- Bitcoin’s recent price drop has led to significant market liquidations.

- Poor performance of the Hong Kong and U.S. spot ETFs underline market struggles.

As a seasoned financial analyst with extensive experience in the cryptocurrency market, I’ve witnessed firsthand Bitcoin’s [BTC] volatile nature and its ability to test even the most resilient investors. The recent price drop below $58,000 has left many questioning the health of this bull run.

In the face of intense market turmoil, Bitcoin (BTC) has slipped beneath the $58,000 threshold. Analyst predictions now suggest a possible price drop of approximately 30-40% during this market trend.

The significant decrease in value that this cryptocurrency might experience could cause it to revert to prices last witnessed during past bull markets, instilling fear and prompting investment planning among market participants.

Bitcoin dangles close to $55K

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin’s performance over the last week hasn’t been ideal. The digital currency has experienced a 10% drop in value, causing its trading price to hover around the $55,000 threshold.

Based on the analysis of expert Scott Melker, Bitcoin has broken through significant support thresholds, which have since transformed into barriers for advancement, possibly triggering additional decreases. Melker issued a warning.

“Nothing but air until around $52,000 on the chart.”

This suggested that Bitcoin could face a free-fall if it fails to maintain current support levels.

The technical perspective offers a bleak outlook as well.

Melker noted that according to the Relative Strength Index (RSI), which is often used to identify when an asset is overbought or oversold, the asset in question hasn’t yet entered the oversold zone.

The deviation indicates a weak demand for buying, thereby lending credence to the hypothesis that prices will continue to decline.

As a researcher studying the Bitcoin market, I’ve noticed an intriguing pattern in its price behavior that aligns with this specific condition. On the charts, Bitcoin displays a persistent downtrend characterized by progressively lower peaks and troughs. This pattern indicates a strong bearish influence, suggesting that the market is experiencing sustained downward pressure.

According to Melker, the ongoing plunge is only a fraction of what is to come, noting,

“A 23% adjustment is all that has occurred so far, which is minimal for a bull market and in line with previous corrections during this market uptrend. However, more significant declines, such as the 30-40% pullbacks experienced in past bull markets, have yet to materialize.”

Broader market implications

Beyond the immediate price action, broader market indicators reveal underlying challenges.

According to recent data from blockchain analysis company Santiment, there has been a noticeable decline in the number of daily active Bitcoin addresses.

The number of users dropped from approximately 17.1 million in March to about 14.7 million by May 1st, suggesting a decline in user engagement and attraction.

The Social Dominance echoed this sentiment, showing a 20% fall.

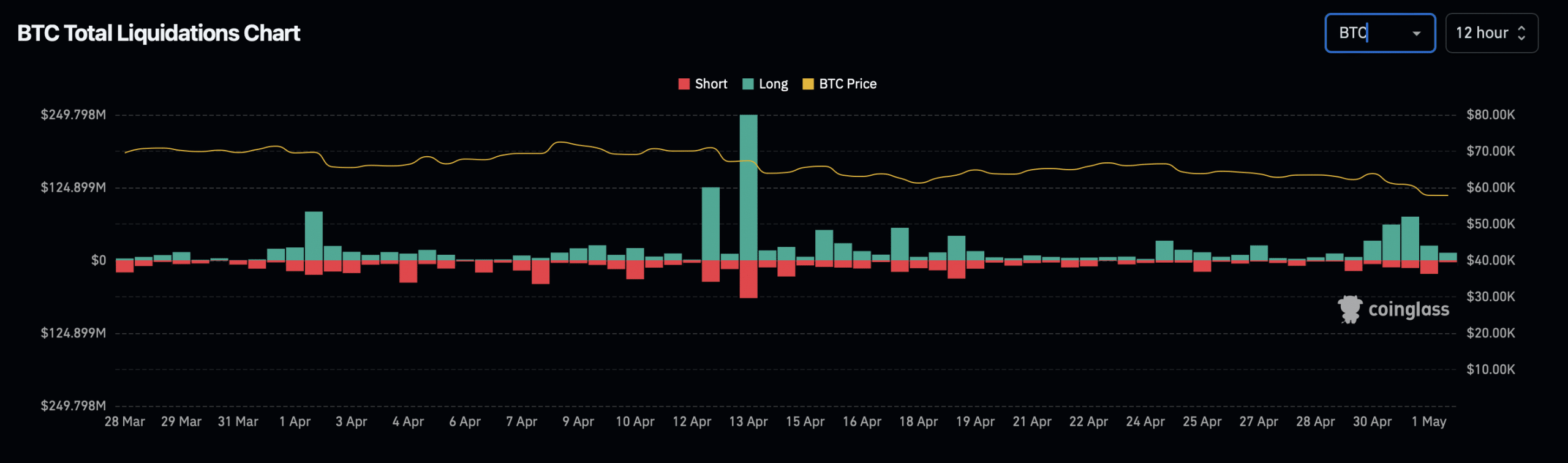

The drop in Bitcoin’s worth has not only affected the previously mentioned market indicators but has also caused numerous traders to sell off their positions due to margin calls, resulting in significant market turbulence.

Based on Coinglass’s report, around 60,795 traders faced liquidation in the past 24 hours, resulting in a total of $205.12 million being withdrawn from their positions.

As an analyst, I’ve been following the developments surrounding the recent listing of spot ETFs in Hong Kong. Unfortunately, their underperformance in the market has added to the existing challenges.

On their debut day, these ETFs saw relatively low trading volume of only $11 million, significantly less than the substantial volumes reported by their U.S. counterparts when they were launched in January.

Over the past five days, there has been a notable trend of investors withdrawing funds from U.S. spot ETFs, with a substantial withdrawal of $161 million observed on Tuesday, according to AMBCrypto’s analysis based on SoSo Value data.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Another interpretation: The expected continuity of U.S. Federal Reserve’s current interest rate policy at the forthcoming FOMC session, caused by surprising inflation levels, has resulted in investors pulling back from riskier assets.

This added further pressure to an already strained market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-02 23:36