- Several crypto analysts are predicting a price drop

- However, a buy signal flashed on the cryptocurrency’s chart

As a seasoned crypto investor with a decade of experience navigating the volatile crypto market, I must say that predicting Bitcoin‘s [BTC] price movement is always a rollercoaster ride. On one hand, we have analysts predicting a potential drop to $60k due to the bearish sentiment and a broadening triangle formation. However, on the other, there are signs of a possible buy signal and an uptick in buying pressure, suggesting a potential price rebound.

Over the last seven days, Bitcoin [BTC] has faced challenges, failing to achieve a substantial price surge. Some market experts even predict that the recent downturn in Bitcoin’s value might suggest a potential drop towards the $60k mark.

Will Bitcoin bears push BTC to $60k again?

As a crypto investor, I’ve noticed that the price of Bitcoin has shown minimal growth over the past week, inching up by just 2%. At this moment, each Bitcoin is being traded at approximately $96,158.09. Moreover, its market capitalization stands above $1.9 trillion. The data I’ve gathered from CoinMarketCap suggests a steady, but not particularly dynamic, movement in the world’s largest cryptocurrency.

Based on recent fluctuations in cryptocurrency prices, well-known crypto analyst Ali has tweeted out several thought-provoking forecasts. One of these predictions, attributed to Peter Brandt, suggests that Bitcoin could potentially break down from a broadening triangle pattern, which might lead to a drop towards the $70,000 price range.

As per Martinez’s analysis, looking at the blockchain data, a potential drop in Bitcoin price to around $70,000 could occur. This is because, below the price point of $93,806, there appears to be a significant range of possible decreases, stretching down to approximately $70,085.

Where is BTC heading?

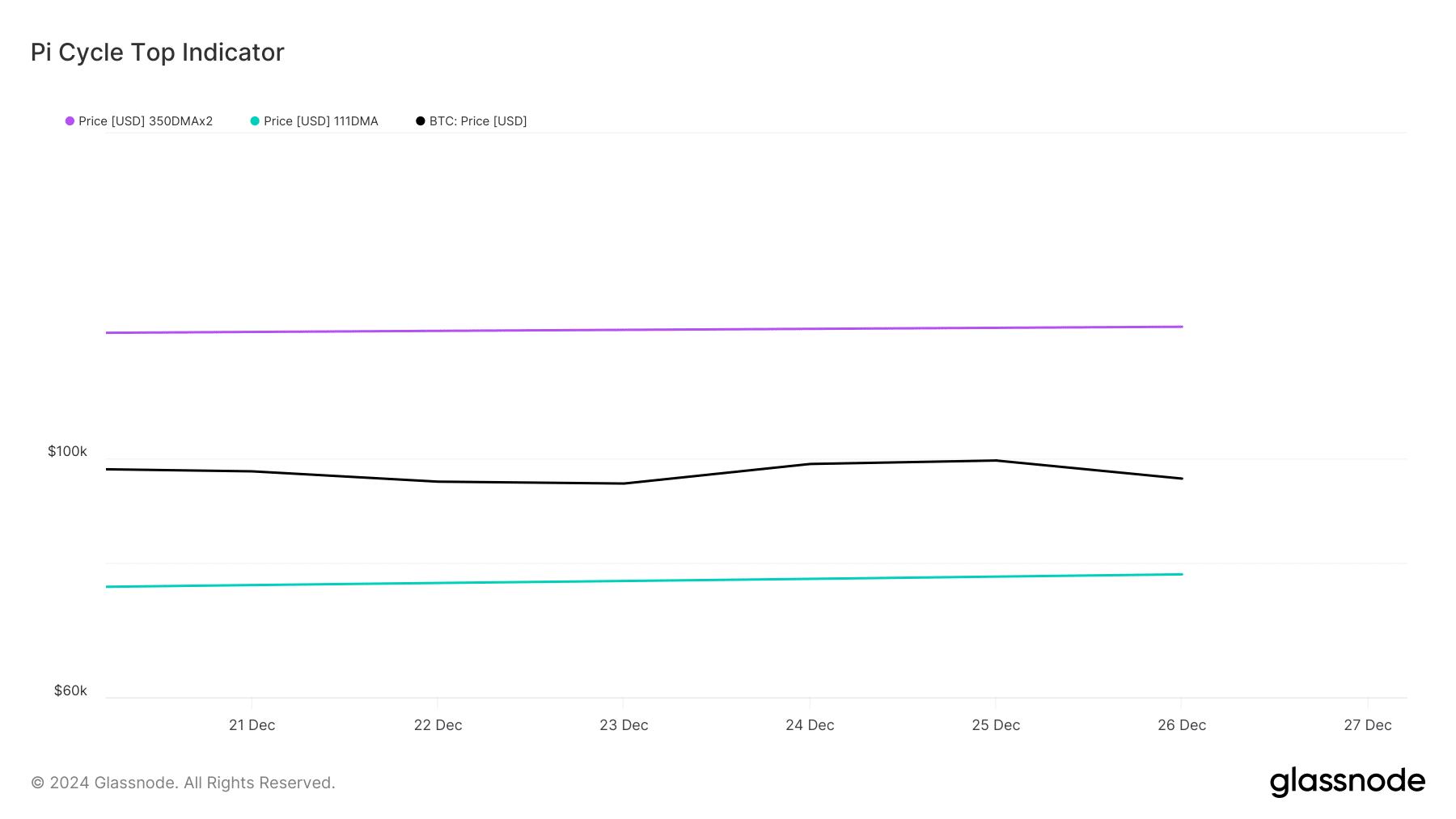

After examining Bitcoin’s on-chain information, AMBCrypto determined that there might not be a repeat drop in price down to $60k. Data from Glassnode suggests that Bitcoin’s market base had already risen above the $60k level.

According to the Pi Cycle Top indicator, it appears that Bitcoin’s potential market low occurred around $78,000. Conversely, the indicator suggests that a potential market high for Bitcoin might be around $132,000.

Currently, when I’m typing this, Bitcoin’s price is hanging out in a neutral range according to the fear and greed index. In simpler terms, this suggests that its value could potentially go up or down over the next few days or even weeks.

Currently, Ali Martinez has shared another tweet, hinting at a potential buying opportunity. This tweet refers to the TD Sequential indicator showing a buy signal on the Bitcoin’s hourly graph, indicating an expected price rise.

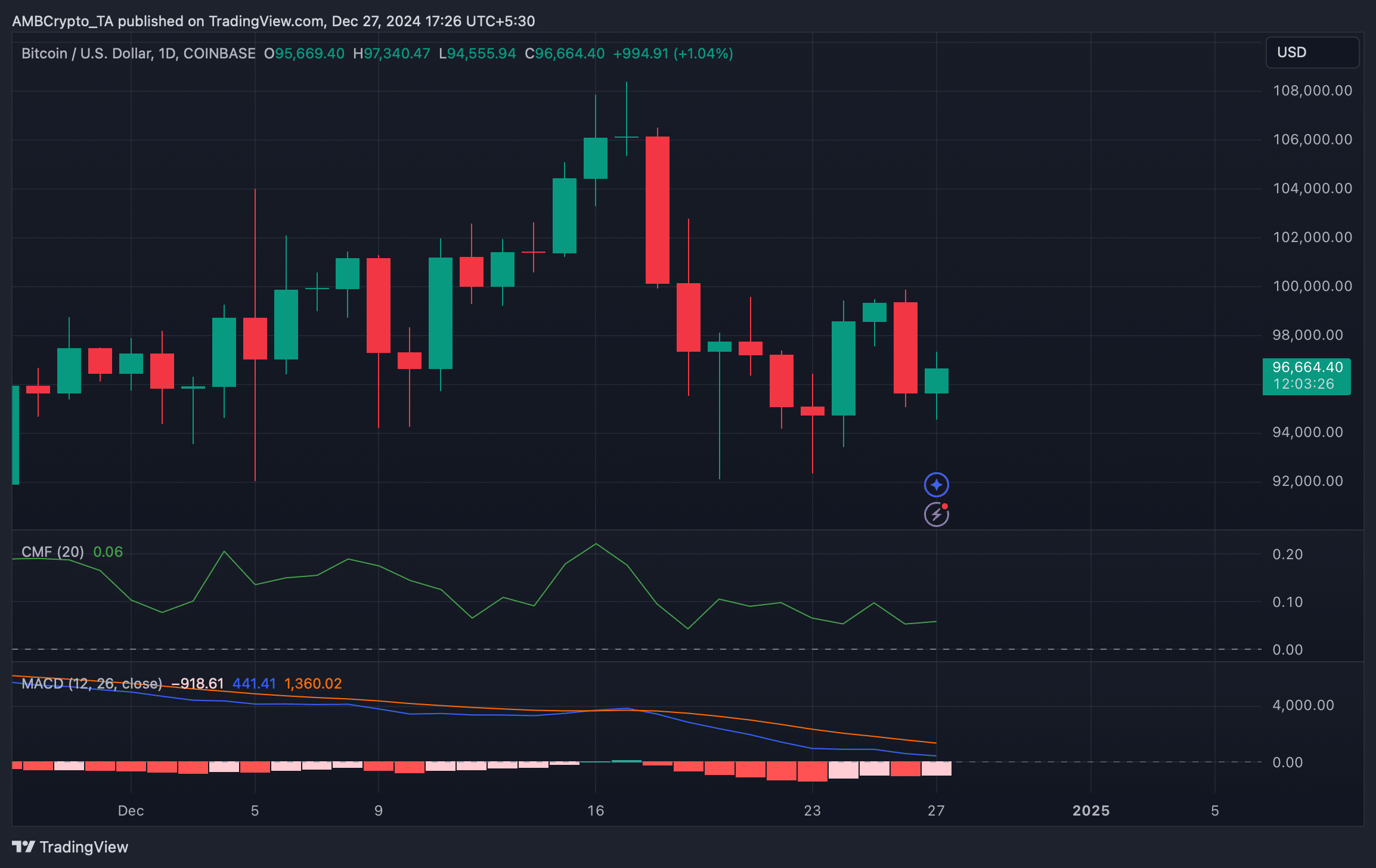

Consequently, we decided to examine Bitcoin’s daily graph more closely. But the technical tool Moving Average Convergence Divergence (MACD) suggested a bearish edge in the market. This might lead to a price adjustment, potentially causing the coin’s value to rebound towards $60k again.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Nonetheless, the Chaikin Money Flow (CMF) registered a slight uptick. A rise in the metric indicates a hike buying pressure and a potential uptrend. Whenever buying pressure rises, it hints at a possible price hike.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-12-28 03:03