Ah, Bitcoin, that mischievous creature flickering like a candle in a drafty Moscow flat-clinging stubbornly to its lofty perch around $110K, as if daring fate and investors alike to play a perilous game of tug-of-war. The charts, those cryptic runes scribbled by market sorcerers, offer a curious dance of contradictions: momentum slows as if nursing a hangover, yet some poor souls still try with all their might to shove the price ever upwards.

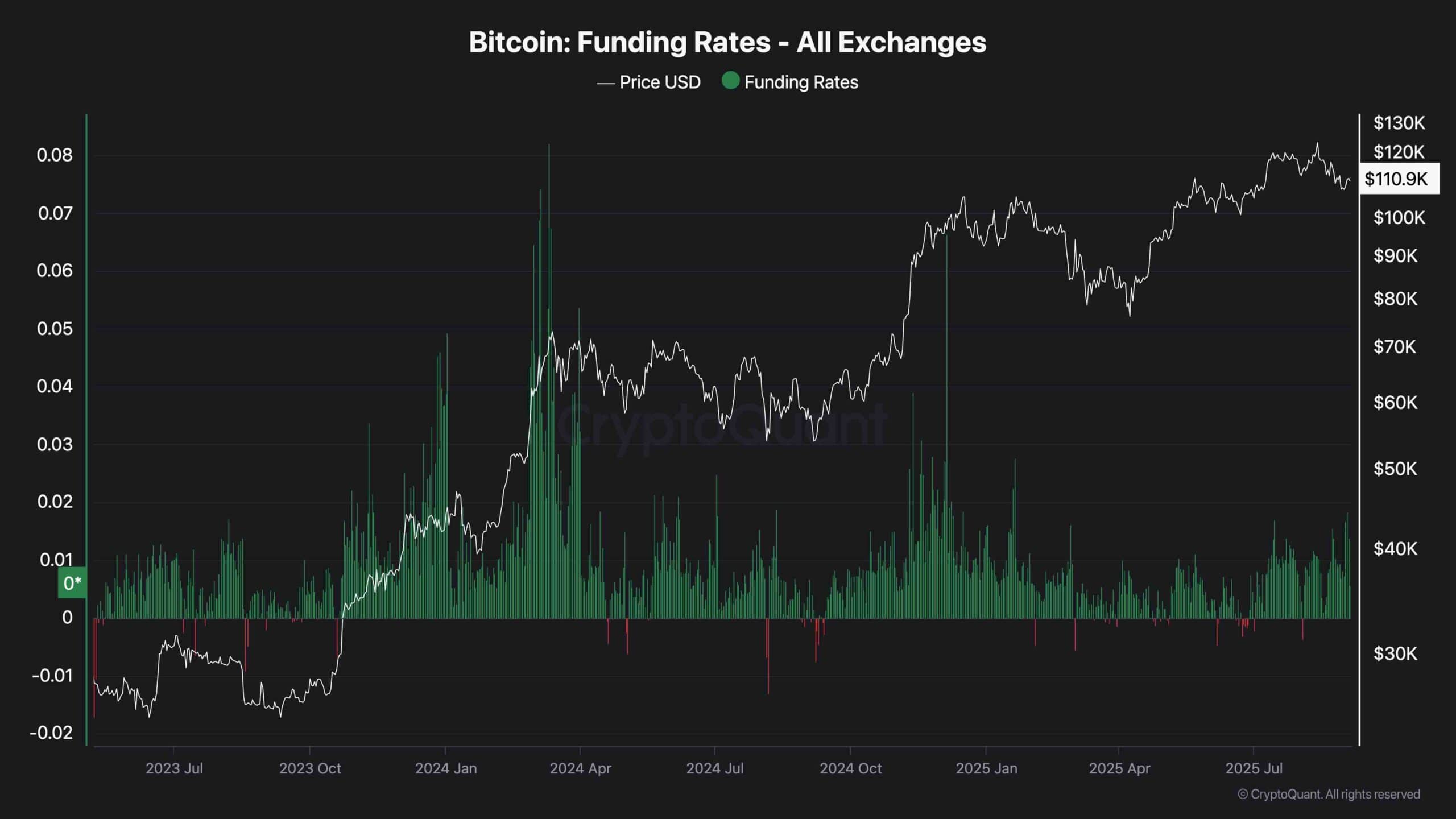

Meanwhile, the funding rates-those sly whispers of trader sentiment-reveal subtle clues that leverage positions are lurking in the shadows, ready to pounce like a cat on a mouse, or perhaps a bureaucrat on a bribe.

Technical Analysis

By Shayan, the oracle of candlesticks and moving averages

The Daily Chart

On the daily chart, Bitcoin has flounced out of its ascending channel with all the grace of a disgruntled bureaucrat skipping work early. Now, it hovers around $110K, testing the waters from below after last week’s unfortunate tumble. This breakdown from the channel-imagine a grand staircase suddenly missing a few steps-signals waning momentum after months of steady, if somewhat deluded, optimism.

RSI, that fickle gauge of enthusiasm, languishes near 45, as if the market can’t decide whether to order vodka or just water at the tavern of speculation. Meanwhile, the 100-day moving average skulks nearby, aligning ominously with our $110K battleground. It’s a classic stalemate: if the buyers fail to reclaim this fortress, the poor defenders must retreat to the next outpost at $104K.

But ah! Should they somehow muster the courage to storm back and seize $110K once more, who knows? Perhaps a triumphant march toward the $124K all-time high awaits, with brass bands playing and matrons fainting in the streets.

The 4-Hour Chart

On the 4-hour chart, Bitcoin popped out of a descending channel as if sneaking out past curfew, signaling a brief cessation of short-term selling pressure. This ephemeral freedom was cruelly cut short by a rejection at $113K-better luck next time, dreamers.

Now, it skulks back towards the $110K-$109K support nest, RSV flirting just above 50, undecided as a cat before a bath. Bulls dream of a second wind pushing prices toward $113K and then $117K, while bears sharpen their claws, eagerly waiting for a decisive dip below $110K to spring the trap that might lead us down to $104K-the shadowy realm of “fair value gaps.”

Sentiment Analysis

Funding Rates

The funding rates across exchanges whisper tales of leverage skewed positively, but thank heavens, not to the nauseating extremes of previous frenzied peaks-because no one likes a party that gets out of hand. Long traders hold the spotlight, though the crowd remains suspiciously sober, no longer throwing confetti in wild reckless abandon.

Despite Bitcoin’s heroic sprints earlier this year, funding rates have settled down to a tepid calm, like an exhausted bard after bellowing his song. This temperance suggests speculative mania is sipping tea rather than chasing wild adventures. A stable groundwork, if you will, for the next inevitable outburst-or slump-because such is the fate of our volatile hero.

Read More

- When Is Hoppers’ Digital & Streaming Release Date?

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Sunday Rose Kidman Urban Describes Mom Nicole Kidman In Rare Interview

- 10 Movies That Were Secretly Sequels

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Thanos Comics (September 2025)

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- Marvel Should Make These 7 “Life Story” Books

2025-09-04 17:27