-

Bitcoin faced a critical support test at $59K, with potential for a significant move in either direction.

On-chain data showed that 81% of BTC holders were in profit, with bullish exchange signals hinting at possible recovery.

As a seasoned analyst with over a decade of experience in the financial markets, I have learned to read between the lines when it comes to market trends and indicators. Bitcoin [BTC] is currently testing a crucial support level at $59K, and the road ahead appears uncertain but intriguing.

🚀 EUR/USD to Explode? Trump Trade Shocks Incoming!

Don't miss the crucial analysis before the market reacts!

View Urgent ForecastBitcoin [BTC] was trading near a critical support level, raising questions about its next move.

At the moment of reporting, the price of Bitcoin stood at approximately $59,340.68. Over the last day, it saw a small dip of 0.33%, while over the course of the past week, its value dropped by 2.69%.

Bitcoin’s market capitalization stood at approximately $1.17 trillion, with a 24-hour trading volume of $34.49 billion.

Experts are keeping a close eye on the Bitcoin price holding within the $59,000 to $60,000 support zone. According to Daan Crypto Trades, a cryptocurrency analyst, Bitcoin is currently trading below the midpoint of this range, with $66,000 to $67,000 being the next potential resistance level.

Should Bitcoin not sustain its position above $59K, potential decreases might follow. Nevertheless, if it rebounds from this point, it could potentially set sights on the mid-range goal of approximately $66,092.

Bitcoin shows mixed signals

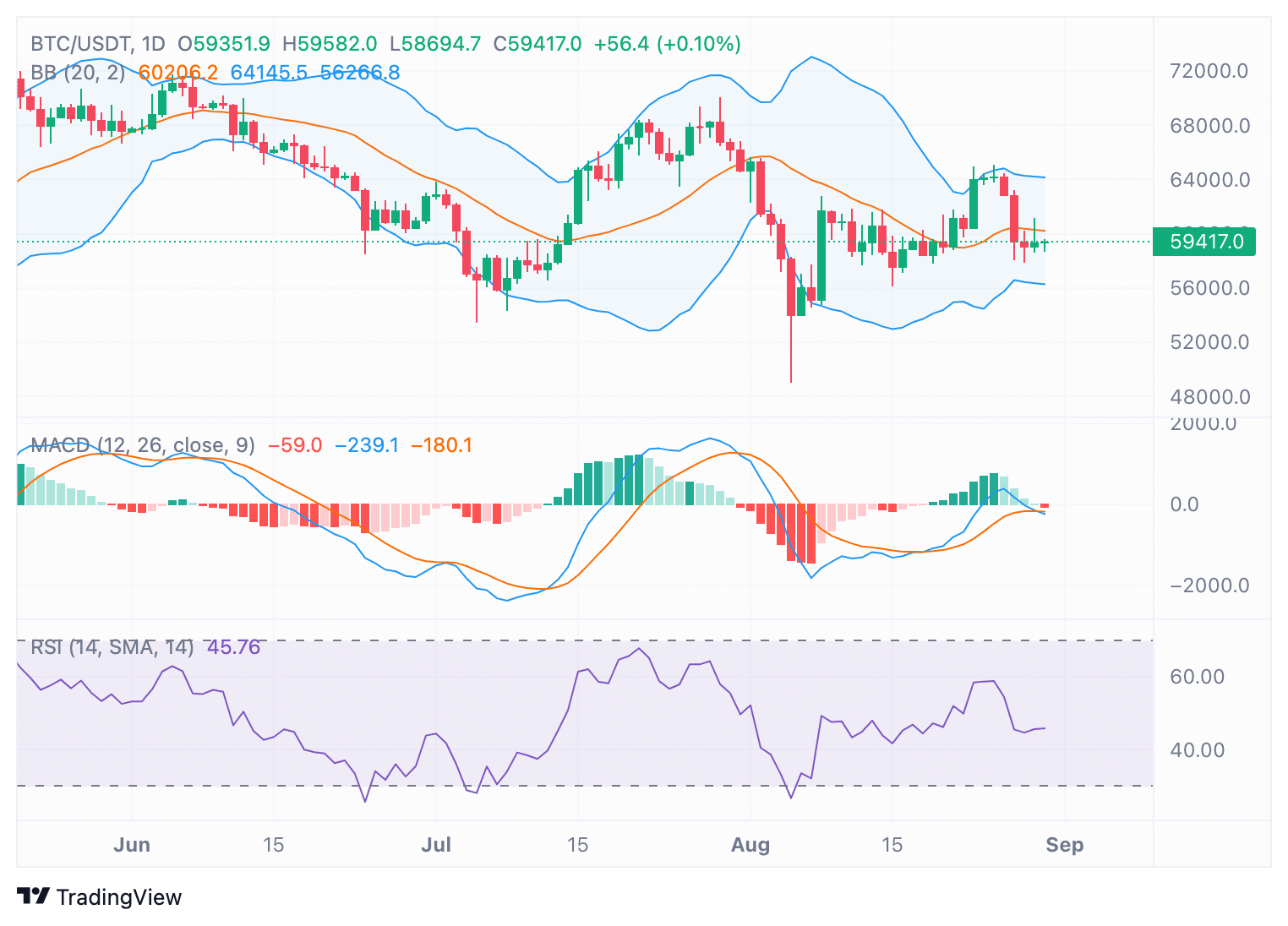

At the moment, the technical signs for Bitcoin were showing a blend of trends. Specifically, the Bitcoin price was maintaining a steady position around $59,417, which was quite near the midpoint of the Bollinger Bands.

Broad regions show heightened market instability, and when the price approaches the lower region, it may signal possible price stabilization or support.

If this support fails, the next level to watch is around $56,266.

The MACD chart hinted at a decline in the strength of the upward trend, suggesting a potential weakening of bullish energy.

Currently, the Moving Average Convergence Divergence (MACD) line is getting closer to crossing below the signaling line, suggesting a potential change to a falling pattern. Keep an eye out for this cross-over, as it might be a warning of additional price drops for traders.

Currently, the Relative Strength Index (RSI) stands at 45.76, indicating a neutral stance that slightly tilts towards an oversold market scenario.

This suggested that Bitcoin had room to move lower before reaching oversold territory.

An increasing Relative Strength Index (RSI) might signal an upcoming change in trend, possibly a pause for consolidation before a substantial price shift occurs.

Exchange signals: A mostly bullish outlook

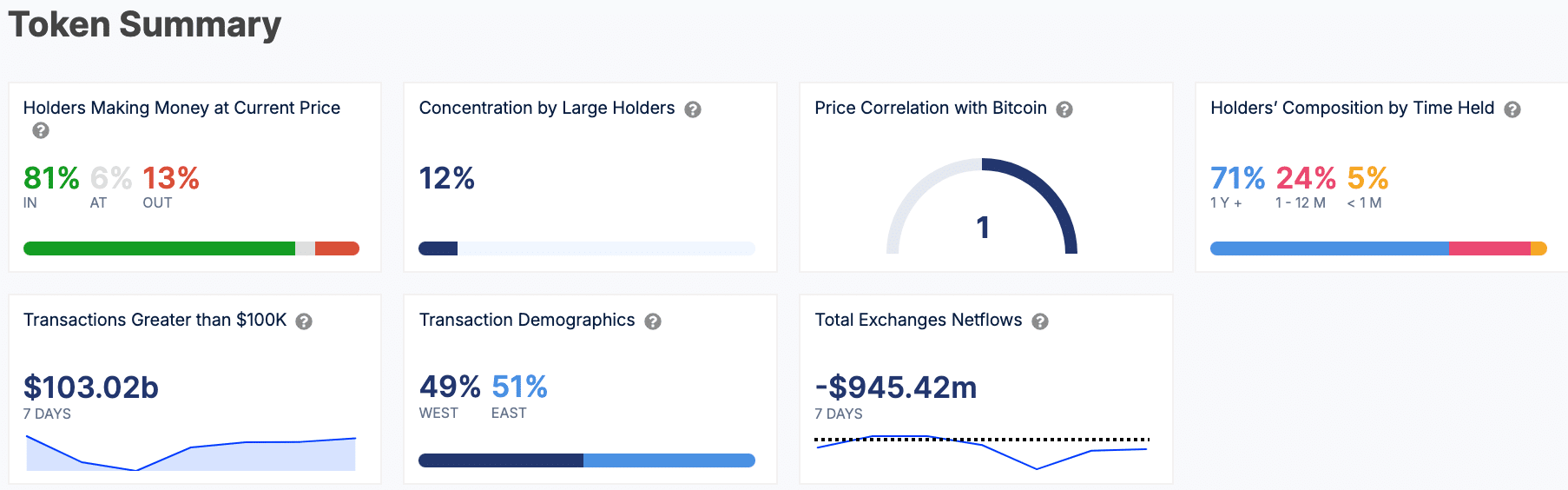

Regardless of some conflicting technical signs, the overall picture from blockchain and trading platforms was predominantly optimistic for Bitcoin. At the current moment, it’s shown that about 81% of Bitcoin holders are enjoying profits, with just 13% experiencing losses.

Large holders accounted for 12% of the total supply, suggesting moderate concentration.

Over the past week, there’s been a $945.42 million withdrawal from Bitcoin exchanges, implying that more Bitcoins are being taken out of these platforms. This might be an indication that investors are stockpiling Bitcoin.

As an analyst, I observed a bullish trend in the market based on the positive signs from the Smart Price and Bid-Ask Volume Imbalance indicators. These signals suggest that a potential increase in price could be imminent.

In the last 24 hours, the combined value of all cryptocurrencies dropped by approximately 1.7%, reaching a total of around $2.183 trillion. This downward trend, affecting Bitcoin and significant other digital currencies, appears to be part of a broader market movement.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

According to DefiLlama’s data, the Total Value Locked (TVL) currently stands at approximately $527.89 million. In the last 24 hours, the DeFi sector generated around $457,690 in fees and recorded a transaction volume of roughly $11,017.

As an analyst, I’ve observed that during the specified timeframe, approximately 723,280 active addresses were engaged, suggesting a consistent level of activity within the Decentralized Finance (DeFi) ecosystem.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-08-31 07:04