- FTM’s MVRV ratio at -4.64% suggested investors may be hesitant to sell at a loss

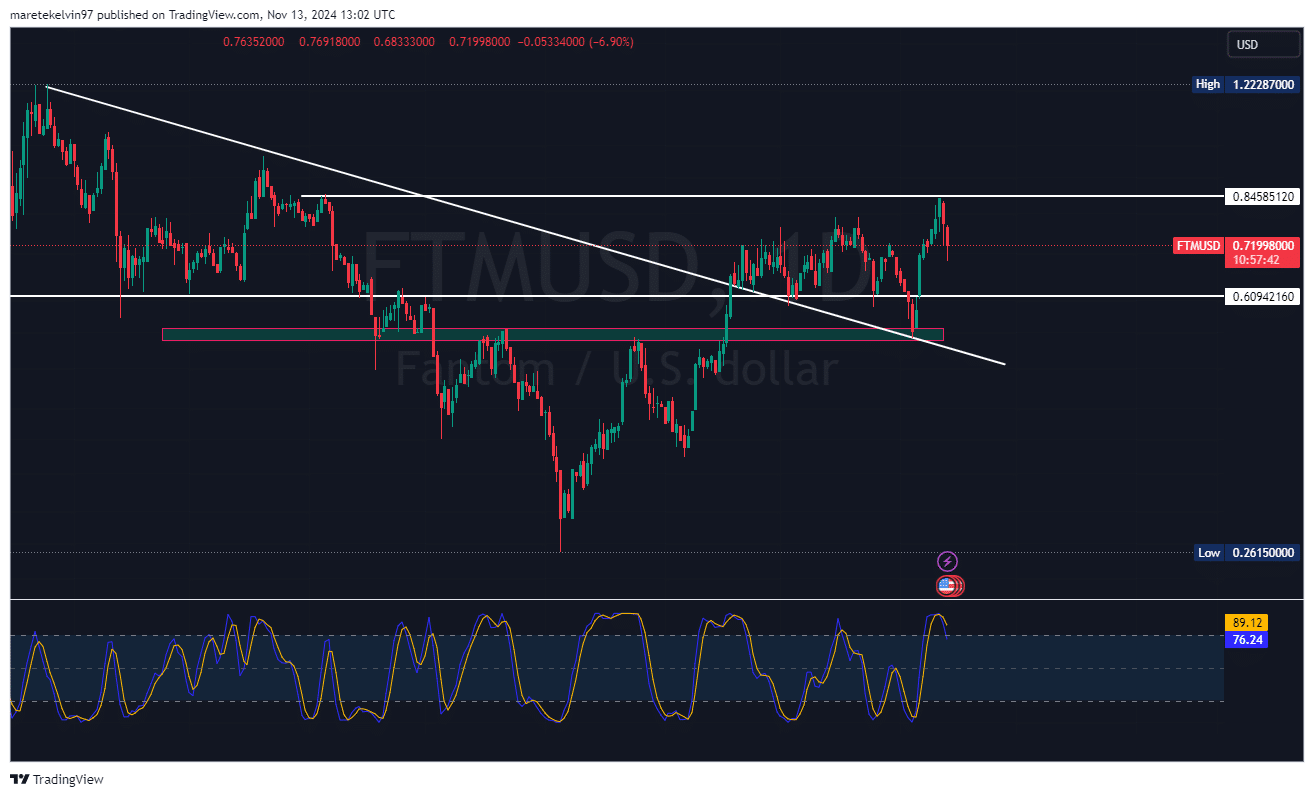

- Next critical support level at $0.609 after a 14% decline to decide the market direction

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bull and bear runs. The current situation with Fantom (FTM) is intriguing, to say the least.

Recently, Fantom’s (FTM) price fluctuations have been quite erratic, with the cryptocurrency experiencing both gains and losses on the charts, even amidst the broader market’s persistent upward trend. At present, many investors and analysts are closely monitoring the next significant support level, as certain on-chain indicators suggest a possible reversal pathway may be emerging.

Will the $0.609-level hold the line?

Over the past two days, Fantom (FTM) experienced a significant 14% drop in value as depicted on daily charts. This dramatic decrease piqued the interest of both short-term traders and long-term investors. Furthermore, this slide has sparked questions about whether FTM will maintain its position at the upcoming crucial support level of $0.609.

If this support wall falls, further downside movements may follow.

Elon Musk’s influence

The significant resistance at $0.609 aligns with FTM’s past price patterns, where we have previously seen strong buying activity. As the market responds to the excitement stirred by key appointments of influential figures within cryptocurrency, this crucial observation becomes increasingly relevant.

Example – Recently, Elon Musk expressed his support for an appointment within the U.S. government’s efficiency department, proposed by President Trump.

FTM’s key metrics back a potential reversal

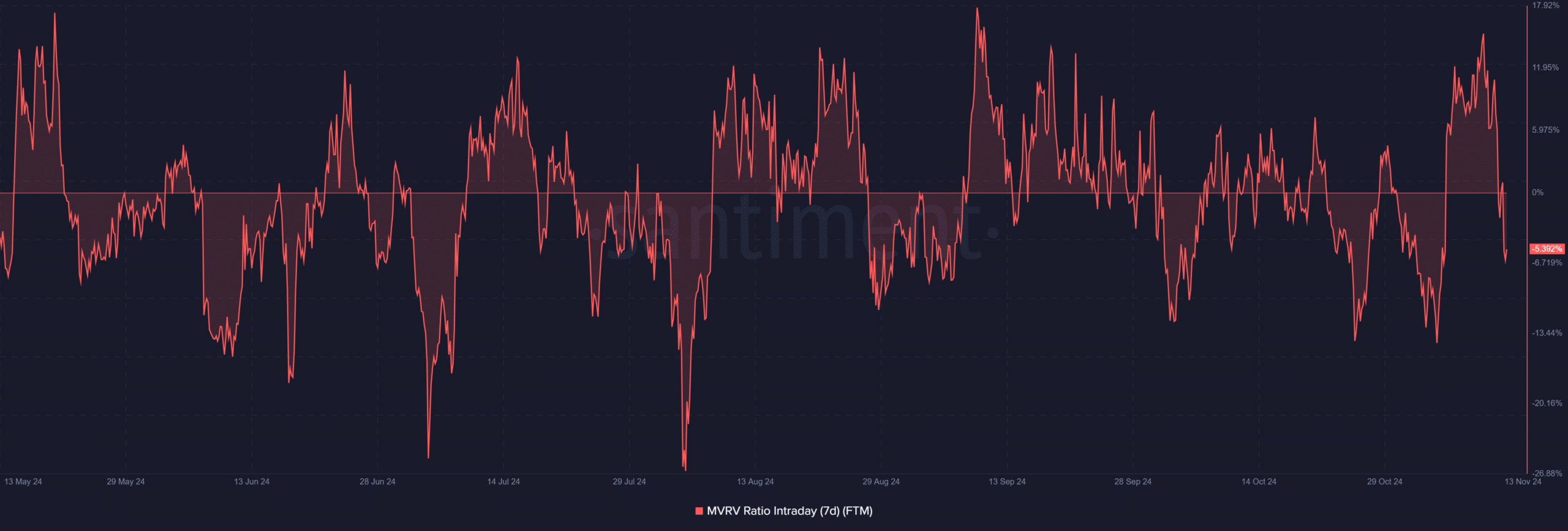

The current behavior of this altcoin isn’t happening in a vacuum; on-chain data has been crucial for our examination. For example, as we speak, the MVRV ratio from Santiment is showing -4.64%, which means the market price is less than the average value at which it was realized.

Previously, when the MVRV (Miner’s Verification of Value) ratio is less than zero, it often suggests that a potential low point may be forming because investors usually choose to hold onto their assets during times of poor performance rather than selling at a loss.

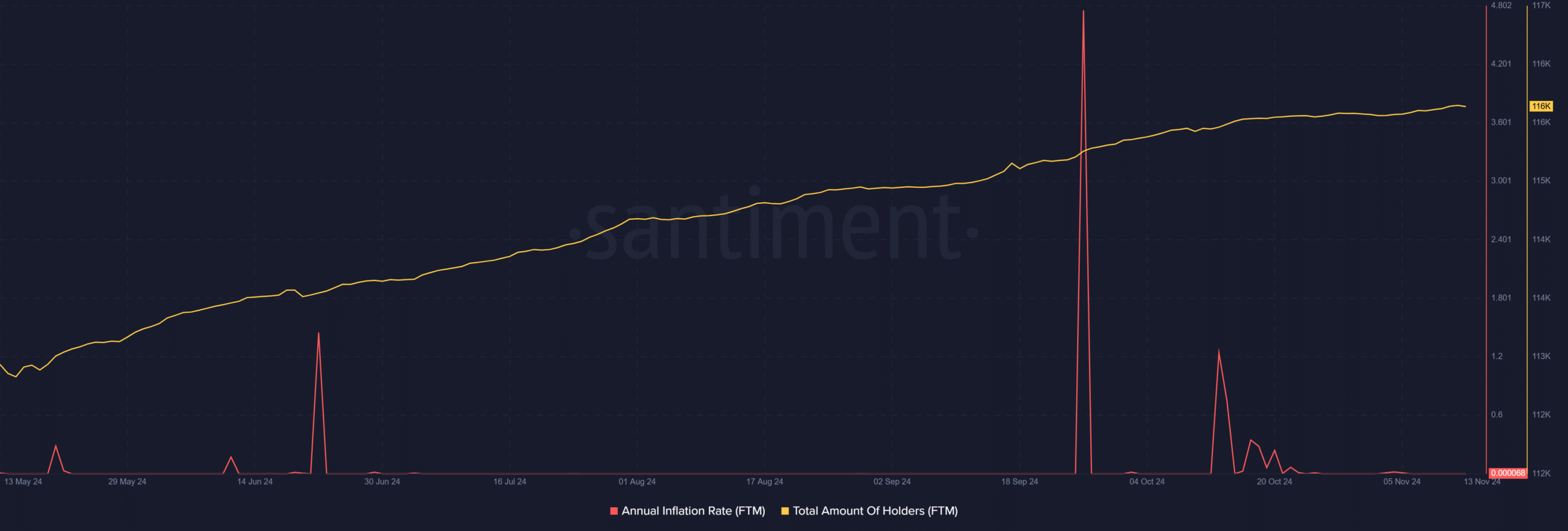

Additionally, it appears that the number of FTM holders, as indicated by data from Santiment, has been rising concurrently. This suggests that investor faith remains strong, even after a recent price decline, with larger investors expressing optimism about the token’s future prospects.

More holders may provide a stable base, supporting the price during these periods of volatility.

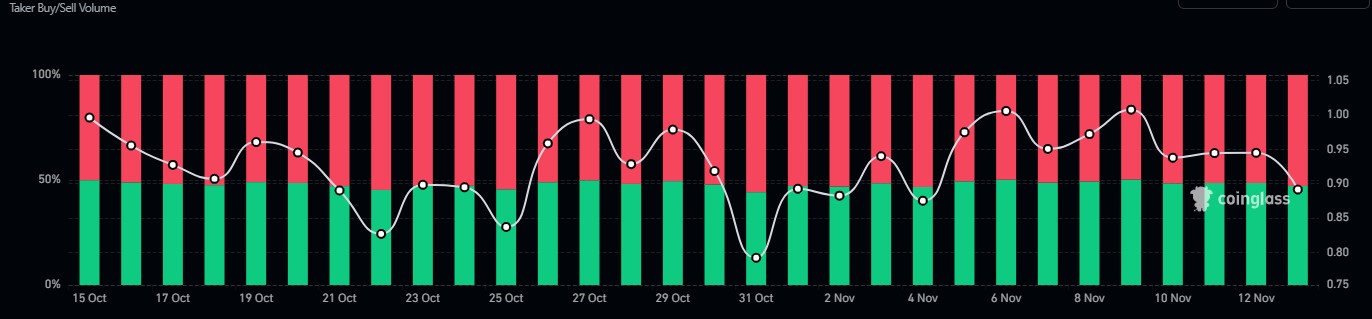

After examining the trends in long and short positions, AMBCrypto determined potential short-term market tendencies. The long/short ratio showed a minor decrease, suggesting that 52.87% of the market is held by those taking short positions – an indication of cautious optimism among traders.

The balance between longer trades and shorter ones being slightly skewed towards the former might indicate that traders anticipate a shift or stabilization around the $0.609 mark.

What next for FTM?

After dropping by 14%, FTM is now facing a crucial challenge at around $0.609. The current Market Value to Realized Value (MVRV) ratio, increase in the number of holders, and long-term investment trends all suggest that it might bounce back at its significant support point.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-14 13:11