- Bitcoin’s price declined by more than 4% in the last 24 hours.

- Most market indicators and metrics hinted at a further price drop.

As a seasoned crypto analyst with years of experience in the market, I have seen Bitcoin’s [BTC] price fluctuations time and again. The recent decline of more than 4% in the last 24 hours, as well as most market indicators and metrics pointing towards further price drops, is not an unfamiliar sight.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin [BTC] has faced challenges in shifting to a bullish trend lately. The digital currency’s price remains below the $67,000 mark.

An intriguing development has emerged, implying a potential shift in the current trend. A notable indicator suggests that Bitcoin’s price may surge up to $86k in the near future or even further down the line.

Bitcoin’s road to $86k

Last week saw bears take control, leading most crypto prices to plummet, including Bitcoin’s significant price decrease on June 6th, as reported by CoinMarketCap.

As a crypto investor, I’ve noticed that the value of the coin I’m following has decreased by more than 4% in the last week. Currently, Bitcoin is being traded at around $66,344, and its market capitalization exceeds $1.3 trillion.

Ali, a well-known cryptocurrency analyst, recently shared on Twitter an intriguing piece of information: The cost to mine one Bitcoin is currently around $86,668. This revelation has sparked optimism among some in the crypto community, suggesting that the price could potentially rise above this level.

Based on historical patterns, Bitcoin’s price could potentially increase, as it has a tendency to rise above the average mining cost.

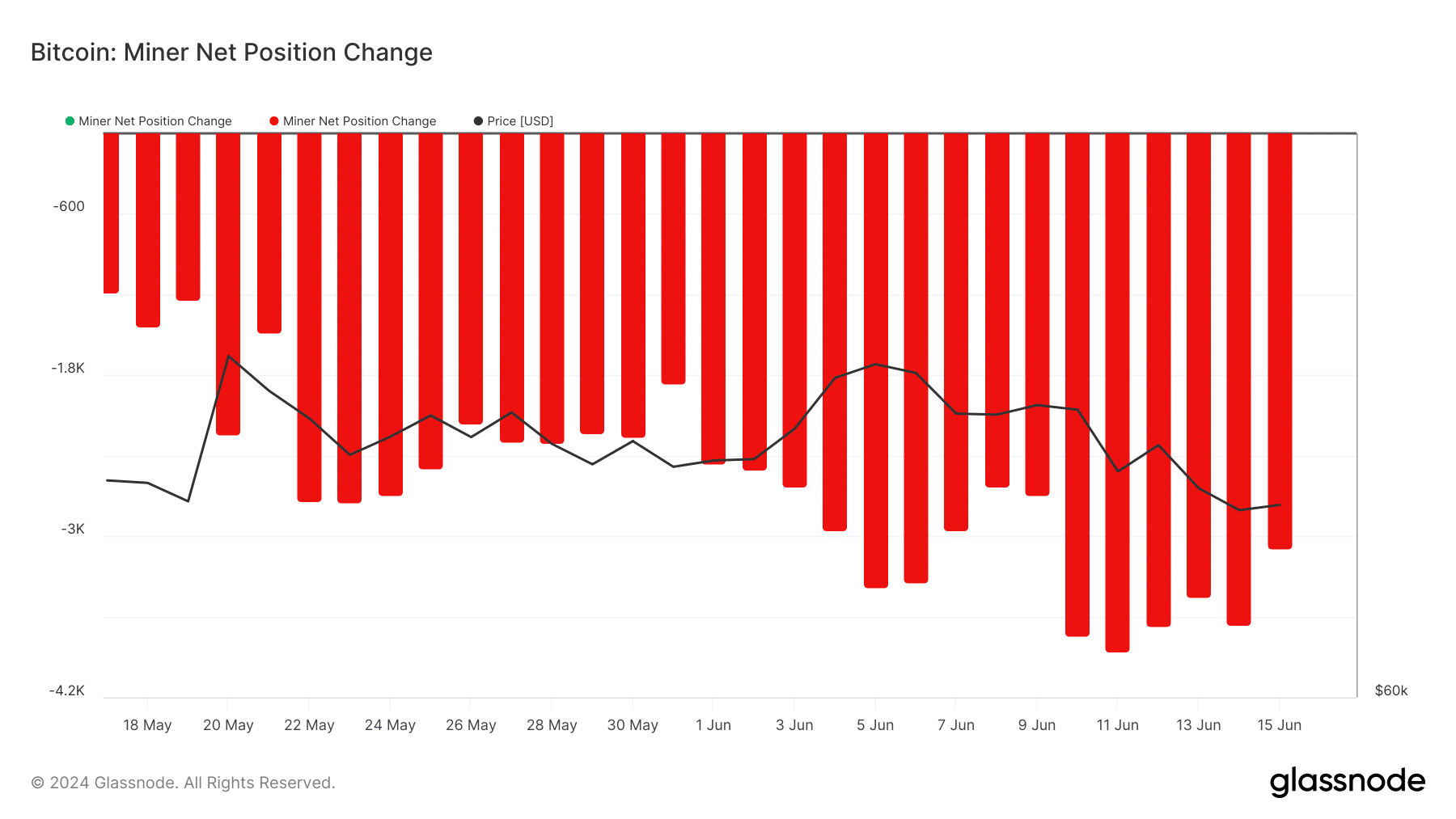

Analyzing the data from Glassnode, AMBCrypto determined the mining behavior of miners as Bitcoin’s mining costs reached an all-time high of $86k. It appears that these miners were inclined towards selling.

It was clear from the significant decrease in Bitcoin miners’ net position change, indicating that they lacked confidence in the cryptocurrency and opted to dispose of their stashes.

Miners’ balance also registered a decline over the past few weeks.

Will BTC remain bearish?

As a crypto investor, I recognized the selling pressure from miners affecting Bitcoin (BTC). To gain insights into whether this trend would persist and potentially signal further bearishness for BTC, I decided to explore alternative datasets for analysis with AMBCrypto.

As a crypto investor, I’ve noticed from AMBCrypto’s analysis of CryptoQuant’s data that the amount of Bitcoin being deposited into exchanges has been significantly higher than the average over the past week. This could be a sign that investors are selling their BTC or that there is an increased demand for fiat currency to purchase crypto, which may impact the market price. Keeping an eye on such trends can help inform investment decisions.

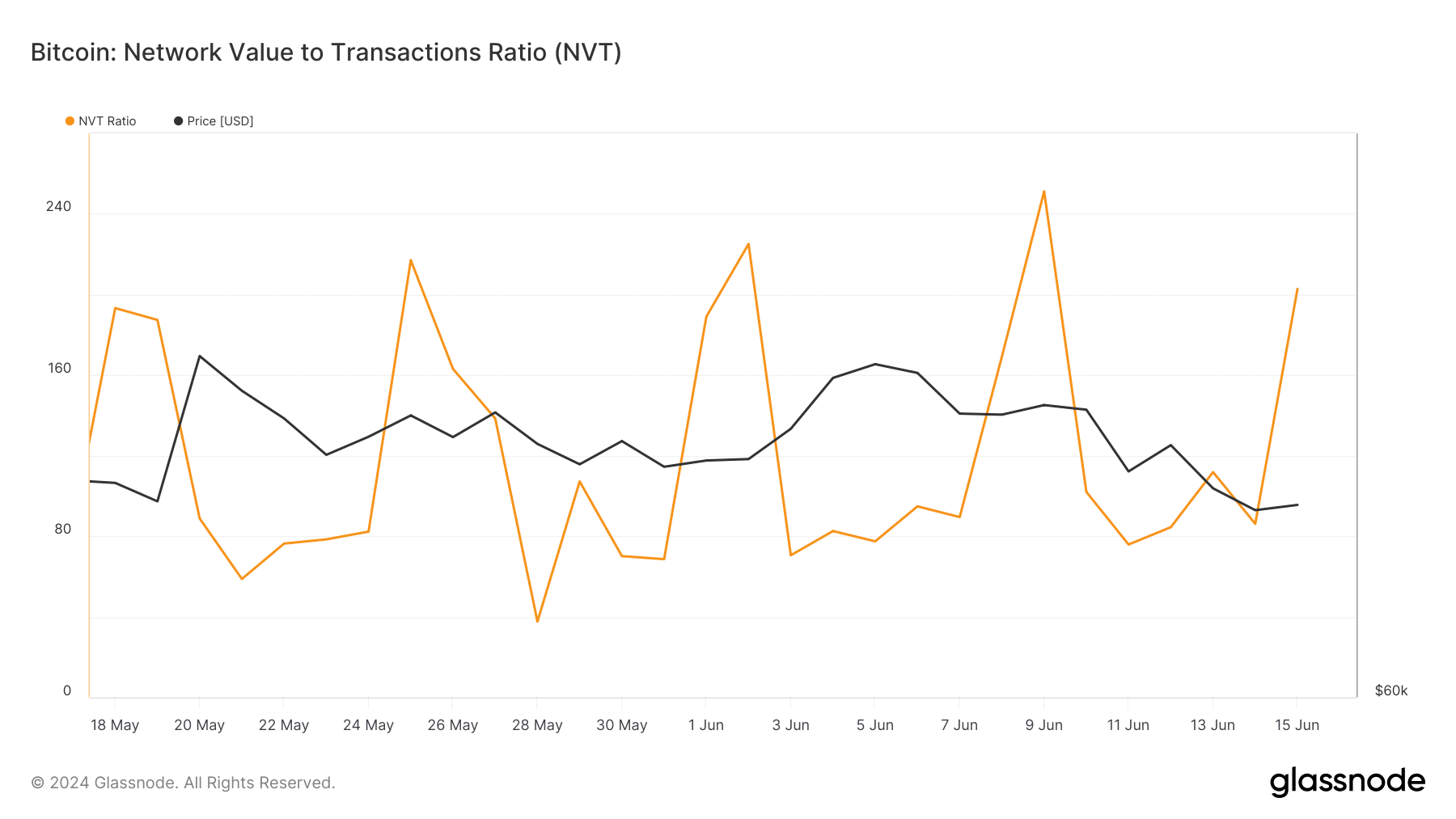

The leader among cryptocurrencies, Bitcoin’s Coinbase Premium indicator turned red, signaling that American investors were more inclined towards selling rather than buying. Additionally, Bitcoin’s NVT ratio saw a significant increase on the 15th of June.

As an analyst, I would interpret a surge in the metric as a sign that the asset is potentially overvalued, suggesting the possibility of a corrective price adjustment.

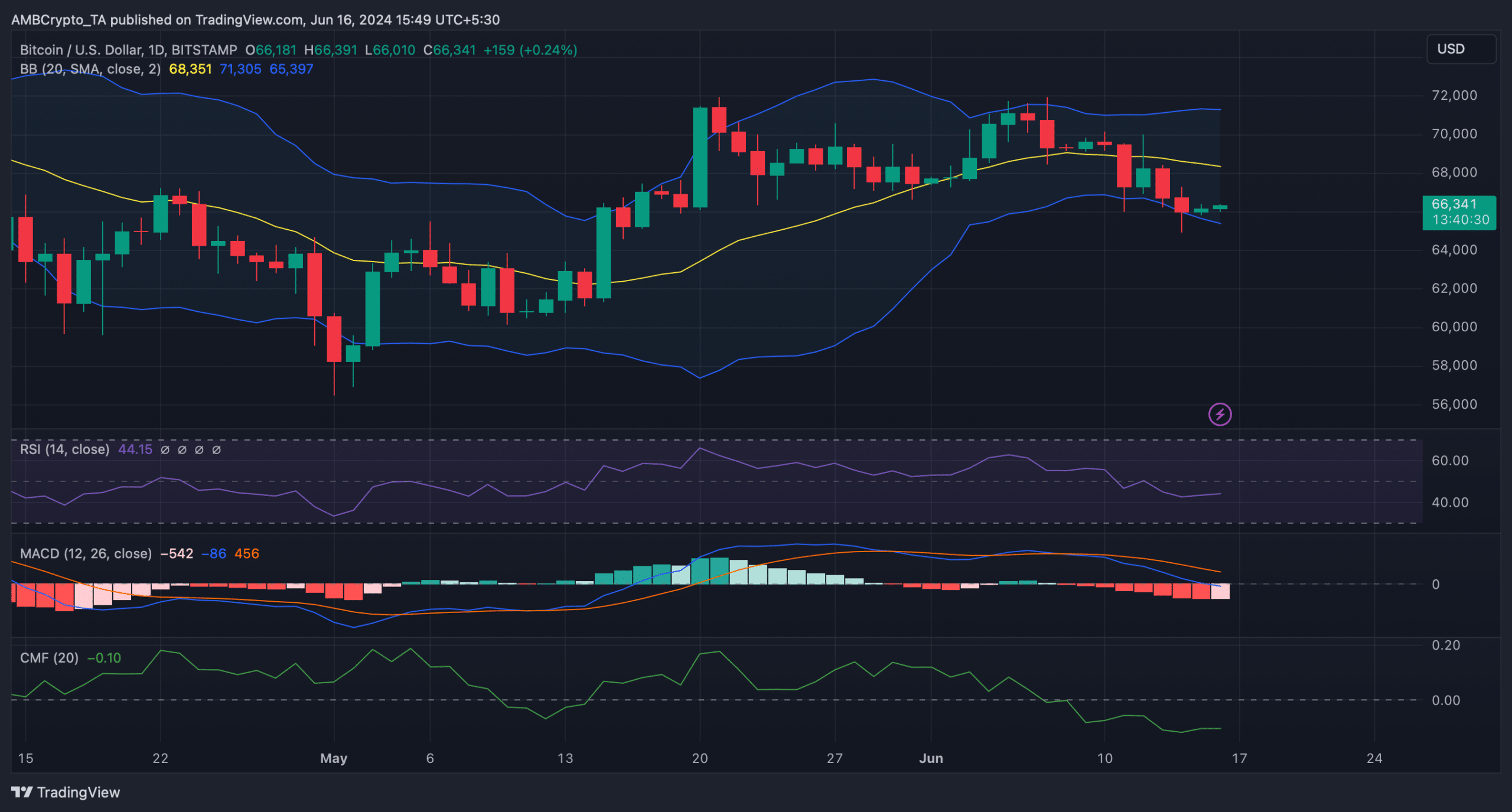

As a crypto investor, I couldn’t help but feel a sense of unease as I observed the market trends. The moving averges convergence divergence (MACD) line, a popular indicator among traders, was signaling a bearish condition for the market. This meant that the short-term average was falling below the long-term average, suggesting a potential downturn in prices. The ominous bearishness of this indicator added to my concerns and reinforced my cautious stance towards investments during that period.

In simpler terms, the Chaikin Money Flow (CMF) for Bitcoin (BTC) dropped significantly and remained below the threshold of 0, which is considered neutral. Meanwhile, the RSI for BTC was also reading a value less than 50, signifying that it was in a sub-neutral range.

Read Bitcoin’s [BTC] Price Prediction 2024-25

These indicators suggested a further price decline.

Despite reaching the bottom limit of BTC‘s Bollinger Bands, this occurrence often indicates an impending price increase in the near future.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-17 05:11