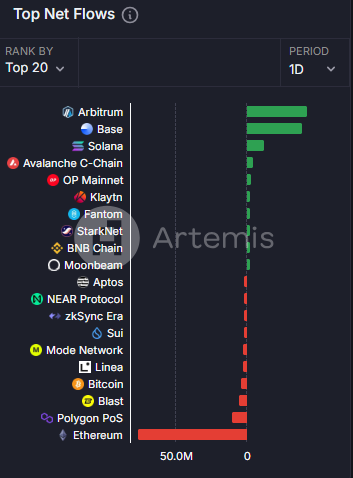

- ARB recorded the largest chain netflow in the last 24 hours, surpassing Ethereum and Solana.

- However, it faced a major hindrance at a key resistance level, where significant selling pressure exists.

As a seasoned analyst with over two decades of market observation under my belt, I find myself thoroughly intrigued by Arbitrum’s [ARB] recent performance. The altcoin’s impressive 78.80% gain over the past month and consistent bullish trend is not something to be taken lightly.

Over the last four weeks, I’ve observed an upward trajectory in Arbitrum [ARB], boasting a substantial 78.80% surge. Interestingly, this bullish trend persists even when zooming into shorter periods, with weekly and daily gains of 15.20% and 8.08%, respectively.

In my analysis, the positive trajectory we’ve been observing may continue unabated, given that the actions of market players are consistently fueling the bullish energy. (As AMBCrypto previously reported)

Rise in netflow fuels accumulation interest

Currently, the latest figures indicate that this altcoin has experienced the largest amount of network activity (chain netflow) over the past 24 hours, outpacing Base, Solana, and Ethereum by a significant margin, recording approximately $42.6 million in net inflows.

One way of rephrasing the given text in a more natural and easy-reading style: Netflow in a chain (or network) is calculated by subtracting outflows from inflows for an asset. This metric helps monitor fund transfers, user actions, trading patterns, and liquidity patterns. A positive netflow, as observed with ARB, signifies accumulation and could hint at possible price increase.

According to additional examination by AMBCrypto, it appears that the positive trend for ARB is likely to continue.

Selling pressure eases as gains momentum

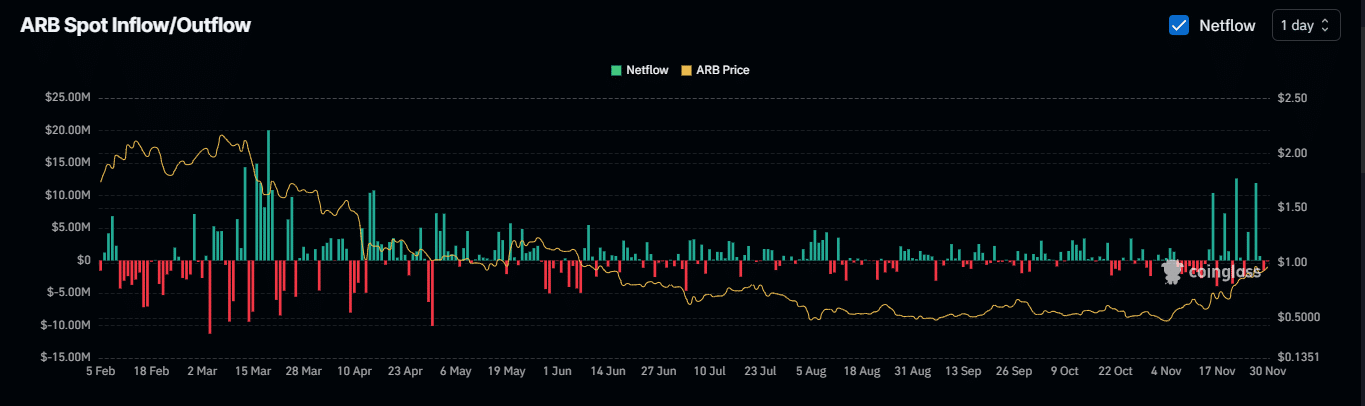

Following a run of four straight days with substantial inflows in foreign currency exchanges amounting to $17.04 million, suggesting a high demand for selling—a reversal has taken place.

For the last two days, there’s been a decrease in outgoing flow compared to incoming flow for the token ARB, indicating that market participants are currently accumulating or holding onto their ARB. Currently, approximately $1.66 million in ARB transactions showing a negative netflow have played a significant role in its recent 8% price increase.

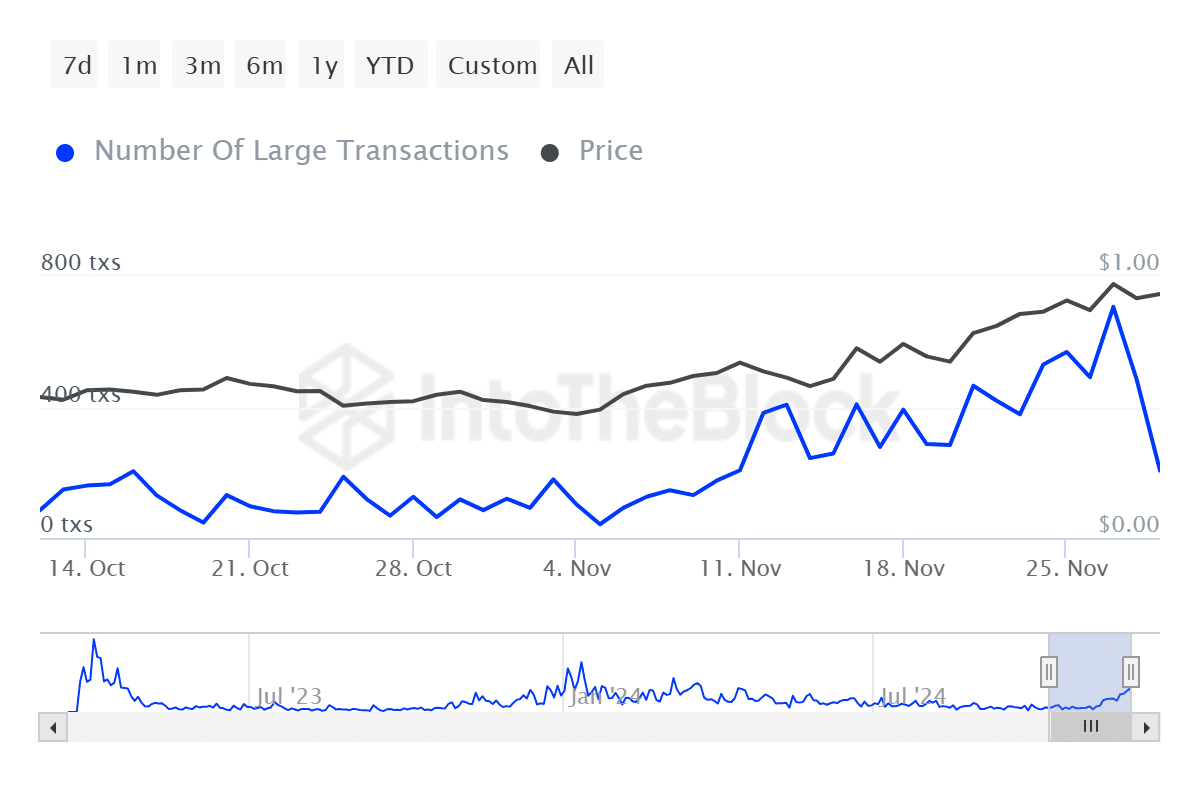

I’ve observed a significant decrease in the trading volume of large holders, suggesting that big players like “whales” are reducing their sell-off of ARB, which could be a positive sign for the coin’s price stability and potential growth.

During a span of 48 hours, data from IntoTheBlock indicates a decrease of approximately 500 large-scale transactions. This number dropped from 706 to 206 in the same timeframe.

If this trend continues, ARB could sustain its upward momentum.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

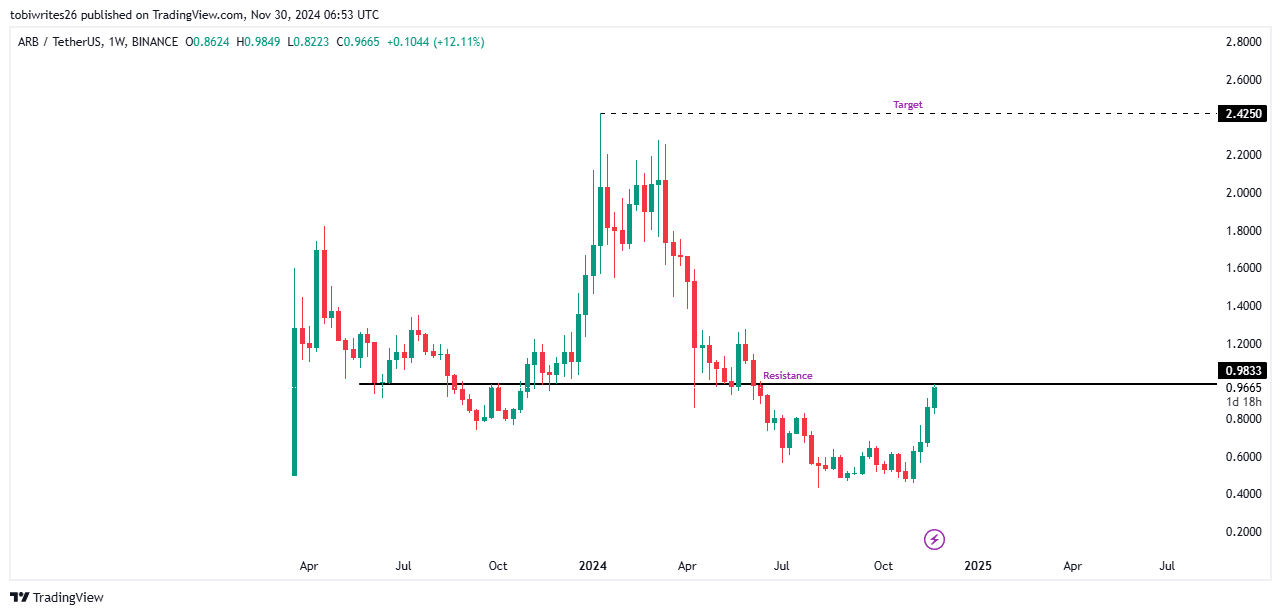

Key resistance ahead for ARB with a $2.4 target in sight

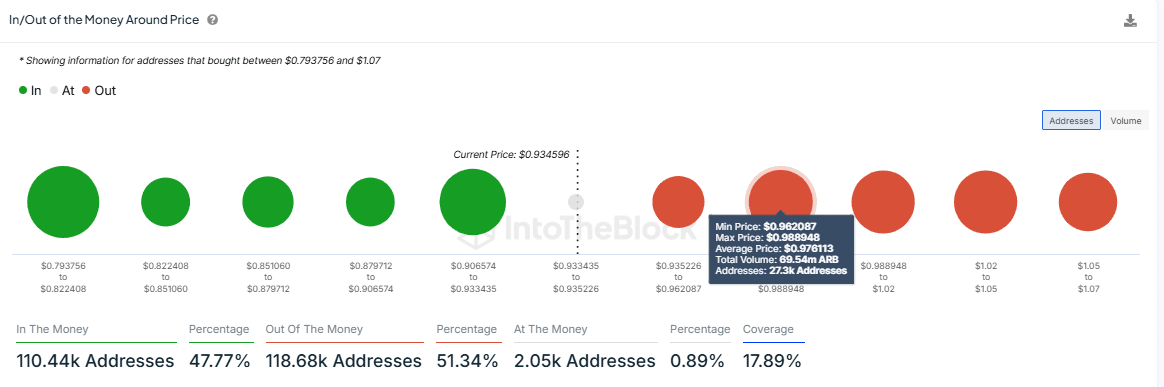

As the coin gets closer to a large supply area marked by the In/Out of the Money Around Price (IOMAP) indicator, it’s likely to experience considerable resistance.

In simpler terms, there’s an area where the digital asset ARB is likely to be sold, stretching from approximately $0.96 to $0.98. This area holds about 69.5 million ARB tokens, spread across over 27,000 different accounts. This selling zone aligns with a challenging resistance point on the chart, where ARB has found it difficult to break through and reach $0.983.

If ARB manages to build enough strength to surpass the current resistance level, it might push upward towards a potential peak of $2.4. This area is significant as it houses a large amount of market activity.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-12-01 08:07