Will Bitcoin Hit $120K or Crack? Experts Say Beware the Pressure Cooker!

Bitcoin shot up to an all-time high faster than a rocket-powered squirrel on a sugar rush this week, charming speculators and causing chaos in the markets.

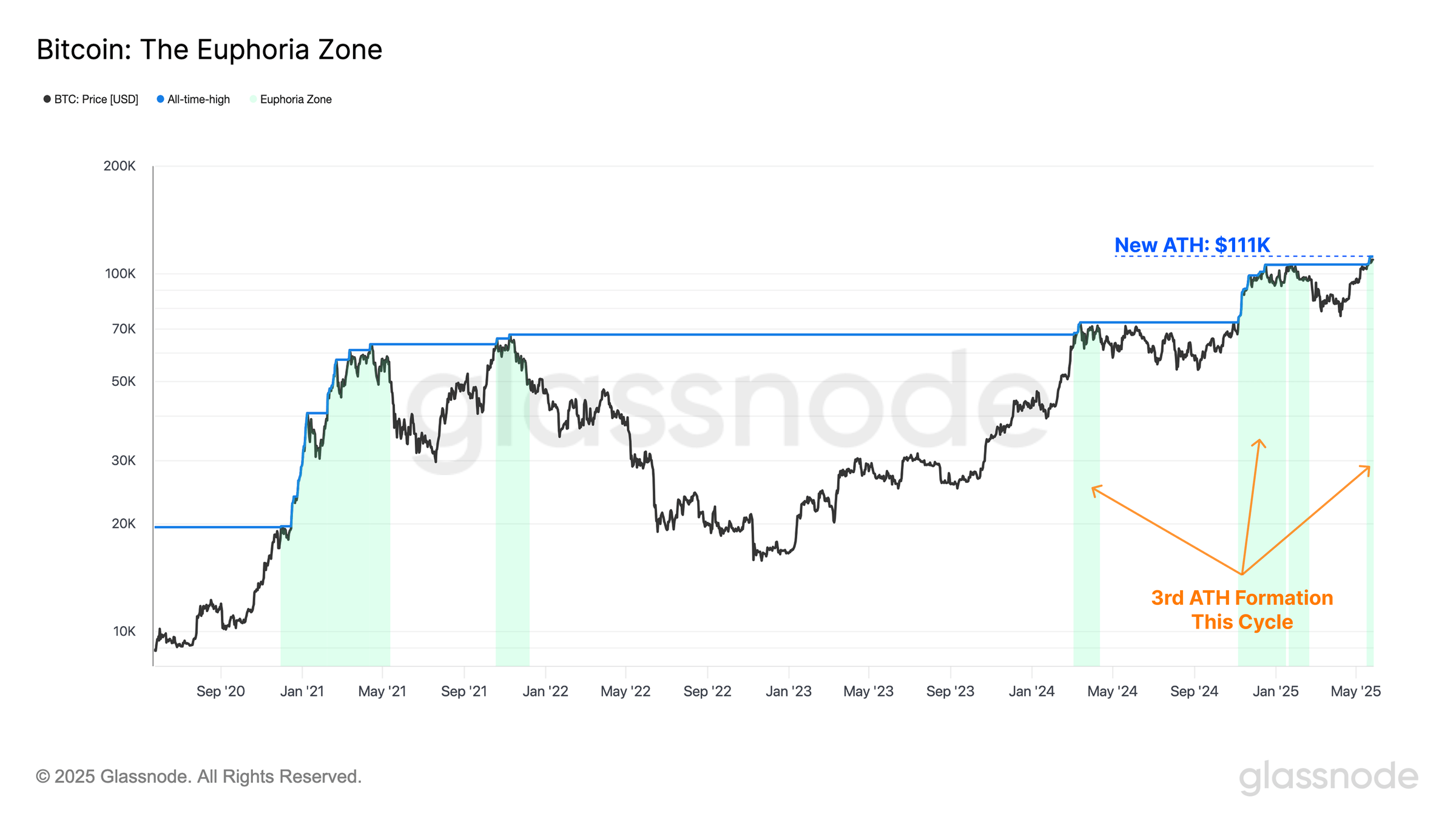

Glassnode Data Shows Bitcoin Profit-Taking Surge Amid Record Highs

According to the brainiacs over at Glassnode — with some help from the ever-enthusiastic Cryptovizart and Ukuria OC — this latest frenzy suggests investors are more involved than a bunch of caffeine-fueled raccoons at a trash can convention. They’re trading across exchanges, derivatives, and those fancy ETFs, although just as everyone gets excited for a rare comet expected to spark mayhem, the $120,000 mark might just press the “SELL” button in their pockets.

Glassnode’s latest “Heating Up” report reveals that Bitcoin’s joyride has driven unrealized profits into “euphoric phase” territory — because nothing screams caution quite like a metric exceeding its +2σ band. Still, the report notes that actual profit-taking is mostly under control, with only 14.4% of days sporting higher realized gains. Basically, traders aren’t completely losing their minds yet.

Cryptovizart and Ukuria OC probably said it best: everyone’s spending like they’ve just found a pot of gold at the end of a rainbow, with coins deposited to exchanges raking in an average gain of $9,300—a tiny fortune compared to losses, which are apparently less popular than overcooked toast.

Not surprisingly, exchange activity exploded like popcorn in a microwave. Now, about a third of all Bitcoin on-chain action happens on centralized platforms. This surge makes sense because demand is hotter than a jalapeño in the Sahara, with daily inflows and outflows dancing between $4 billion and $8 billion. Yep, billion with a B.

Derivatives markets are also riding the Bitcoin rollercoaster. Futures open interest shot up 51% since April — that’s a lot of zeroes — totaling $55.6 billion. Options? They hit a record-breaking $46.2 billion, which makes some folks look more like seasoned chess players than speculative gamblers. According to the wise folks at Glassnode, this signals that investors are getting serious and using strategies that might even impress a Wall Street wizard.

Meanwhile, spot ETF money flowing in is still pouring at over $300 million daily, giving the market a steady push since late April. So many dollars, so little time! As for Bitcoin itself, it’s strutting above key momentum indicators like a peacock, with the 111DMA at $91.8K, the 200DMA at $94.3K, and the STH cost-basis sitting pretty at $95.9K.

But wait — not all is sunshine and rainbows. Glassnode’s MVRV Ratio warns that the price is hanging out between +0.5σ ($100.2K) and +1σ ($119.4K). This zone has a fun tradition of being linked to “overheating,” which in trader-speak means “probably about to explode.” The big red flag is the $120,000 level, right at the edge where sellers might start hitting the panic button faster than a cat on a hot tin roof.

In conclusion, while most indicators are racing ahead like a herd of caffeinated cheetahs, the consensus near that psychological wall of $120K suggests caution — because, as we’ve seen before, this rollercoaster has plenty of twists and turns. Buckle up, folks — or better yet, hold onto your hats!

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2025-05-29 18:27