-

Bitcoin, at $52,000, could represent the last golden opportunity to purchase.

Large traders offloading their BTC holdings could drive the price down to this critical support level.

As a seasoned crypto investor who has weathered numerous market cycles, I can confidently say that the current price of Bitcoin at $56,855.25 presents a compelling opportunity for long-term investors. The convergence of the descending channel’s bottom with a major support zone at $52k could potentially trigger a significant breakout, pushing BTC toward new highs.

For the past few weeks, Bitcoin [BTC] hasn’t shown any substantial price fluctuations. After hitting an all-time high of $59,844.10, it has dropped to $56,855.25, suggesting that the market is leaning towards a more pessimistic outlook

Continuing bearish trends could potentially offer an advantageous opportunity for investors, allowing them to buy at lower costs if they are patient enough

Golden opportunity at $52k

crypto expert Carl Runefelt has spotted an essential trend in Bitcoin’s latest transactions. Based on his findings, Bitcoin appears to be moving within a falling trendline, exhibiting a side-to-side and downward trend

Historically, when an asset trades within such a pattern, a further decline is anticipated.

Following its typical pattern, Bitcoin has experienced a 4.62% decrease over the past week, and there are signs suggesting it could further decline towards the lower limit of its current channel

In this instance, the situation becomes very interesting as the channel’s lower end aligns with a significant support level at approximately $52k

If Bitcoin’s price reaches that point, it might initiate a substantial breakaway from the downward trend line and push the asset towards unprecedented peaks

Runefelt views this scenario as a critical buying opportunity, remarking,

“It could be our last golden opportunity to accumulate it this cheap.”

It appears that BTC may not return to those levels once it starts heading upwards, leading us at AMBCrypto to consider the possibility of BTC’s price potentially dropping even more

Investors heed Bitcoin’s bearish call

According to AMBCrypto’s study, it appears that major investors and institutional traders are expecting Bitcoin prices to fall even more, based on noticeable selling activities observed in the market

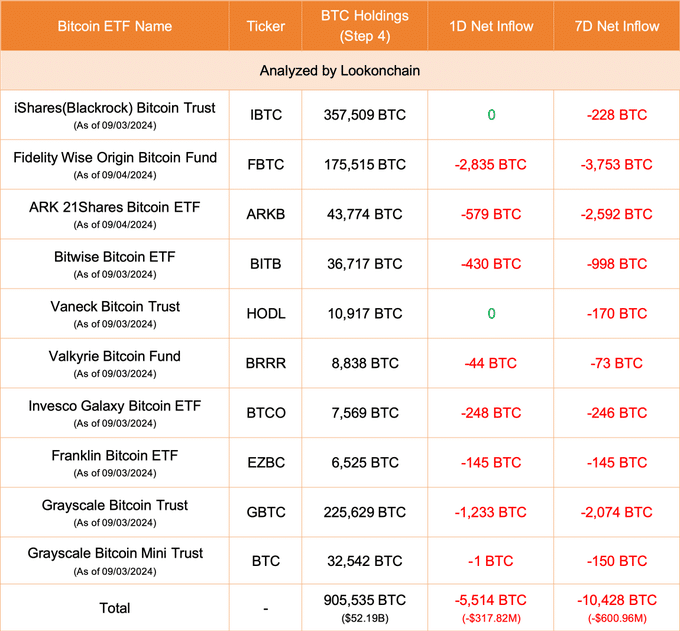

According to data from Lookonchain, there has been a significant withdrawal of Bitcoin from exchange-traded funds (ETFs) focused on institutions over the last day and week

As a researcher, I’ve found that the total withdrawals amounted to approximately 5,514 Bitcoin, equivalent to around $317.82 million USD, and another 10,428 Bitcoin, equivalent to roughly $600.96 million USD

According to additional reports from Lookonchain, it appears that Ceffu, a company specializing in digital asset management, recently moved approximately 3,063 Bitcoin (valued at around $182 million) to the Binance platform

This suggested a strategy that endorses sales over long-term holdings.

These actions indicate that investors are choosing more stable investments, such as the US Dollar, in an attempt to safeguard their capital’s worth, as they move away from volatile assets

Given the current trajectory, it seems more likely than not that Bitcoin could drop towards the significant $52,000 mark, which lines up with the lower boundary of its trading range

Larger holders in a bearish outlook

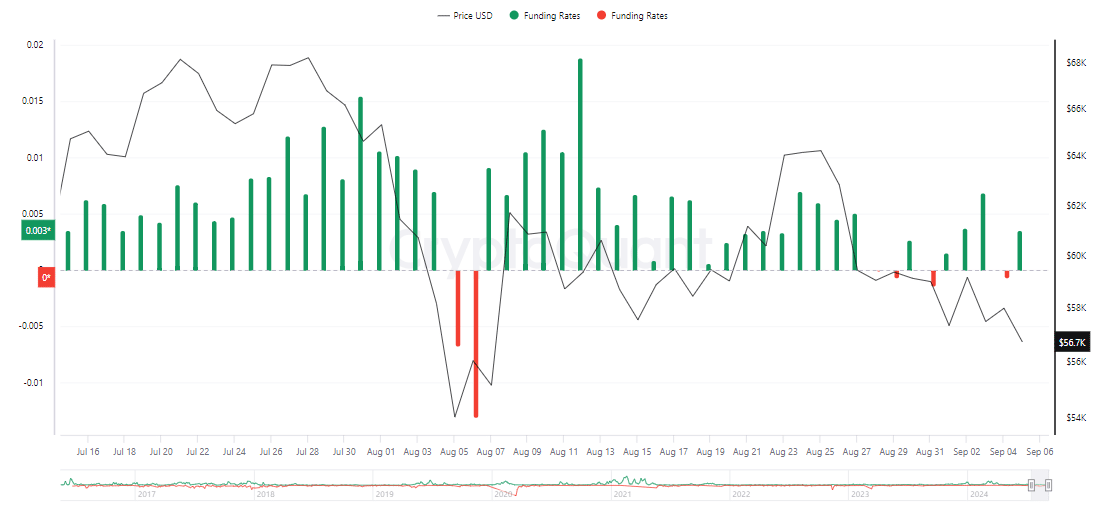

According to CryptoQuant, there’s been an increasing pessimism among individual traders in the crypto market. The Funding Rate, which has been on a downward trend since September 3rd, has dipped from 0.006839 to its current level of 0.004357

If this pattern persists day after day, it might indicate that the price of Bitcoin could potentially drop even more from its present value

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Based on data from Coinglass, the Open Interest has lent credence to this viewpoint by indicating a decrease, approaching its lowest point recorded on September 1st. At the current moment, there’s been a slight 0.58% decrease over the past 24 hours

A continuous downward trend in investor sentiment (bearish pressure) might lead to a decrease in the number of outstanding contracts (Open Interest), which could directly influence Bitcoin’s market price, possibly causing it to fall even further from its current level

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-05 19:12