On Sunday, Bitcoin tumbled below the magnificent $100,000 mark—yes, you read that right—even before most folks could finish their breakfast cereal. The U.S. said, “Yes indeed, we’re tangled up in the Israel-Iran kerfuffle,” and the crypto traders immediately started behaving like hungry crocodiles at lunchtime. Volatility? Oh, it’s on the menu.

Bitcoin Options Mountain Hits $51 Billion: Fear or Greed?

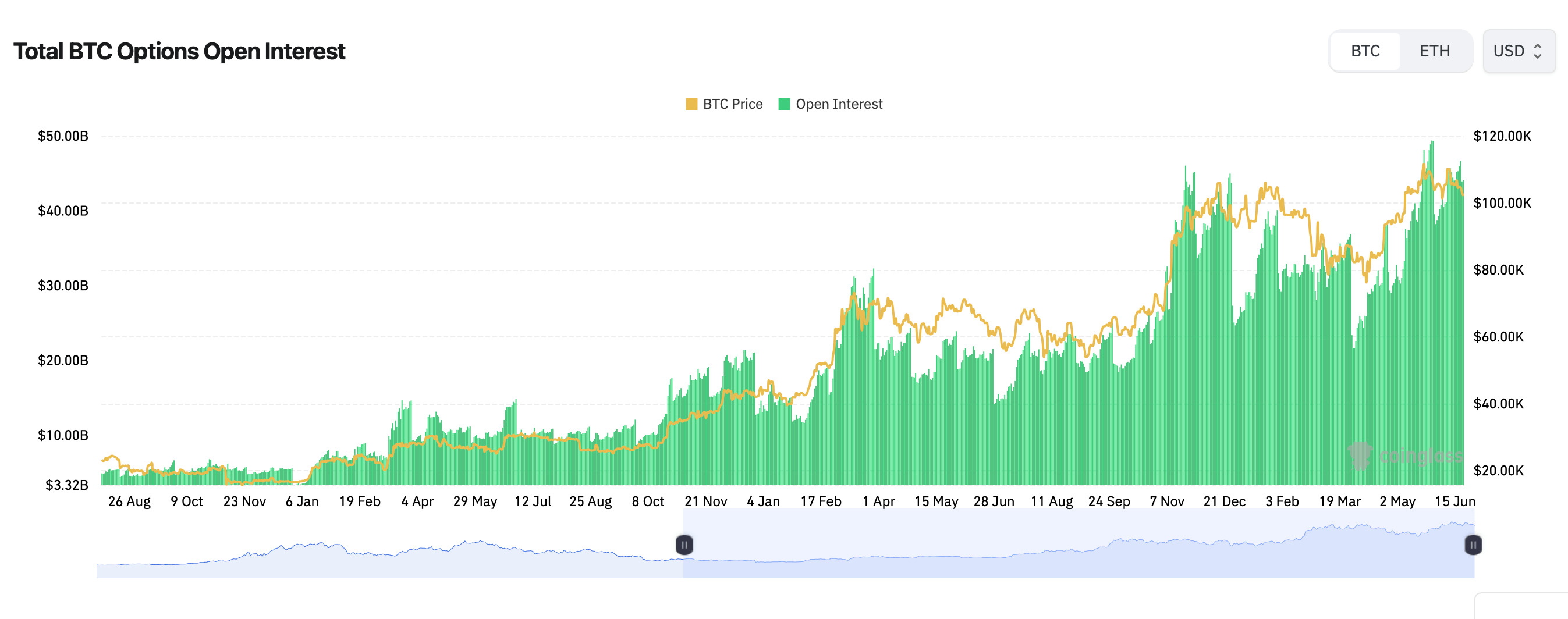

If you stuck a thermometer into the options market right now, it would explode with numbers: open interest in bitcoin (BTC) options is perched at an eye-watering $51 billion. Meanwhile, poor Ethereum (ETH) is trailing behind with a measly $17 billion—like the little brother always picked last for dodgeball. The world is apparently obsessed with Bitcoin when things get spicy.

For those who like counting beans: open interest = total value of unresolved bets, a handy way to peek inside the minds (and pockets) of the punters. Over at Deribit, the majority of Bitcoin and Ethereum gamblers are stacking up on call options. That means 59.73% of bitcoin bets are on it going UP, while the worrywarts only muster 40.27% for the big doomsday “put” bets. For ETH, the call cheerleaders have an even bigger lead, with over 67% of action. Apparently, hope springs eternal—unless you own ETH, where the bears seem to be throwing a gloomy garden party.

Let’s get into the meat and potatoes of these bets. For Bitcoin, call option volume sits at 24,168 BTC. But look! Puts have edged out ahead with 24,780 BTC. It’s almost like the crowd at a Quidditch match: one minute the Slytherins are winning, next thing you know the Gryffindors are dancing!

What about Ethereum fans? According to Ethereum trading stats, 53.06% of bets hope for a price pop. But the hottest Bitcoin wager right now is betting BTC will fall to $95,000 or below by June 27—over 2,000 BTC are riding that broomstick south. 🧹

Meanwhile, eternal optimists are staking it all on Bitcoin shooting up to $105,000 by July 11. As for Ethereum, the popular bets would have it scraping to $2,100, $2,200, or $2,000 faster than you can say “Oompa Loompa.”

Despite all the short-term doomsday prepping, the crowd keeps betting on upside—the classic, “It’ll all be fine in the end!” Maybe. Or maybe not. In any event, the options market looks like a funhouse mirror: wobbly, bizarre, and, as always, just a bit bonkers. 🤡

Sponsor

Psst! Want to earn some pocket money? Seems like everyone’s jittery about Bitcoin, but guess what? While you’re watching the market do its wobbly dance, why not hop over to [UniqPaid.com](https://pollinations.ai/redirect-nexad/G9lNq0fM?user_id=983577)? It’s like finding a golden ticket, but instead of a chocolate factory, you get paid for doing fun stuff like surveys and games. So, ditch the doom and gloom and maybe make enough to buy yourself a nice, big bar of chocolate! 🍫💰

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

- Masters Toronto 2025: Everything You Need to Know

2025-06-22 23:09