-

BTC’s hold on $60K range-low at stake as $6.6 billion options expire.

However, QCP Capital was confident that the level would be defended.

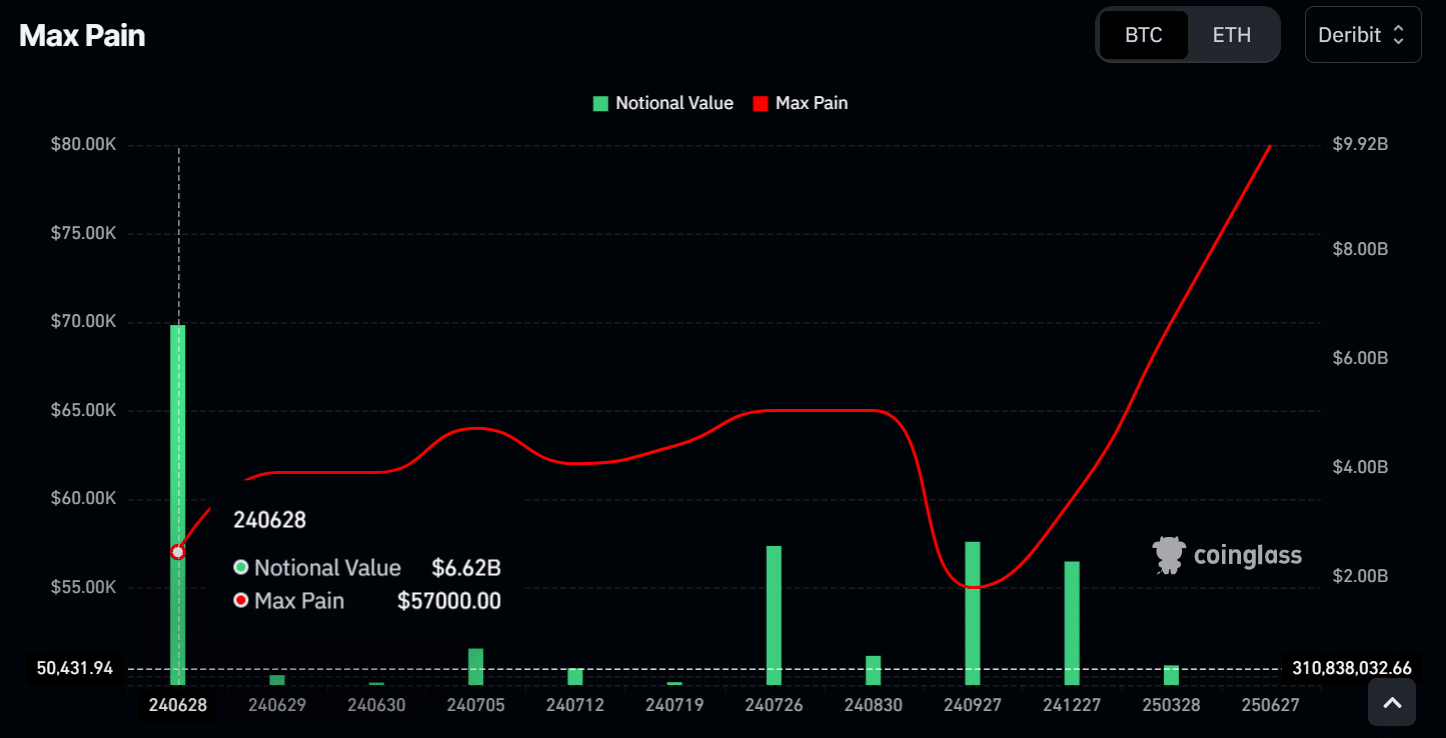

As a seasoned crypto investor with several years of experience in this volatile market, I have witnessed firsthand how options expiries can significantly impact Bitcoin’s price action. The impending expiration of over $6.6 billion worth of BTC options on June 28th has me on edge, as the max pain level for these options sits at $57K. This means that market makers are likely to induce prices towards this level to limit their losses.

As an analyst, I’ve observed that the persistent bearish market mood in June caused Bitcoin (BTC) to retreat back towards its support levels around $60,000. This marked the fifth occasion where BTC encountered this price range. On certain instances, the cryptocurrency dipped even further, reaching as low as $56,000 and $58,000.

As a researcher studying the cryptocurrency market, I’ve discovered that over ten billion dollars worth of crypto options are approaching their expiration date on June 28th. Approximately two-thirds of this amount, around six and a half billion dollars, pertain to Bitcoin options. With such a large volume of options set to expire, market volatility was anticipated, increasing the possibility that Bitcoin’s support levels could be breached.

The point of maximum risk for Bitcoin options sellers, generally considered as the level with the least financial danger before options expiration, was at $57K.

Put differently, market makers tend to induce prices toward the max pain level to reduce losses.

The price of Bitcoin often returns to a certain point, yet there were additional elements influencing its behavior. According to the options market, Bitcoin may dip below $60,000.

BTC to defend $60K?

As a financial analyst, I’ve observed that while the cryptocurrency market is known for its volatility, QCP Capital, a leading crypto trading firm, held a strong belief in Bitcoin’s ability to protect its $60,000 support level.

‘We think the 60k support will be defended’

The German government’s relaxation of selling pressure and the accelerated inflows into US Bitcoin exchange-traded funds (ETFs) were cited as reasons. According to Soso Value’s data, these Bitcoin ETFs halted their 7-day streak of outflows on Tuesday and have since reported positive net inflows for the past 3 days.

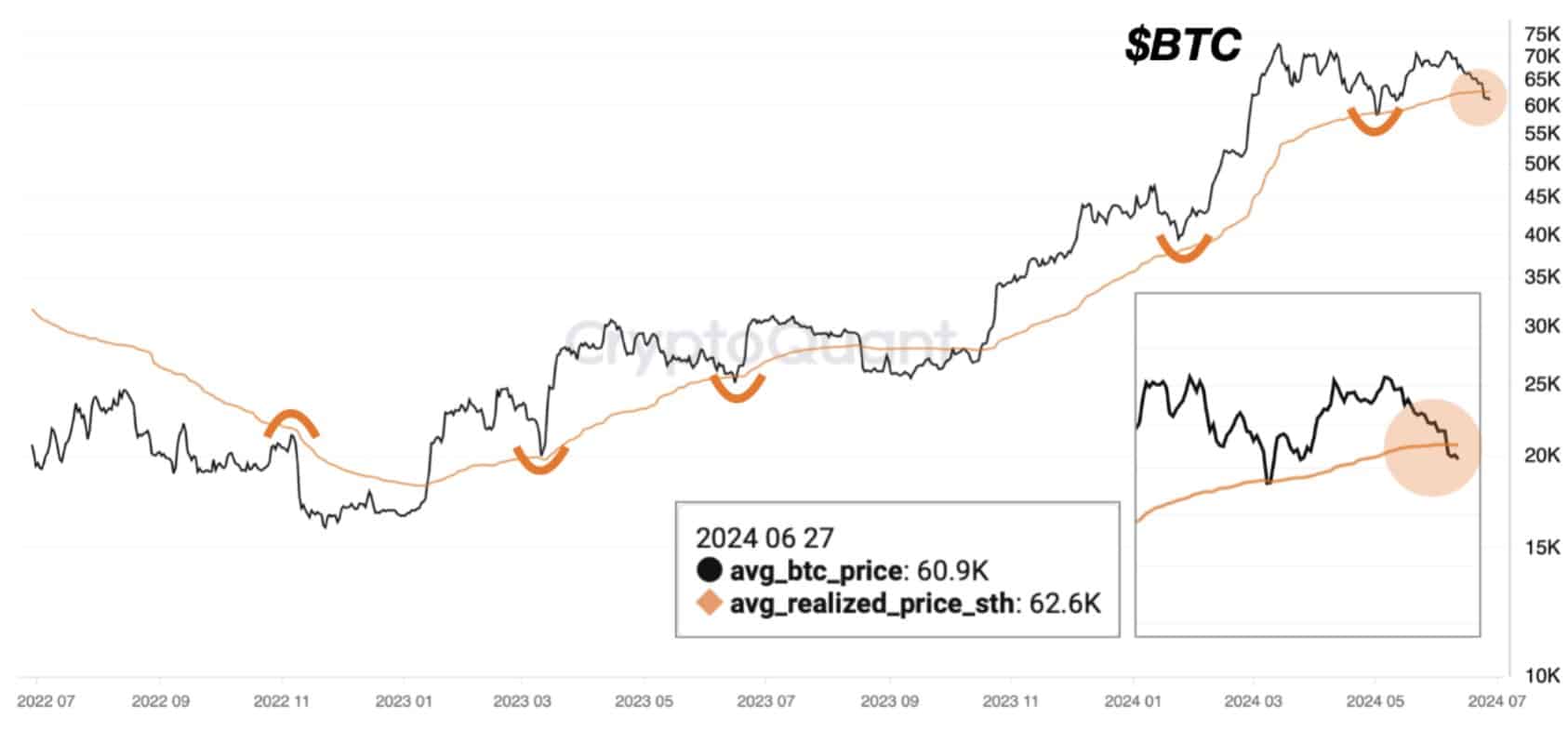

On the positive side, the current perspective might be challenged if short-term Bitcoin investors find themselves in the red and choose to sell in desperation should the cryptocurrency’s value decrease further.

As a crypto investor following the analysis of a pseudonymous expert at CryptoQuant, I’ve observed that Bitcoin (BTC) has dipped below its short-term realization price of $62,600. This drop might lead to an increase in selling pressure due to investors realizing their profits at this level.

As a researcher analyzing market trends, I’ve observed that if a particular price level doesn’t act as a supportive floor and fail to push the price higher within a reasonable timeframe, it may transform into a formidable barrier for further price advancement. In other words, it could morph into a resistance level.

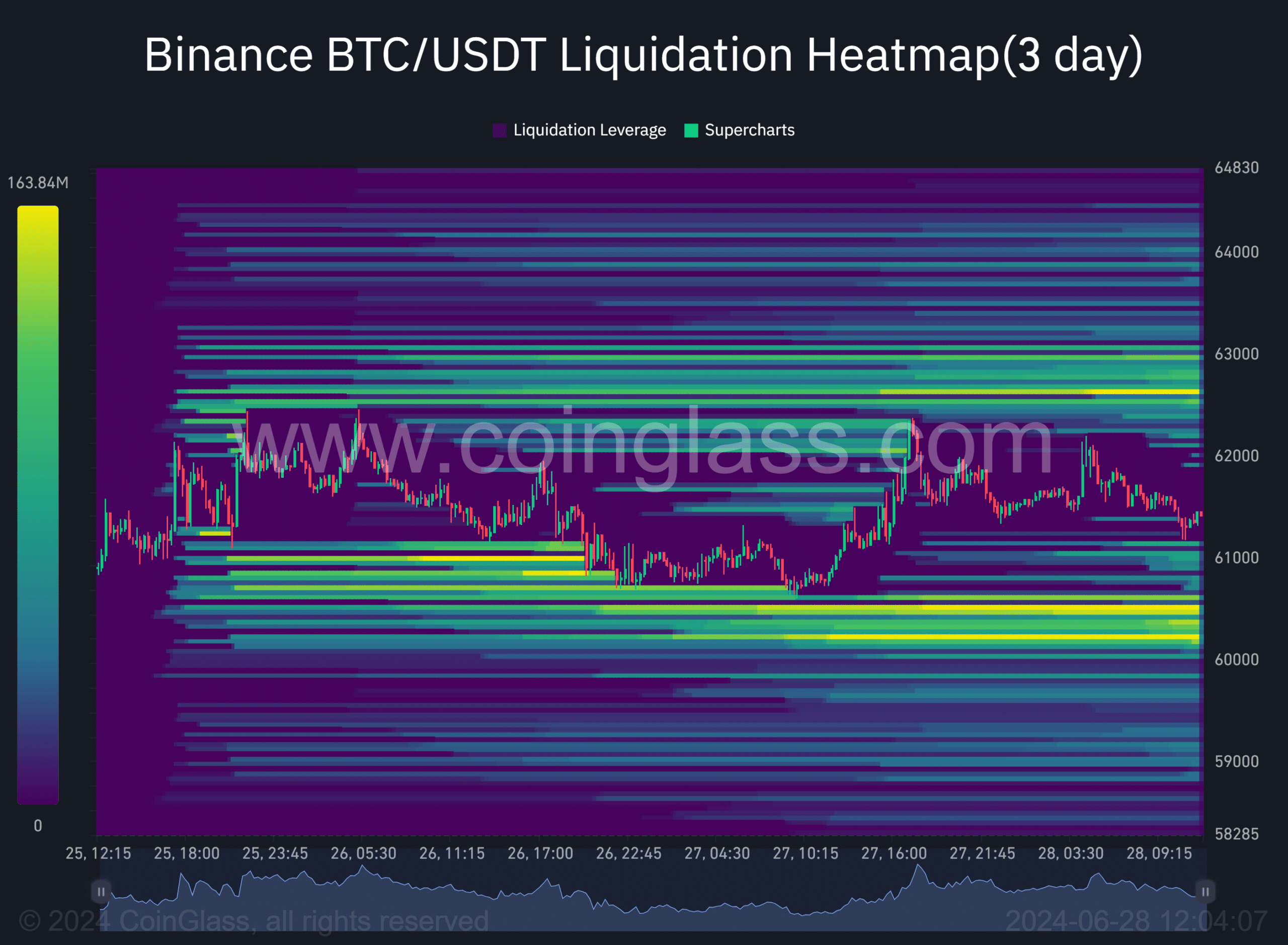

The AMBCrypto analysis of the liquidation heatmap revealed significant liquidity pockets, highlighted in orange, positioned on both sides of the price movement. However, there was a slightly greater concentration of liquidity at the prices $60.2K and $60.4K.

As a researcher studying price action, I’ve identified a significant clustering of prices around the $62.6K mark on the chart’s upper side. This point is particularly noteworthy because it aligns with the short-term realized price. Additionally, I’ve observed that price movements often gravitate towards massive liquidity areas.

The combined data indicated a potential market manipulation pushing Bitcoin’s price toward $57,000. However, there were signs that Bitcoin could recover and reach $60,000 again for further testing near $62,600.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-28 20:08