- Bitcoin ETF inflows remained positive despite its declining price

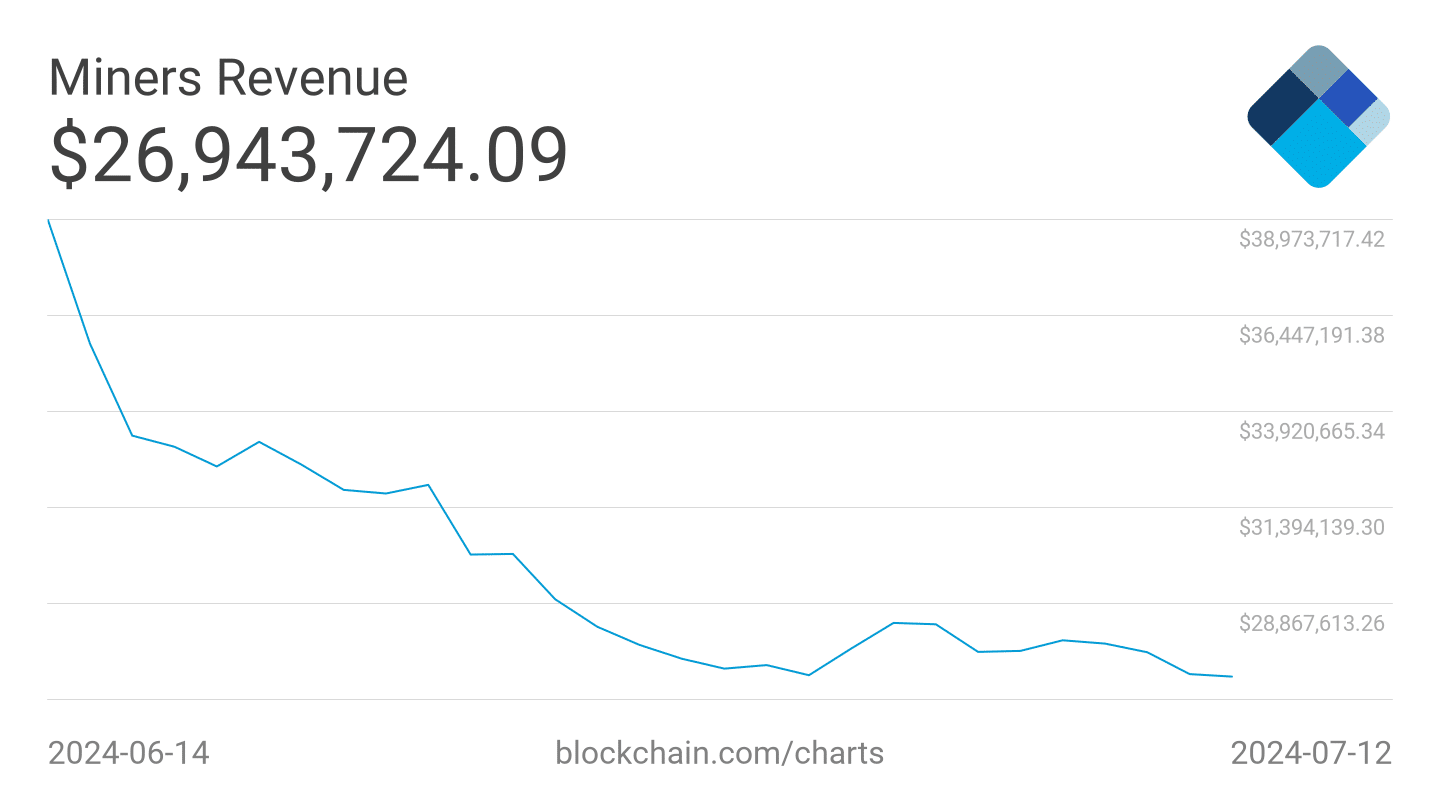

- Overall miner revenues fell materially over the past month

As a seasoned crypto investor with a few years under my belt, I’ve seen my fair share of market ups and downs. The recent price dip in Bitcoin below $60,000 has left me feeling a mix of apprehension and intrigue. On one hand, the sentiment around BTC seems to be soured, but on the other, there are positive signs emerging from the institutional investment front.

The drop in Bitcoin’s [BTC] price beneath $60,000 significantly dampened the global mood towards the leading cryptocurrency. Nevertheless, emerging market data hints that Wall Street might still hold a positive outlook for Bitcoin as the “king coin.”

A thumbs up from Wall Street

As I pen this down, the most recent data unveils a total accumulated investment of $15.50 billion in these ETFs since their debut, which translates to an average daily inflow of approximately $79 million. This positive trend represents six consecutive days of net purchases, suggesting a lasting optimistic attitude among investors.

Instead of “On the contrary,” you could use “However” or “Despite this.” So the sentence could be: “However, the Grayscale Bitcoin Trust ETF (GBTC) exhibited a contrasting trend on July 11, with daily net outflows of $38 million, adding to a total net outflow of $18.7 billion.”

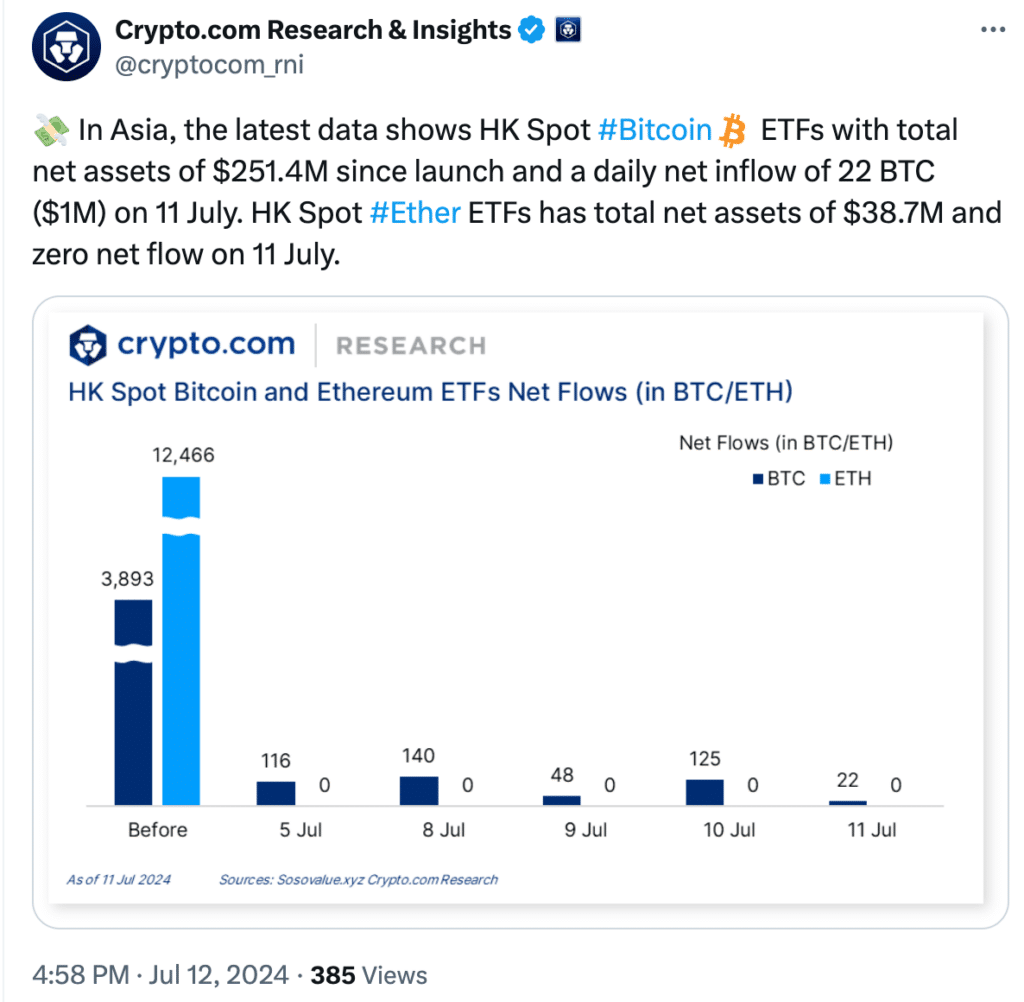

As a crypto investor with an interest in Asian markets, I’ve noticed the burgeoning Hong Kong Spot Bitcoin ETF scene. Since its launch, this market has seen significant growth, currently managing net assets worth $251.4 million. The daily net inflows, as of July 11, reached 22 Bitcoins or approximately $1 million. This trend signifies a surging demand for Bitcoin exposure in the region, with investors eager to be part of this dynamic and growing market.

During market corrections, Bitcoin’s price may experience significant drops. However, large investments into Bitcoin ETFs can help cushion these declines by acting as buying pressure. In simpler terms, when investors pour money into a Bitcoin ETF, it can prevent drastic price decreases.

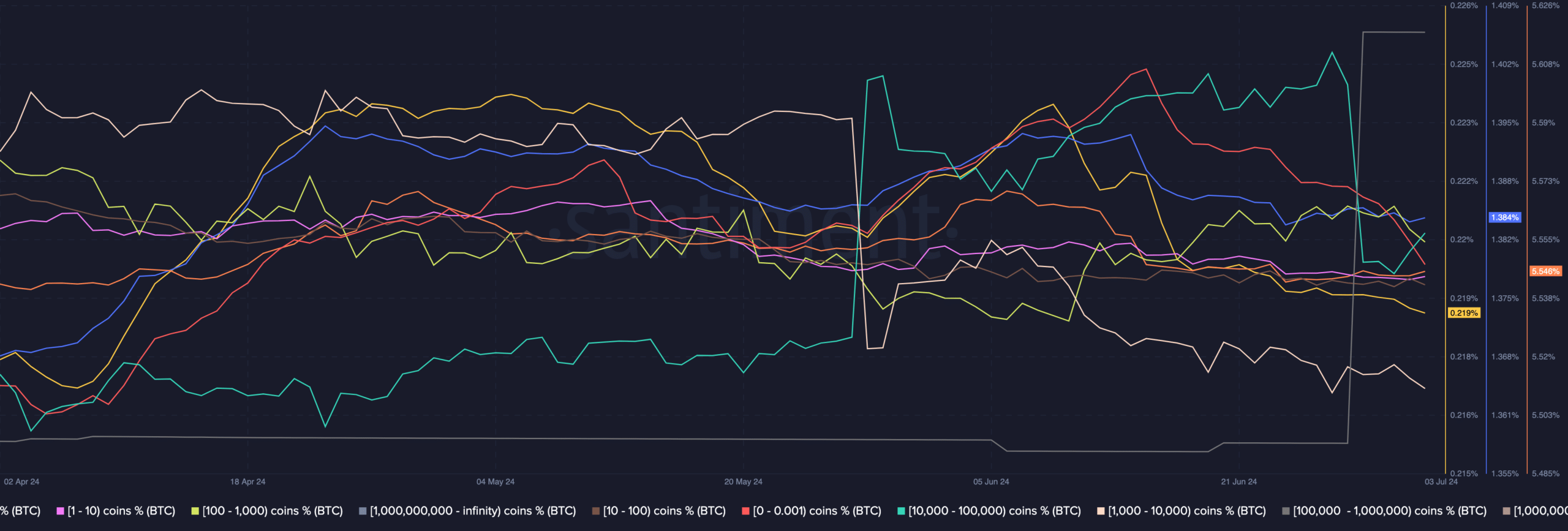

Despite growing curiosity from Wall Street investors regarding Bitcoin (BTC), the same level of enthusiasm isn’t observed among crypto investors as a whole. A study by AMBCrypto using data from Santiment unveiled that both large-scale and retail investors have shown decreasing interest in BTC recently. Furthermore, accumulation patterns across various investor groups have waned over the past few days.

Although ETF investments have bolstered Bitcoin, waning enthusiasm from major investors and retail buyers could potentially trigger more selling activity for the cryptocurrency.

Miner revenue declines

As a crypto investor, I cannot stress enough the significant impact the miner situation can have on Bitcoin (BTC). When miners face challenges or decide to sell their coins in large quantities, it could lead to increased supply and put additional selling pressure on BTC.

During the past month, the earnings from Bitcoin mining have significantly decreased, potentially compelling miners to offload more Bitcoin in order to maintain profitability – Resulting in increased supply and potential downward pressure on the cryptocurrency’s price.

After completing the sale of their confiscated Bitcoin stash, the German authorities may cause an increase in Bitcoin supply on the market in the coming days. Consequently, this could lead to heightened selling activity and potentially fuel a wave of pessimism towards Bitcoin and the crypto market as a whole.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Read More

2024-07-13 18:15