-

BTC continues to decline as federal rates cuts speculation persists.

An analysts eyes a recovery to $62000 after FED decision.

As a seasoned analyst with over two decades of experience in financial markets, I have seen my fair share of market fluctuations and unpredictability. Over the past month, Bitcoin has been no exception to this rule, with its extreme volatility reminding me of a roller coaster ride at an amusement park.

Over the past month, Bitcoin (BTC) has shown significant price swings. For a week now, it’s tried to defy the ‘September curse’, but so far, it hasn’t gained enough traction to sustain an upward trend.

Over the last seven days, Bitcoin rose significantly from approximately $52,546 to a peak of $60,670. However, in the previous 24 hours, it has shown volatility and lost much of its gains. Currently, it’s being traded at around $58,552, which represents a decrease of about 2.38% compared to its price a week ago.

Previously, Bitcoin had been increasing by 5.98% according to weekly graphs. Despite a drop over the last 24 hours, the crypto market’s activity has significantly risen. Specifically, the trading volume for Bitcoin increased an impressive 100%, reaching approximately $26.9 billion in the past day.

Under the present economic circumstances, there’s been extensive debate among various analysts. They are now considering the prospect of future Federal Reserve interest rates as a potential factor.

According to well-known crypto expert Hasan, a reduction in federal involvement could be influencing investor feelings in the market.

What’s next for Bitcoin?

According to Hasan’s examination, the imminent federal reductions due this week were identified as the primary source of market turbulence.

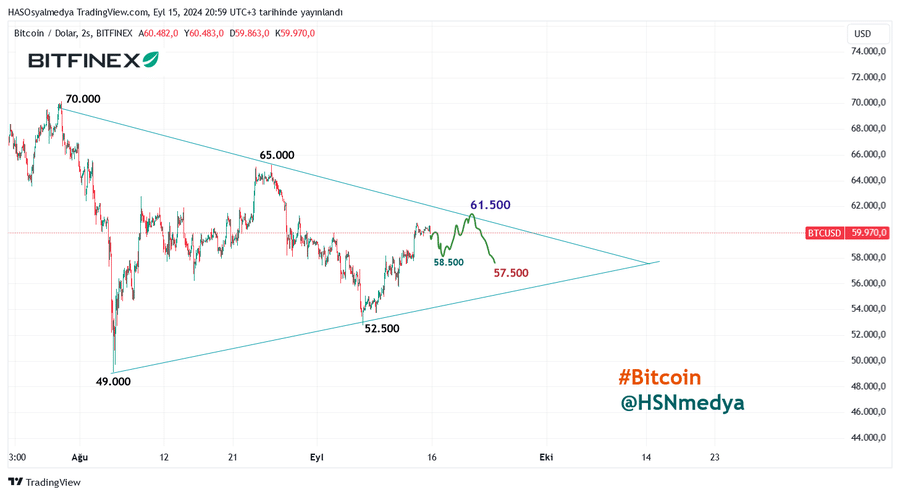

Based on his assessment, Bitcoin markets are expected to undergo a drop near $58,500. This price point appears crucial as it serves as a potential support level until the outcome of the Federal Reserve’s interest rate decision becomes clear.

Despite a potential dip at the current market level, the analyst anticipates a rebound that could take the price up to $61,500.

Consequently, should the Federal Reserve decide on a 0.25% reduction in interest rates, we can expect Bitcoin’s value to rebound and its prices to climb towards the $61,500 to $62,000 range.

Should the market undergo a dip after the FED’s decision, Bitcoin prices may drop down to around $57,500.

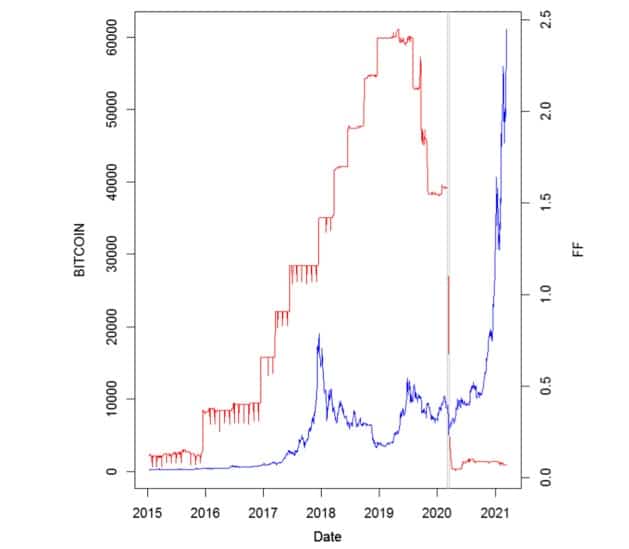

historically, reductions in federal interest rates have tended to boost Bitcoin prices; for example, in March 2020, when Bitcoin’s price soared past its earlier records due to the surge following the rate cuts triggered by the economic impact of COVID-19.

As a result, it’s probable that the predicted interest rate reductions within four years will enhance cash inflows for both retail and institutional investors, thereby potentially boosting Bitcoin fund flow. Nevertheless, if Bitcoin strays from its traditional pattern, it may face additional adjustments.

What BTC charts suggest

According to Hasan’s observations, there’s been a rise in market unpredictability due to speculations about the FED interest rate reductions. Consequently, the market trends seem to be headed towards a continued downturn until further notice.

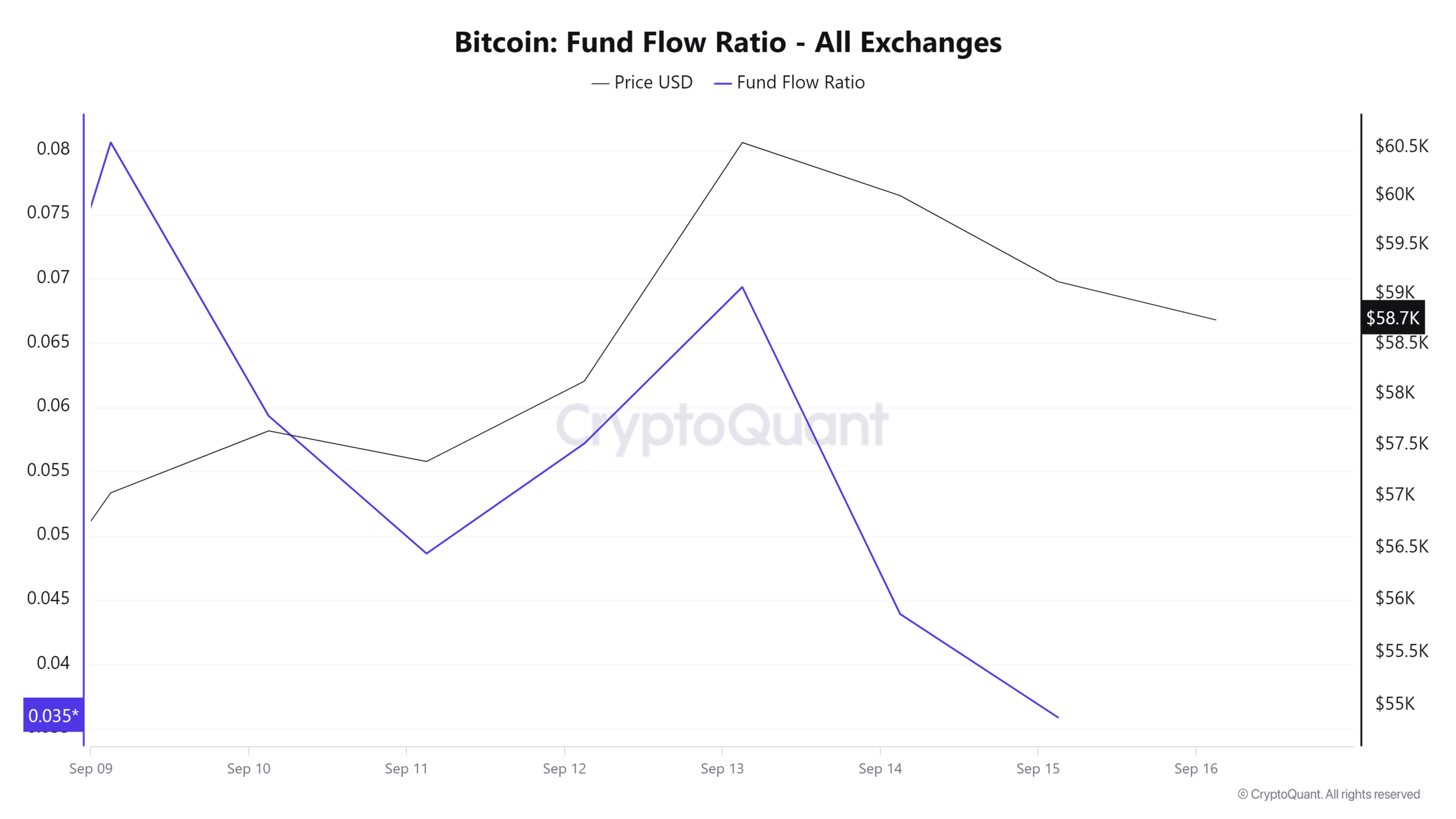

Over the last seven days, the Bitcoin Fund Flow Ratio dropped from 0.08 to 0.03. This decrease indicates that more capital is being withdrawn from the market compared to new investments flowing in. This trend aligns with a doubling of trading activity.

Thus, these trading activities are causing selling pressure which further pushes prices down.

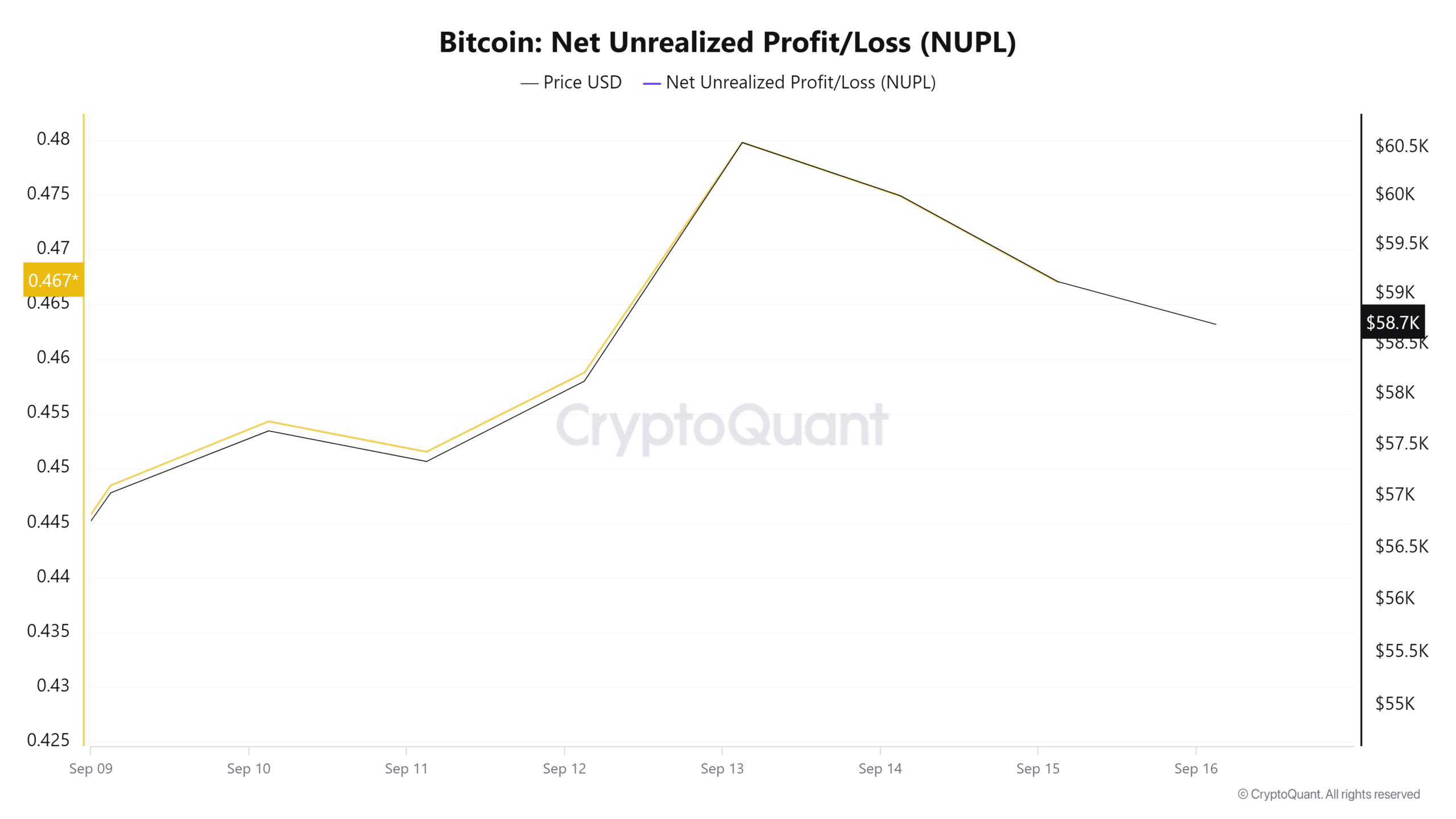

Furthermore, it appears that Bitcoin’s total unrealized gain or loss has decreased during the last 3 days. This suggests an upward trend in the number of individuals experiencing losses, as opposed to those with profits.

In simple terms, when the market situation becomes unfavorable, it can cause investors to become fearful and sell their assets quickly to minimize potential losses. This increased selling activity puts additional pressure on the market to continue falling.

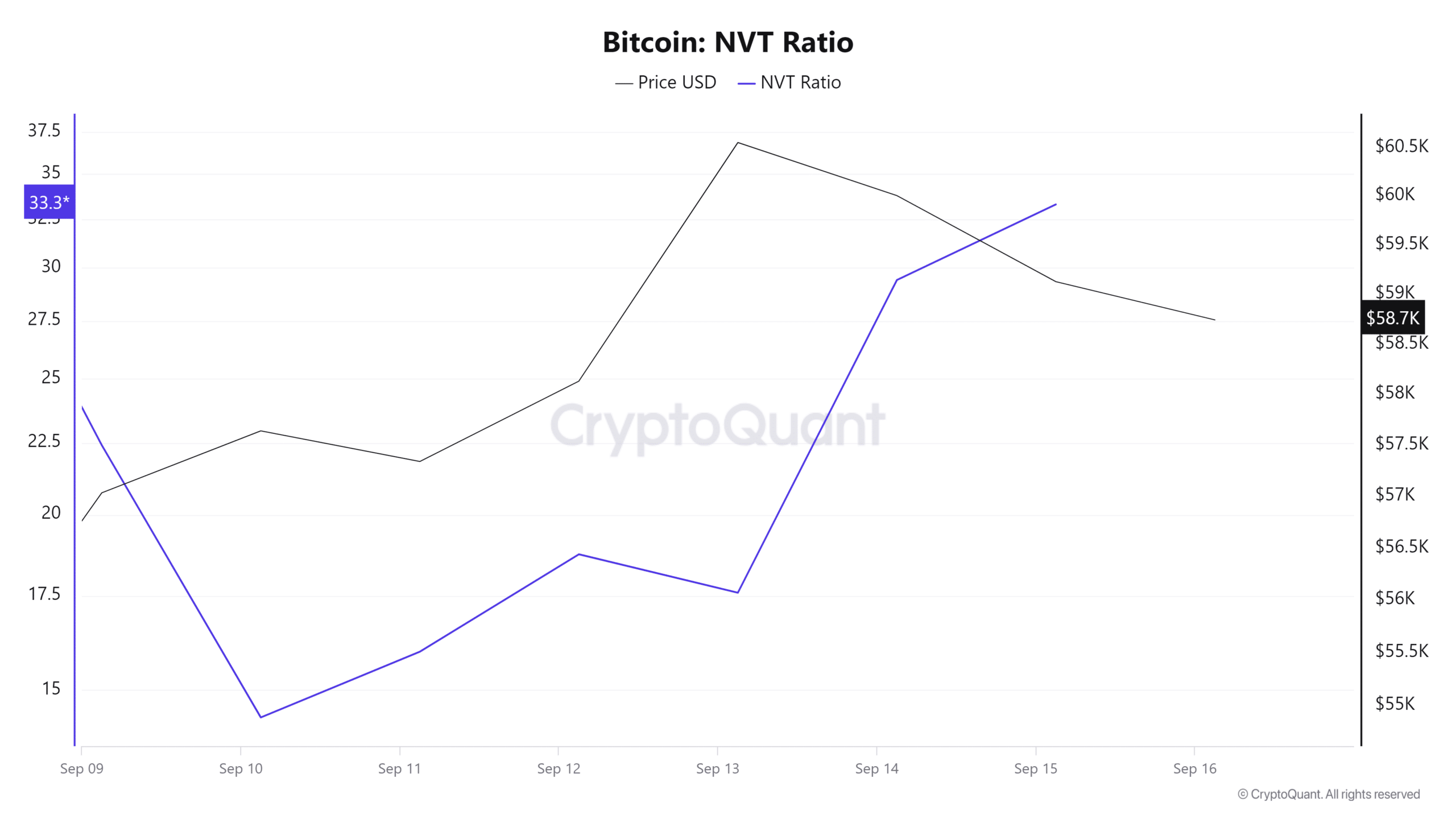

To wrap up, the Network Value to Transactions (NVT) Ratio of Bitcoin has risen significantly over the last seven days, climbing from a minimum of 14.3 to 33.3. An upward trend in the NVT ratio typically indicates that the recent price surge is driven by speculative purchases rather than organic growth or increased usage.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In simpler terms, this rapid increase in Bitcoin’s price doesn’t seem sustainable because there aren’t enough strong underlying reasons to support it. As a result, it’s expected that the market will adjust itself, which is exactly what we’re seeing right now following the recent surge.

As a researcher, I’m observing that as long as Federal Reserve rates remain unchanged, Bitcoin (BTC) might continue its downward trend. If the market responds favorably to anticipated rate cuts, it could potentially surge towards the $62,852 mark. Conversely, should the market undergo a correction, BTC’s value may dip down to around $57,342.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-17 10:16