working Independent Fund (WIF) was surging, resulting in a bearish divergence between the two.

When there’s a significant difference between expectations and actual outcomes, leading to a downward trend, this is commonly seen as a warning sign that the price direction might change.

As a crypto investor, if the price of WIF continues to rise without any significant increase in demand, I’m concerned that a correction could be on the horizon. This persistent uptrend might not be sustainable and may signal a lack of genuine market interest, potentially leading to a downturn.

Should the bullish forecast discussed earlier prove incorrect, there’s a possibility that WIF‘s price could drop below $3, reaching as low as $2.8 in the market.

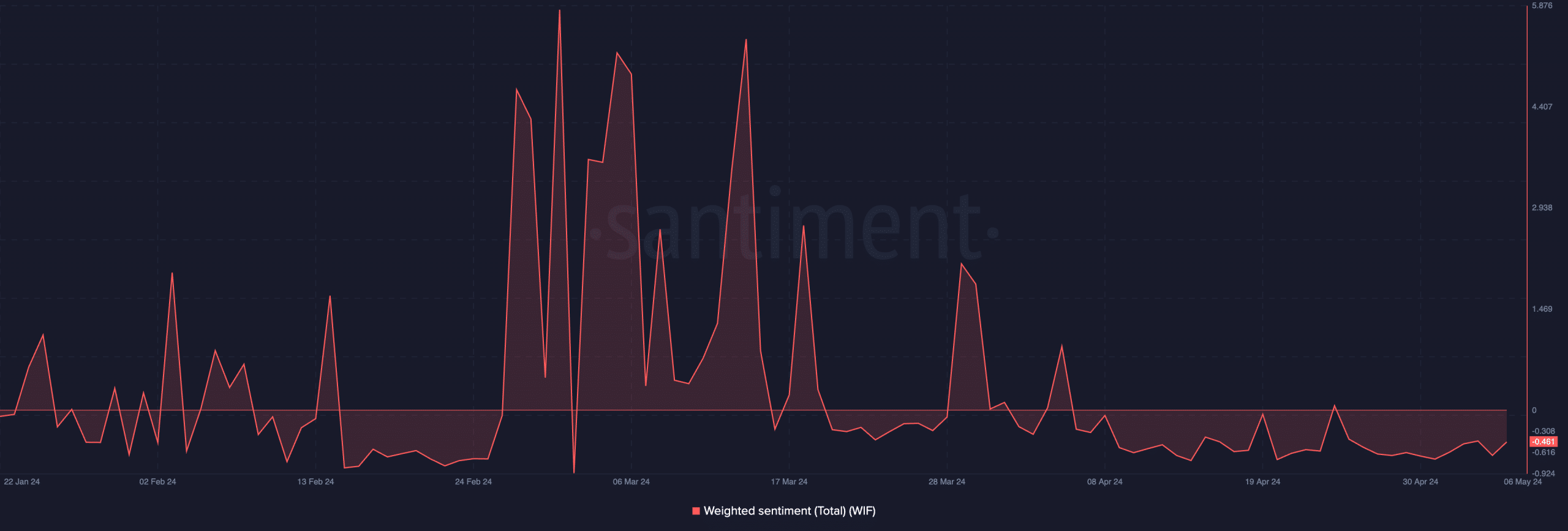

Despite WIF‘s price surge in recent weeks, a bearish outlook persists among market participants.

As a data analyst looking into the recent market trends of WIF using Santiment’s insights, I’ve observed that despite a substantial 10% price increase over the past week, the Weighted Sentiment for this asset remains negative with a score of -0.46 at present.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-05-07 18:15