- Aave’s Total Value Locked has recently hit an ATH.

- Its token saw strong liquidity inflows and bullish technical trends.

As a seasoned researcher who has navigated through the complexities of the DeFi space for years, it’s always fascinating to witness the growth and dominance of projects like Aave. The recent surge in Aave’s Total Value Locked (TVL) to an all-time high is a testament to its robust platform and the confidence investors have in it.

In the world of decentralized finance lending, Aave [AAVE] consistently strengthens its lead, controlling approximately 45% of the market.

The unique advantage that Aave’s platform is currently enjoying indicates increasing trust, as both the Total Value Locked and token price are exhibiting a robust increase.

Aave’s market share reflected in TVL surge

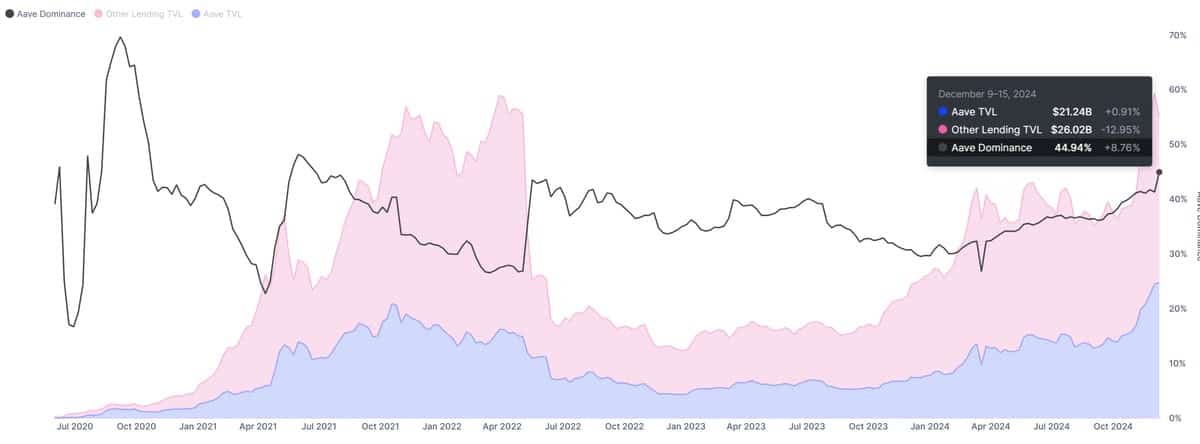

According to the data from DeFiLlama, there was a significant increase in the amount of money locked within Aave, reaching an impressive figure of more than $21 billion.

This amount made up a substantial share of the overall worth of the lending market, thereby reinforcing Aave’s dominance as a key player in the field of decentralized finance.

The significant influence of this platform, almost reaching 45%, emphasizes its pivotal position within the system and highlights its edge against rival platforms.

An in-depth look at Aave’s Total Value Locked (TVL) progression throughout the last year has unveiled a steady climb, noticeably boosting since early 2024. This examination found that the present TVL figure reaches an all-time high.

Lately, we’ve seen a significant rise that corresponds to an influx of liquidity, which is being fueled by investment from both large institutions and individual retail investors, all drawn towards the world of decentralized lending platforms.

According to IntoTheBlock’s visual representation, Aave consistently demonstrates strength and durability as it holds onto its top spot.

Unlike some other lending platforms, which have seen ups and downs, Aave has consistently grown, with a significant surge in influence observed during the last three months.

These advancements strengthen its reputation as the go-to option for peer-to-peer lending and borrowing within a decentralized system.

AAVE price analysis: Bulls in control

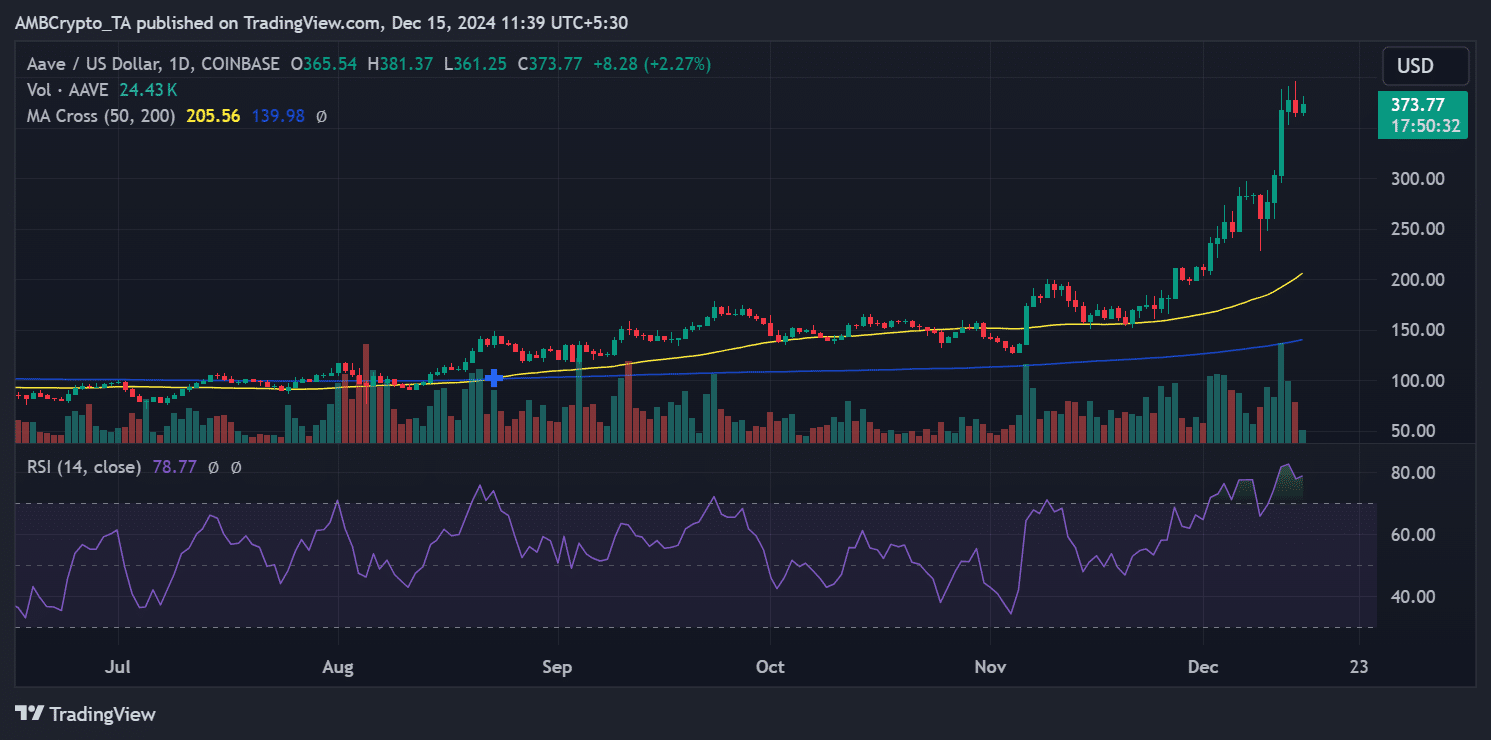

The price of AAVE appears to be mirroring the rise in the Total Value Locked (TVL). As per current data from TradingView, the token is being traded at approximately $373.77, indicating a noticeable upward momentum over the past few days.

Analysis further revealed an impressive surge of 21.20% on the 12th of December, igniting a strong uptrend. This upward push has been maintaining its strength since November, allowing AAVE to break significant resistance barriers.

Looking at the technical analysis, the price of AAVE appears to be bolstered by longer-term bullish tendencies. The token consistently hovers above both its 50-day and 200-day moving averages, which underscores a generally positive trend in its direction.

In simpler terms, the Relative Strength Index is high too, indicating robust investor interest even when the market seems to be oversold.

The sharp increase in trading volumes further validates AAVE’s price breakout, indicating strong buying activity.

As a researcher, I am observing that if the positive trend persists for AAVE, it could potentially reach higher resistance zones. Key psychological thresholds that traders are keeping a close eye on include $400 and levels surpassing this mark.

Can it maintain its momentum?

As an analyst, I find myself observing that Aave’s prominent role in the world of decentralized lending gives it a strategic advantage to tap into the increasing energy and expansion within the decentralized finance (DeFi) industry.

The increasing amount of Total Value Locked and strong token price gains suggest a positive trend that might result in new highs within the next few months.

Even though temporary price drops might occur due to overbought conditions in the token value, the ongoing influx of funds into the market and strong investor confidence may foster Aave’s long-term expansion.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-16 04:08