- Whale investment and a cup-and-handle pattern hinted at potential bullish momentum for PEPE

- On-chain data and declining MVRV highlighted cautious optimism

The purchase of 107.89 billion PEPE tokens by a whale for approximately $2.1 million has ignited discussions among cryptocurrency enthusiasts about the future prospects of this memecoin. This substantial investment indicates a growing belief in PEPE’s potential.

Currently, PEPE is being traded at $0.00001884, after experiencing a small increase of 1.34% over the past day. But does this strong buying interest suggest an upcoming rally for PEPE, or will the token encounter resistance that might slow its progress?

Breaking resistance – Is a rally on the horizon?

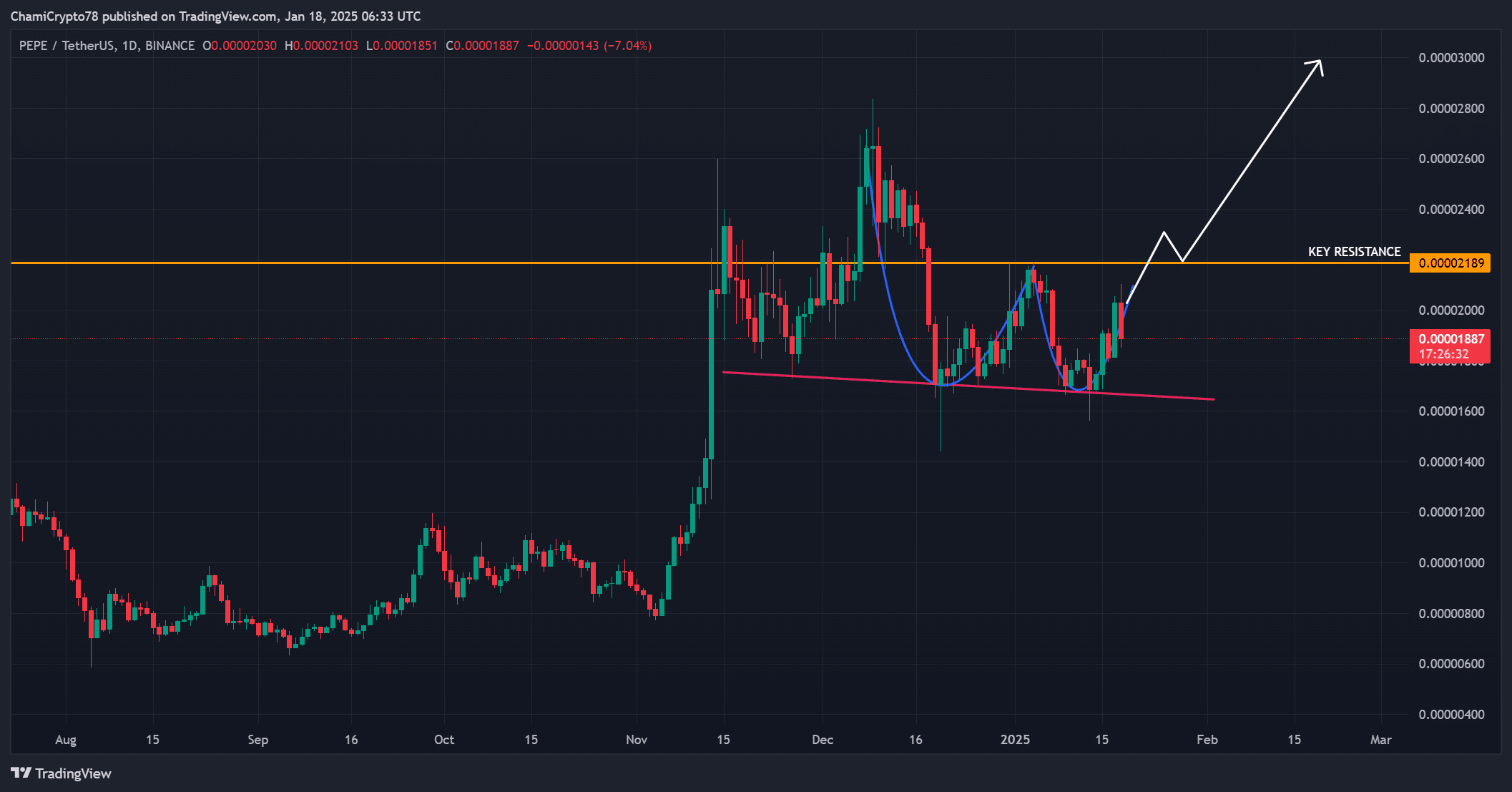

The behavior of this meme coin suggests it might be developing a cup-and-handle pattern on the daily chart – usually a sign of upcoming price increases. Moreover, the token appears to be nearing a significant resistance level around $0.00002189, as shown in the charts.

Overcoming this barrier could trigger an upward trend potentially reaching $0.00003, greatly increasing its worth. On the other hand, if it can’t pass this point, we might see a period of stabilization or even reversal, making this a crucial juncture for the memecoin.

Furthermore, the new presence of the whale has boosted our optimism, however, maintaining this positive trend relies heavily on the overall market circumstances.

Are new addresses driving PEPE’s growth?

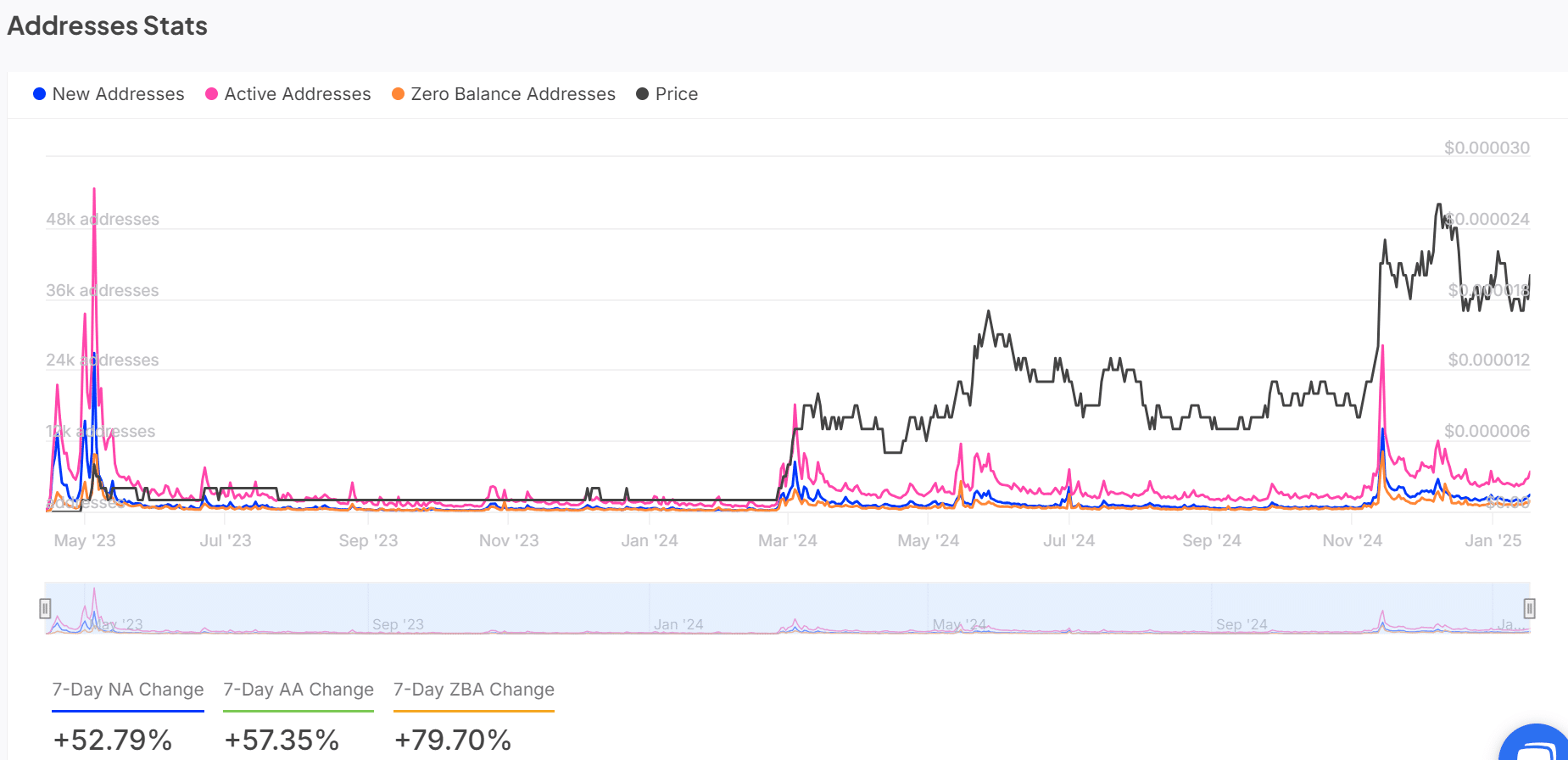

Data recorded on the blockchain shows an increase in both newly created and active accounts engaging with the cryptocurrency PEPE. In the last seven days, there’s been a 52.79% rise in new accounts, and active accounts have grown by approximately 57.35%.

This surge suggests increased curiosity and action within the memecoin market, while the significant increase of 79.7% in empty wallets indicates a growing number of traders investigating this particular token.

Yet, these memecoin traders might still hesitate to invest large sums. Consequently, consistent expansion in user base is vital to transform this initial interest into lasting backing for the memecoin.

Are transaction trends aligning with bullish sentiment?

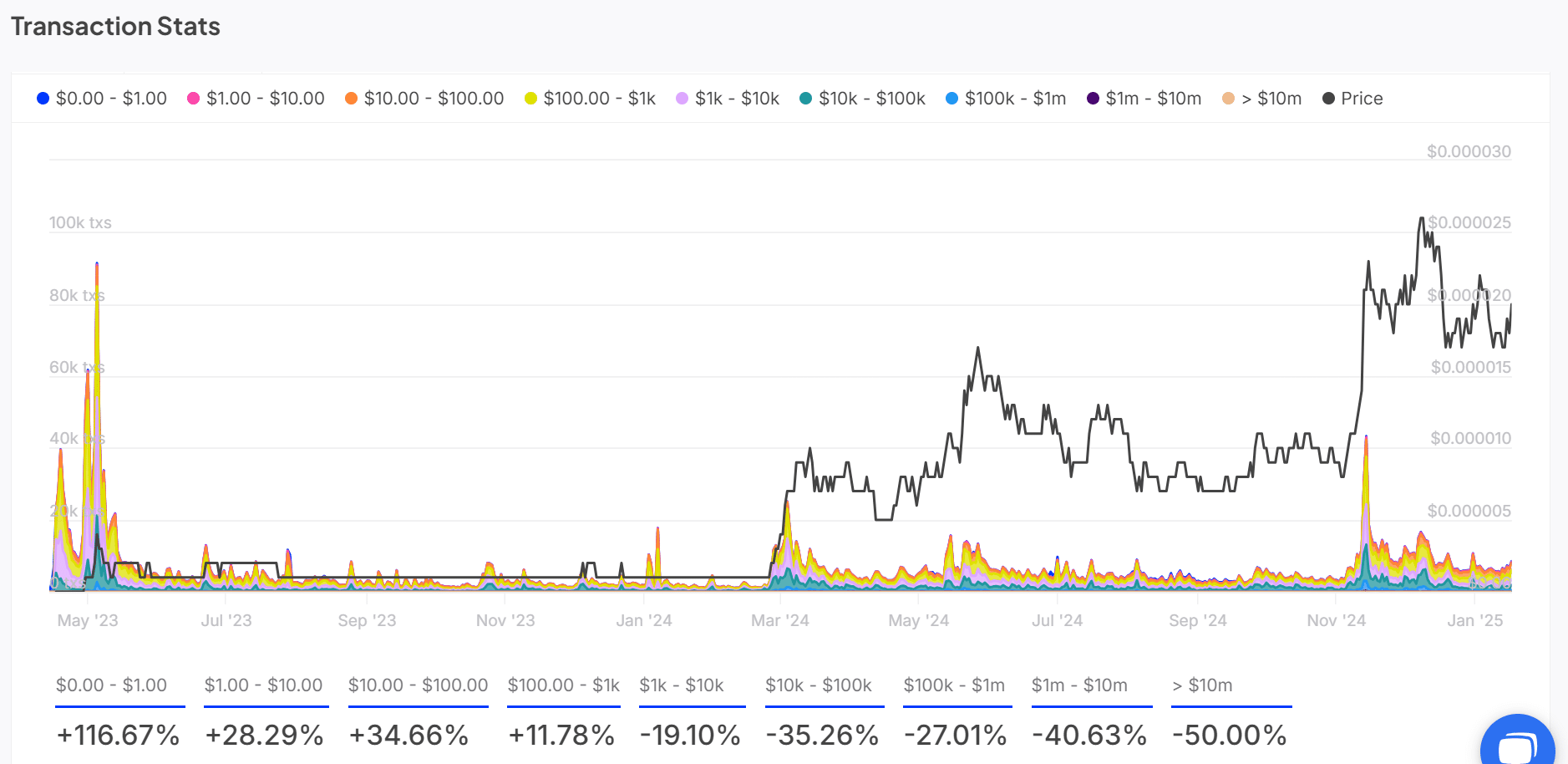

Instead, the transaction data presented a rather diverse image. Transactions under $10 witnessed a significant increase of 28.29%, suggesting an uptick in retail involvement. Conversely, transactions over $100,000 declined by 35.26%, implying decreased confidence from larger investors.

Consequently, as retail interest grows, it’s essential that there’s a balanced involvement from smaller investors and larger institutions for a prolonged price surge. Moreover, the lack of significant transactions by ‘whales’ might indicate a sense of caution among market heavyweights.

Declining MVRV – What does it mean for PEPE?

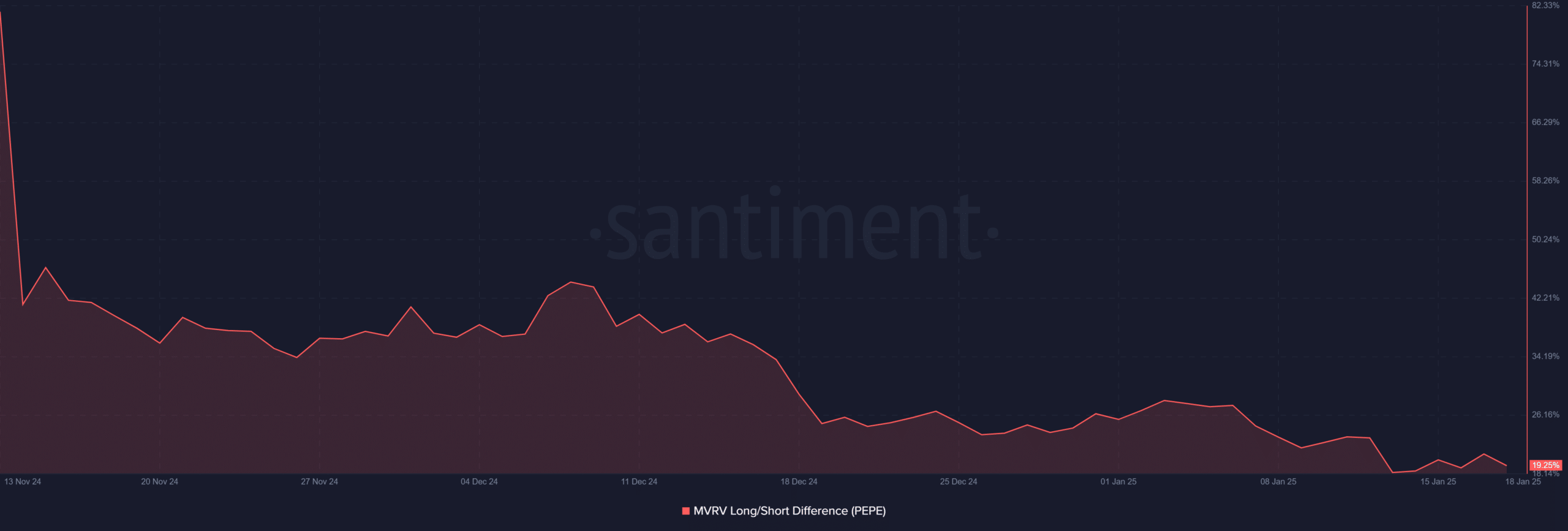

The gap between Market Value to Realized Value (MVRV) for both long and short positions has decreased to 19.25%. This suggests that the profitability among holders is reduced, which usually means traders are less inclined to sell at the current price, potentially leading to a decrease in selling pressure.

On the other hand, the falling trend in MVRM suggests a decrease in speculative excitement that might prevent an immediate surge. Moreover, this indicator underscores the delicate equilibrium between sustaining investor engagement and preventing excessive selling.

Read Pepe’s [PEPE] Price Prediction 2025–2026

Can PEPE deliver on investor expectations?

A mix of increased whale behavior, the appearance of a cup-and-handle chart pattern, and growing interest in PEPE’s address suggests a positive outlook for its future prospects.

But overcoming the current resistance at $0.00002189 is vital to ensure a prolonged price increase for PEPE. If PEPE manages to build on its current strength and conquer these hurdles, it could potentially experience a strong surge in value.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-19 05:11