- AVAX trapped in a symmetrical triangle, testing $19 support, as Vladimir Nabokov’s ghost ponders its fate.

- Bearish on-chain signals and high underwater investor percentages suggest a potential downside, but will it be a mere ripple or a catastrophic cascade?

Avalanche [AVAX] is currently consolidating within a symmetrical triangle pattern on the 4-hour chart and testing a critical support level of $19. 📈🔍

This support has held firm in recent price action, which may indicate a potential rebound. AVAX is currently at a crucial level, trading at $19.56 with a slight 0.20% increase in the last 24 hours. 🤔

Will AVAX maintain its support, or will it fall further? Let’s find out. 🔮📉

What does the current price action reveal about AVAX?

At press time, AVAX’s price was testing a key $19 support level, which has acted as a reliable floor in previous price movements. 🏠

The symmetrical triangle pattern that is currently forming suggests a build-up of market indecision, where both buyers and sellers are waiting for the next move. 🕰️

If AVAX can break above the upper boundary of the triangle, the price could experience a short-term rally. However, a failure to hold this support might push the price lower, potentially leading to a deeper correction. 📉🌊

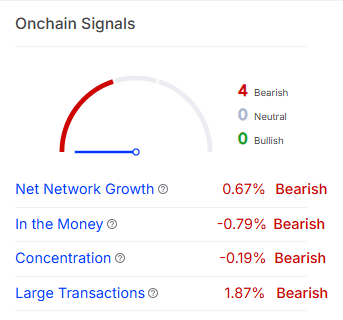

Are the on-chain signals pointing towards bullish or bearish sentiment?

Examining the on-chain signals for AVAX, the overall outlook appears more bearish than bullish. The net network growth stands at -0.67%, showing a slight decrease in network activity. 📉

In addition, the “In the Money” metric has dropped by 0.79%, indicating that fewer investors are in profit. 📉

Furthermore, the concentration metric is at -0.19%, signaling that there has been little change in the distribution of AVAX tokens. 😐

Lastly, large transactions have decreased by 1.87%, suggesting a lack of significant bullish movement among large investors. All these on-chain signals point to a lack of strong bullish momentum at this time. 🐻

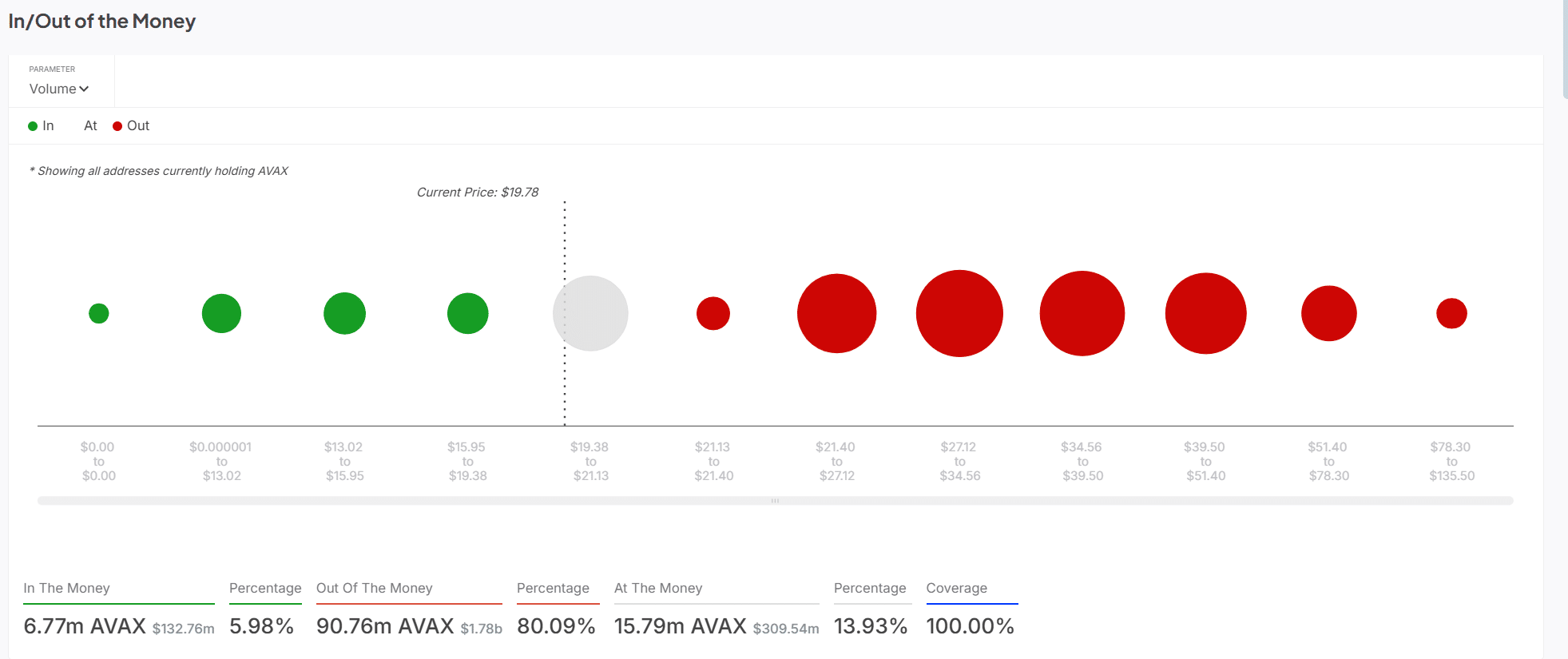

How does in/out of the money data influence its price action?

The in/out of the money chart further highlights the bearish sentiment around AVAX. At the time of writing, 80.09% of addresses holding AVAX are out of the money, with a significant portion of these investors holding losses. Only 5.98% of holders are in profit at the current price level. 🌊

This suggests that numerous investors are underwater and might be tempted to sell if the price falls below the $19 support. 🏊♂️

Additionally, as the price struggles to stay above this level, more selling pressure could mount, further driving down the price of AVAX. 📉

Can AVAX hold $19, or will it break lower?

AVAX is at a critical juncture, and the next few hours could determine whether it experiences a rebound or breaks lower. 🔮📉

With a symmetrical triangle pattern forming and on-chain signals leaning bearish, the risk of a breakdown seems higher. 🐻

Given the overwhelming number of investors who are out of the money and the lack of bullish on-chain momentum, AVAX may struggle to maintain its $19 support. 🏠

Therefore, if the price fails to hold this key level, AVAX is likely to face further downside movement soon. 🌊

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2025-03-10 09:19