- An analyst predicted that a hike above the resistance would spark a 300% rally for ALGO

- Metrics suggested that there were chances of a correction in the short term

As an analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market predictions and trends come and go. The recent bullish breakout by Algorand [ALGO] has piqued my interest, given the potential for a 300% hike predicted by World of Charts. However, as someone who’s been around long enough to remember when a ‘greedy’ market was often followed by a correction, I can’t help but feel a sense of caution.

Currently, Algorand’s [ALGO] price has surged past a favorable uptrend on the graphs, leading to substantial increases in value. At present, the token appears to be nearing a downward trendline.

A breakout above the same could result in a 300% hike over the coming months.

Is Algorand ready for a double breakout?

A well-known crypto analyst named World of Charts recently posted a tweet about Algorand (ALGO) breaking through an optimistic falling wedge pattern a few days ago. Since then, the token has seen a 50% increase in value. In simpler terms, Algorand’s price has surged by more than 32% over the past week.

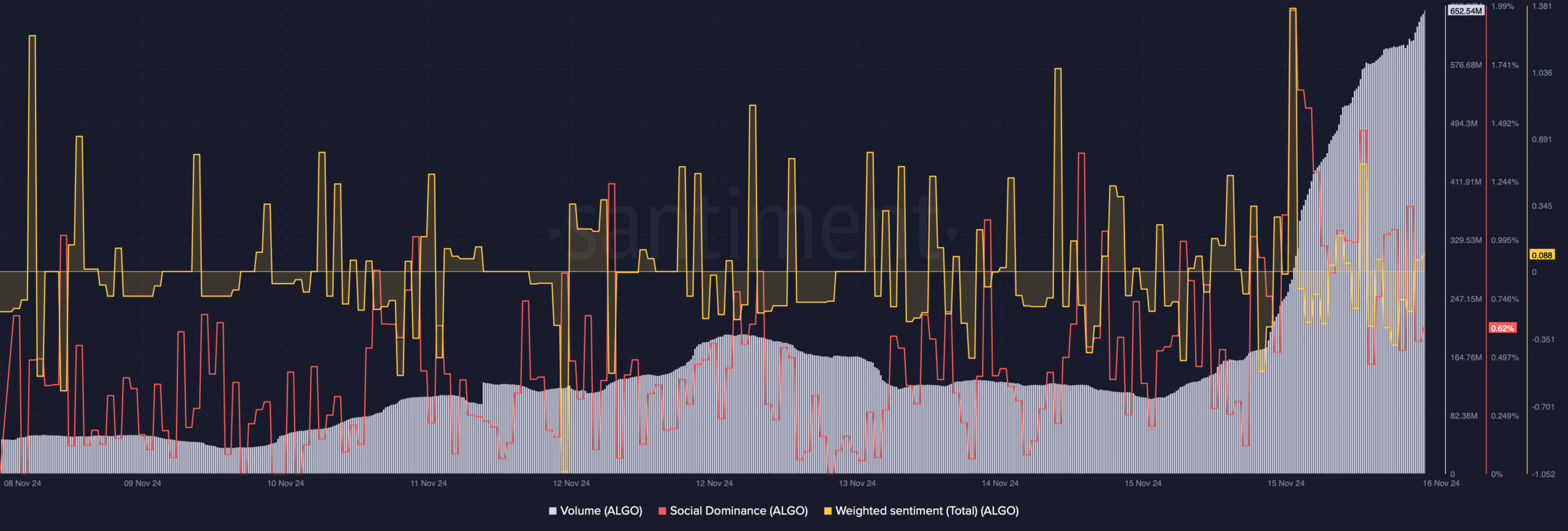

As a researcher, I’ve noticed an uptick in the value of ALGO, which has subsequently boosted its social dominance. This increase suggests that the altcoin is gaining traction and becoming increasingly popular among users.

The token experienced an increase in weighted positivity as well, suggesting growing optimism among traders. Furthermore, its price surge was bolstered by a substantial rise in trading activity.

Based on its recent price movements, ALGO is approaching another potential resistance point. As suggested by a tweet from World of Charts, if it manages to successfully breach this level, there’s a possibility that ALGO could surge by up to 300% within the next few months.

Although achieving a 300% increase may seem impractical over the short term, AMBCrypto nonetheless scrutinized the token’s blockchain activity.

Odds of a bullish breakout

According to Coinglass data analysis, Algorand’s Open Interest (OI) saw a significant surge. However, although this initial observation may appear bullish, it could in fact be pointing towards something else entirely.

In the past, when Algo’s Open Interest (OI) reached its current value, it was typically preceded by price adjustments or corrections. This pattern was evident even as far back as April, when Algo’s price fell to $0.17 following a surge in its OI.

As I compose this text, Algorand’s Fear & Greed Index stands at 71, indicating a “greed” state within the market. It’s important to note that the likelihood of a price adjustment tends to increase significantly when market sentiments lean towards greed.

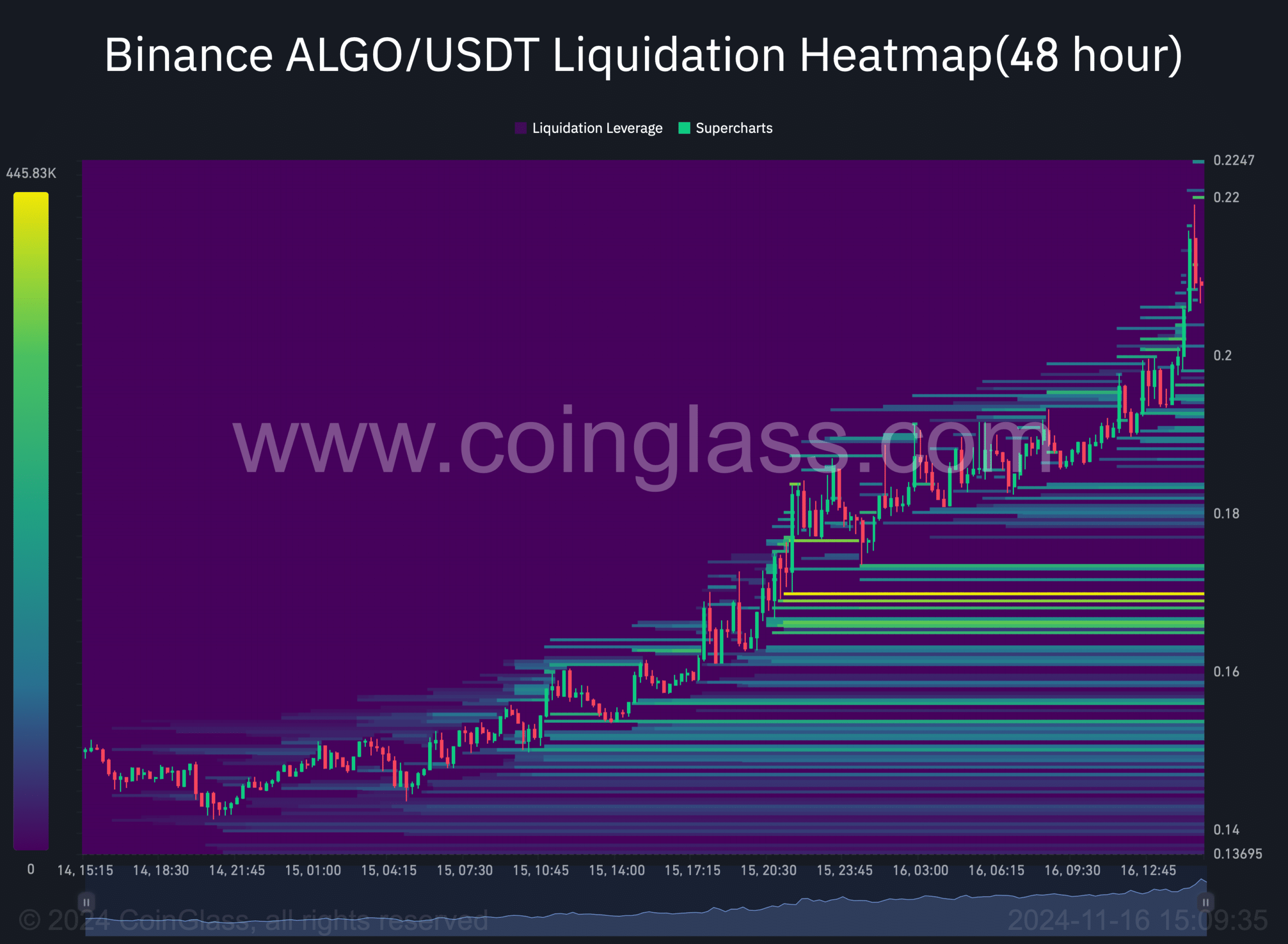

Based on its price charts, Algo’s value has significantly exceeded the upper boundary of the Bollinger Bands, suggesting a potential price adjustment. If this correction occurs, Algo could potentially fall back to around $0.18 again.

The altcoin’s liquidation heatmap also revealed a similar possibility. At the time of writing, the token had a strong liquidation floor near $0.16-$0.18.

In case of a price drop, ALGO will have a chance to regain bullish momentum from that range.

If the bullish trend persists strongly, it might not be overly optimistic to expect the token price to reach around $0.3 by the end of November.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-17 09:11