- AAVE net deposits surged to an all-time high of $35 billion in 2025 amid renewed interest in DeFi.

- If this network growth continues, it could bode well for AAVE’s price performance in 2025.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have witnessed firsthand the rollercoaster ride that is blockchain technology and its various applications. The recent surge in AAVE net deposits to an all-time high of $35 billion in 2025 has caught my attention, particularly given the renewed interest in DeFi.

The growth of AAVE could indeed bode well for its price performance if this network expansion continues. However, as we all know too well in this industry, past performance is not always indicative of future results. The daily chart shows a bearish double-top pattern, and while the rising activity has driven AAVE’s price gains in Q4 2024, it’s essential to remain cautious.

The RSI line is tipping north, which could potentially ignite a rally toward the $391 resistance level. But let’s not forget that the crypto market can be as unpredictable as a game of roulette in Monaco – just when you think it’s all going smoothly, the ball might land on a different number altogether!

In my experience, it’s always wise to keep an eye on crucial support levels like the neckline. If AAVE were to breach below this level, we could see a drop to $207. On the other hand, a short squeeze due to an increase in short positions while the price is gaining could potentially push AAVE higher.

In the end, it’s crucial to remember that investing in cryptocurrencies is like trying to predict the weather – sometimes you get it right, and sometimes you don’t. But as they say in my hometown of Glasgow, “If you can’t laugh at yourself, who can you laugh at?” So let’s keep our fingers crossed for AAVE and see where this ride takes us!

2024 saw a revival for the Decentralized Finance (DeFi) sector as the overall value locked (TVL) reached an impressive two-year peak of $154 billion by December 17th, marking a significant increase in its growth trajectory.

This growth stirred interest in DeFi protocols and tokens such as Aave [AAVE].

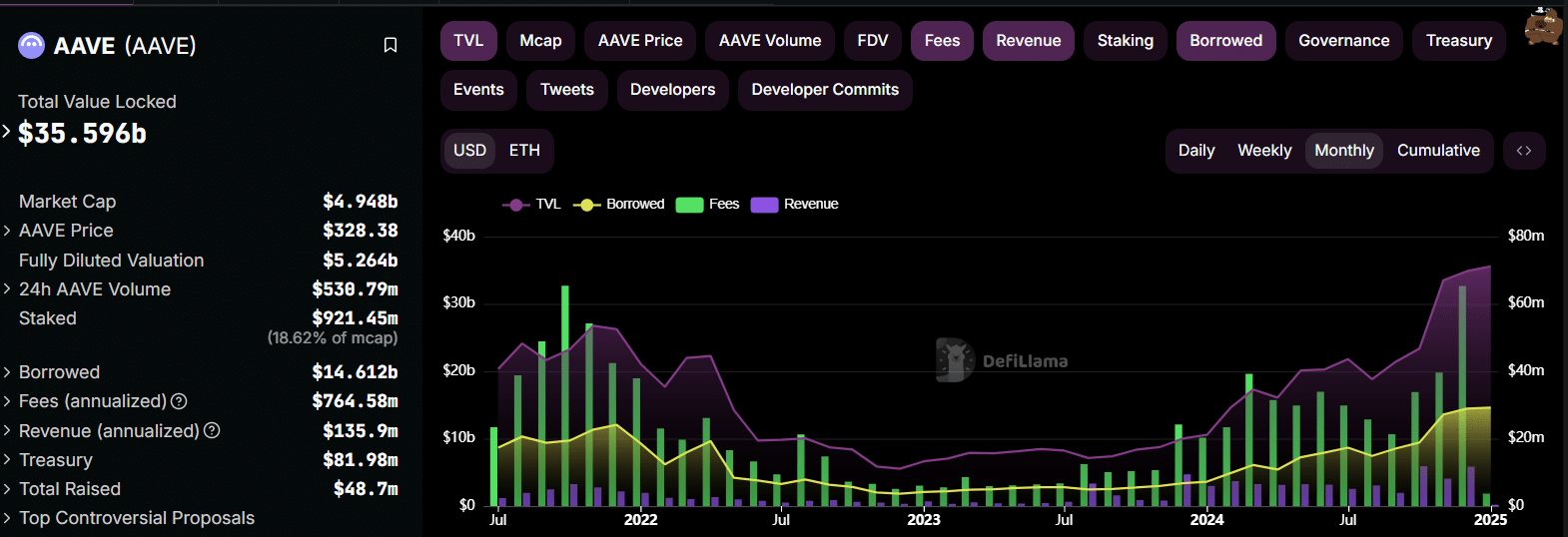

2024 marked a significant milestone for the AAVE protocol as net deposits reached an all-time high of $35 billion, making it the leading platform within the decentralized finance (DeFi) sector due to its impressive growth.

According to DeFiLlama’s data, the total monthly fees on the platform surged to a peak of $65.34 million over the past three years, coinciding with an increase in overall earnings to approximately $11.68 million.

The total amount borrowed on the protocol has also increased to more than $14 billion.

In the fourth quarter of 2024, the surge in activity led to price increases for AAVE. If similar growth occurs this year, it could be beneficial for the cryptocurrency. However, even with the DeFi revival, the token’s daily chart indicates potential bearish tendencies.

AAVE price analysis

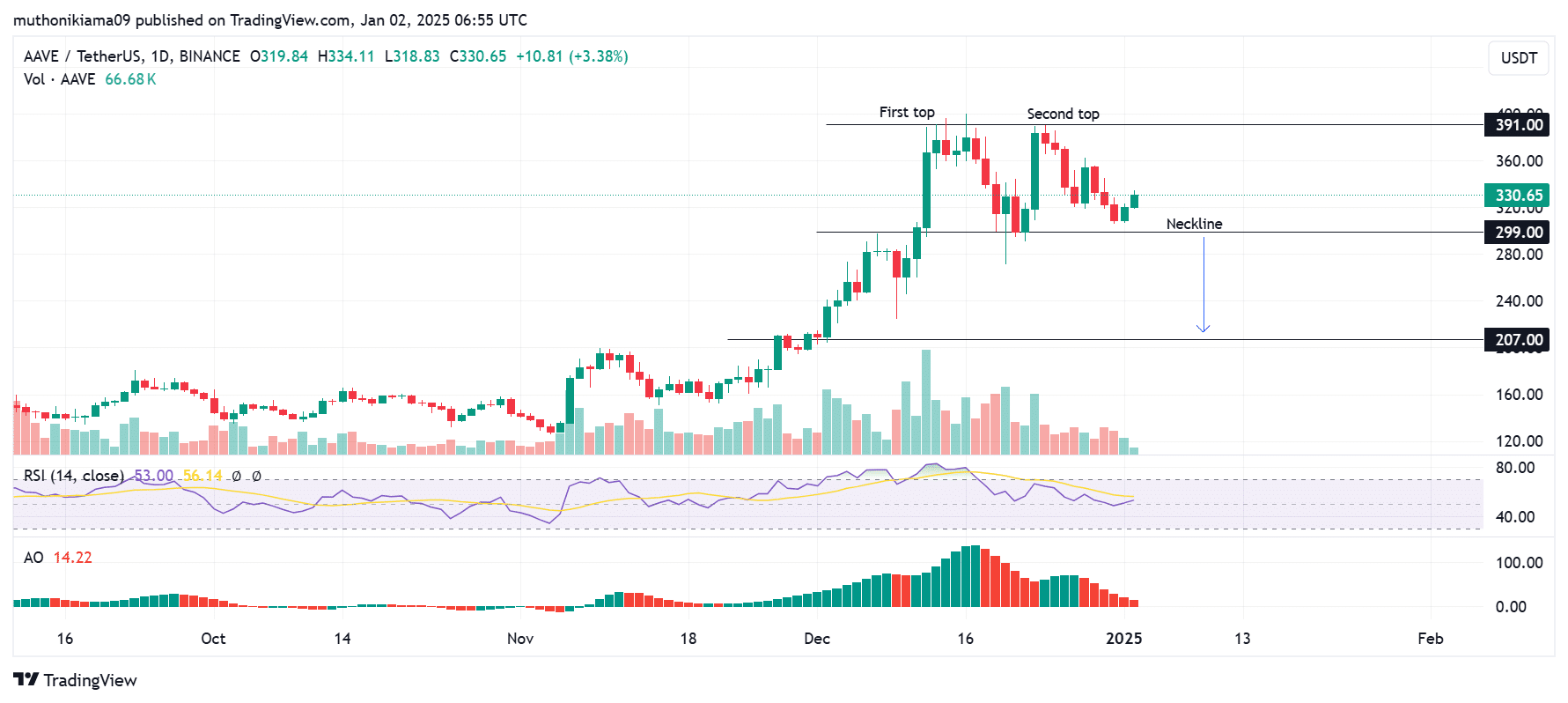

Currently, AAVE is valued at approximately $330 following a 6.4% increase over the past day. However, despite this rise, the daily price chart suggests a potentially bearish double-top pattern.

As a crypto investor, I noticed that AAVE had rebounded from the neckline of its pattern at $299, suggesting that the bulls were putting up a strong fight to regain control in the market.

If the purchasing trend as shown by the volume histogram lines persists, and AAVE surpasses the resistance levels at its two peaks ($391), this might contradict the negative prediction (bearish thesis) suggested by the double top pattern.

Simultaneously, the Relative Strength Index (RSI) was pointing upward. Should this line surpass the signal line, creating a buy signal, it might spark an advance towards the potential resistance at $391.

The Awesome Oscillator indicated a lessening intensity of downward trends, as evidenced by the shrinking length of the histogram bars.

Even though there are encouraging indicators, it’s essential to keep an eye on the critical support at the neckline. If the price falls below this point, it might lead to a decline towards $207.

Long/Short Ratio suggests…

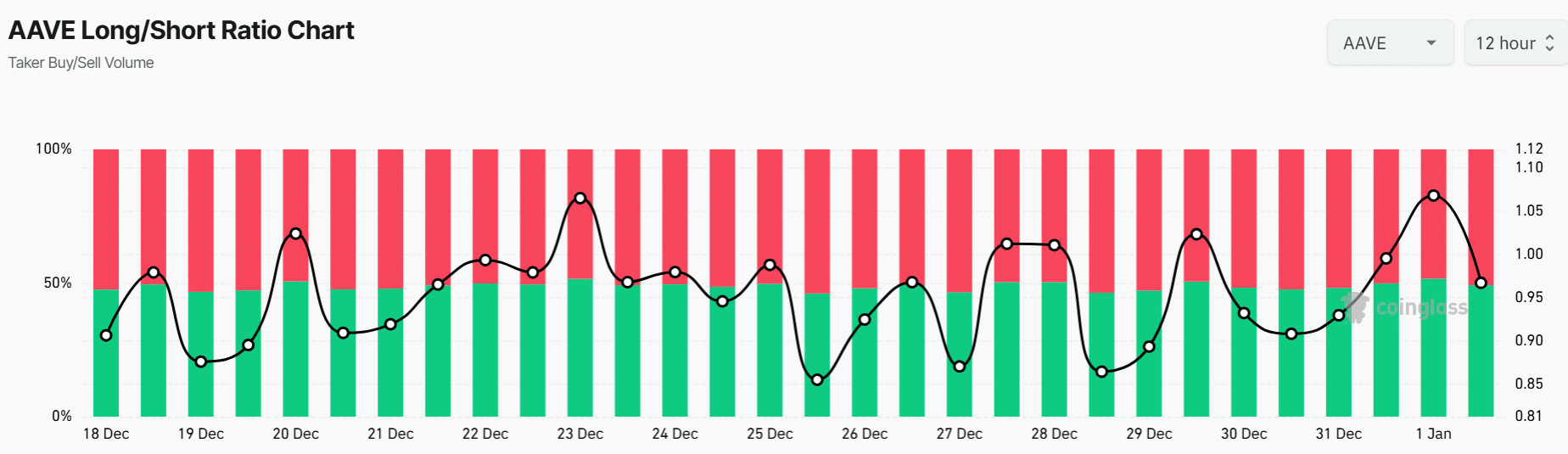

Regarding derivatives, Aave showed a generally bearish trend as a result of a decrease in the Long/Short Ratio. Currently, this ratio is at 0.95, implying that there are slightly more traders holding short positions compared to those with long positions.

Read Aave’s [AAVE] Price Prediction 2025–2026

Although such a decrease might indicate pessimistic feelings, a rise in short positions during a price surge could lead to a “short-squeeze” scenario if these positions are closed out.

The resulting buying pressure could push AAVE higher.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2025-01-03 04:08