-

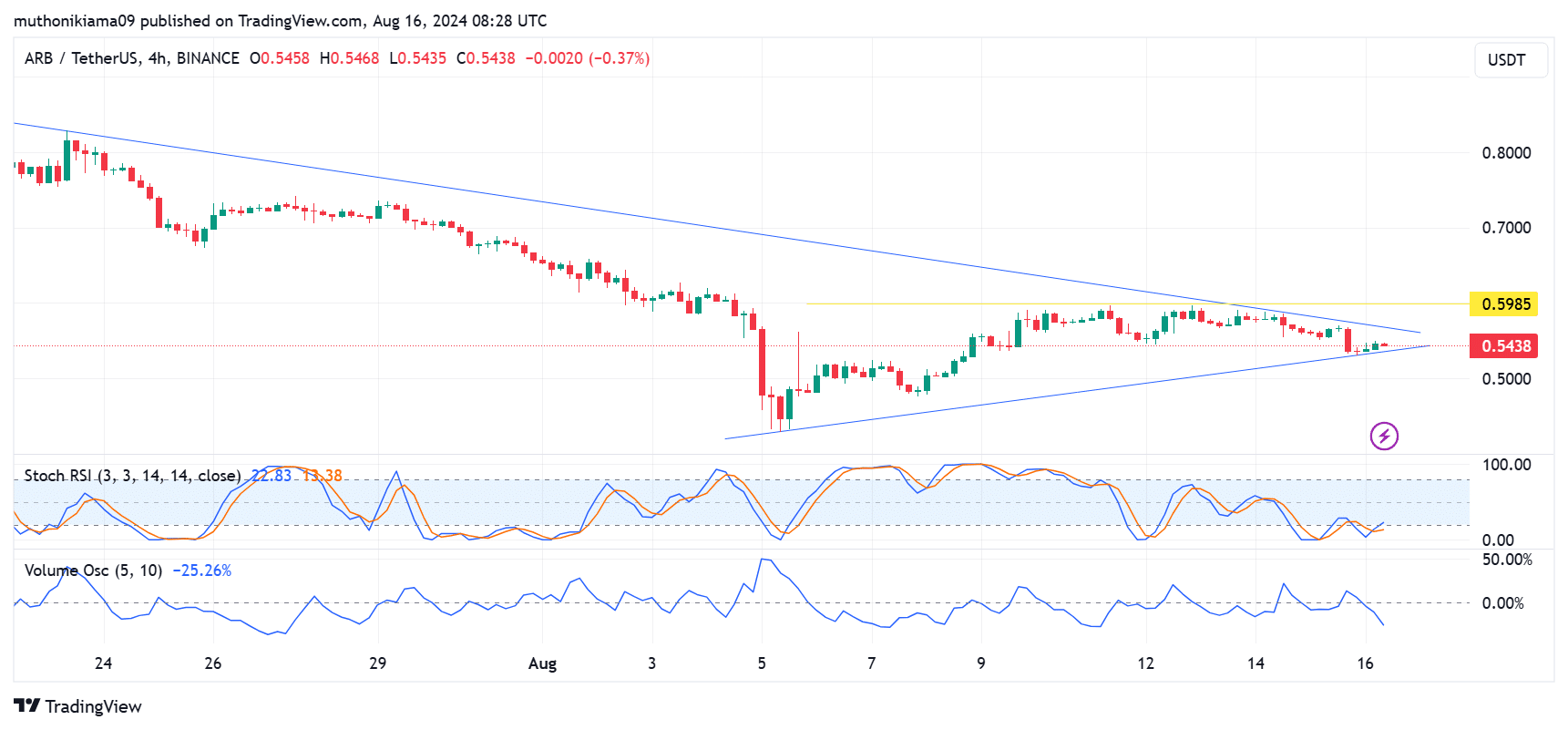

Arbitrum has formed a falling wedge pattern on the 4-hour chart, with a breakout above the upper trendline can confirm a bullish trend.

A recent DAO proposal could be the catalyst ARB needs to extend gains.

As a seasoned analyst with years of experience navigating the turbulent waters of the crypto market, I find myself intrigued by the current state of Arbitrum (ARB). The falling wedge pattern on the 4-hour chart, while potentially bullish, is tempered by the negative Volume Oscillator, suggesting that a breakout might not be as straightforward as it seems.

After a steep fall, the prices of various alternative cryptocurrencies (altcoins) dipped due to Bitcoin‘s [BTC] decline to its weekly low of around $57K on the 15th of August. However, since then, there has been a modest recovery observed in the overall crypto market.

The bearish sentiment also saw Arbitrum [ARB] post a 1.3% drop.

ARB was trading at $0.546 at the time of writing. The token has slightly bounced after dropping to a weekly low of $0.53 on the 16th of August amid high selling pressure.

As we speak, the Stochastic Relative Strength Index (RSI) stood at around 24, which is near the oversold zone. This relatively low RSI suggests that the price of ARB might have reached its lowest point and could potentially start recovering soon.

In simpler terms, when the Relative Strength Index (RSI) reached a new peak, it suggested a possible change in direction, potentially indicating a reversal. Moreover, as it surpassed the signal line, this could mean the current upward trend might be losing strength and there could be more increases to come.

On the four-hour chart, the graph of ARB shows a descending wedge formation. If the price surges beyond the upper boundary of this pattern, it would suggest a bullish movement and a challenge to the significant resistance level at $0.59.

This could help ARB potentially reach $1 in the coming days.

In essence, the extent to which the established trend is broken often hinges upon the level of purchasing activity. A rising Negative Volume Oscillator might signal doubts about the robustness of a breakout.

If ARB escapes the downward trendline (falling wedge), it could still struggle to maintain any advancements if the market continues to be sluggish or lack activity.

Is staking needed for ARB’s rally?

One of the factors that might trigger an active market around ARB and a sustained uptrend is the launch of staking on the Ethereum [ETH] layer-2 network.

As a researcher, I’m excited to share that the Arbitrum Decentralized Autonomous Organization (DAO) has successfully passed a proposal titled “Unlock ARB Utility and Align Governance.” This initiative, approved by an impressive 91% of the community, paves the way for staking on the network. I can’t wait to see how this development unfolds!

This proposal will increase ARB’s utility within the Arbitrum ecosystem.

Arbitrum boasts as the most extensive layer-2 network, according to L2Beat data, with a locked-in value of approximately $14 billion. This total value locked is more than double that of the second-largest layer-2 network, Base.

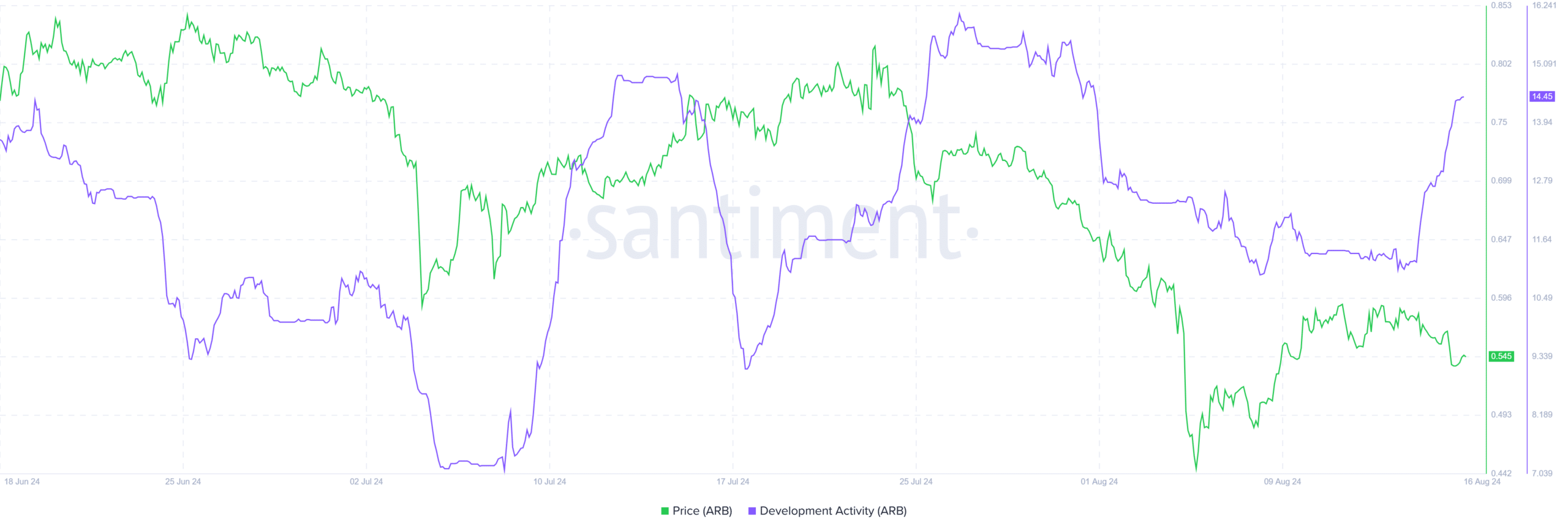

Upon closer examination of Santiment’s data, it appears that there’s been a substantial rise in ongoing projects or updates. At this moment, the activity level is at its peak since the beginning of August.

Historical data shows that such increases have often coincided with price growth.

Realistic or not, here’s ARB’s market cap in BTC’s terms

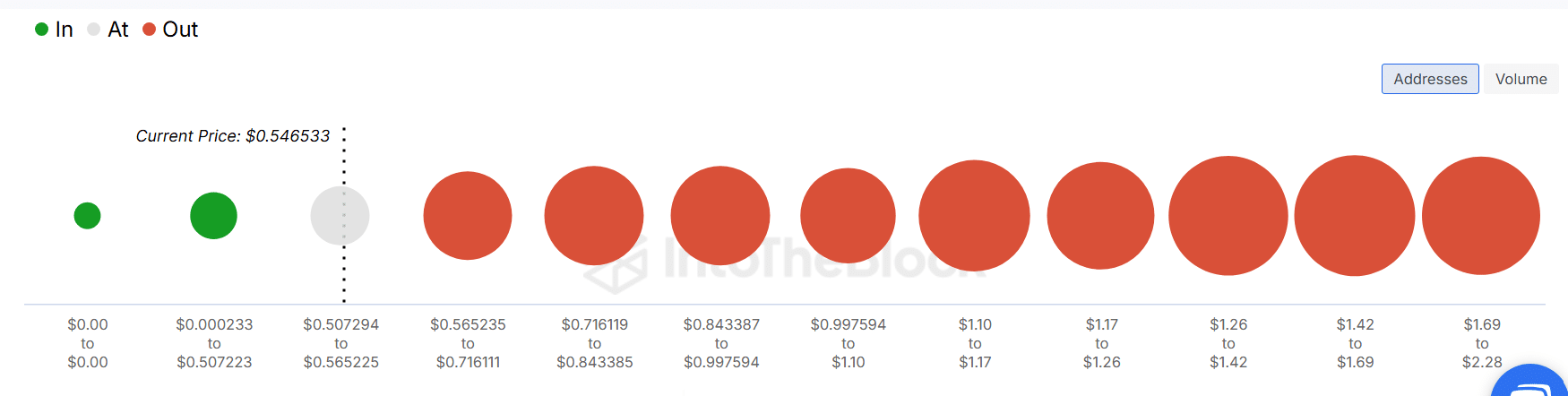

Despite Arbitrum’s network leading the way in the layer-two industry, its native token ARB has not performed as well. According to a recent DAO proposal, only a small fraction (less than 1%) of the total tokens are being utilized within the Arbitrum ecosystem.

At the current moment, based on IntoTheBlock’s latest data, I find myself among 98% of ARB holders who are currently in a loss position due to the apparent lack of utility associated with this asset.

Read More

2024-08-17 06:48