- AVAX hovers at $34.05 with $875 million in 24-hour trading volume.

- Large transactions hit 542 in 24 hours, while 59.5% of AVAX holders remain profitable.

As a seasoned researcher with years of experience navigating the ever-changing crypto markets, I find myself intrigued by the current state of Avalanche (AVAX). At $34.05, AVAX seems to be holding steady, albeit within a relatively tight trading range. The 24-hour trading volume suggests that market interest remains strong, but the price movement is cautious and controlled – much like a well-trained racehorse waiting in the starting gate.

At the moment of reporting, Avalanche (AVAX) was being traded at $34.05, showing a 0.54% rise in the last 24 hours and a 1.52% growth over the past week. The trading volume within the last day amounts to $87.5 million, indicating continued market attention.

For the past week, Avalanche (AVAX) prices have been moving up and down within a span of $31.00 to $37.01. Over the last day, the price has varied from $32.54 to $35.62.

Even though the token’s price fluctuates, it’s been confined to a limited price band, indicating that traders are attentively observing crucial support and resistance points to determine potential price movements.

Key levels and technical indicators signal range-bound movement

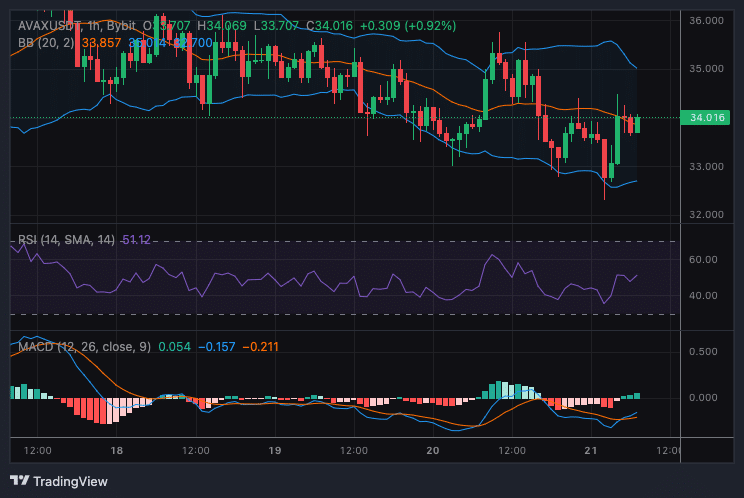

On the 1-hour chart, AVAX has bounced back from a significant support level around $33.00 that’s given by the lower Bollinger Band. At the moment, the prices are lingering slightly below the upper Bollinger Band at approximately $34.85, which represents immediate resistance.

A breakout above this level could pave the way for further gains toward $35.50 or even $36.00.

momentum indicators sometimes give conflicting messages; at the moment, the Relative Strength Index (RSI) is 54, suggesting a neutral to moderately optimistic outlook for the bulls.

Furthermore, the Moving Average Convergence Divergence (MACD) indicator has switched to a positive state, indicating a recent crossing point that could signal an ongoing increase in market strength.

Nevertheless, the power of this move appears restrained at the moment, suggesting that a surge beyond $34.85 would provide a stronger indication of bullish momentum.

Profitability metrics indicate selling pressure at higher levels

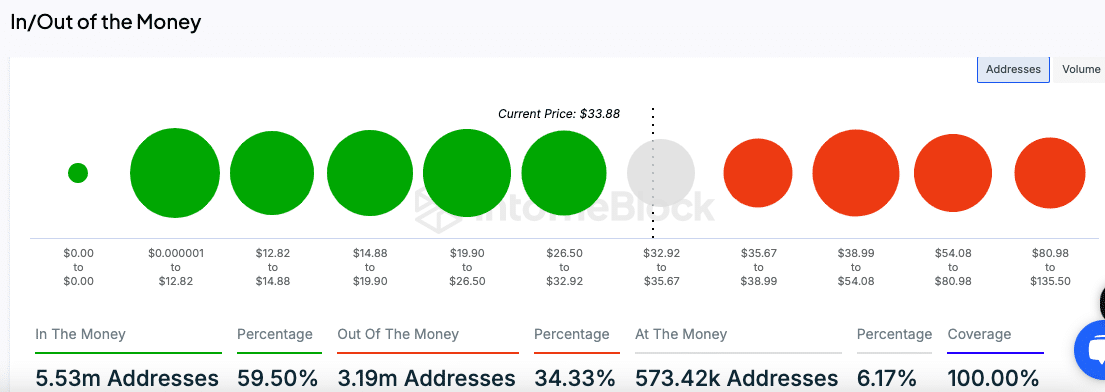

Approximately 59.5% of Avalanche (AVAX) investors are currently seeing a profit, as the majority of them purchased their tokens at prices ranging from around $19.90 to $26.50, according to the “In/Out of the Money” graph.

In simpler terms, as the price increases within this profitable region, those who own these assets might decide to cash out their profits, potentially leading to increased selling activity.

Approximately one third of owners are experiencing losses, largely within the price band stretching from around $35.67 to $38.99. At these rates, sell-offs could occur as owners aim to recoup their initial investment, potentially creating resistance points.

As a crypto investor, I’ve noticed that about 6.17% of wallets are currently “at breakeven,” implying a tight trading band that mirrors the present market value and hints at continued consolidation.

Read Avalanche Price Prediction 2024–2025

Large transaction data reflects moderate activity

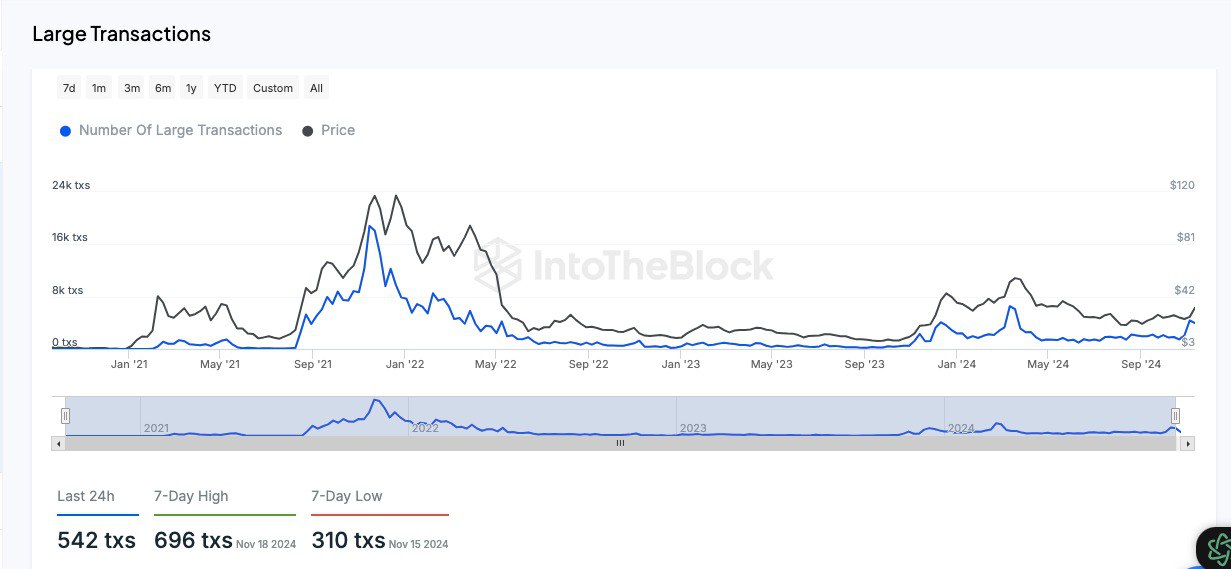

According to IntoTheBlock’s data, there were approximately 542 significant transactions over the past day, which is a decrease compared to the 7-day peak of 696. This level of activity can be considered moderate, but an increase in large transactions might suggest renewed involvement from major market players.

Currently, big financial transactions associated with institutional or high-volume traders (whales) are occurring less frequently than usual when compared to the highest recorded periods in history.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-11-21 18:16